Paperwork

7 Tax Papers Needed

Understanding the Importance of Tax Papers

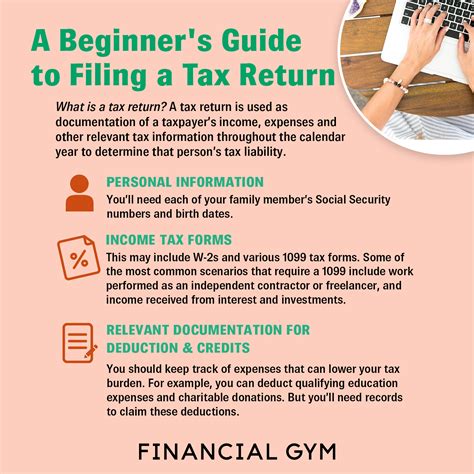

When it comes to managing your finances, especially during tax season, having the right documents is crucial. These documents, often referred to as tax papers, are essential for filing your taxes accurately and efficiently. In this article, we will delve into the world of tax papers, exploring what they are, why they are necessary, and the top 7 tax papers you might need during tax season.

What Are Tax Papers?

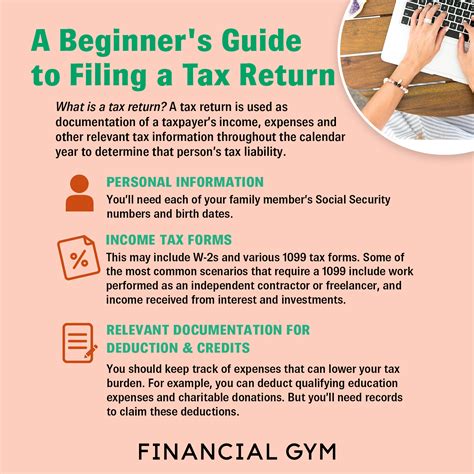

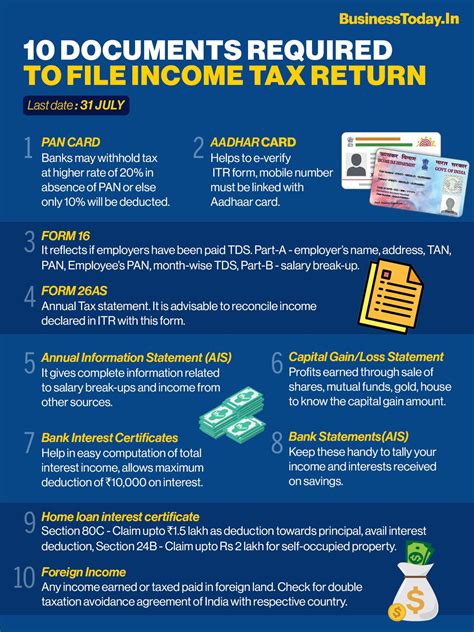

Tax papers encompass a wide range of documents that contain information about your income, expenses, deductions, and credits. They are vital for preparing your tax return, as they provide the necessary details to calculate your taxable income and the amount of tax you owe or the refund you are eligible for. Tax papers can include forms, receipts, invoices, and statements that you receive from employers, banks, investment institutions, and other relevant parties.

Why Are Tax Papers Necessary?

The primary reason tax papers are necessary is to ensure accuracy in tax filing. By having all the required documents, you can avoid errors that might lead to delays in processing your tax return or even audits. Furthermore, these papers help in identifying eligible deductions and credits, which can significantly reduce your tax liability. Essentially, tax papers are the backbone of the tax filing process, providing the substance needed to complete your tax return correctly.

The Top 7 Tax Papers You Might Need

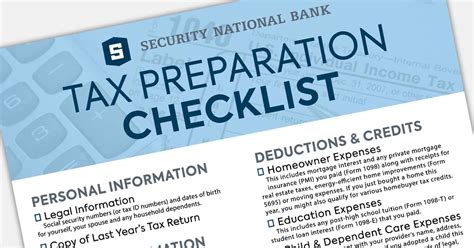

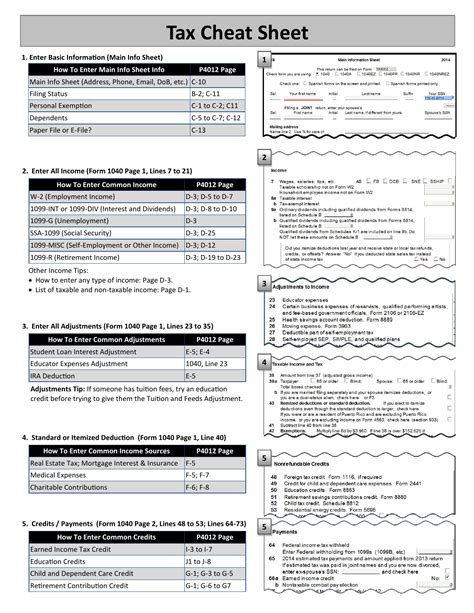

Here are the top 7 tax papers that individuals typically need during tax season: - Form W-2: Issued by your employer, this form shows your income and the taxes withheld from your paycheck. - Form 1099: You will receive this form if you are self-employed or have income from freelance work, interest, dividends, or capital gains distributions. - Interest Statements (1099-INT): Banks and other financial institutions provide these statements to report the interest you earned on your accounts. - Dividend Statements (1099-DIV): Similar to interest statements, these are provided by investment companies to report dividends you received. - Capital Gains and Losses Statements: If you sold stocks, bonds, or other investments, you will need statements showing the gains or losses from these transactions. - Charitable Donation Receipts: Donations to qualified charitable organizations can be deductible. Keep receipts for cash donations and appraisals for non-cash donations. - Medical Expense Receipts: If you have significant medical expenses, keep receipts for doctor visits, prescriptions, hospital stays, and other healthcare costs, as these may be deductible.

Organizing Your Tax Papers

To make the tax filing process smoother, it’s essential to keep your tax papers organized. Consider using a folder or digital storage system where you can categorize and store each type of document. This organization will save you time when you’re ready to file your taxes and reduce the stress associated with searching for misplaced documents.

Tips for Managing Tax Papers Digitally

In today’s digital age, managing your tax papers electronically can be highly efficient. Here are some tips: - Scan your documents: Use a scanner or a scanning app on your smartphone to digitize your tax papers. - Use cloud storage: Services like Google Drive, Dropbox, or OneDrive allow you to store and access your documents from anywhere. - Utilize tax software: Many tax preparation software programs, such as TurboTax or H&R Block, offer tools to import your tax documents directly into your return. - Keep your documents secure: Use strong passwords and enable two-factor authentication to protect your digital tax papers from unauthorized access.

📝 Note: Always ensure that your digital storage method is secure to protect your personal and financial information from identity theft or data breaches.

Conclusion Without a Heading But Still Concluding

In summary, tax papers are fundamental to the tax filing process. They provide the necessary information to accurately report your income, claim deductions, and receive credits. By understanding what tax papers are, why they are necessary, and how to manage them efficiently, you can navigate tax season with confidence. Remember, organization is key, whether you choose to keep your documents in physical form or switch to a digital method. With the right approach, you can ensure a smoother and less stressful tax filing experience.

What is the purpose of Form W-2 in tax filing?

+

Form W-2 is used to report your income and the taxes withheld from your paycheck to the IRS. It’s a crucial document for filing your tax return accurately.

How do I organize my tax papers for easier access?

+

Consider using a physical folder or a digital storage system where you categorize and store each type of tax document. This organization will make the tax filing process more efficient.

Can I file my taxes without all the necessary tax papers?

+

While it’s technically possible to start the tax filing process without all your documents, it’s highly recommended that you gather all necessary tax papers to ensure accuracy and avoid potential audits or delays in your refund.