SR22 Insurance Nebraska Requirements

Understanding SR22 Insurance in Nebraska

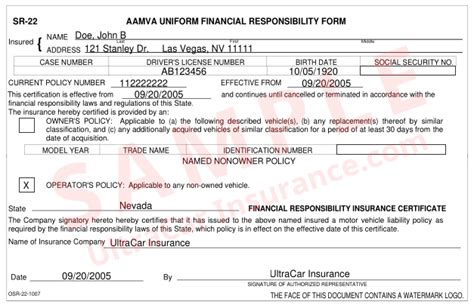

SR22 insurance is a type of car insurance that provides proof of financial responsibility to the state. In Nebraska, drivers who have been convicted of certain offenses, such as driving under the influence (DUI) or reckless driving, may be required to obtain an SR22 insurance policy. This type of insurance is usually more expensive than a standard car insurance policy, and it requires the insurance company to notify the state if the policy is canceled or lapses.

Nebraska SR22 Insurance Requirements

To obtain an SR22 insurance policy in Nebraska, drivers must meet certain requirements. These requirements include: * Being a resident of Nebraska: To obtain an SR22 insurance policy, drivers must be a resident of Nebraska. * Holding a valid driver’s license: Drivers must hold a valid driver’s license to obtain an SR22 insurance policy. * Having a vehicle registered in Nebraska: Drivers must have a vehicle registered in Nebraska to obtain an SR22 insurance policy. * Meeting the state’s minimum liability insurance requirements: SR22 insurance policies must meet the state’s minimum liability insurance requirements, which include: + Bodily injury liability coverage: 25,000 per person and 50,000 per accident + Property damage liability coverage: 25,000 per accident * <b>Paying the required filing fee</b>: Drivers must pay a filing fee to the state, which is typically around 25.

How to Obtain an SR22 Insurance Policy in Nebraska

To obtain an SR22 insurance policy in Nebraska, drivers can follow these steps: * Research insurance companies: Drivers should research insurance companies that offer SR22 insurance policies in Nebraska. * Get quotes from multiple companies: Drivers should get quotes from multiple companies to compare rates and coverage. * Choose a policy that meets the state’s requirements: Drivers should choose a policy that meets the state’s minimum liability insurance requirements. * Pay the required filing fee: Drivers must pay the required filing fee to the state. * File the SR22 form with the state: The insurance company will file the SR22 form with the state, which provides proof of financial responsibility.

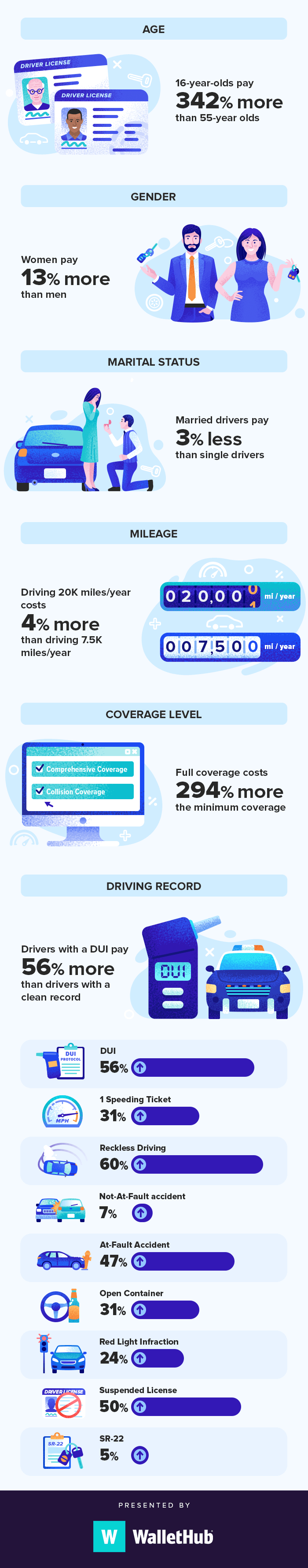

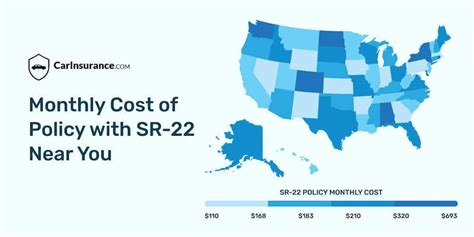

Cost of SR22 Insurance in Nebraska

The cost of SR22 insurance in Nebraska can vary depending on several factors, including: * Driving record: Drivers with a poor driving record may pay more for SR22 insurance. * Age and experience: Younger drivers or those with limited driving experience may pay more for SR22 insurance. * Vehicle type and value: Drivers who own high-value vehicles or vehicles with high-performance capabilities may pay more for SR22 insurance. * Insurance company: Different insurance companies may charge different rates for SR22 insurance. * Policy limits and coverage: Drivers who choose higher policy limits or additional coverage may pay more for SR22 insurance.

| Insurance Company | Monthly Premium |

|---|---|

| Company A | $150 |

| Company B | $200 |

| Company C | $250 |

Penalties for Not Having SR22 Insurance in Nebraska

Drivers who are required to have SR22 insurance in Nebraska but fail to obtain or maintain a policy may face penalties, including: * License suspension: The state may suspend the driver’s license for failing to obtain or maintain SR22 insurance. * Fines: Drivers may be required to pay fines for failing to obtain or maintain SR22 insurance. * Vehicle registration suspension: The state may suspend the vehicle registration for failing to obtain or maintain SR22 insurance.

🚨 Note: Drivers who are required to have SR22 insurance in Nebraska should ensure that they obtain and maintain a policy to avoid penalties and maintain their driving privileges.

To maintain their driving privileges and avoid penalties, drivers who are required to have SR22 insurance in Nebraska should ensure that they obtain and maintain a policy. This includes paying premiums on time, maintaining the required coverage, and notifying the state if the policy is canceled or lapses. By understanding the requirements and costs of SR22 insurance in Nebraska, drivers can make informed decisions about their insurance coverage and maintain their driving privileges.

In summary, SR22 insurance is a type of car insurance that provides proof of financial responsibility to the state. In Nebraska, drivers who have been convicted of certain offenses may be required to obtain an SR22 insurance policy. The cost of SR22 insurance can vary depending on several factors, and drivers who fail to obtain or maintain a policy may face penalties. By understanding the requirements and costs of SR22 insurance, drivers can make informed decisions about their insurance coverage and maintain their driving privileges.

What is SR22 insurance in Nebraska?

+

SR22 insurance is a type of car insurance that provides proof of financial responsibility to the state. It is usually required for drivers who have been convicted of certain offenses, such as driving under the influence (DUI) or reckless driving.

How do I obtain an SR22 insurance policy in Nebraska?

+

To obtain an SR22 insurance policy in Nebraska, drivers must research insurance companies, get quotes from multiple companies, choose a policy that meets the state’s requirements, pay the required filing fee, and file the SR22 form with the state.

What are the penalties for not having SR22 insurance in Nebraska?

+

Drivers who are required to have SR22 insurance in Nebraska but fail to obtain or maintain a policy may face penalties, including license suspension, fines, and vehicle registration suspension.