5 Tips 501c3

Understanding the Basics of 501c3 Organizations

When it comes to non-profit organizations, one of the most common and beneficial designations is the 501c3 status. This designation is granted by the Internal Revenue Service (IRS) to organizations that meet specific requirements, including being organized and operated exclusively for charitable, educational, or religious purposes. In this article, we will delve into the world of 501c3 organizations, exploring their benefits, requirements, and providing valuable tips for those looking to establish or manage such an entity.

Benefits of 501c3 Status

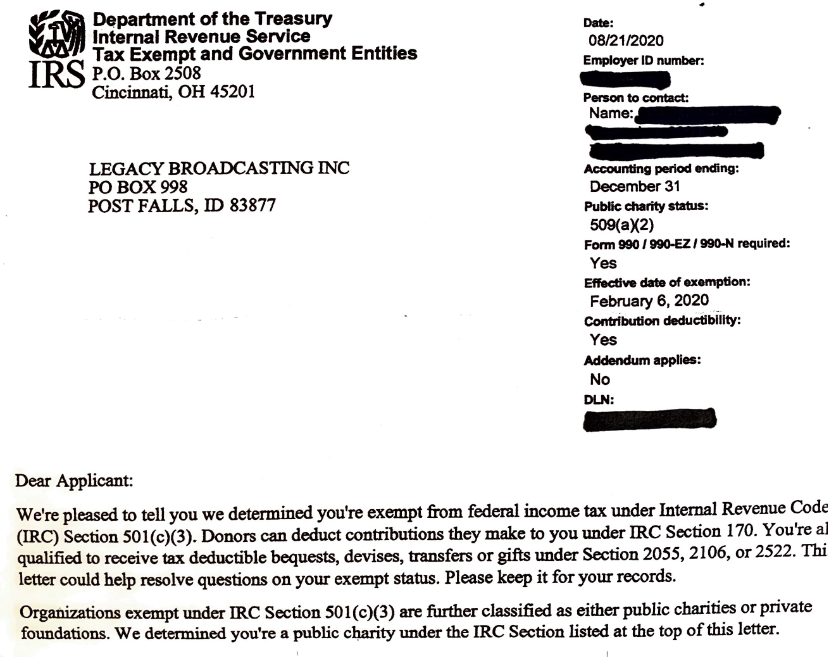

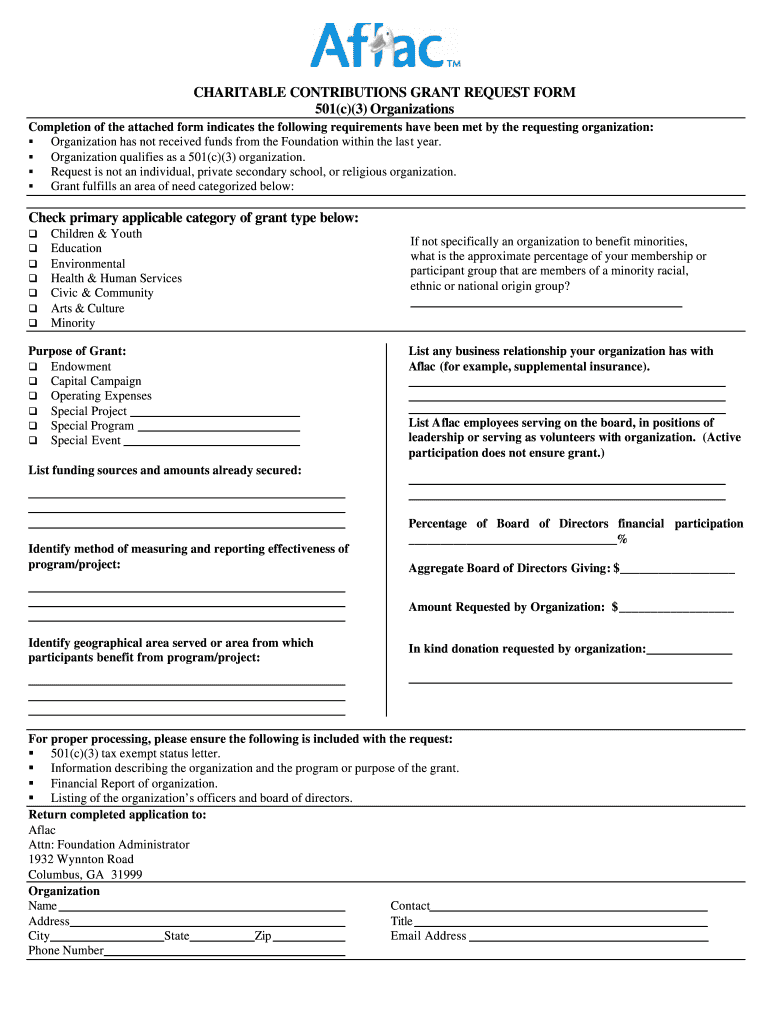

One of the primary advantages of having a 501c3 designation is that it allows organizations to be exempt from federal income tax. This means that any income the organization generates through donations or fundraising efforts is not subject to taxation, allowing more resources to be dedicated to the organization’s mission. Additionally, donations made to 501c3 organizations are tax-deductible for the donors, which can significantly increase the attractiveness of the organization to potential donors. Donor confidence is also boosted, as the 501c3 status signifies that the organization is held to a high standard of accountability and transparency.

Requirements for 501c3 Status

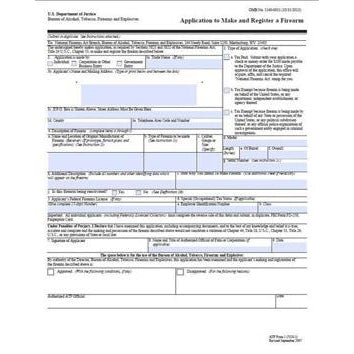

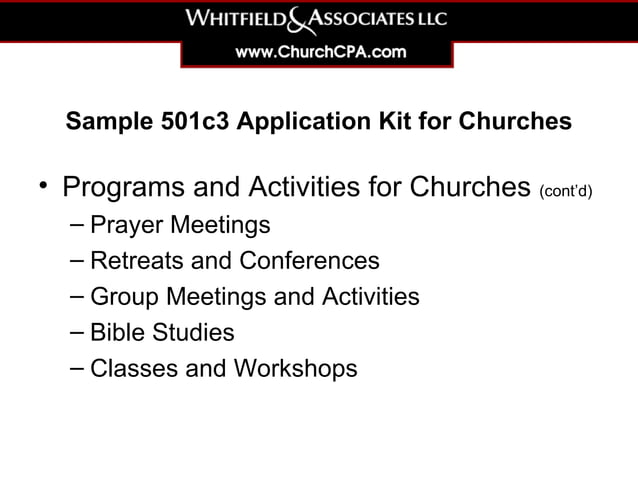

To qualify for 501c3 status, an organization must meet several critical requirements: - It must be organized as a corporation, trust, or association. - Its purpose must be exclusively charitable, educational, or religious. - It must not be an action organization, i.e., it cannot participate in, or intervene in, any political campaign on behalf of (or in opposition to) any candidate for public office. - The organization’s net earnings may not inure to the benefit of any private shareholder or individual. - It must file Form 1023 with the IRS, which includes detailed information about the organization, its structure, its mission, and its financial situation.

5 Tips for 501c3 Organizations

For those looking to establish or successfully manage a 501c3 organization, here are five invaluable tips:

Develop a Strong Mission Statement: A clear and compelling mission statement is the foundation of any successful non-profit organization. It should succinctly articulate the organization’s purpose, goals, and the impact it aims to make. This statement will guide decision-making, help in communicating with stakeholders, and ensure everyone involved is working towards the same objectives.

Build a Diverse and Experienced Board: The board of directors plays a crucial role in the governance and strategic direction of a 501c3 organization. A diverse board with a mix of skills, experiences, and perspectives can provide valuable insights, ensure good governance, and help in making informed decisions. It’s essential to include members with expertise in areas such as finance, law, marketing, and the specific field of the organization’s mission.

Implement Transparent Financial Practices: Transparency in financial dealings is paramount for 501c3 organizations. This includes maintaining accurate and detailed financial records, conducting annual audits, and making financial information available to the public. Transparency helps build trust with donors and stakeholders, ensuring the long-term sustainability of the organization.

Engage in Continuous Fundraising Efforts: Relying on a single source of funding can be risky for any non-profit. Developing a diverse fundraising strategy that includes individual giving, grants, events, and corporate partnerships can help stabilize the organization’s financial situation. Donor retention is also key, and efforts should be made to build long-term relationships with donors through regular communication and recognition of their contributions.

Stay Compliant with Regulatory Requirements: Compliance with IRS regulations and other legal requirements is essential for maintaining 501c3 status. This includes filing the annual Form 990, which provides information about the organization’s financial activities, governance, and compliance with tax laws. Failure to comply can result in penalties, loss of tax-exempt status, or even legal action.

Conclusion of 501c3 Journey

Navigating the world of 501c3 organizations requires dedication, persistence, and a deep understanding of the legal, financial, and operational aspects of non-profit management. By following the tips outlined above and staying focused on the organization’s mission, leaders of 501c3 organizations can ensure their entity not only thrives but also makes a meaningful and lasting impact in the community it serves.

What is the primary benefit of having a 501c3 status?

+

The primary benefit is that the organization is exempt from federal income tax, allowing it to dedicate more resources to its mission. Additionally, donations to 501c3 organizations are tax-deductible for donors.

How do I apply for 501c3 status for my organization?

+

To apply, you must file Form 1023 with the IRS, providing detailed information about your organization, including its purpose, structure, and financial situation. It’s recommended to consult with a legal or tax professional to ensure all requirements are met.

What are the consequences of not complying with IRS regulations as a 501c3 organization?

+

Failure to comply can result in penalties, loss of tax-exempt status, or even legal action. It’s crucial for 501c3 organizations to stay up-to-date with all regulatory requirements, including annual filing of Form 990.