LLC Business Paperwork Requirements

Introduction to LLC Business Paperwork Requirements

When forming a Limited Liability Company (LLC), it is essential to understand the various paperwork requirements involved. These requirements vary by state, but there are some common documents and filings that are necessary to establish and maintain an LLC. In this article, we will delve into the world of LLC business paperwork requirements, exploring the different types of documents needed, the filing process, and the importance of maintaining accurate records.

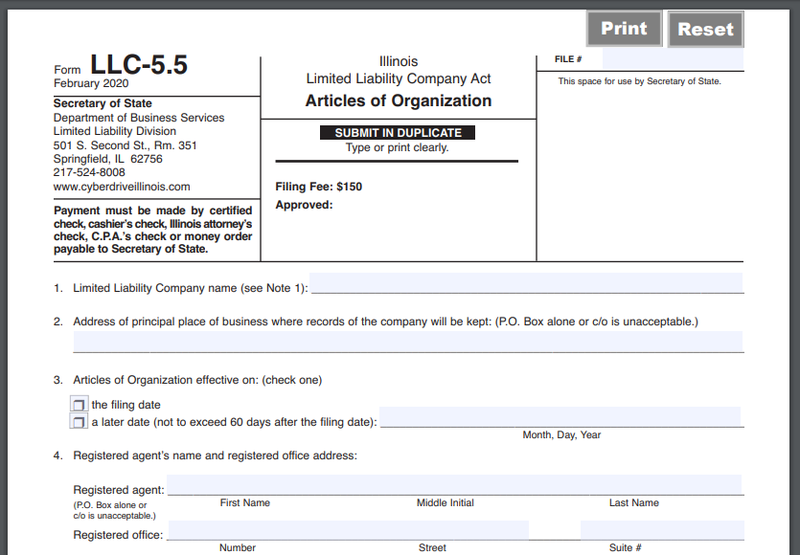

Articles of Organization

The first step in forming an LLC is to file the Articles of Organization with the state’s business registration office. This document provides basic information about the LLC, such as its name, address, and purpose. The Articles of Organization typically include: * The LLC’s name and address * The names and addresses of the LLC’s members (owners) * The name and address of the LLC’s registered agent * A statement of the LLC’s purpose * The duration of the LLC (if not perpetual)

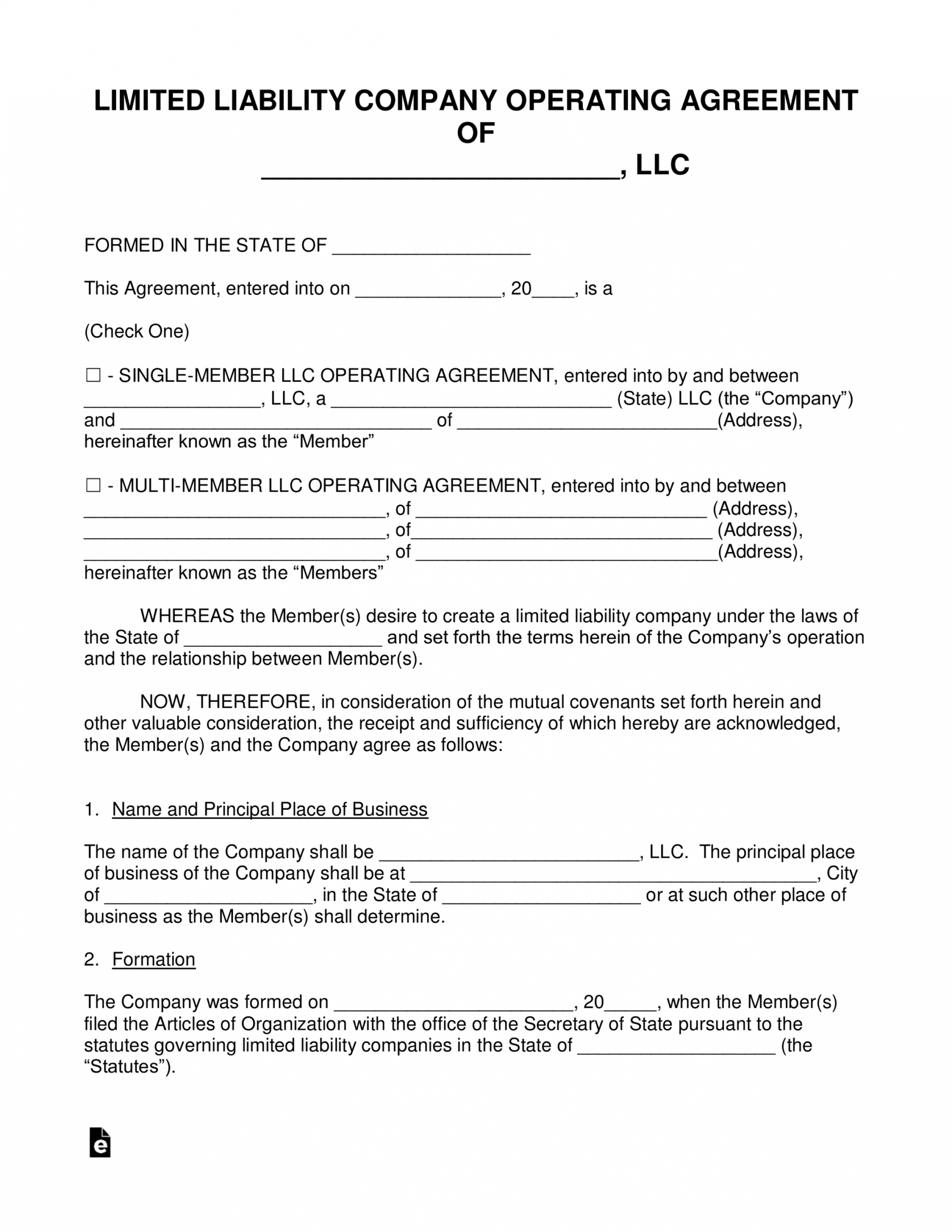

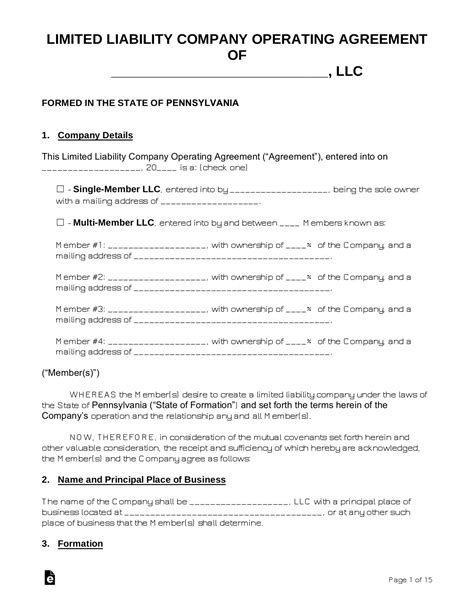

Operating Agreement

An Operating Agreement is a document that outlines the ownership, management, and operation of the LLC. This agreement is not typically filed with the state, but it is essential for internal use. The Operating Agreement should include: * The ownership structure of the LLC * The roles and responsibilities of the members and managers * The procedures for making decisions and resolving disputes * The rules for distributing profits and losses * The procedures for adding or removing members

Business Licenses and Permits

Depending on the type of business and location, an LLC may need to obtain various business licenses and permits. These can include: * Sales tax permit: required for businesses that sell tangible goods * Employer identification number (EIN): required for businesses that hire employees * Professional licenses: required for businesses that provide professional services, such as law or medicine * Zoning permits: required for businesses that operate in specific locations

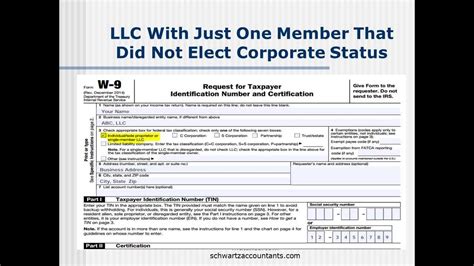

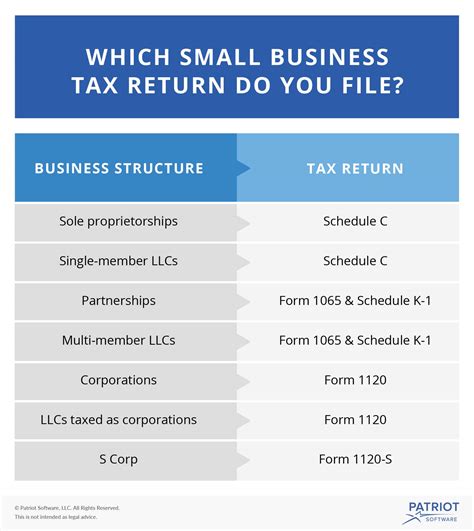

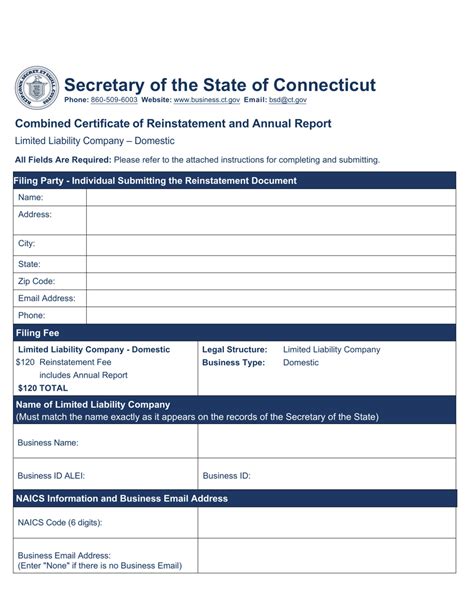

Tax Filings

LLCs are required to file various tax returns with the state and federal government. The most common tax filings include: * Annual report: a report that provides information about the LLC’s activities and finances * Income tax return: a return that reports the LLC’s income and expenses * Employment tax return: a return that reports the LLC’s employment taxes * Sales tax return: a return that reports the LLC’s sales tax liability

Other Paperwork Requirements

In addition to the above documents, LLCs may need to file other paperwork, such as: * Amendments to the Articles of Organization: required when the LLC’s name, address, or purpose changes * Dissolution documents: required when the LLC is dissolved * Merger documents: required when the LLC merges with another business * Foreign qualification documents: required when the LLC operates in multiple states

💡 Note: The specific paperwork requirements for an LLC vary by state, so it is essential to check with the state's business registration office for specific requirements.

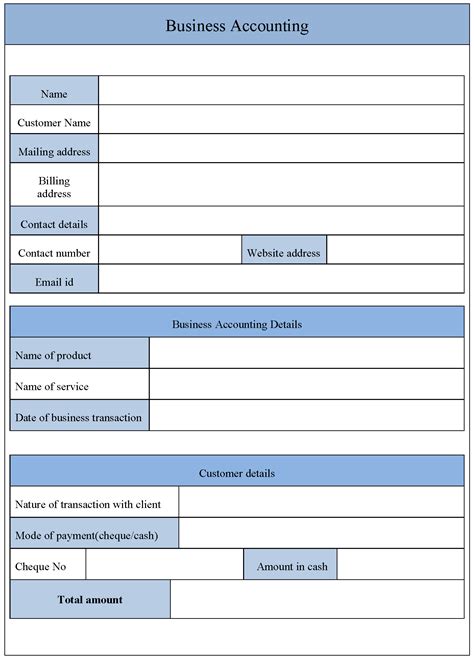

Maintaining Accurate Records

Maintaining accurate and up-to-date records is crucial for an LLC. This includes: * Minutes of meetings: records of meetings and decisions made by the members and managers * Financial statements: records of the LLC’s income, expenses, and financial transactions * Tax returns: copies of the LLC’s tax returns and supporting documentation * Business licenses and permits: copies of the LLC’s business licenses and permits

| Document | Purpose | Filing Requirement |

|---|---|---|

| Articles of Organization | Establishes the LLC | Filed with the state |

| Operating Agreement | Outlines the ownership and management of the LLC | Not filed with the state |

| Business Licenses and Permits | Authorizes the LLC to operate | Varies by state and locality |

| Tax Filings | Reports the LLC's income and expenses | Filed with the state and federal government |

In summary, forming and maintaining an LLC requires various paperwork filings and record-keeping. It is essential to understand the specific requirements for your state and business to ensure compliance and avoid penalties.

What is the purpose of the Articles of Organization?

+

The Articles of Organization establish the LLC and provide basic information about the business, such as its name, address, and purpose.

Do I need to file an Operating Agreement with the state?

+

No, the Operating Agreement is not typically filed with the state. However, it is essential for internal use and should be kept with the LLC’s records.

What are the consequences of not filing the necessary paperwork?

+

Failing to file the necessary paperwork can result in penalties, fines, and even the dissolution of the LLC. It is essential to understand the specific requirements for your state and business to ensure compliance.