7 LLC Paperwork Essentials

Introduction to LLC Paperwork Essentials

Forming a Limited Liability Company (LLC) is a significant step for any entrepreneur or small business owner. One of the critical aspects of this process is completing the necessary paperwork. LLC paperwork involves various documents and filings that are required by law to establish and maintain the legal existence of an LLC. In this article, we will delve into the essential LLC paperwork requirements, exploring what they entail, their importance, and how to navigate the process efficiently.

Understanding the Basics of LLC Paperwork

Before diving into the specifics, it’s crucial to understand the basics of LLC paperwork. The primary purpose of this paperwork is to provide a legal framework for the operation of the LLC, protecting both the business and its owners. This involves separating personal and business assets, which is a core benefit of forming an LLC. By doing so, owners (or members) can safeguard their personal assets in case the business incurs debts or legal issues.

Essential LLC Paperwork Documents

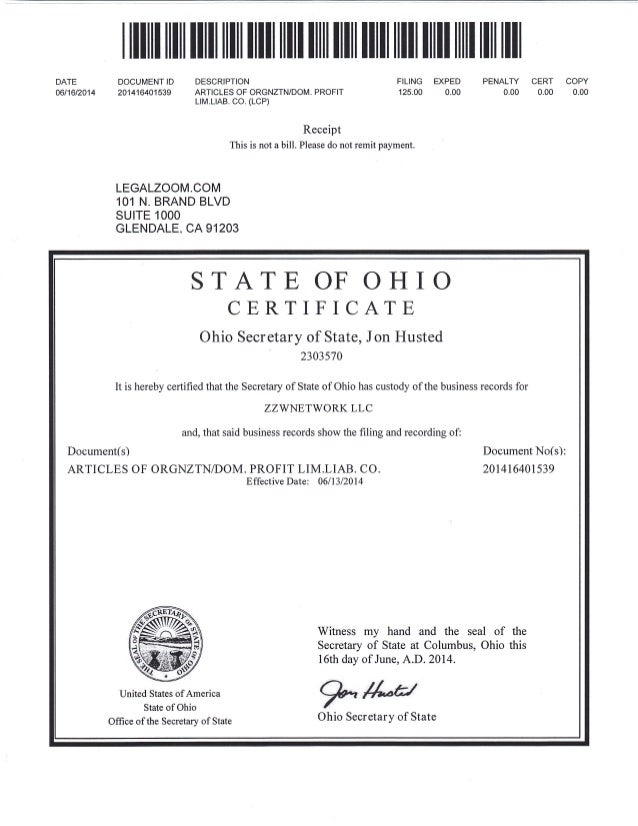

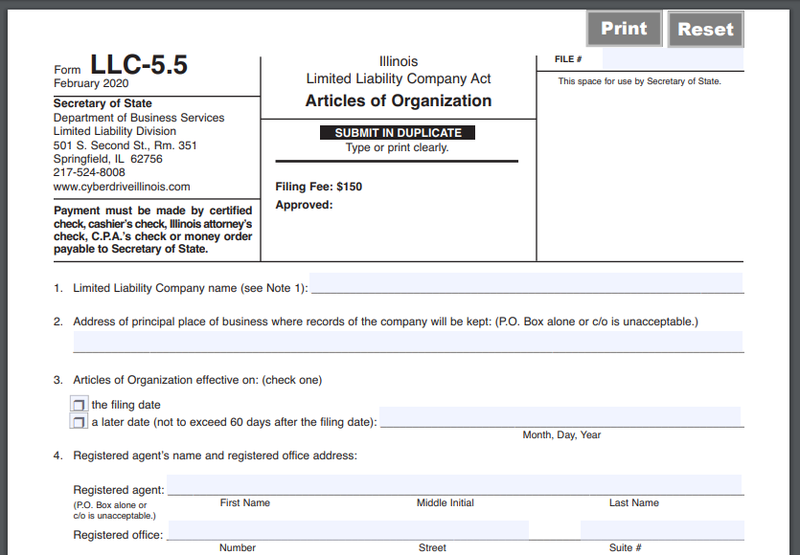

Several key documents are necessary for the formation and ongoing operation of an LLC. These include: - Articles of Organization: This document is filed with the state to formally create the LLC. It typically includes the LLC’s name, address, purpose, and the names of its members or managers. - Operating Agreement: Although not always required by law, an operating agreement is a vital document that outlines the ownership, management structure, and operational procedures of the LLC. - EIN (Employer Identification Number) Application: An EIN is necessary for tax purposes, including filing tax returns and hiring employees. - Business Licenses and Permits: Depending on the type of business and its location, various licenses and permits may be required to operate legally. - Annual Reports: Many states require LLCs to file annual reports to keep their information up to date.

Steps to Complete LLC Paperwork

Completing the necessary LLC paperwork involves several steps: - Choose a Business Name: Ensure the name is unique and complies with state regulations. - File Articles of Organization: Submit the articles to the state and pay the required filing fee. - Obtain an EIN: Apply for an EIN through the IRS website or by mail/fax. - Draft an Operating Agreement: Even if not mandatory, this agreement is crucial for outlining the inner workings of the LLC. - Secure Necessary Licenses and Permits: Research and obtain all required licenses and permits for your business. - File Annual Reports: Submit annual reports as required by your state to maintain good standing.

Importance of Accurate and Timely Paperwork

Accurate and timely completion of LLC paperwork is crucial for several reasons: - Legal Compliance: Failing to file necessary documents or obtaining required licenses can lead to legal penalties, fines, or even dissolution of the LLC. - Business Credibility: Proper paperwork contributes to the professionalism and credibility of the business, which can impact relationships with clients, partners, and investors. - Protection of Assets: One of the primary reasons for forming an LLC is to protect personal assets. Incomplete or incorrect paperwork can jeopardize this protection.

Challenges and Solutions in LLC Paperwork

Despite its importance, managing LLC paperwork can be challenging, especially for new business owners. Some common challenges include: - Complexity of Legal Requirements: Understanding and complying with state and federal regulations can be overwhelming. - Time-Consuming Process: Gathering and filing paperwork can be time-consuming, taking away from other critical business activities. - Costs Associated with Filing: Filing fees and costs associated with obtaining licenses and permits can be significant.

Solutions to these challenges include: - Seeking Professional Help: Hiring a lawyer or using a formation service can simplify the process and ensure compliance. - Utilizing Online Resources: Many states offer online platforms for filing paperwork, and there are numerous resources available to guide business owners through the process. - Planning Ahead: Allowing sufficient time for the paperwork process and budgeting for associated costs can help mitigate these challenges.

📝 Note: It's essential to stay organized and keep detailed records of all paperwork and filings to ensure compliance and facilitate future reference.

Conclusion and Next Steps

In conclusion, LLC paperwork is a critical aspect of forming and operating a Limited Liability Company. By understanding the essential documents required, following the necessary steps, and ensuring accurate and timely completion of paperwork, business owners can protect their assets, maintain legal compliance, and focus on growing their business. Whether you’re just starting out or already operating an LLC, it’s crucial to prioritize your paperwork to reap the full benefits of this business structure. As you move forward, remember to stay informed about any changes in regulations and continuously review and update your LLC’s paperwork as necessary to ensure ongoing compliance and success.

What is the primary purpose of filing Articles of Organization?

+

The primary purpose of filing Articles of Organization is to formally create the LLC with the state, providing a legal framework for its operation.

Is an Operating Agreement required by law?

+

An Operating Agreement is not always required by law, but it is highly recommended as it outlines the ownership, management, and operational procedures of the LLC, protecting the interests of its members.

What happens if an LLC fails to file annual reports?

+

Failing to file annual reports can lead to penalties, fines, and potentially the dissolution of the LLC, highlighting the importance of compliance with state regulations.