Paperwork

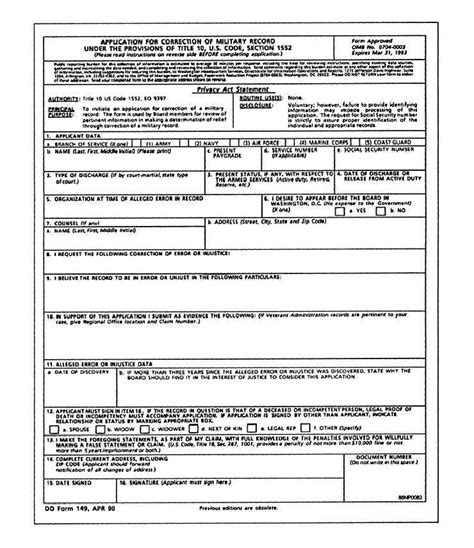

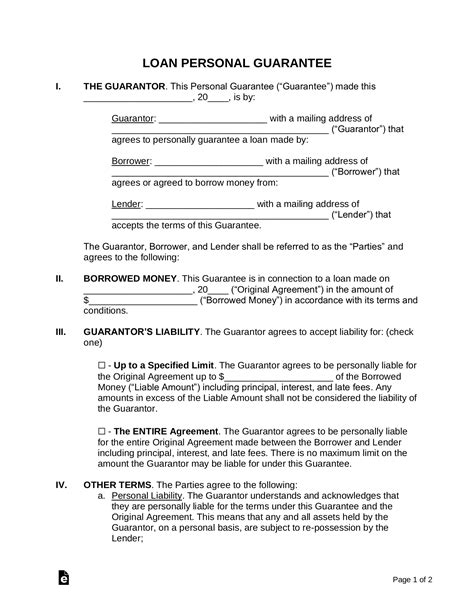

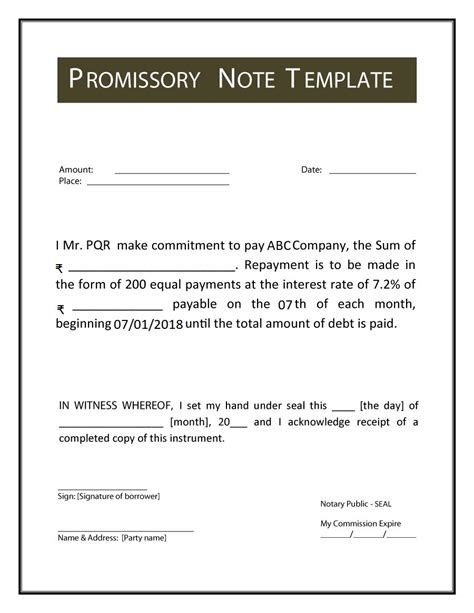

Lender Note Paperwork Example

Introduction to Lender Note Paperwork

When engaging in any form of lending, whether it’s between individuals or institutions, the legal and financial aspects must be clearly outlined to protect both parties. A lender note, also known as a promissory note, is a legal document that specifies the terms of a loan, including the amount borrowed, interest rate, repayment terms, and the obligations of both the lender and the borrower. This document is crucial as it provides a clear understanding of the agreement and can serve as evidence in case of disputes. In this article, we will delve into the details of lender note paperwork, its components, and the process of creating one.

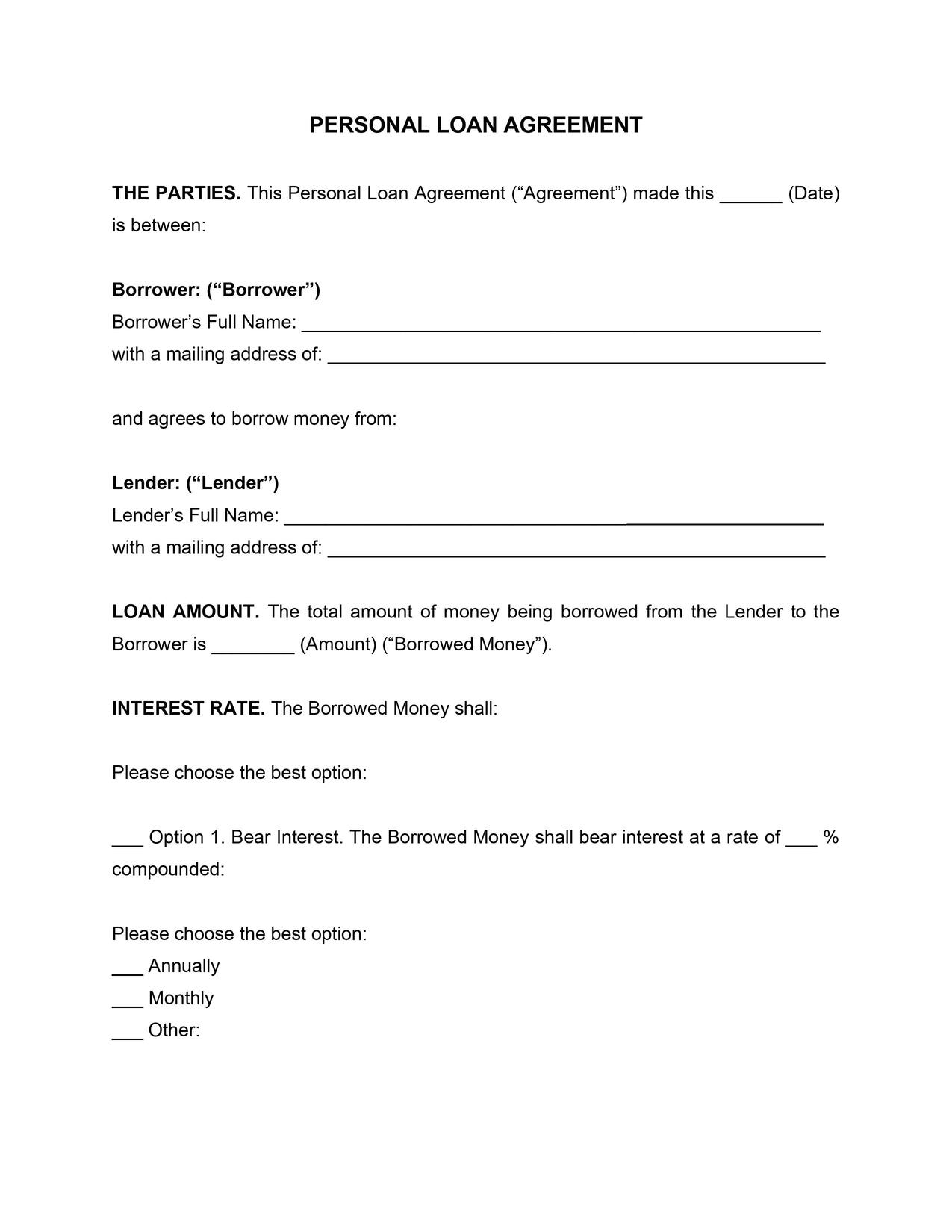

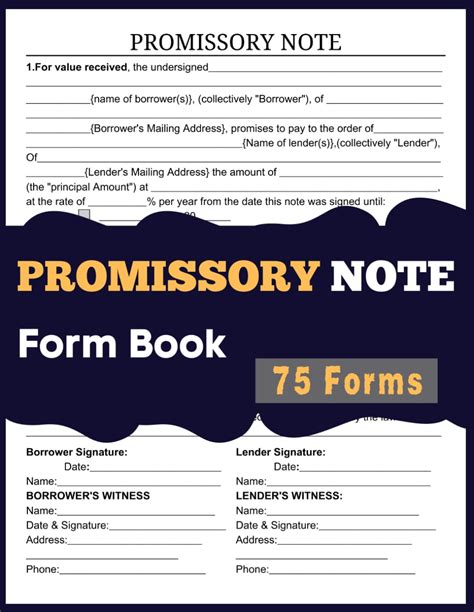

Components of a Lender Note

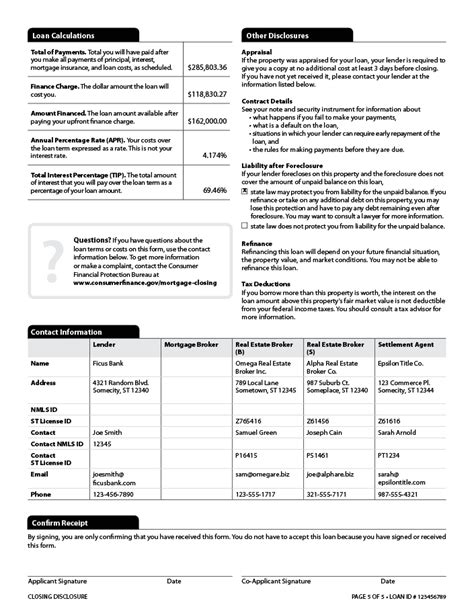

A comprehensive lender note should include several key components to ensure clarity and legality. These components are: - Loan Amount: The total amount borrowed by the borrower. - Interest Rate: The rate at which interest is calculated on the loan amount. This can be fixed or variable. - Repayment Terms: Details on how the loan will be repaid, including the payment schedule, amount, and method. - Collateral: If the loan is secured, a description of the collateral provided by the borrower. - Default and Late Payment Terms: Conditions that apply if the borrower fails to make payments on time or defaults on the loan. - Governing Law: The jurisdiction under which the note will be governed in case of disputes.

Creating a Lender Note

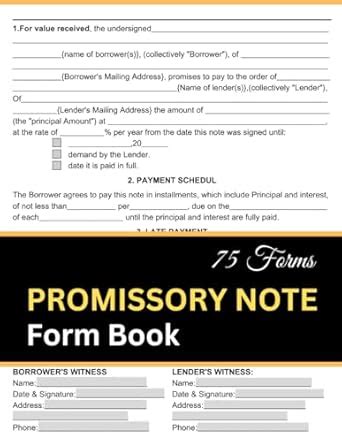

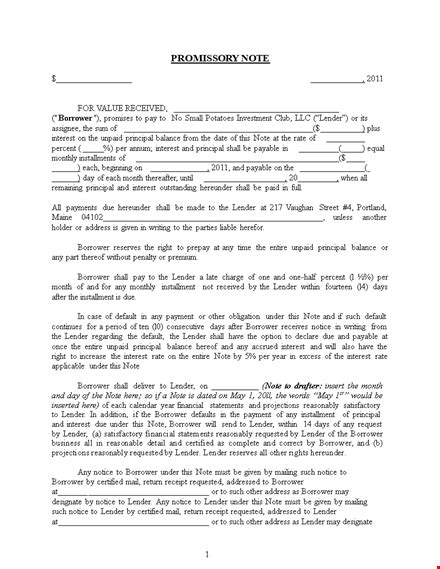

Creating a lender note involves several steps, from drafting the initial document to finalizing the agreement. Here’s a simplified guide: - Drafting: Start by drafting the note, ensuring all necessary components are included. It’s advisable to use a template as a starting point. - Review: Both parties should review the document carefully to ensure all terms are understood and agreed upon. - Negotiation: If necessary, terms can be negotiated before finalizing the document. - Signing: Once both parties are satisfied with the terms, the document should be signed in the presence of a witness or notary, depending on local legal requirements. - Execution: The final step involves executing the agreement, which means adhering to the terms outlined in the note.

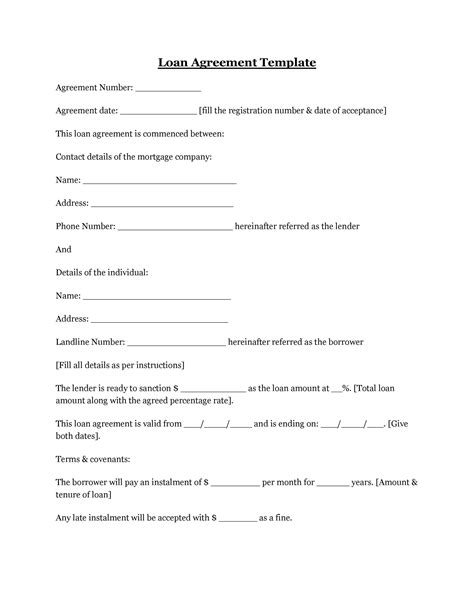

Example of a Lender Note

Below is a simplified example of what a lender note might look like:

| Component | Description |

|---|---|

| Loan Amount | 10,000</td> </tr> <tr> <td>Interest Rate</td> <td>5% per annum</td> </tr> <tr> <td>Repayment Terms</td> <td>Monthly payments of 188.71 over 60 months |

| Collateral | None |

| Default Terms | A late fee of $25 will be applied to each late payment |

📝 Note: This is a highly simplified example and actual lender notes should be more detailed and reviewed by a legal professional to ensure compliance with local laws and regulations.

Importance of Lender Notes

Lender notes are crucial for several reasons: - Legal Protection: They provide legal recourse in case of disputes or default. - Clear Understanding: They ensure both parties have a clear understanding of the loan terms. - Financial Planning: They help borrowers plan their finances according to the repayment terms.

Conclusion

In essence, a lender note is a vital document for any lending transaction, serving as a legally binding agreement between the lender and the borrower. By understanding the components and process of creating a lender note, individuals can better navigate loan transactions, whether personal or professional. It’s essential to approach lending with caution and ensure that all agreements are well-documented to avoid potential pitfalls.

What is the purpose of a lender note?

+

The purpose of a lender note is to provide a legal and binding agreement between a lender and a borrower, outlining the terms of a loan.

What components should a lender note include?

+

A lender note should include the loan amount, interest rate, repayment terms, collateral (if any), default and late payment terms, and the governing law.

Why is it important to have a lender note?

+

It’s important because it provides legal protection, ensures a clear understanding of the loan terms for both parties, and aids in financial planning for the borrower.