Paperwork

5 COBRA Paperwork Tips

Introduction to COBRA Paperwork

When an employee leaves a job, whether due to resignation, termination, or other circumstances, they often face significant changes in their benefits, including health insurance. The Consolidated Omnibus Budget Reconciliation Act of 1985, commonly referred to as COBRA, provides a way for these employees and their families to continue their health coverage for a limited time after the job ends. However, managing COBRA paperwork can be complex and time-consuming. Here are five tips to help navigate this process efficiently.

Understanding COBRA Eligibility

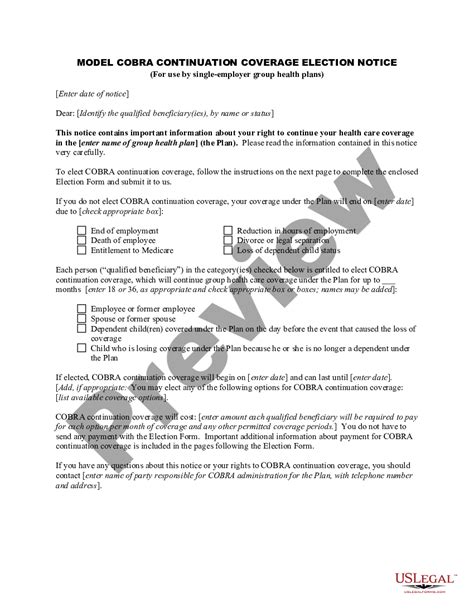

To begin with, it’s crucial to understand who is eligible for COBRA benefits. This typically includes employees, their spouses, and their dependent children who were covered under the employer’s health plan before the qualifying event (such as job loss or reduction in work hours). The key to eligibility is that the qualifying event must directly result in the loss of health coverage. Knowing who is eligible helps in preparing and managing the necessary paperwork.

Tips for Managing COBRA Paperwork

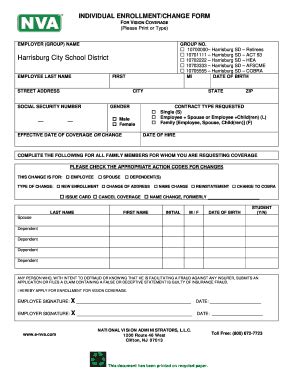

Here are five essential tips for managing COBRA paperwork effectively: - Tip 1: Identify the Qualifying Event - Clearly define the qualifying event that triggers COBRA eligibility. This could be the employee’s termination, reduction in hours, death, divorce, or a child losing dependent status. Accurately documenting this event is vital for the paperwork process. - Tip 2: Notify the Plan Administrator - The employer or plan administrator must be notified within a certain timeframe (usually 30 days) of the qualifying event. This notification is critical for initiating the COBRA process. - Tip 3: Provide Notice to the Qualified Beneficiaries - After the plan administrator is notified, they must provide notice to the qualified beneficiaries (the employee and their covered family members) within 14 days. This notice explains their rights under COBRA and how to elect continuation coverage. - Tip 4: Complete the COBRA Election Form - Qualified beneficiaries must complete and return the COBRA election form within 60 days of receiving the notice. It’s essential to review the form carefully to ensure all required information is provided and deadlines are met. - Tip 5: Maintain Accurate Records - Keeping detailed and accurate records of all correspondence, notices, and forms related to COBRA is vital. This includes dates of notices, election forms, and payments. Organized records can help resolve any disputes or issues that may arise during the COBRA process.

Key Considerations for Employers

For employers, managing COBRA paperwork involves several key considerations: - Ensuring compliance with COBRA regulations to avoid penalties. - Clearly communicating the COBRA process and deadlines to qualified beneficiaries. - Maintaining detailed records of COBRA-related activities. - Understanding the costs associated with COBRA coverage and how these are managed and paid.

Benefits of Efficient COBRA Management

Efficiently managing COBRA paperwork provides several benefits, including: - Reduced risk of non-compliance and associated penalties. - Improved relationships with former employees by ensuring they receive necessary benefits information. - Enhanced organizational efficiency through streamlined processes and record-keeping.

📝 Note: Employers should consult with legal or HR professionals to ensure their COBRA administration processes are compliant with all relevant laws and regulations.

Conclusion and Next Steps

In summary, navigating COBRA paperwork requires a thorough understanding of the process, from identifying qualifying events to maintaining accurate records. By following these tips and considering the key aspects of COBRA management, employers can ensure compliance, efficiency, and satisfaction for all parties involved. Whether you’re an employer seeking to streamline your COBRA administration or an individual looking to understand your benefits options after a job change, taking a proactive and informed approach is crucial.

What is the timeframe for notifying the plan administrator of a qualifying event?

+

The employer or plan administrator must be notified within 30 days of the qualifying event.

How long do qualified beneficiaries have to elect COBRA continuation coverage?

+

Qualified beneficiaries have 60 days from the date they receive the COBRA notice to elect continuation coverage.

What are the consequences of not complying with COBRA regulations?

+

Failure to comply with COBRA regulations can result in significant penalties, including fines and legal action.