5 Nonprofit Paperwork Tips

Understanding the Importance of Nonprofit Paperwork

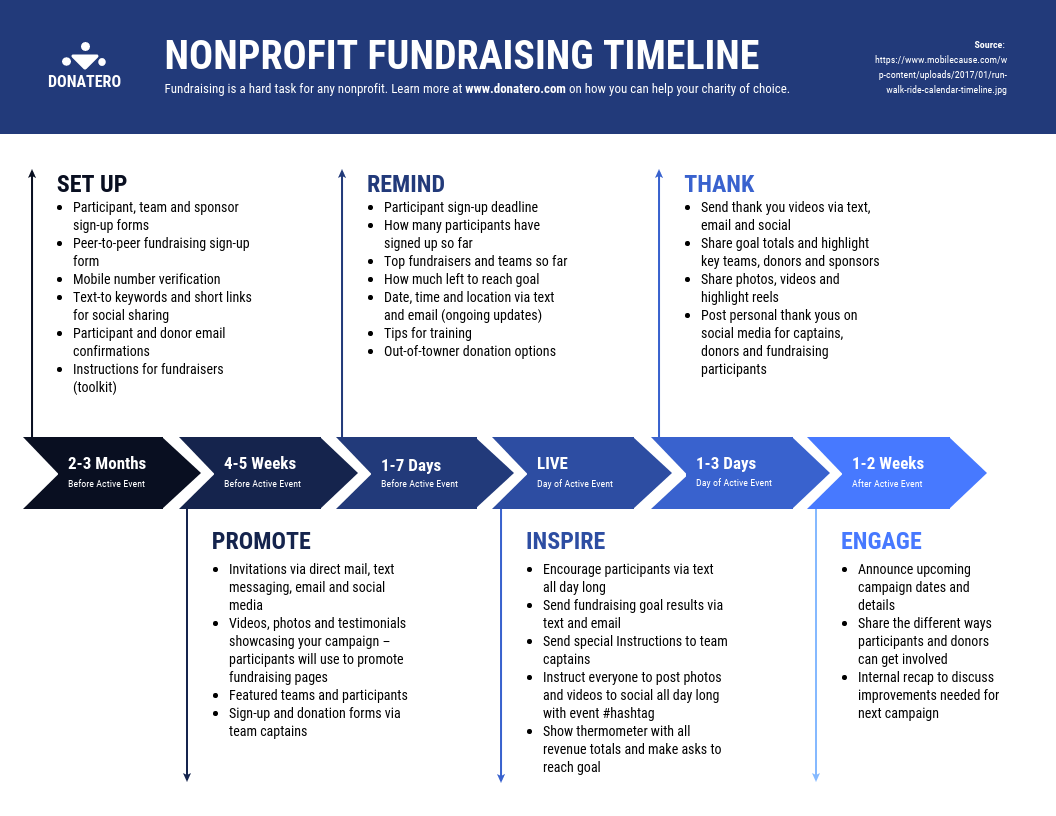

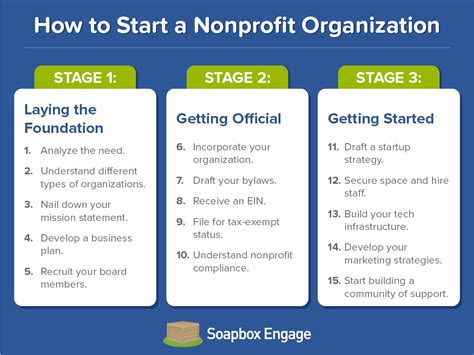

When it comes to running a nonprofit organization, there are numerous aspects to consider, from fundraising and volunteer management to community outreach and program development. However, one crucial aspect that often gets overlooked is paperwork. Nonprofit paperwork is essential for maintaining transparency, ensuring compliance with regulations, and demonstrating accountability to stakeholders. In this article, we will explore five nonprofit paperwork tips to help organizations navigate the complex world of documentation and compliance.

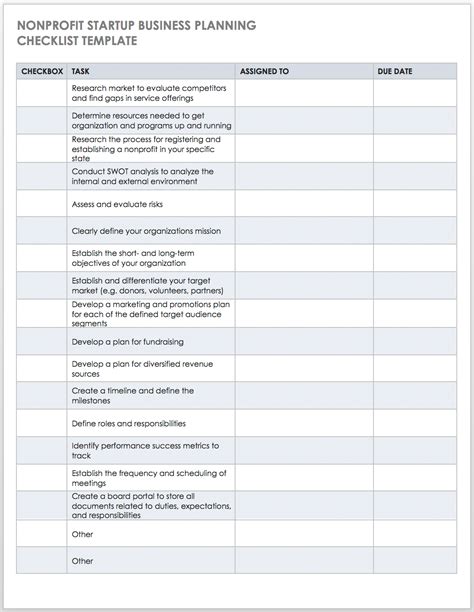

Tip 1: Develop a Comprehensive Filing System

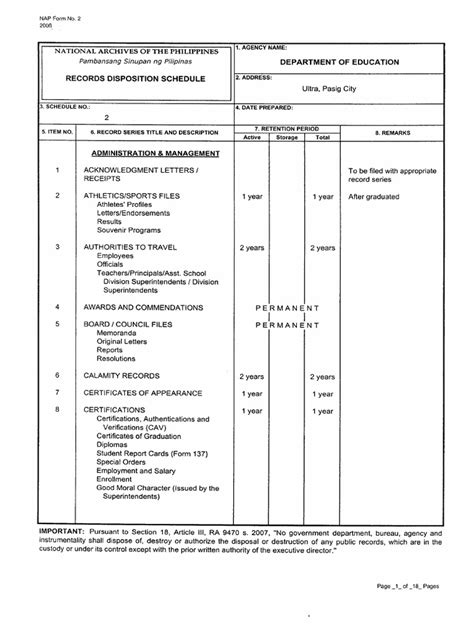

A well-organized filing system is the backbone of any nonprofit’s paperwork management. This includes both physical and digital files, such as board meeting minutes, financial statements, and donor records. A comprehensive filing system enables quick access to important documents, reducing the time spent searching for information and minimizing the risk of lost or misplaced files. Consider implementing a cloud-based storage solution to enhance collaboration and security.

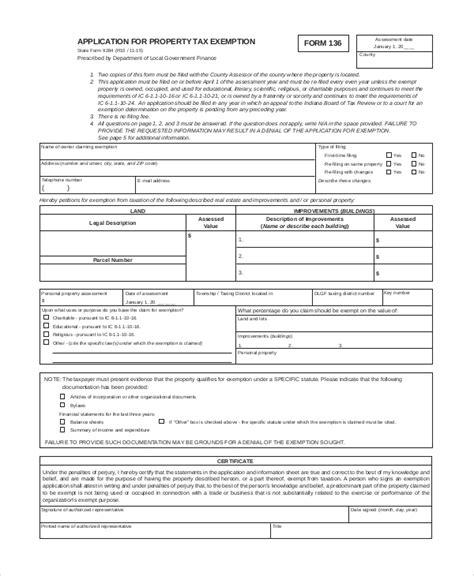

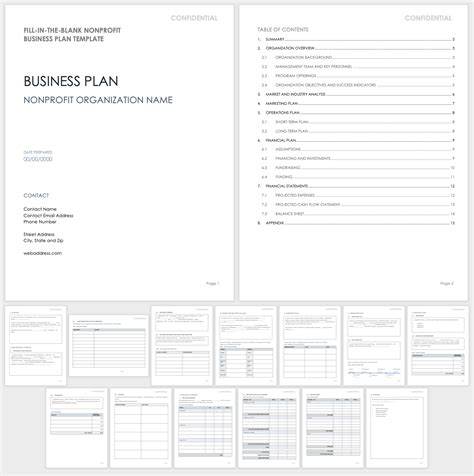

Tip 2: Ensure Compliance with Regulatory Requirements

Nonprofits must comply with various regulatory requirements, including annual reporting to the Internal Revenue Service (IRS) and state charity registration. It is essential to stay up-to-date with changing regulations and deadlines to avoid penalties and maintain tax-exempt status. Key documents to keep track of include: * Form 990: Annual information return filed with the IRS * Form 1023: Application for recognition of exemption under Section 501©(3) * State charity registration documents

Tip 3: Maintain Accurate Financial Records

Accurate financial records are critical for nonprofit organizations, as they provide a clear picture of the organization’s financial health and help identify areas for improvement. Key financial documents to maintain include: * Balance sheets * Income statements * Cash flow statements * Accounting ledgers Consider implementing a robust accounting software to streamline financial record-keeping and ensure compliance with accounting standards.

Tip 4: Protect Donor Information and Maintain Confidentiality

Nonprofits often handle sensitive donor information, including contact details and donation amounts. It is essential to protect this information and maintain confidentiality to build trust with donors and ensure ongoing support. Consider implementing a donor management system to securely store and track donor information.

Tip 5: Review and Update Paperwork Regularly

Nonprofit paperwork is not a one-time task; it requires regular review and updates to ensure accuracy and compliance. Schedule regular audits to: * Review financial statements and accounting records * Update donor records and contact information * Ensure compliance with changing regulatory requirements * Destroy or archive outdated or unnecessary documents

| Document Type | Retention Period |

|---|---|

| Financial statements | 3-5 years |

| Donor records | Permanent |

| Board meeting minutes | Permanent |

📝 Note: The retention period for documents may vary depending on the organization's policies and regulatory requirements. It is essential to consult with a legal or financial expert to determine the appropriate retention period for each document type.

As nonprofit organizations continue to play a vital role in addressing social and community needs, it is essential to prioritize paperwork management to ensure transparency, accountability, and compliance. By implementing these five nonprofit paperwork tips, organizations can streamline their documentation processes, reduce the risk of errors or noncompliance, and focus on their core mission.

In summary, effective nonprofit paperwork management is critical for maintaining transparency, ensuring compliance, and demonstrating accountability. By developing a comprehensive filing system, ensuring compliance with regulatory requirements, maintaining accurate financial records, protecting donor information, and reviewing and updating paperwork regularly, nonprofits can ensure the long-term sustainability and success of their organization.