Employee Paperwork Requirements

Introduction to Employee Paperwork Requirements

When hiring new employees, it’s essential to ensure that all necessary paperwork is completed accurately and efficiently. This not only helps to avoid potential legal issues but also ensures a smooth onboarding process for the new hire. In this blog post, we will delve into the world of employee paperwork requirements, exploring the various documents and forms that employers need to be aware of.

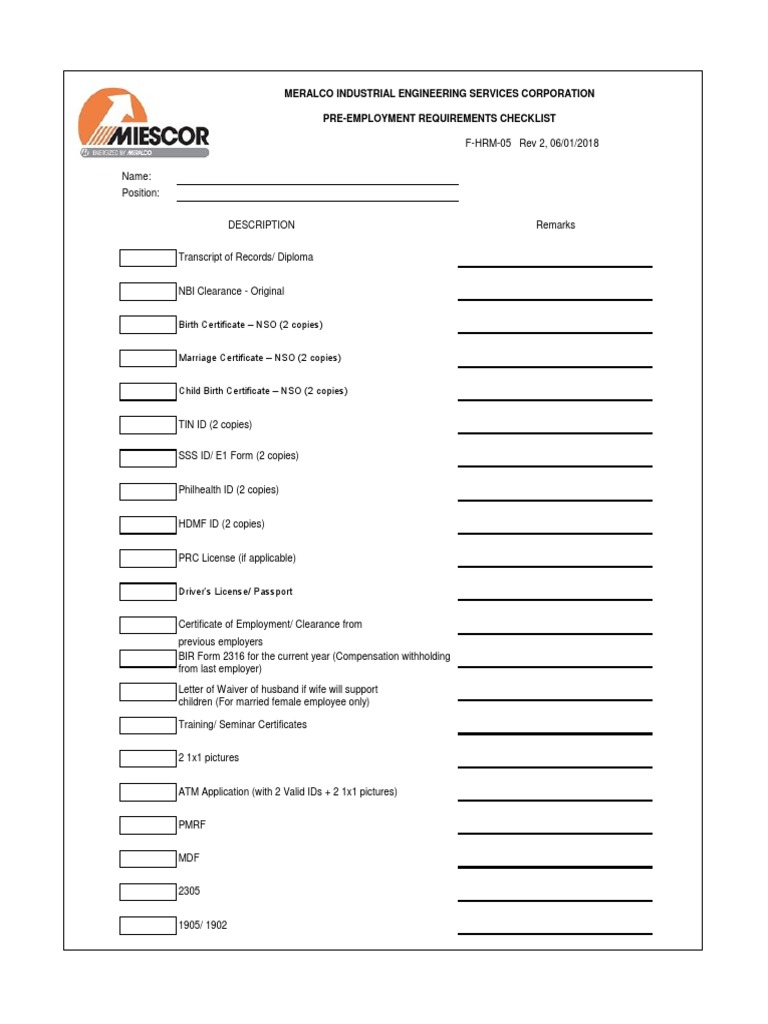

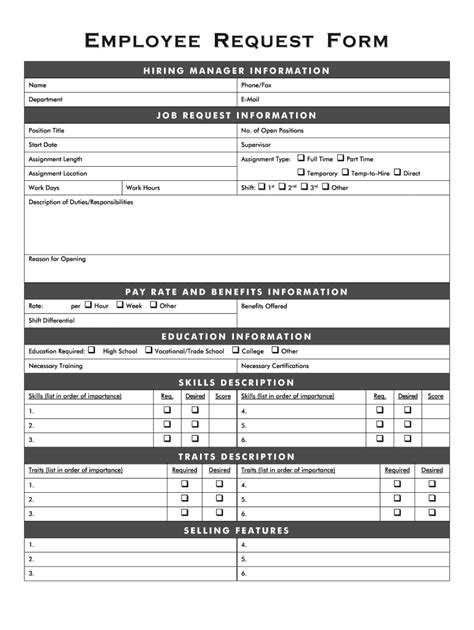

Pre-Employment Paperwork

Before an employee starts working, there are several documents that need to be completed. These include: * Job application form: This form provides essential information about the applicant, including their contact details, work experience, and qualifications. * Resume and cover letter: These documents provide a more detailed overview of the applicant’s skills and experience. * Reference checks: Employers may request references from previous employers or colleagues to verify the applicant’s work history and performance. * Background checks: Depending on the industry and job requirements, employers may conduct background checks to ensure the applicant’s suitability for the role.

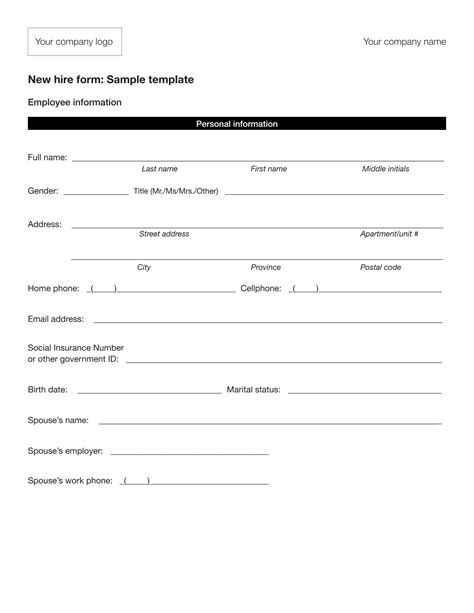

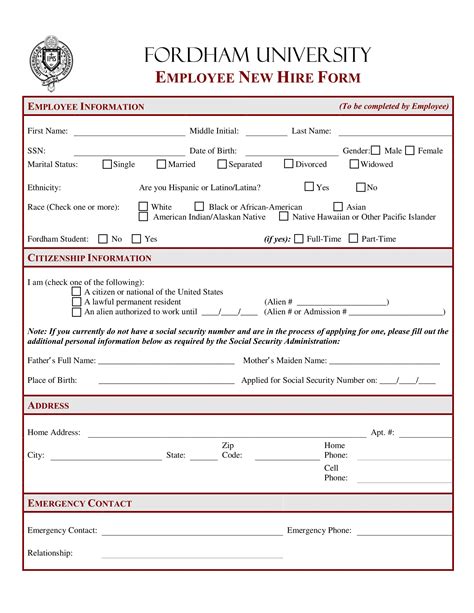

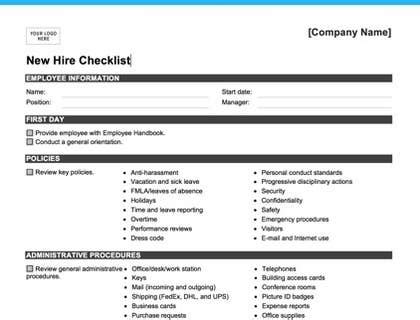

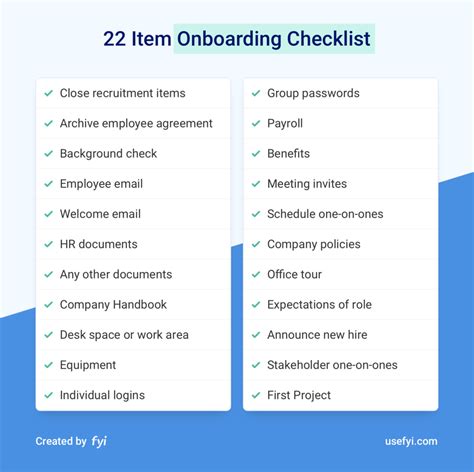

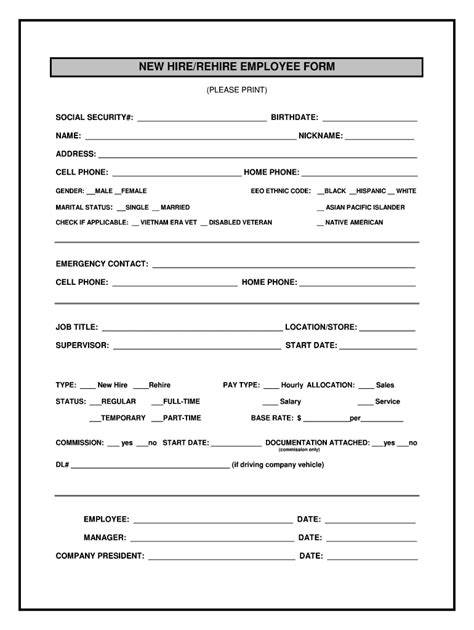

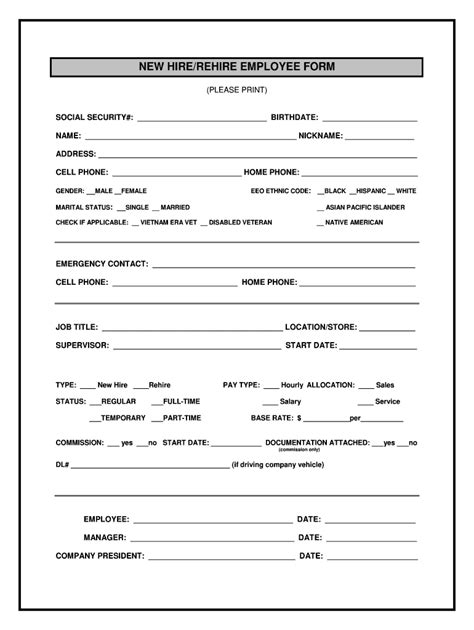

New Hire Paperwork

Once an employee has been hired, there are several documents that need to be completed as part of the onboarding process. These include: * Employment contract: This contract outlines the terms and conditions of employment, including salary, benefits, and job responsibilities. * W-4 form: This form is used to determine the amount of taxes to be withheld from the employee’s salary. * I-9 form: This form is used to verify the employee’s identity and eligibility to work in the country. * Benefits enrollment forms: These forms are used to enroll the employee in benefits such as health insurance, retirement plans, and other perks.

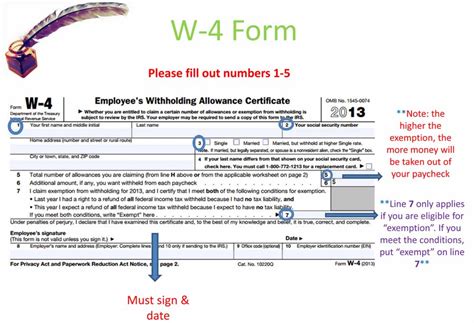

Tax-Related Paperwork

Employers are required to comply with various tax laws and regulations, including: * Withholding taxes: Employers must withhold taxes from employees’ salaries and pay them to the relevant authorities. * Reporting taxes: Employers must report taxes withheld to the relevant authorities and provide employees with a summary of taxes withheld. * Complying with tax laws: Employers must comply with various tax laws and regulations, including those related to payroll taxes, income taxes, and employment taxes.

Compliance with Labor Laws

Employers must comply with various labor laws and regulations, including: * Minimum wage laws: Employers must pay employees at least the minimum wage required by law. * Overtime laws: Employers must pay employees overtime pay for hours worked beyond the standard working hours. * Leave laws: Employers must provide employees with leave entitlements, including sick leave, vacation leave, and family leave.

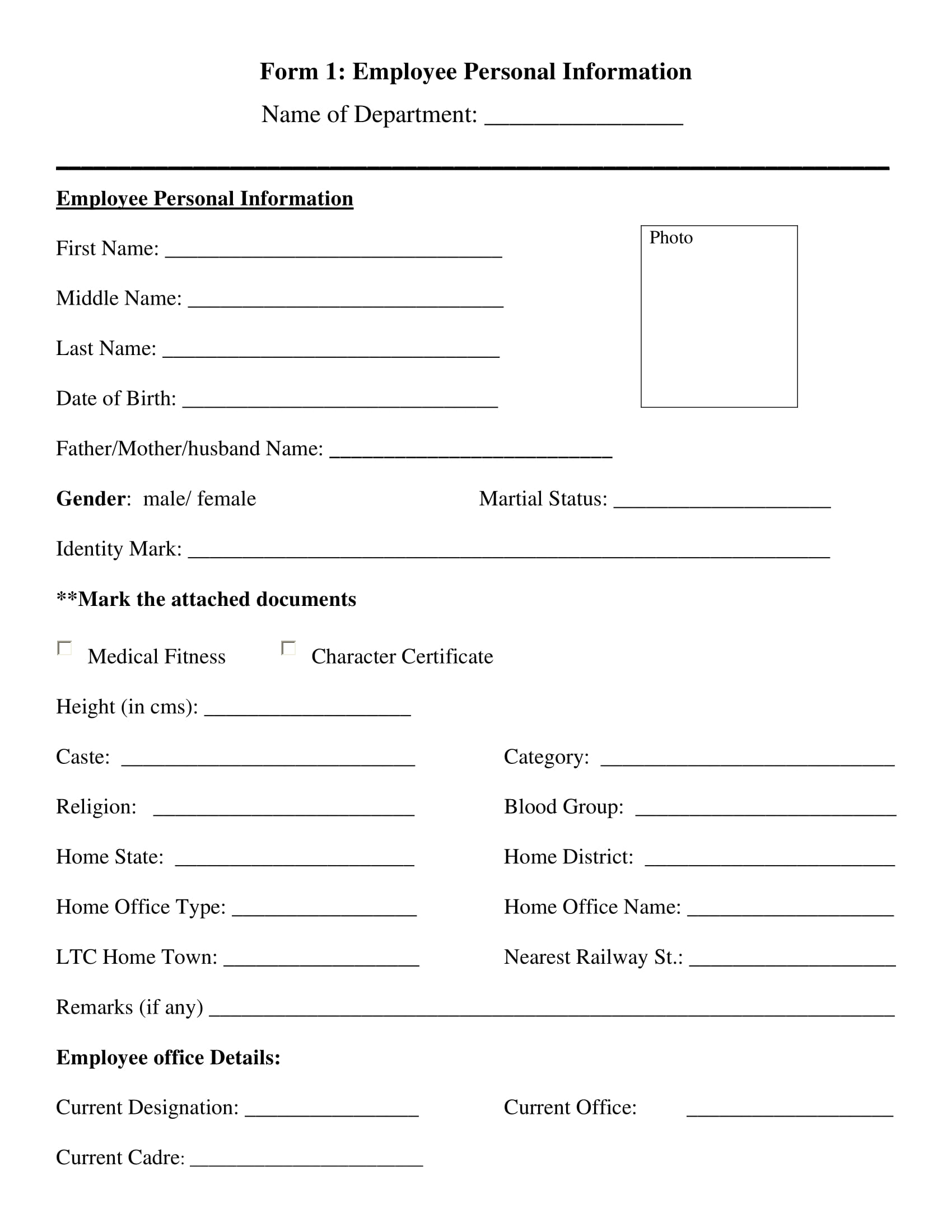

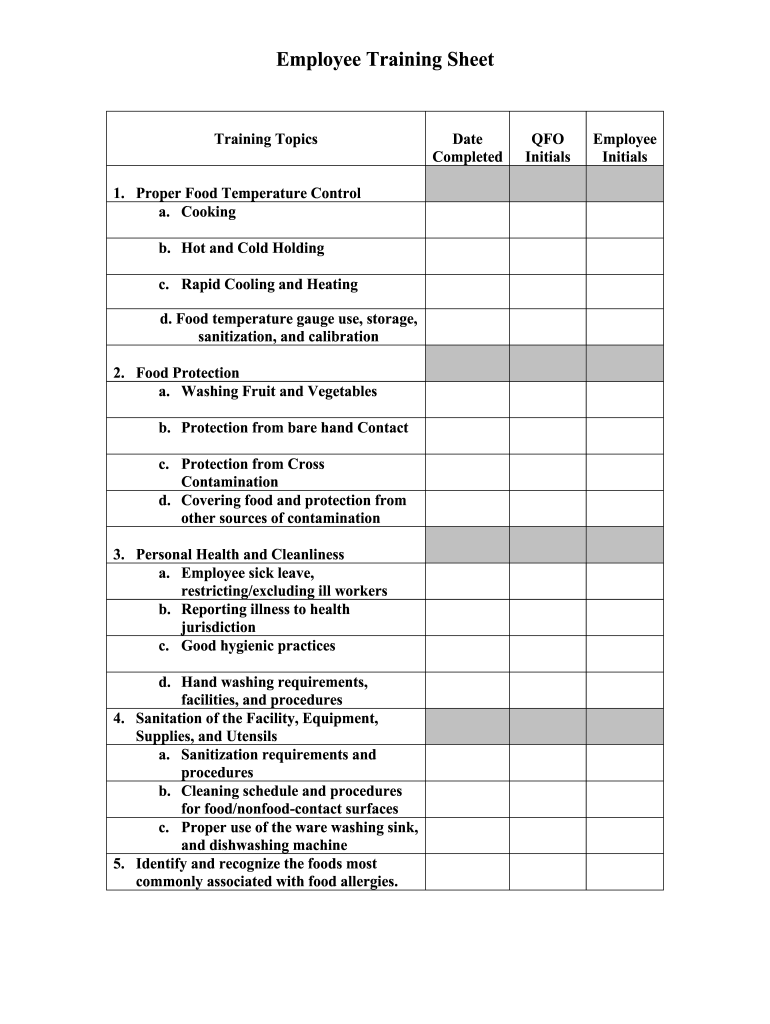

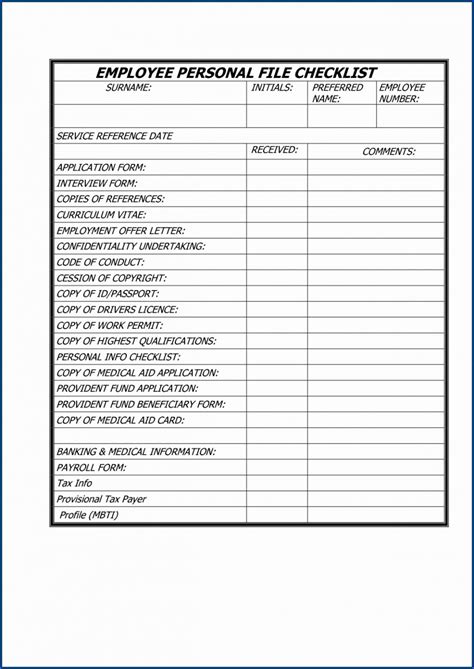

Record-Keeping Requirements

Employers are required to maintain accurate and up-to-date records of employee information, including: * Personnel files: Employers must maintain a personnel file for each employee, containing information such as job application, employment contract, and performance reviews. * Payroll records: Employers must maintain accurate and up-to-date payroll records, including information on employee salaries, benefits, and taxes withheld. * Training records: Employers must maintain records of employee training, including information on courses completed and certifications obtained.

📝 Note: Employers must ensure that all employee paperwork is completed accurately and efficiently to avoid potential legal issues and ensure a smooth onboarding process for new hires.

Best Practices for Managing Employee Paperwork

To ensure compliance with various laws and regulations, employers should follow best practices for managing employee paperwork, including: * Using electronic forms: Employers can use electronic forms to streamline the paperwork process and reduce errors. * Implementing a document management system: Employers can implement a document management system to store and manage employee paperwork securely and efficiently. * Providing training to HR staff: Employers should provide training to HR staff on the importance of accurate and efficient paperwork management.

| Document | Purpose |

|---|---|

| Job application form | To provide essential information about the applicant |

| Employment contract | To outline the terms and conditions of employment |

| W-4 form | To determine the amount of taxes to be withheld from the employee's salary |

As we summarize the key points, it’s clear that employee paperwork requirements are a critical aspect of the hiring process. Employers must ensure that all necessary documents are completed accurately and efficiently to avoid potential legal issues and ensure a smooth onboarding process for new hires. By following best practices for managing employee paperwork, employers can reduce errors, improve compliance, and create a positive experience for new employees.

What is the purpose of the I-9 form?

+

The I-9 form is used to verify the employee’s identity and eligibility to work in the country.

What is the importance of accurate payroll records?

+

Accurate payroll records are essential for ensuring compliance with tax laws and regulations, as well as providing employees with accurate information about their salaries and benefits.

What is the best way to manage employee paperwork?

+

The best way to manage employee paperwork is to use electronic forms, implement a document management system, and provide training to HR staff on the importance of accurate and efficient paperwork management.