Keep Closed Bank Account Paperwork

Understanding the Importance of Keeping Closed Bank Account Paperwork

When you close a bank account, it’s essential to keep the paperwork related to the account closure for several reasons. Record-keeping and auditing purposes are two primary reasons why you should maintain these documents. In this blog post, we will delve into the details of why keeping closed bank account paperwork is crucial and how it can benefit you in the long run.

Why Keep Closed Bank Account Paperwork?

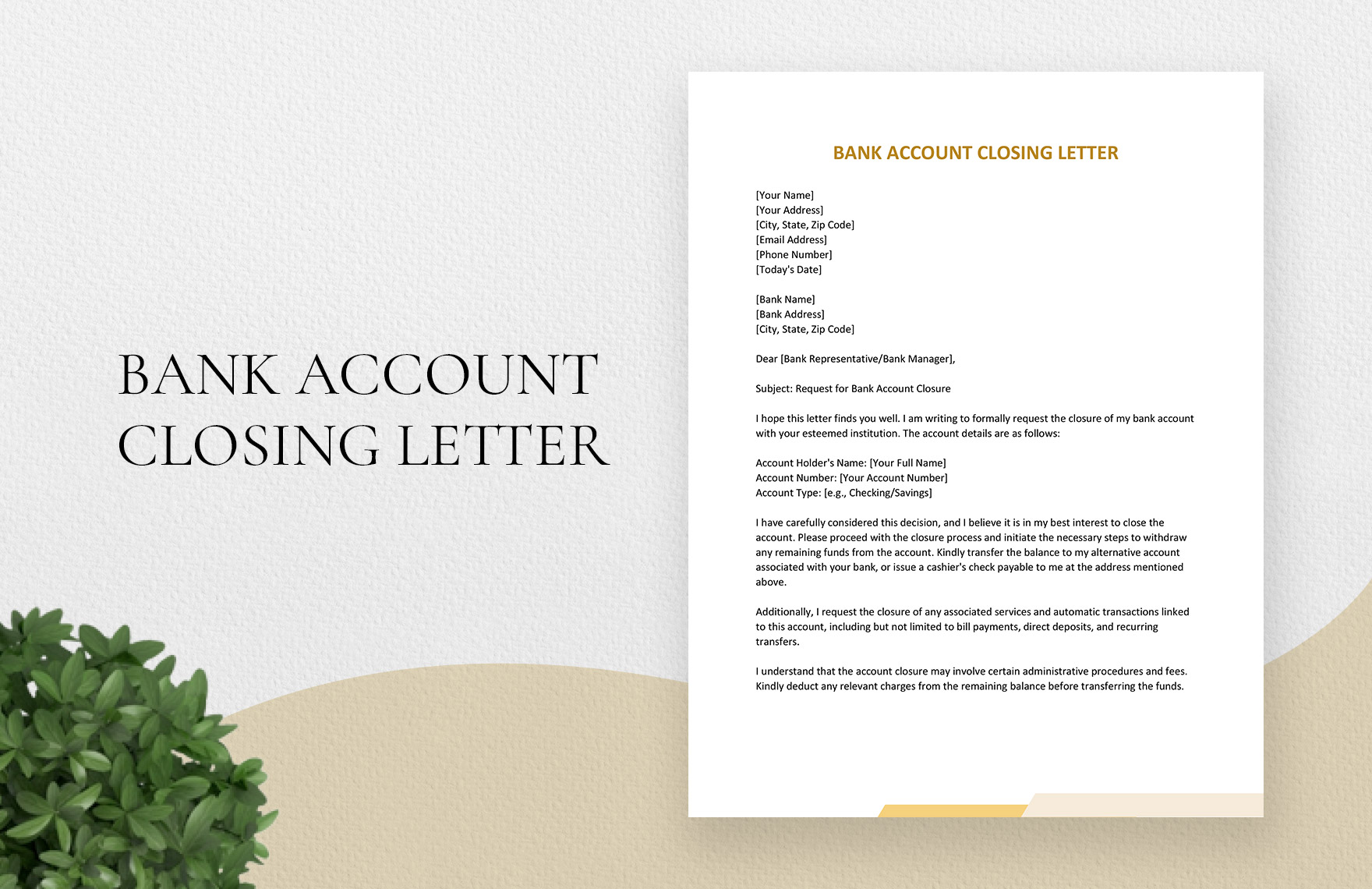

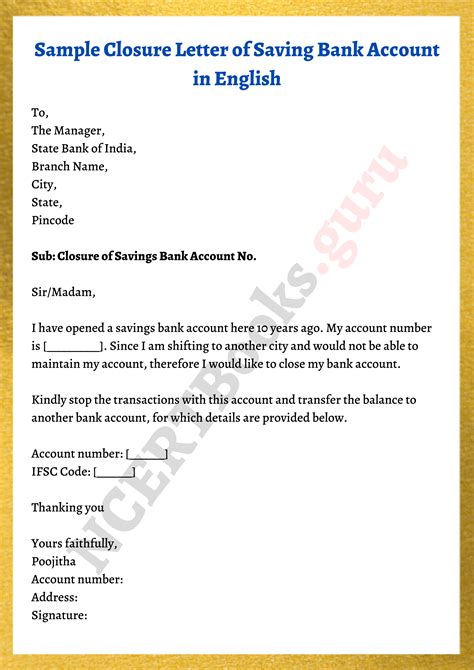

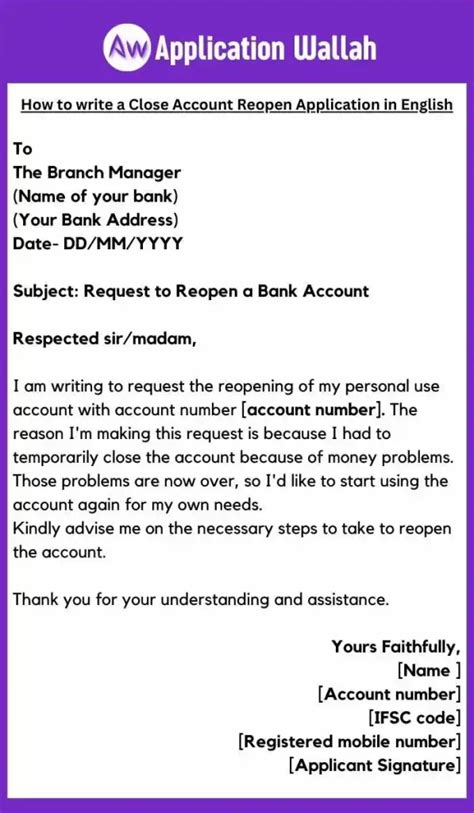

There are several reasons why keeping closed bank account paperwork is necessary. Some of the key reasons include: * Proof of account closure: The paperwork serves as proof that the account was indeed closed, which can be useful in case of any disputes or issues that may arise in the future. * Tax purposes: You may need to provide documentation to support your tax returns, and the closed bank account paperwork can be useful in this regard. * Avoiding identity theft: Keeping the paperwork can help prevent identity theft, as it provides a record of the account closure and can help prevent unauthorized activity. * Reference for future banking: If you need to open a new bank account in the future, the closed bank account paperwork can serve as a reference, providing information about your previous banking history.

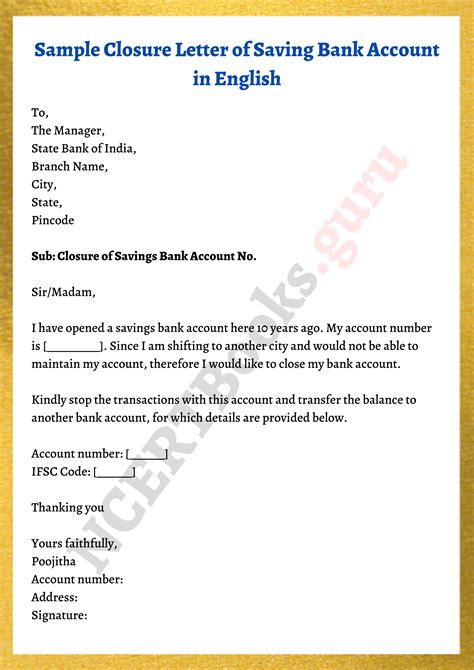

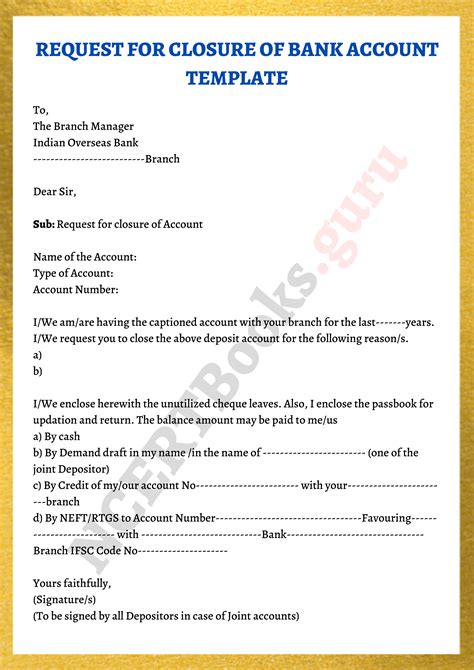

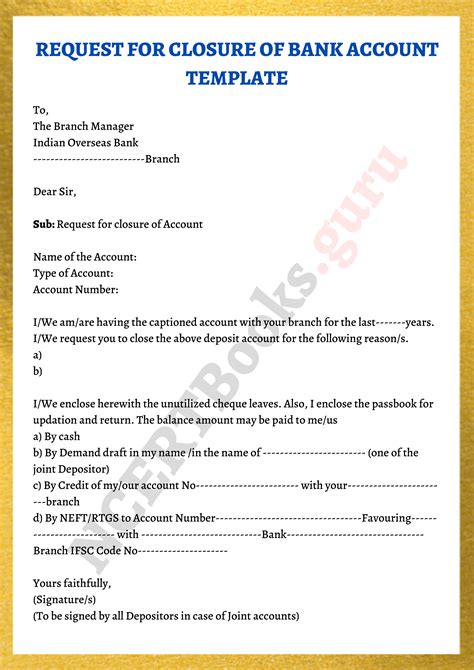

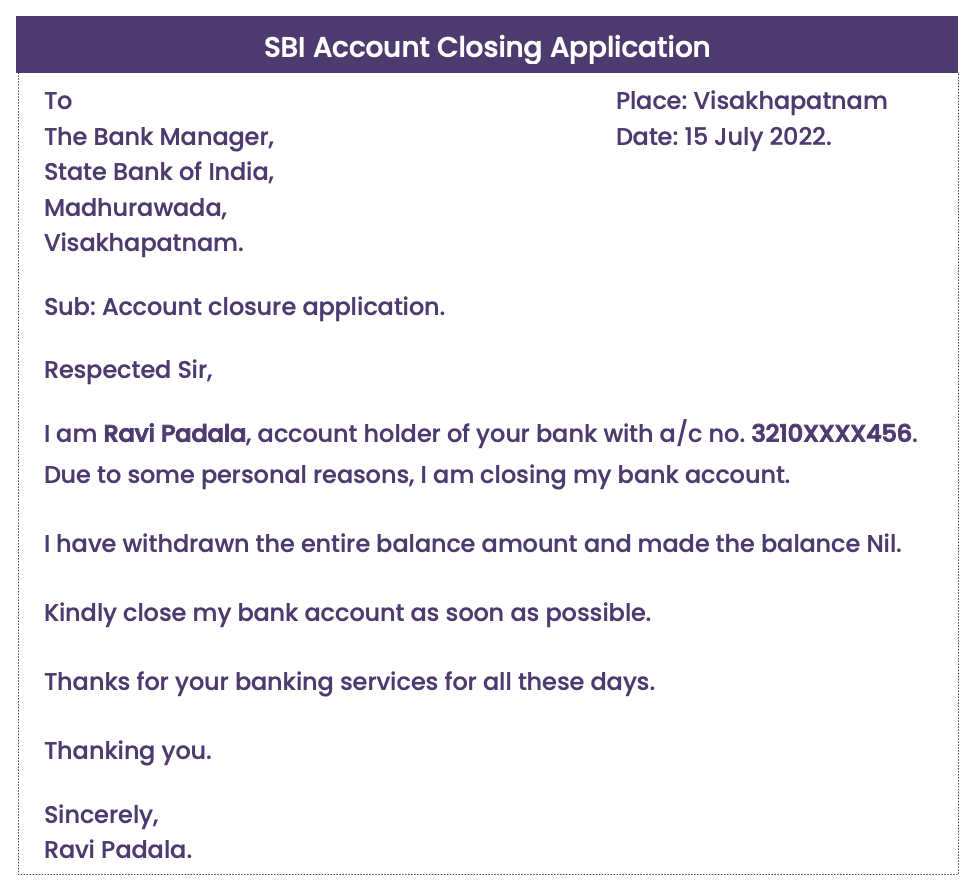

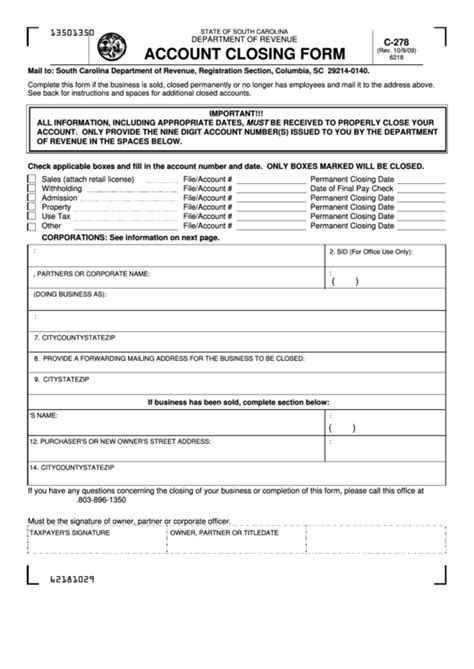

What Paperwork Should You Keep?

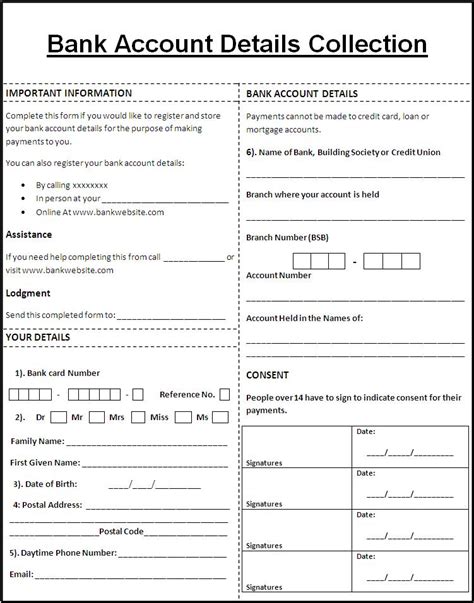

When closing a bank account, it’s essential to keep the following paperwork: * Account closure confirmation: This is the document that confirms the account has been closed. * Final statement: The final statement shows the final balance and any transactions that were made before the account was closed. * Transaction records: Keep records of any transactions that were made on the account, including deposits, withdrawals, and transfers. * Account agreement: The account agreement outlines the terms and conditions of the account, and it’s essential to keep a copy of this document.

How Long Should You Keep the Paperwork?

The length of time you should keep the closed bank account paperwork depends on the specific circumstances. As a general rule, it’s recommended to keep the paperwork for at least three to seven years. This allows you to have a record of the account closure and any related transactions in case of any issues or disputes that may arise.

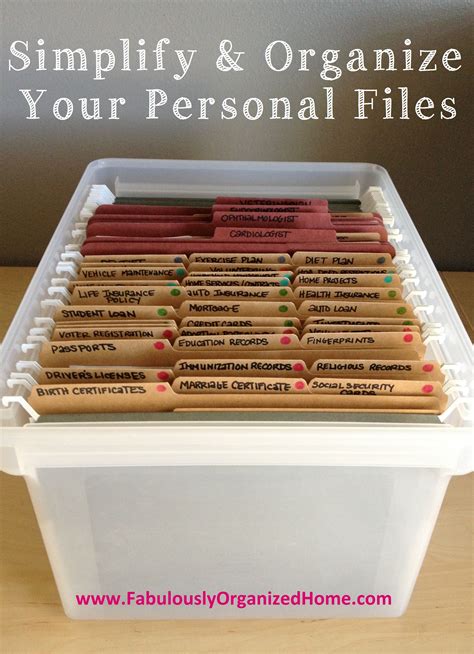

Best Practices for Keeping Closed Bank Account Paperwork

To ensure that you keep the closed bank account paperwork safely and securely, follow these best practices: * Store the paperwork in a secure location: Keep the paperwork in a safe and secure location, such as a fireproof safe or a secure online storage service. * Make digital copies: Make digital copies of the paperwork and store them in a secure location, such as an external hard drive or cloud storage service. * Organize the paperwork: Organize the paperwork in a logical and systematic way, making it easy to access and retrieve the documents when needed.

Benefits of Keeping Closed Bank Account Paperwork

Keeping closed bank account paperwork has several benefits, including: * Peace of mind: Knowing that you have a record of the account closure and any related transactions can give you peace of mind and reduce stress. * Easy access to information: Keeping the paperwork makes it easy to access information about the account closure and any related transactions. * Protection from identity theft: Keeping the paperwork can help prevent identity theft and protect you from unauthorized activity.

Common Mistakes to Avoid

When keeping closed bank account paperwork, there are several common mistakes to avoid, including: * Not keeping the paperwork at all: Failing to keep the paperwork can lead to issues and disputes in the future. * Not storing the paperwork securely: Failing to store the paperwork securely can lead to loss, damage, or unauthorized access. * Not making digital copies: Failing to make digital copies of the paperwork can lead to loss or damage of the original documents.

📝 Note: Always keep the closed bank account paperwork in a secure location and make digital copies to ensure that you have a record of the account closure and any related transactions.

In summary, keeping closed bank account paperwork is essential for record-keeping, auditing purposes, and protecting yourself from identity theft. By understanding the importance of keeping this paperwork and following best practices for storage and organization, you can ensure that you have a record of the account closure and any related transactions, and protect yourself from potential issues and disputes.

To recap, the key points to remember are: * Keep the closed bank account paperwork for at least three to seven years * Store the paperwork in a secure location and make digital copies * Organize the paperwork in a logical and systematic way * Avoid common mistakes, such as not keeping the paperwork at all or not storing it securely

By following these guidelines and best practices, you can ensure that you keep your closed bank account paperwork safely and securely, and have a record of the account closure and any related transactions.

What is the primary reason for keeping closed bank account paperwork?

+

The primary reason for keeping closed bank account paperwork is for record-keeping and auditing purposes.

How long should I keep the closed bank account paperwork?

+

It’s recommended to keep the closed bank account paperwork for at least three to seven years.

What are the benefits of keeping closed bank account paperwork?

+

The benefits of keeping closed bank account paperwork include peace of mind, easy access to information, and protection from identity theft.