5 ORS Paperwork Laws

Understanding the 5 ORS Paperwork Laws

The Oregon Revised Statutes (ORS) contain a plethora of laws that govern various aspects of life in Oregon, from business operations to personal freedoms. Among these laws, there are five key paperwork laws that individuals and businesses should be aware of to avoid any potential legal issues. Compliance with these laws is crucial to maintaining a smooth and lawful operation. In this article, we will delve into each of these laws, exploring their requirements and implications.

1. Business Registration (ORS 60.001 to 60.144)

For any business operating in Oregon, registration with the Secretary of State’s office is mandatory. This includes corporations, limited liability companies (LLCs), limited partnerships, and other business entities. The paperwork involves submitting articles of incorporation or organization, which detail the business’s name, purpose, structure, and other essential information. Annual reports are also required to keep the state updated on the business’s status and any changes.

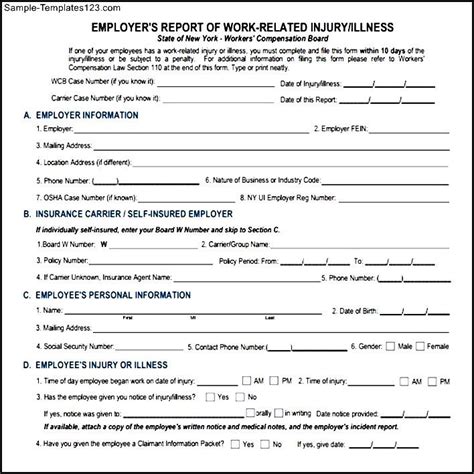

2. Employment Law (ORS 653.010 to 653.992)

Employers in Oregon must comply with various employment laws, including those related to wage and hour requirements, workers’ compensation, and employment discrimination. The paperwork for employment laws includes maintaining accurate records of employee hours, wages, and other employment conditions. Employers must also display certain posters in the workplace, informing employees of their rights under Oregon law.

3. Real Estate Transactions (ORS 93.010 to 93.865)

The paperwork for real estate transactions in Oregon is extensive, involving deeds, titles, and other documents that must be accurately prepared and recorded. The laws govern how property can be bought, sold, and transferred, including the requirements for disclosure statements and contract provisions. Compliance with these laws is essential to ensure that real estate transactions are valid and enforceable.

4. Taxation (ORS 305.001 to 320.940)

Oregon’s tax laws require individuals and businesses to file various tax returns and reports. The paperwork includes income tax returns, business tax returns, and other tax-related forms. The laws also provide for tax exemptions and credits under certain conditions, which can reduce the tax liability of eligible individuals and businesses.

5. Environmental Regulations (ORS 465.001 to 466.860)

The environmental regulations in Oregon aim to protect the state’s natural resources and public health. The paperwork for these regulations involves permit applications, environmental impact statements, and compliance reports. Businesses and individuals must comply with laws related to air and water quality, waste management, and hazardous substances to avoid penalties and ensure a sustainable environment.

📝 Note: It is essential to consult with a legal professional to ensure compliance with the specific paperwork requirements of each law, as the regulations can change and may have unique application to individual circumstances.

In summary, understanding and complying with the 5 ORS paperwork laws is vital for individuals and businesses in Oregon. These laws govern business registration, employment, real estate transactions, taxation, and environmental regulations, each with its own set of paperwork requirements. By being aware of these laws and maintaining accurate and timely paperwork, individuals and businesses can avoid legal issues and ensure smooth operations.

To further illustrate the importance of compliance, consider the following table:

| Law | Paperwork Requirements | Consequences of Non-Compliance |

|---|---|---|

| Business Registration | Articles of incorporation, annual reports | Fines, dissolution of the business |

| Employment Law | Employee records, posters | Lawsuits, fines, loss of business license |

| Real Estate Transactions | Deeds, titles, disclosure statements | Invalid transactions, lawsuits |

| Taxation | Tax returns, reports | Fines, penalties, interest on unpaid taxes |

| Environmental Regulations | Permit applications, environmental impact statements | Fines, penalties, legal action |

The implications of non-compliance with these laws can be severe, ranging from fines and penalties to the dissolution of a business or legal action. Therefore, it is crucial to prioritize compliance and seek professional advice when necessary.

In wrapping up our discussion on the 5 ORS paperwork laws, it’s clear that compliance is not just a legal requirement but also a strategic move for any individual or business operating in Oregon. By understanding and adhering to these laws, entities can protect themselves from legal repercussions, maintain a good standing with regulatory bodies, and contribute to the state’s economic and environmental well-being.

What are the consequences of not registering a business in Oregon?

+

The consequences can include fines, and the business may not be able to enforce its contracts or protect its assets. Additionally, the business may face dissolution.

How often must employers in Oregon update their employee records?

+

Employers must maintain accurate and up-to-date records of their employees, including hours worked, wages paid, and other employment conditions. The frequency of updates can depend on the specific requirements of the law and the nature of the business.

What is the purpose of environmental impact statements in Oregon?

+

The purpose of environmental impact statements is to assess the potential environmental effects of a proposed project or activity. This helps regulatory bodies make informed decisions and ensures that projects are carried out in a way that minimizes harm to the environment.