5 Tips for 1099 Paperwork

Understanding 1099 Paperwork: A Comprehensive Guide

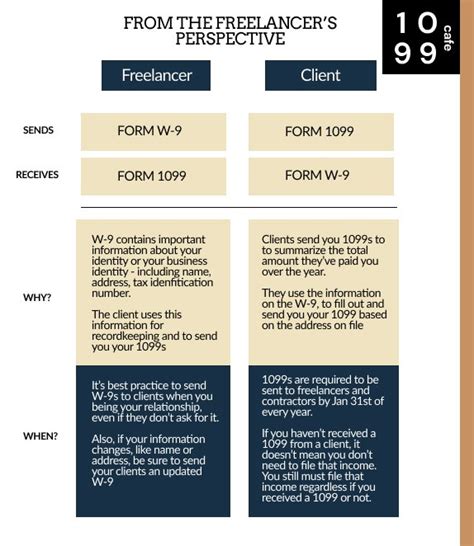

As a freelancer or independent contractor, receiving 1099 paperwork is a crucial part of your annual tax obligations. The 1099 form is used to report income earned from freelance work, and it’s essential to understand how to handle it correctly to avoid any tax-related issues. In this article, we’ll provide you with 5 tips for 1099 paperwork to help you navigate the process with ease.

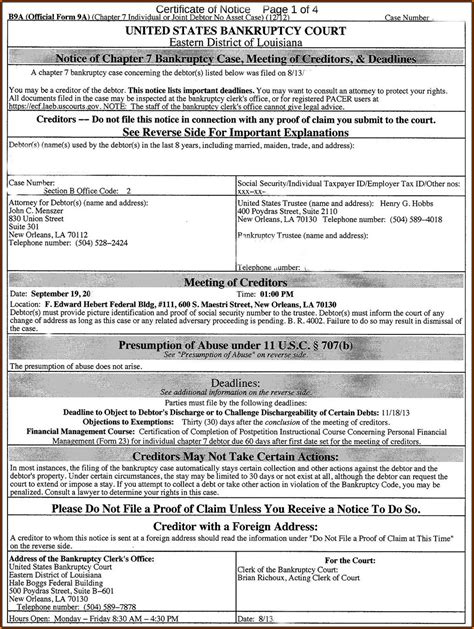

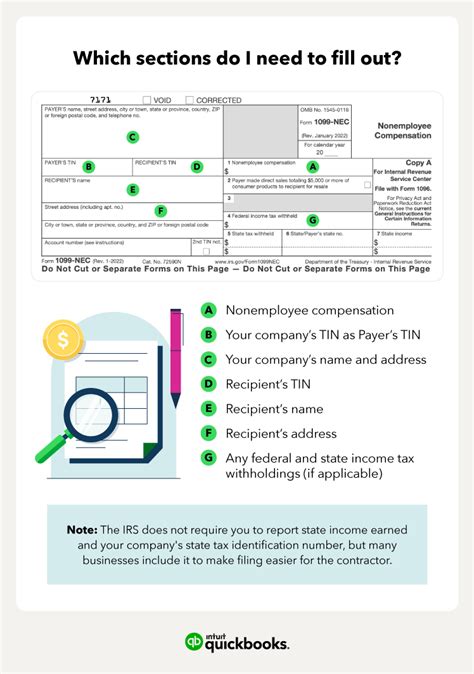

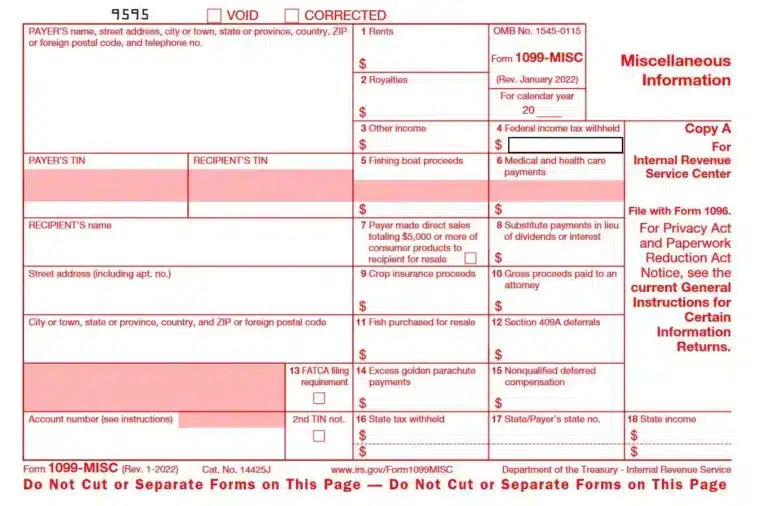

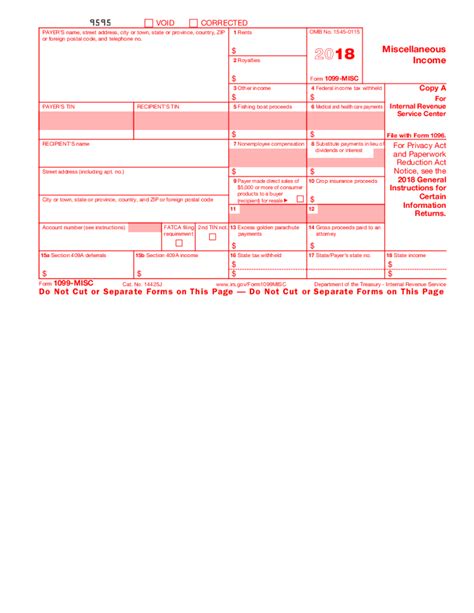

Tip 1: Familiarize Yourself with the 1099 Form

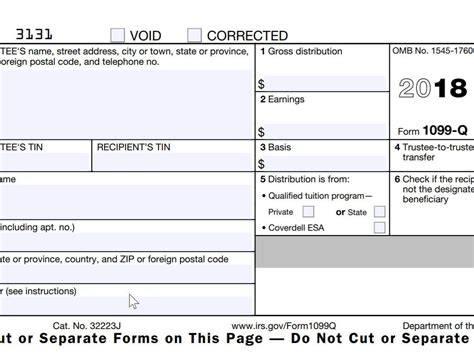

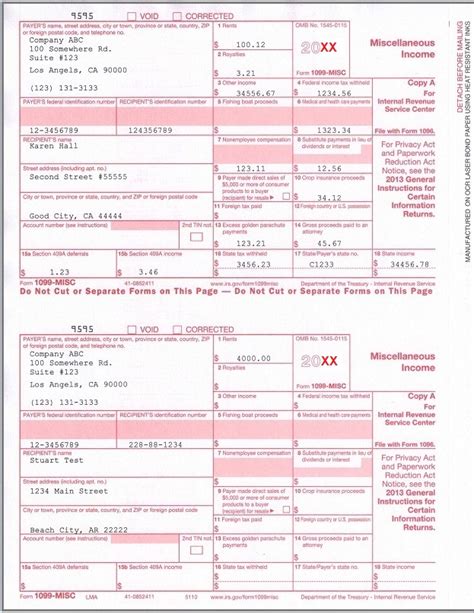

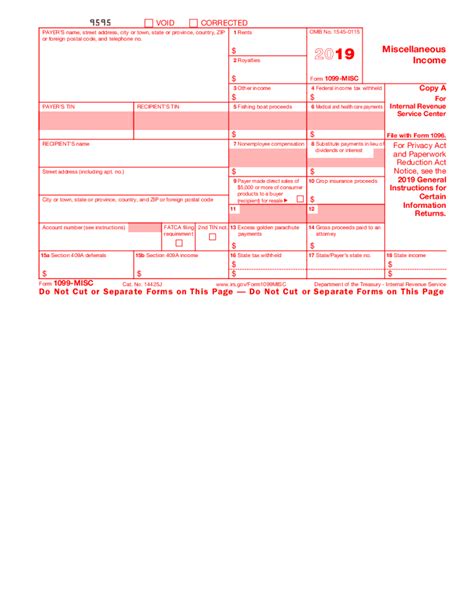

The 1099 form is a critical document that reports your freelance income to the IRS. It’s essential to understand the different types of 1099 forms, including the 1099-MISC and 1099-K. The 1099-MISC form is used to report miscellaneous income, such as freelance work, while the 1099-K form is used to report payment card and third-party network transactions. Make sure you receive the correct form from your clients, and review it carefully to ensure all information is accurate.

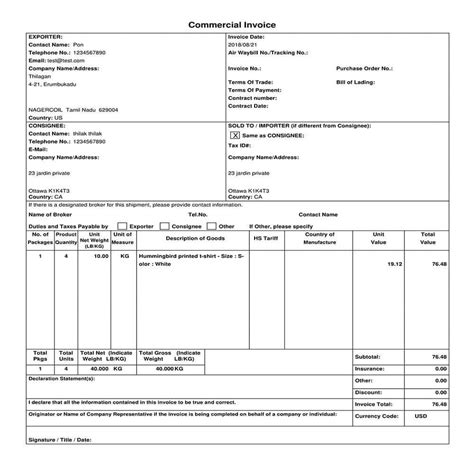

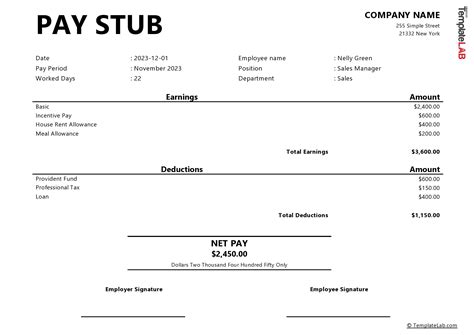

Tip 2: Keep Accurate Records

To ensure you’re reporting your income correctly, it’s crucial to keep accurate records of your freelance work. This includes invoices, contracts, and payment receipts. You should also keep track of your business expenses, as these can be deductible on your tax return. Consider using a accounting software or spreadsheet to help you stay organized and ensure you’re not missing any critical information.

Tip 3: Understand the Deadline

The deadline for receiving 1099 forms is typically January 31st of each year. However, it’s essential to note that this deadline may vary depending on the type of 1099 form and the payer. Make sure you receive your 1099 forms on time, and review them carefully to ensure all information is accurate. If you don’t receive your 1099 form by the deadline, contact the payer to request a copy.

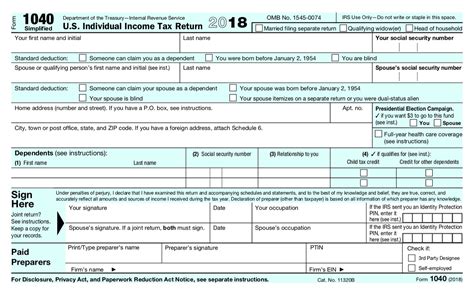

Tip 4: Report Income Correctly

When reporting your income on your tax return, it’s essential to report it correctly. You should report your freelance income on Schedule C of your tax return, which is the form used for business income and expenses. Make sure you’re using the correct tax rates and deductions, and consider consulting a tax professional if you’re unsure about any aspect of the process.

Tip 5: Take Advantage of Deductions

As a freelancer, you may be eligible for business deductions that can help reduce your taxable income. These deductions can include expenses such as home office expenses, equipment, and travel costs. Make sure you’re taking advantage of all the deductions you’re eligible for, and keep accurate records to support your claims. Consider using a tax software or consulting a tax professional to help you navigate the deduction process.

💡 Note: It's essential to keep accurate records of your business expenses, as these can be deductible on your tax return.

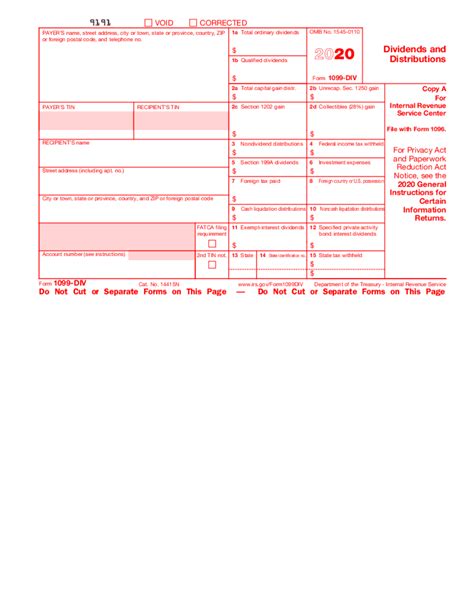

In addition to these tips, it’s also important to understand the 1099 paperwork process in more detail. The following table provides an overview of the different types of 1099 forms and their uses:

| Form Type | Description |

|---|---|

| 1099-MISC | Reports miscellaneous income, such as freelance work |

| 1099-K | Reports payment card and third-party network transactions |

| 1099-INT | Reports interest income |

| 1099-DIV | Reports dividend income |

To further illustrate the importance of accurate record-keeping, consider the following scenario: * You’re a freelance writer, and you’ve completed several projects throughout the year. * You’ve kept accurate records of your income and expenses, including invoices and payment receipts. * When you receive your 1099 form, you review it carefully and notice an error in the reported income. * You contact the payer to request a corrected 1099 form, and you’re able to avoid any potential tax issues.

In summary, handling 1099 paperwork correctly is crucial for freelancers and independent contractors. By following these 5 tips, you can ensure you’re reporting your income correctly and taking advantage of all the deductions you’re eligible for. Remember to keep accurate records, understand the deadline, and report your income correctly to avoid any tax-related issues.

What is the deadline for receiving 1099 forms?

+

The deadline for receiving 1099 forms is typically January 31st of each year.

How do I report my freelance income on my tax return?

+

You should report your freelance income on Schedule C of your tax return, which is the form used for business income and expenses.

What are some common business deductions for freelancers?

+

Common business deductions for freelancers include home office expenses, equipment, and travel costs.