Adoption Paperwork for Taxes

Understanding Adoption Paperwork for Taxes

When it comes to adoption, the process can be complex and emotionally challenging. One aspect that is often overlooked until the last minute is the adoption paperwork for taxes. Adoption taxes can be a significant factor in the overall cost of adoption, and understanding the necessary paperwork is crucial for a smooth and successful adoption process. In this article, we will delve into the world of adoption paperwork for taxes, exploring the key documents, tax credits, and other essential information that prospective adoptive parents need to know.

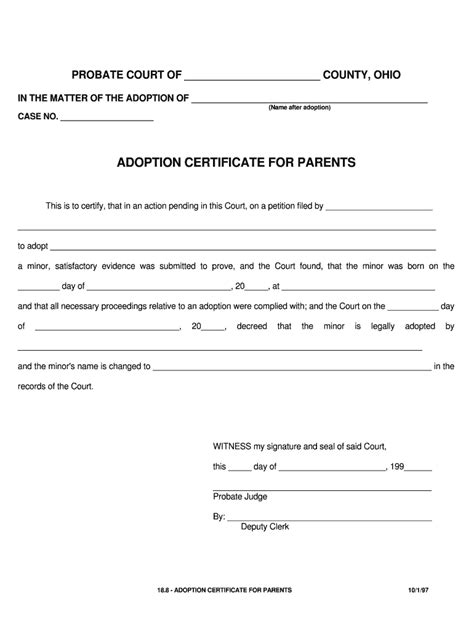

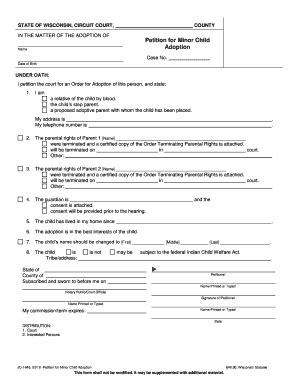

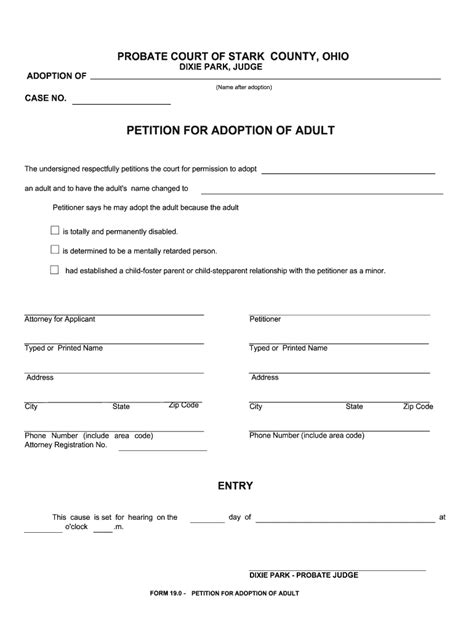

Key Documents for Adoption Paperwork

The adoption process involves a multitude of documents, and it’s essential to understand which ones are relevant for tax purposes. Some of the key documents include: * Adoption decree: This is the official document that finalizes the adoption and is typically issued by the court. * Placement agreement: This document outlines the terms of the adoption, including the placement of the child with the adoptive parents. * Home study report: This report is conducted by a social worker and assesses the suitability of the prospective adoptive parents to adopt a child. * Expense records: Keeping accurate records of adoption-related expenses is crucial for tax purposes.

Adoption Tax Credit

The Adoption Tax Credit is a significant benefit for adoptive parents, as it can help offset the costs associated with adoption. The credit can be claimed for qualified adoption expenses, which include: * Adoption fees * Attorney fees * Travel expenses * Medical expenses * Other adoption-related costs The credit is subject to income limits, and the amount of the credit varies from year to year. It’s essential to consult with a tax professional to determine eligibility and to ensure that the necessary paperwork is completed accurately.

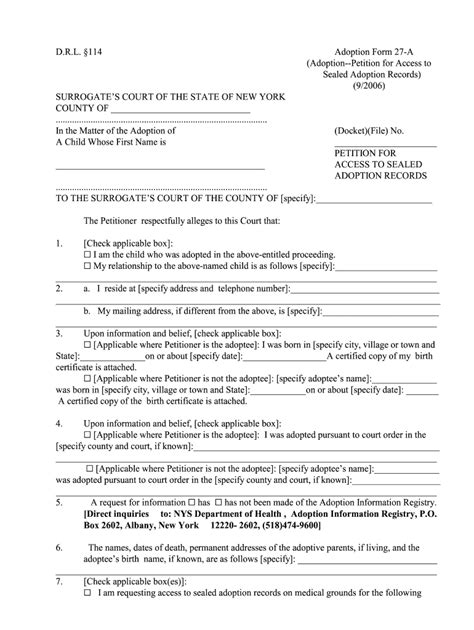

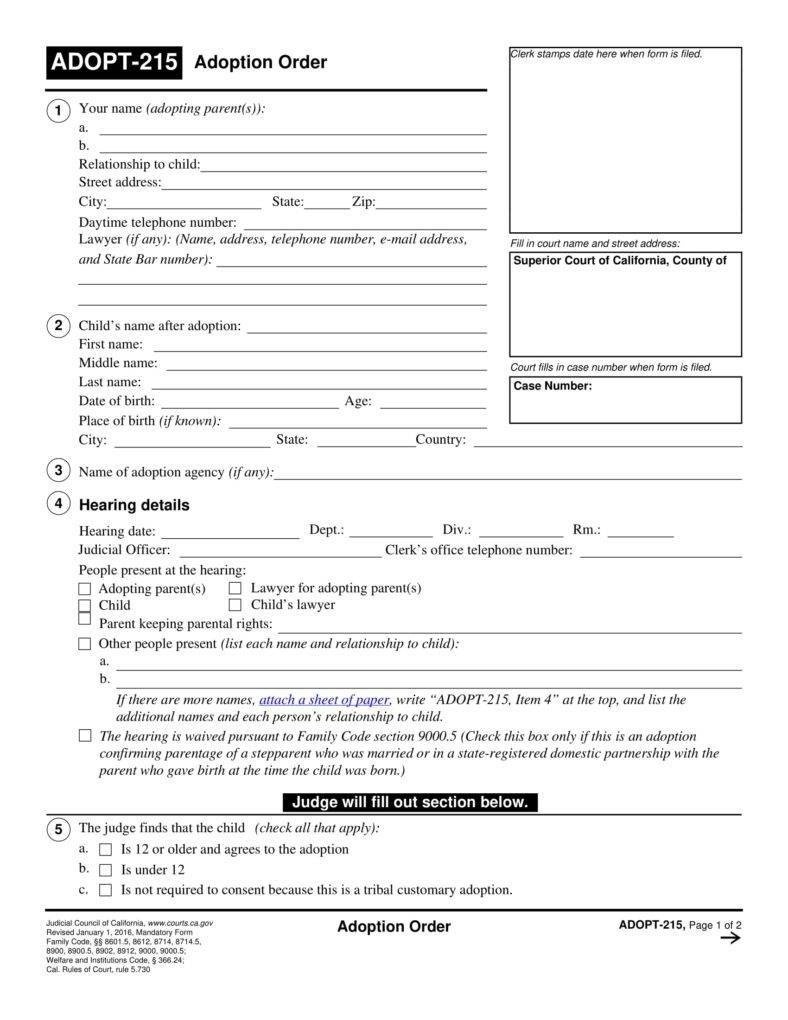

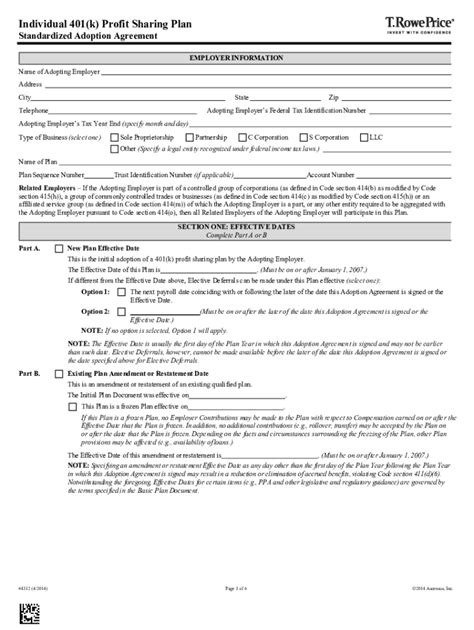

Claiming the Adoption Tax Credit

To claim the Adoption Tax Credit, adoptive parents must complete Form 8839, which is the Qualified Adoption Expenses form. This form requires detailed information about the adoption, including the date of the adoption, the child’s name and social security number, and the qualified adoption expenses. It’s crucial to attach supporting documentation, such as receipts and invoices, to the form to substantiate the expenses claimed.

Other Tax Benefits for Adoptive Parents

In addition to the Adoption Tax Credit, there are other tax benefits available to adoptive parents. These include: * Dependent care credit: This credit can be claimed for childcare expenses, including those related to adoption. * Child tax credit: This credit can be claimed for each qualifying child, including adopted children. * Exclusion from income: Certain adoption benefits, such as employer-provided adoption assistance, may be excluded from income.

Table of Adoption Tax Credits and Benefits

The following table provides a summary of the adoption tax credits and benefits available to adoptive parents:

| Benefit | Description | Amount |

|---|---|---|

| Adoption Tax Credit | Offset qualified adoption expenses | Varies by year |

| Dependent Care Credit | Offset childcare expenses | Up to 3,000</td> </tr> <tr> <td>Child Tax Credit</td> <td>Offset expenses for qualifying children</td> <td>Up to 2,000 |

| Exclusion from Income | Exclude employer-provided adoption assistance from income | Varies by employer |

📝 Note: The amounts listed in the table are subject to change, and it's essential to consult with a tax professional to determine the most up-to-date information.

As we near the end of our discussion on adoption paperwork for taxes, it’s essential to summarize the key points. Understanding the necessary paperwork, tax credits, and other benefits available to adoptive parents can help make the adoption process less overwhelming. By being aware of the Adoption Tax Credit, dependent care credit, and child tax credit, adoptive parents can better plan for the financial aspects of adoption. In the end, it’s crucial to consult with a tax professional to ensure that all necessary paperwork is completed accurately and that the adoptive parents receive the benefits they are eligible for.

What is the Adoption Tax Credit?

+

The Adoption Tax Credit is a tax credit that can be claimed for qualified adoption expenses, such as adoption fees, attorney fees, and travel expenses.

How do I claim the Adoption Tax Credit?

+

To claim the Adoption Tax Credit, you must complete Form 8839, which is the Qualified Adoption Expenses form, and attach supporting documentation to substantiate the expenses claimed.

Are there other tax benefits available to adoptive parents?

+

Yes, there are other tax benefits available to adoptive parents, including the dependent care credit, child tax credit, and exclusion from income for employer-provided adoption assistance.