Paperwork

5 Tips Fix Finance Error

Introduction to Financial Errors

Financial errors can be a significant setback for individuals and businesses alike. These errors can range from minor mistakes in accounting to major frauds that can lead to legal issues. Identifying and fixing financial errors is crucial to maintain the health and integrity of financial records. In this article, we will explore five tips to fix finance errors, ensuring that financial statements are accurate and reliable.

Understanding the Nature of Financial Errors

Before diving into the solutions, it’s essential to understand the nature of financial errors. These errors can be categorized into two main types: intentional errors, which include fraud and deliberate misrepresentations, and unintentional errors, which are honest mistakes due to lack of knowledge, carelessness, or system failures. Recognizing the type of error is crucial in applying the appropriate corrective measures.

Tips to Fix Finance Errors

Here are five tips to help in fixing financial errors:

- Regular Audits: Conducting regular audits is a proactive approach to identifying and fixing financial errors. Audits can be internal or external, and they help in reviewing financial statements and transactions to ensure accuracy and compliance with financial regulations.

- Use of Technology: Leveraging technology, such as accounting software, can significantly reduce financial errors. These tools automate many processes, minimizing the chance for human error. They also provide real-time updates and can highlight discrepancies or anomalies in financial records.

- Employee Training: Ensuring that employees, especially those in financial roles, are well-trained and updated with the latest financial regulations and best practices can prevent many financial errors. Training programs should cover topics such as financial reporting, compliance, and internal controls.

- Implementing Internal Controls: Strong internal controls are vital in preventing and detecting financial errors. This includes separating duties, requiring approvals for transactions, and having a system for reporting and addressing discrepancies.

- Seeking Professional Help: For complex financial errors, seeking help from financial professionals or consultants can be beneficial. They can provide expert advice on how to correct errors and implement measures to prevent future occurrences.

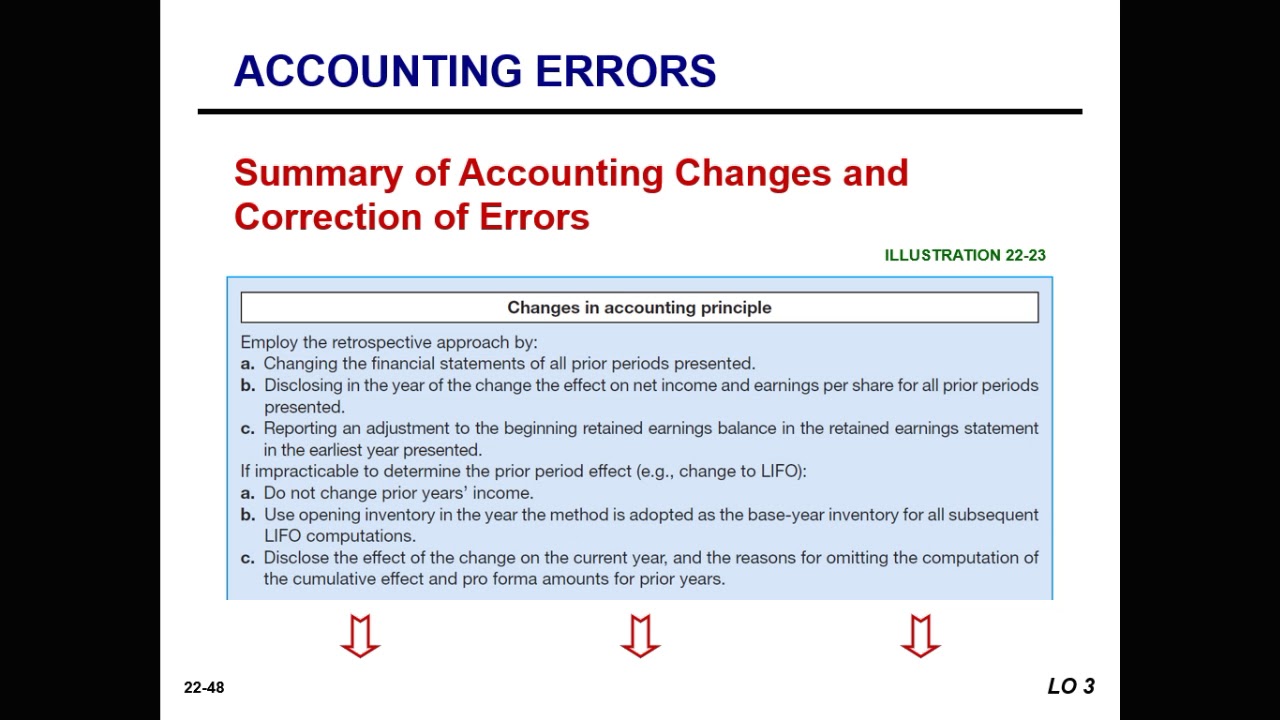

Steps to Correct Financial Errors

Correcting financial errors involves several steps:

- Identify the Error: The first step is to identify the error. This could be through an audit, a review of financial statements, or notification from a regulatory body.

- Assess the Impact: Once the error is identified, assess its impact on the financial statements and the business as a whole.

- Correct the Error: This involves making the necessary adjustments to the financial records. It may require restating financial statements or making adjustments to accounts.

- Implement Preventive Measures: After correcting the error, it’s essential to implement measures to prevent similar errors from occurring in the future. This could involve changing internal controls, providing additional training, or adopting new technologies.

Importance of Preventing Financial Errors

Preventing financial errors is as important as correcting them. Financial errors can lead to legal issues, financial losses, and reputational damage. Preventive measures, such as regular audits, employee training, and the use of technology, can help in minimizing the risk of financial errors.

Conclusion

In conclusion, financial errors are a reality that businesses and individuals must face. However, with the right strategies and proactive measures, these errors can be identified, corrected, and prevented. By understanding the nature of financial errors, implementing regular audits, leveraging technology, providing employee training, implementing internal controls, and seeking professional help when needed, individuals and businesses can ensure the accuracy and reliability of their financial records. This not only protects them from legal and financial repercussions but also builds trust and confidence among stakeholders.

What are the most common types of financial errors?

+

The most common types of financial errors include accounting mistakes, fraud, and errors in financial reporting. These can stem from intentional actions or unintentional mistakes due to lack of knowledge or system failures.

How can technology help in fixing financial errors?

+

Technology, such as accounting software, can help in fixing financial errors by automating financial processes, reducing the chance for human error, and providing real-time updates and alerts for discrepancies or anomalies in financial records.

What is the importance of regular audits in preventing financial errors?

+

Regular audits are crucial in preventing financial errors as they provide a systematic review of financial records and transactions. Audits help in identifying and correcting errors, ensuring compliance with financial regulations, and implementing controls to prevent future errors.