Insurance Address on Paperwork

Understanding the Importance of Accurate Insurance Address on Paperwork

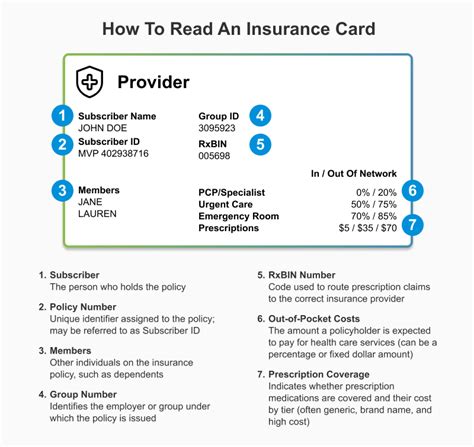

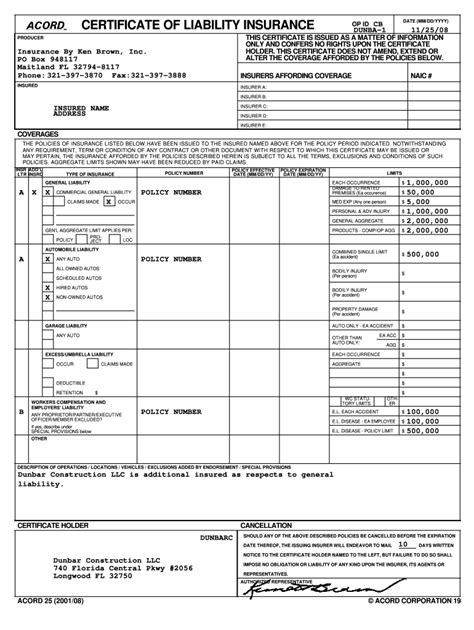

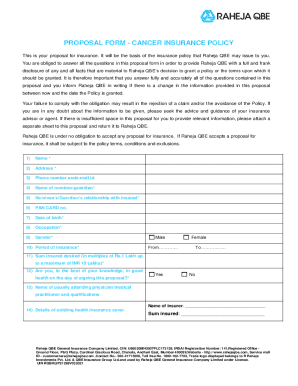

When dealing with insurance, accuracy is key to ensuring that all parties involved are protected and that claims are processed smoothly. One crucial aspect of insurance paperwork is the insurance address, which refers to the physical location where the insured individual or business resides or operates. This address is vital for various reasons, including premium calculations, policy issuance, and claims processing. In this article, we will delve into the significance of accurate insurance addresses on paperwork and provide guidance on how to ensure that this information is correctly recorded.

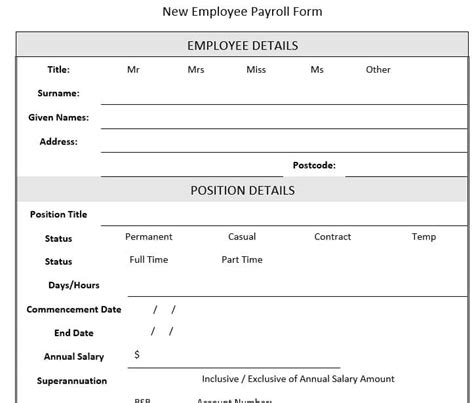

The Role of Insurance Address in Policy Issuance

The insurance address plays a significant role in the policy issuance process. Insurance companies use this address to determine the risk profile of the insured, which in turn affects the premium rates. For instance, if the insured resides in an area prone to natural disasters, the premium rates may be higher to account for the increased risk. Additionally, the insurance address is used to determine the coverage area, which outlines the geographical region where the policy is valid. It is essential to ensure that the insurance address on the paperwork is accurate to avoid any disputes or complications during the policy issuance process.

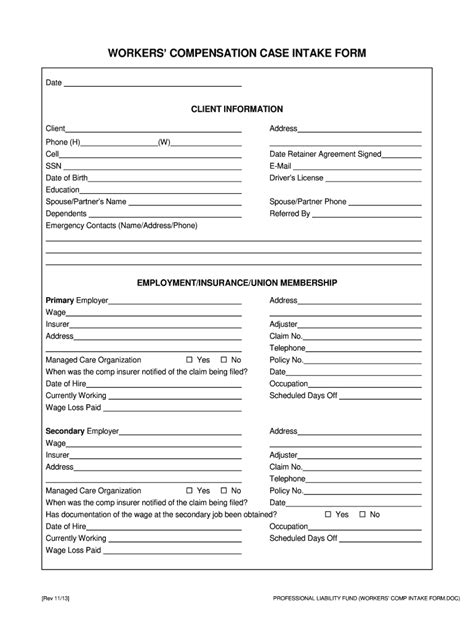

Consequences of Inaccurate Insurance Address

Inaccurate insurance addresses on paperwork can have severe consequences, including: * Delayed or rejected claims: If the insurance address is incorrect, the insurance company may reject or delay claims, leading to financial losses for the insured. * Invalid policy: An incorrect insurance address may render the policy invalid, leaving the insured without coverage. * Premium disputes: Inaccurate insurance addresses can lead to premium disputes, as the insured may be charged incorrect rates based on the wrong location. To avoid these consequences, it is crucial to double-check the insurance address on all paperwork to ensure that it is accurate and up-to-date.

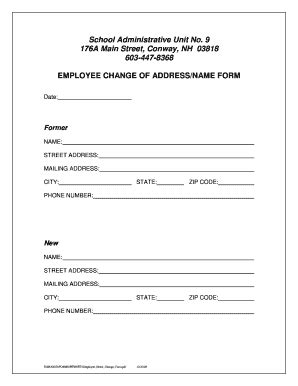

Best Practices for Ensuring Accurate Insurance Address

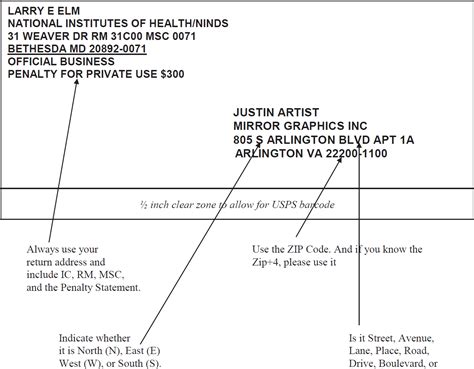

To ensure that the insurance address on paperwork is accurate, follow these best practices: * Verify the address: Double-check the insurance address on all paperwork, including policy documents, invoices, and claims forms. * Update the address: Inform the insurance company of any changes to the insurance address, such as a move to a new location. * Use a standard format: Use a standard format for recording the insurance address, including the street address, city, state, and zip code. By following these best practices, insured individuals and businesses can ensure that their insurance address is accurate and up-to-date, reducing the risk of complications or disputes.

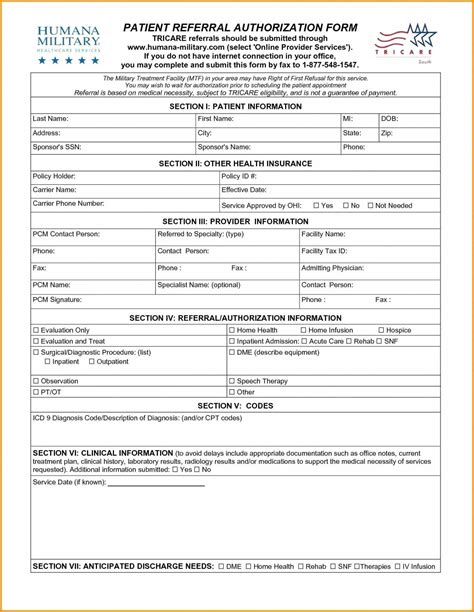

Insurance Address Requirements for Businesses

Businesses have additional requirements when it comes to insurance addresses. The insurance address for a business is typically the principal place of business, which is the primary location where the business operates. However, businesses may also have additional locations, such as branch offices or warehouses, which may require separate insurance addresses. It is essential for businesses to ensure that all locations are accurately recorded on the insurance paperwork to avoid any gaps in coverage.

| Location Type | Insurance Address Requirements |

|---|---|

| Principal Place of Business | Record the primary location where the business operates |

| Branch Offices | Record the address of each branch office as a separate location |

| Warehouses | Record the address of each warehouse as a separate location |

📝 Note: Businesses should consult with their insurance provider to determine the specific insurance address requirements for their industry and operations.

Conclusion and Final Thoughts

In conclusion, accurate insurance addresses on paperwork are crucial for ensuring that insured individuals and businesses are protected and that claims are processed smoothly. By understanding the importance of insurance addresses and following best practices for ensuring accuracy, insured parties can reduce the risk of complications or disputes. It is essential to verify the insurance address on all paperwork, update the address as needed, and use a standard format for recording the address. By taking these steps, insured individuals and businesses can have peace of mind knowing that their insurance coverage is valid and effective.

What is the importance of accurate insurance address on paperwork?

+

Accurate insurance address on paperwork is crucial for determining the risk profile, coverage area, and premium rates. It also helps to avoid disputes or complications during the policy issuance process and claims processing.

What are the consequences of inaccurate insurance address?

+

Inaccurate insurance address can lead to delayed or rejected claims, invalid policy, and premium disputes. It is essential to ensure that the insurance address is accurate and up-to-date to avoid these consequences.

How can I ensure that my insurance address is accurate?

+

To ensure that your insurance address is accurate, verify the address on all paperwork, update the address as needed, and use a standard format for recording the address. You can also consult with your insurance provider to determine the specific insurance address requirements for your industry and operations.