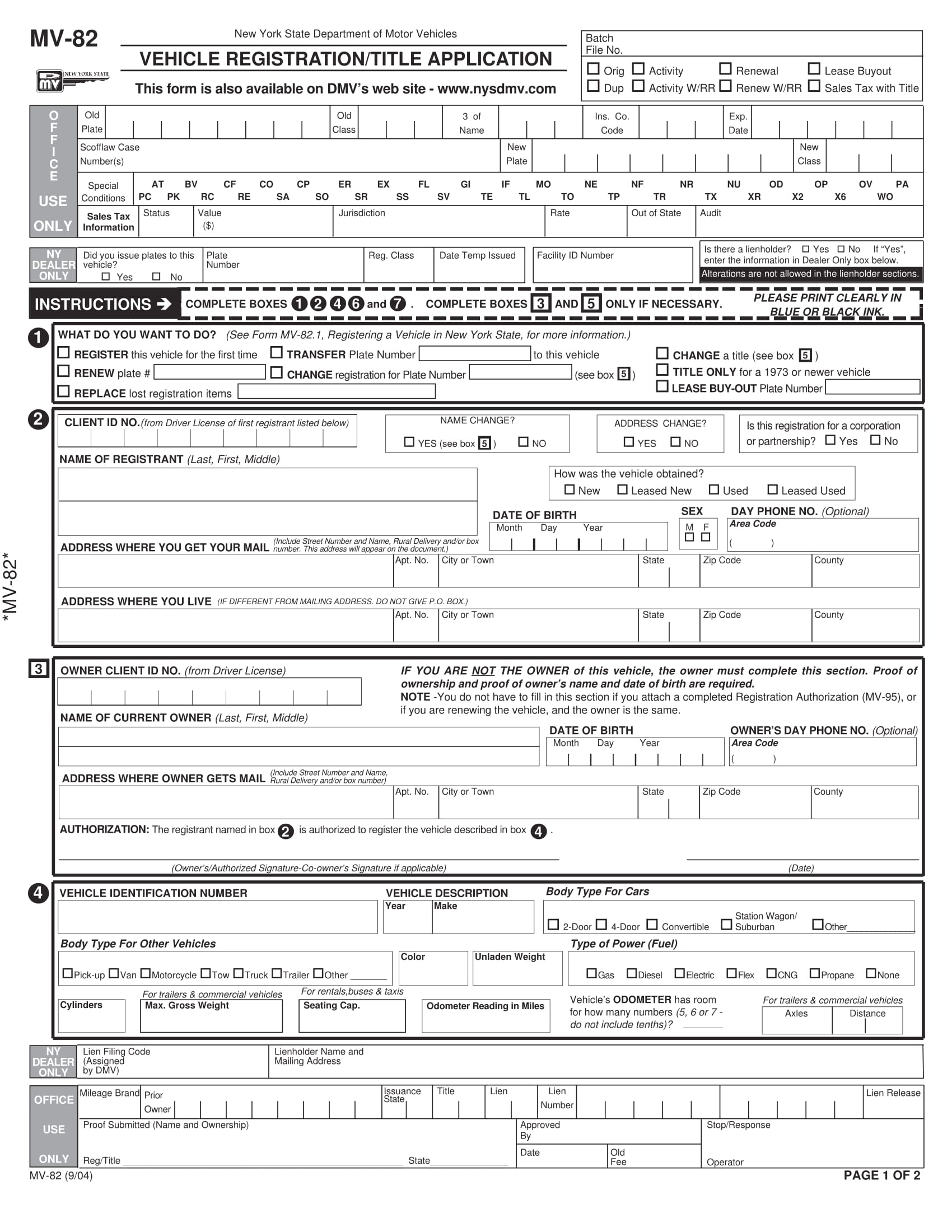

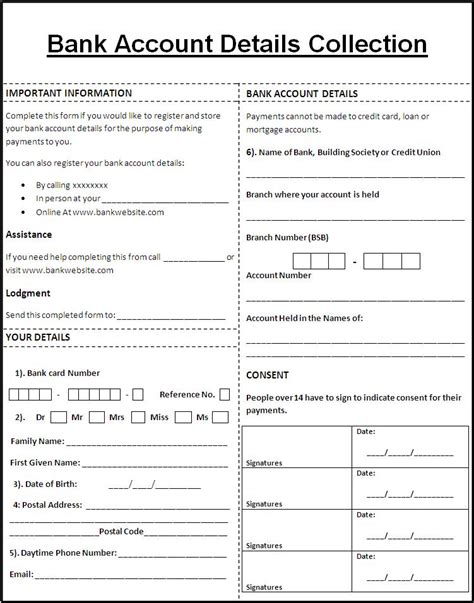

Paperwork

Star Bank Paperwork Taken By FDIC

Introduction to Bank Failures and FDIC Intervention

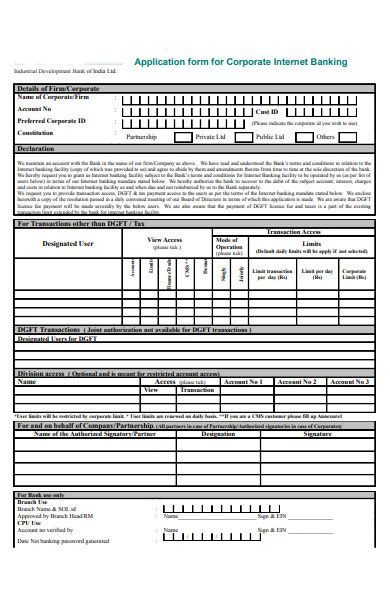

The Federal Deposit Insurance Corporation (FDIC) plays a critical role in maintaining stability in the US financial system, particularly when banks fail. Bank failures are not uncommon and can occur due to various reasons such as poor management, economic downturns, or excessive risk-taking. When a bank fails, the FDIC steps in to protect depositors’ funds, ensuring that they have access to their insured deposits. Recently, Star Bank’s paperwork was taken over by the FDIC, signaling a significant development in the banking sector.

Understanding the FDIC’s Role

The FDIC is an independent agency created by the US Congress to maintain stability and public trust in the financial system. Its primary role is to insure deposits up to a certain limit, currently $250,000 per depositor, per insured bank. This means that if a bank fails, the FDIC will reimburse depositors for their insured funds, usually within a few days. The FDIC also supervises and regulates banks to ensure their safety and soundness, and it has the authority to take over and resolve failed banks.

The Process of Bank Failure and FDIC Takeover

When a bank is on the verge of failure, the FDIC, in conjunction with other regulatory bodies, assesses the situation to determine the best course of action. If the bank cannot recover through private means, such as a merger with another bank or through additional capital infusion, the FDIC will take over the bank’s operations. This process involves the FDIC assuming control of the bank, freezing its assets, and then selling off those assets to other banks or investors. The goal is to minimize disruption to depositors and the broader financial system.

Reasons Behind Bank Failures

Banks can fail for a variety of reasons, including: - Poor Management: Banks that engage in risky lending practices, fail to diversify their loan portfolios, or have inadequate risk management systems are more likely to fail. - Economic Downturns: Economic recessions or downturns in specific industries can lead to a high number of loan defaults, straining a bank’s capital reserves. - Regulatory Issues: Non-compliance with banking regulations can lead to fines, legal issues, and ultimately, to the bank’s failure. - Technological Disruption: The rapid evolution of financial technology (fintech) can disrupt traditional banking models, making some banks less competitive and more susceptible to failure.

Impact on Depositors and the Financial System

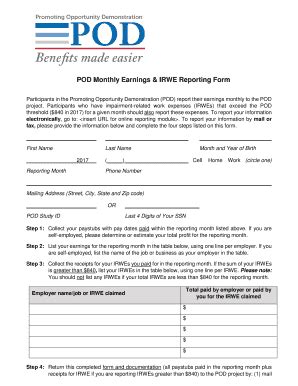

The takeover of a bank by the FDIC has several implications for depositors and the financial system as a whole: - Depositor Protection: The primary benefit is the protection of depositors’ funds. The FDIC ensures that depositors have access to their insured deposits, maintaining trust in the banking system. - Systemic Stability: By resolving bank failures in an orderly manner, the FDIC helps prevent systemic instability that could lead to a broader financial crisis. - Market Confidence: The swift and efficient resolution of bank failures can help maintain market confidence, as it demonstrates the effectiveness of the financial safety net.

Steps for Depositors After an FDIC Takeover

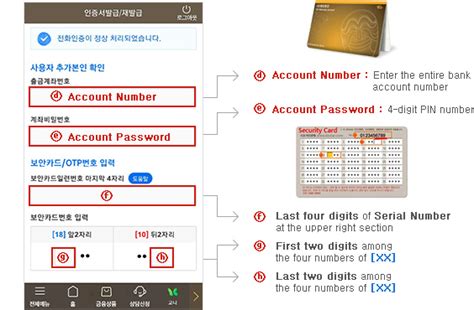

If a bank is taken over by the FDIC, depositors should: - Remain calm, as their insured deposits are protected. - Follow instructions provided by the FDIC or the acquiring bank. - Understand the transition process, including any changes to bank operations, branches, or services. - Review their accounts to ensure all deposits are correctly accounted for and that they understand any changes to terms and conditions.

📝 Note: Depositors should also be aware of the insurance limits and ensure that their deposits are within the insured amount to avoid any potential losses.

Preventing Bank Failures

While bank failures cannot be entirely eliminated, their occurrence can be minimized through: - Effective Regulation: Strong regulatory oversight can help identify and address potential issues before they lead to bank failures. - Bank Capital Requirements: Ensuring that banks maintain adequate capital levels can help them withstand economic downturns and other challenges. - Risk Management Practices: Banks should implement robust risk management practices to mitigate potential risks, including credit, market, and operational risks.

Conclusion and Future Outlook

The takeover of Star Bank’s paperwork by the FDIC highlights the importance of the FDIC’s role in maintaining financial stability. As the banking sector continues to evolve, with challenges such as technological disruption and economic uncertainties, the FDIC’s interventions will remain crucial. Understanding the reasons behind bank failures, the process of FDIC intervention, and the impact on depositors and the financial system can provide valuable insights into the complex dynamics of the banking sector. By learning from past experiences and adapting to new challenges, the financial system can become more resilient and better equipped to handle future bank failures.

What happens to my deposits if my bank fails?

+

If your bank fails, the FDIC will reimburse you for your insured deposits, usually within a few days, ensuring you have access to your money.

How does the FDIC protect depositors?

+

The FDIC protects depositors by insuring their deposits up to $250,000 per depositor, per insured bank, and by resolving bank failures in an orderly manner to minimize disruption.

What are the common reasons for bank failures?

+

Common reasons for bank failures include poor management, economic downturns, regulatory issues, and technological disruption that can make traditional banking models less competitive.