Paperwork

Car Finance Paperwork Explained

Introduction to Car Finance Paperwork

When purchasing a vehicle, understanding the car finance paperwork is crucial to ensure a smooth and hassle-free process. The paperwork involved in car financing can be overwhelming, with numerous documents and contracts to sign. In this article, we will delve into the world of car finance paperwork, explaining the key documents, terms, and conditions involved. By the end of this article, you will be well-equipped to navigate the car finance paperwork process with confidence.

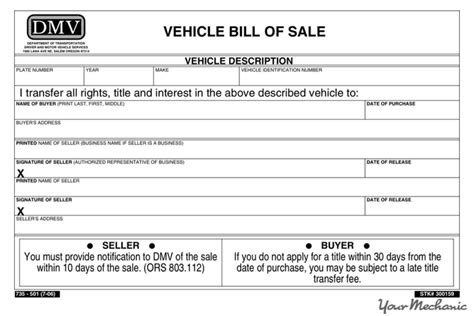

Understanding the Key Documents

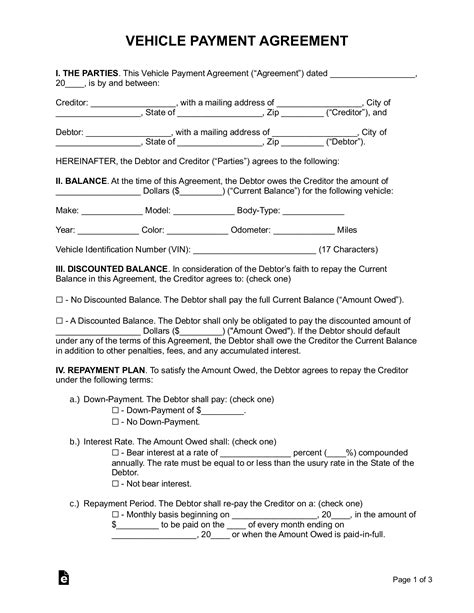

The car finance paperwork process involves several key documents, each serving a specific purpose. These documents include: * Finance Agreement: This is the primary contract between you and the finance provider, outlining the terms and conditions of the loan. * Hire Purchase Agreement: This document is used for hire purchase agreements, where you hire the vehicle for a specified period and have the option to purchase it at the end of the agreement. * Personal Contract Purchase (PCP) Agreement: This document is used for PCP agreements, where you pay a monthly fee to use the vehicle for a specified period, with the option to return or purchase the vehicle at the end of the agreement. * Guarantor Form: If you have a guarantor, this form will need to be completed, outlining their responsibilities and obligations.

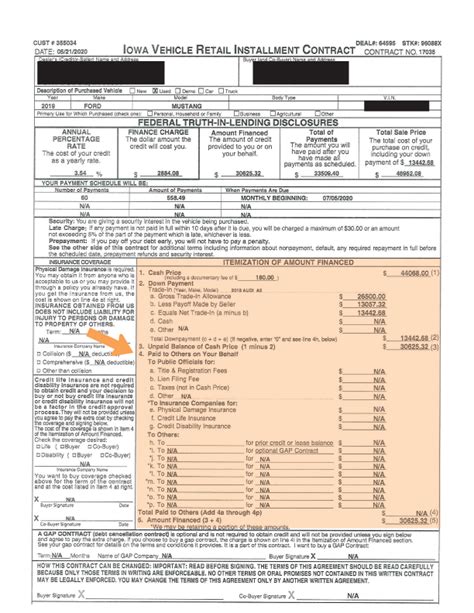

Breaking Down the Finance Agreement

The finance agreement is the most critical document in the car finance paperwork process. It outlines the terms and conditions of the loan, including: * Loan Amount: The total amount borrowed to purchase the vehicle. * Interest Rate: The rate at which interest is charged on the loan. * Repayment Terms: The frequency and amount of repayments, including the repayment period. * Conditions: Any conditions or restrictions associated with the loan, such as mileage limits or maintenance requirements.

Additional Fees and Charges

In addition to the loan amount and interest rate, there may be additional fees and charges associated with the car finance paperwork. These can include: * Arrangement Fee: A fee charged by the finance provider for setting up the loan. * Documentation Fee: A fee charged for preparing and processing the finance documents. * Late Payment Fee: A fee charged for late or missed repayments. * Early Settlement Fee: A fee charged for settling the loan early.

| Fee Type | Description |

|---|---|

| Arrangement Fee | A fee charged by the finance provider for setting up the loan. |

| Documentation Fee | A fee charged for preparing and processing the finance documents. |

| Late Payment Fee | A fee charged for late or missed repayments. |

| Early Settlement Fee | A fee charged for settling the loan early. |

📝 Note: It is essential to carefully review the finance agreement and understand all the fees and charges involved before signing.

Conclusion and Final Thoughts

In conclusion, understanding the car finance paperwork is crucial to ensure a smooth and hassle-free process. By knowing the key documents, terms, and conditions involved, you can make informed decisions and avoid any potential pitfalls. Remember to carefully review the finance agreement and ask questions if you are unsure about any aspect of the process. With this knowledge, you will be well-equipped to navigate the car finance paperwork process with confidence and drive away in your new vehicle with peace of mind.

What is a finance agreement?

+

A finance agreement is the primary contract between you and the finance provider, outlining the terms and conditions of the loan.

What are the different types of car finance agreements?

+

The main types of car finance agreements are hire purchase, personal contract purchase (PCP), and finance lease.

What is a guarantor form?

+

A guarantor form is a document that outlines the responsibilities and obligations of a guarantor, who is responsible for repaying the loan if the borrower defaults.