Loan Paperwork Expired Now What

Introduction to Loan Paperwork Expiration

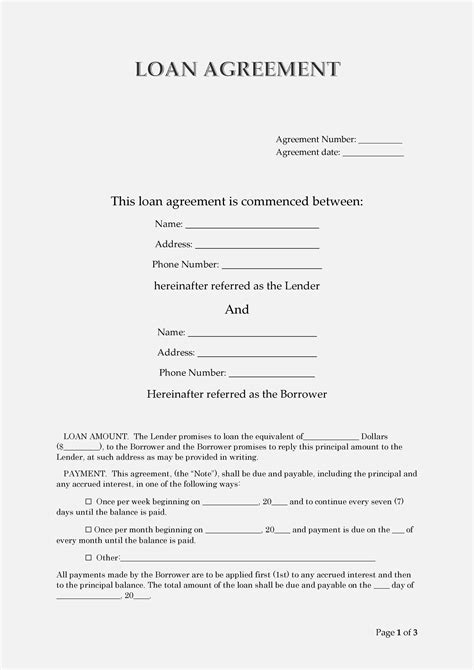

When dealing with loan applications, timeliness is crucial. Loan paperwork can expire, leaving applicants in a state of uncertainty. Expired loan paperwork can cause significant delays or even lead to the rejection of a loan application. Understanding the implications of expired loan paperwork and knowing the steps to take can help mitigate potential issues.

Why Does Loan Paperwork Expire?

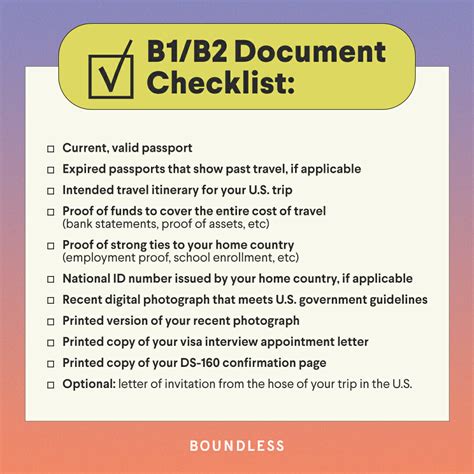

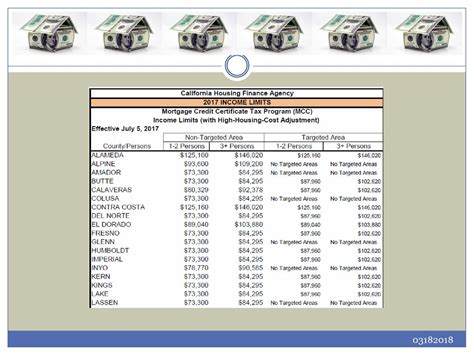

Loan paperwork typically includes credit reports, income verification, and identification documents. These documents have expiration dates because the information they contain can change over time. For instance, a credit report may only be valid for 30 to 60 days, after which the lender may require an update to ensure the applicant’s credit situation has not changed. Similarly, income verification documents may expire if the applicant’s employment status or income level changes.

Consequences of Expired Loan Paperwork

If loan paperwork expires, the lender may not be able to process the loan application. This can lead to:

- Delays in loan approval: The lender may require updated documents, causing delays in the loan approval process.

- Increased interest rates: If the loan application is delayed, interest rates may have changed, potentially increasing the cost of the loan.

- Loan application rejection: In some cases, expired paperwork may lead to the rejection of the loan application, especially if the lender cannot verify the applicant’s current financial situation.

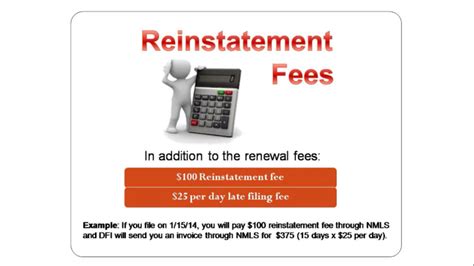

Steps to Take When Loan Paperwork Expires

If loan paperwork expires, the applicant should:

- Notify the lender immediately: Inform the lender about the expired paperwork to discuss possible solutions.

- Update the required documents: Provide the lender with updated documents, such as a new credit report or income verification.

- Resubmit the loan application: Once the updated documents are ready, resubmit the loan application for processing.

📝 Note: It is essential to act quickly when loan paperwork expires to minimize delays and potential rejection of the loan application.

Best Practices to Avoid Expired Loan Paperwork

To avoid the issues associated with expired loan paperwork, applicants should:

- Check the expiration dates of documents: Before submitting the loan application, verify the expiration dates of all required documents.

- Plan ahead: Allow sufficient time for the lender to process the loan application and for any potential delays.

- Stay in touch with the lender: Maintain open communication with the lender to ensure that any issues are addressed promptly.

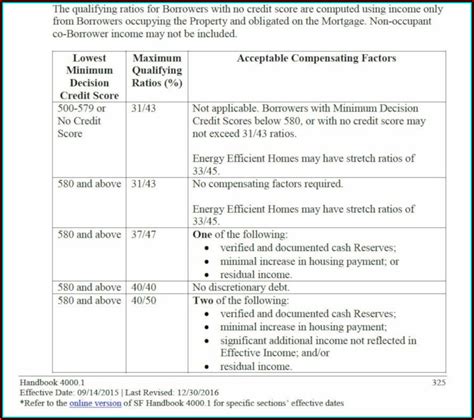

Loan Paperwork Expiration and Credit Scores

Expired loan paperwork can also impact credit scores. If a loan application is rejected due to expired paperwork, it may not affect the credit score. However, if the applicant has to reapply for the loan, it may result in multiple inquiries on the credit report, potentially lowering the credit score.

| Document Type | Expiration Date | Impact on Loan Application |

|---|---|---|

| Credit Report | 30-60 days | May require updated report for loan processing |

| Income Verification | Varies | May require updated documents to verify current income |

| Identification Documents | Varies | May require updated documents to verify identity |

In summary, expired loan paperwork can cause significant issues with loan applications. Understanding the reasons for expiration, the consequences, and the steps to take can help applicants navigate the situation effectively. By being proactive and maintaining open communication with the lender, applicants can minimize delays and potential rejection of the loan application.

As the loan application process comes to a close, it’s essential to reflect on the key points discussed. The expiration of loan paperwork can have far-reaching consequences, from delays in loan approval to potential rejection. However, by staying informed and taking proactive steps, applicants can overcome these challenges and achieve their financial goals.

What happens if my loan paperwork expires?

+

If your loan paperwork expires, the lender may require updated documents, causing delays in the loan approval process. In some cases, the loan application may be rejected.

How can I avoid expired loan paperwork?

+

To avoid expired loan paperwork, check the expiration dates of documents, plan ahead, and stay in touch with the lender to ensure that any issues are addressed promptly.

Will expired loan paperwork affect my credit score?

+

Expired loan paperwork may not directly affect your credit score. However, if you have to reapply for the loan, it may result in multiple inquiries on your credit report, potentially lowering your credit score.