Bankruptcy Paperwork Not Filed

Understanding the Consequences of Not Filing Bankruptcy Paperwork

When individuals or businesses consider filing for bankruptcy, it is essential to understand the importance of completing and submitting all necessary paperwork. Bankruptcy laws are designed to provide a fresh start for debtors, but the process is complex and requires meticulous attention to detail. Failure to file bankruptcy paperwork can have severe consequences, including dismissal of the case, loss of protections, and even criminal charges.

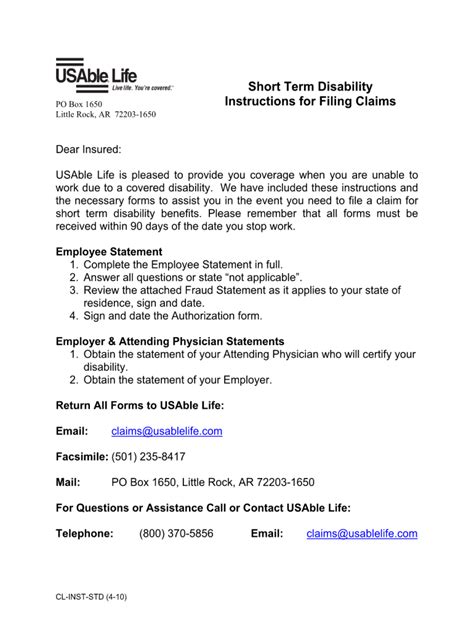

The Bankruptcy Filing Process

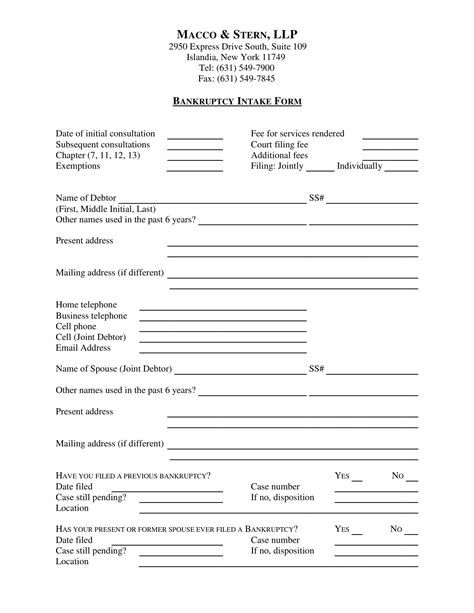

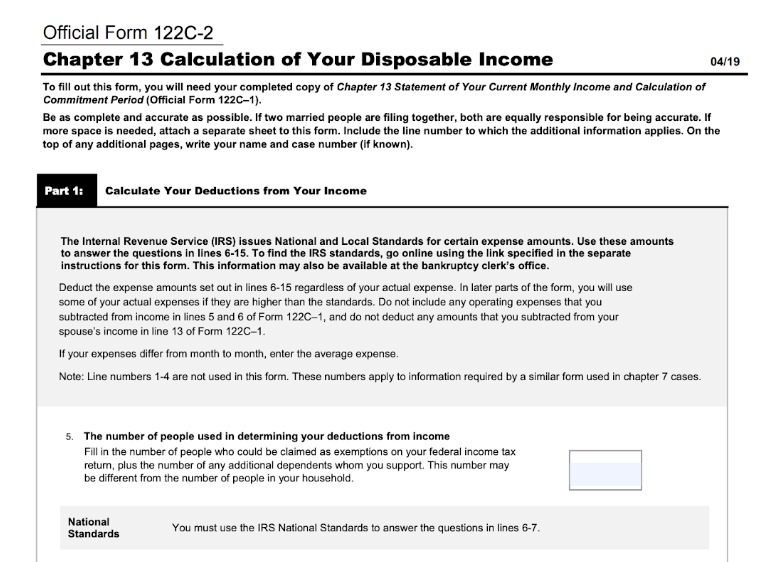

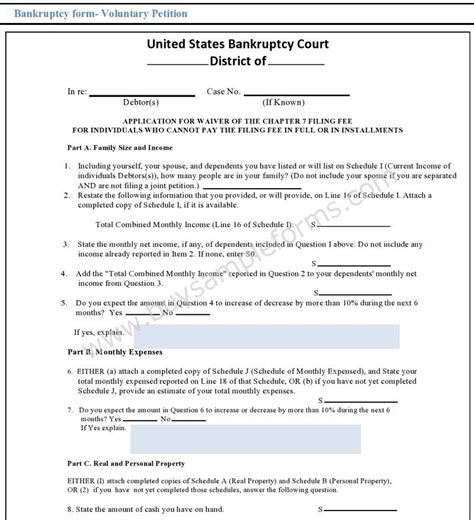

The bankruptcy filing process involves several steps, including: * Gathering financial documents: Debtors must collect and review all relevant financial documents, including income statements, expense reports, and debt records. * Completing bankruptcy forms: Debtors must fill out and submit various forms, such as the Voluntary Petition, Schedules, and Statement of Financial Affairs. * Filing the petition: The completed forms must be filed with the bankruptcy court, along with the required filing fee. * Notifying creditors: Debtors must provide notice to all creditors, informing them of the bankruptcy filing and the automatic stay.

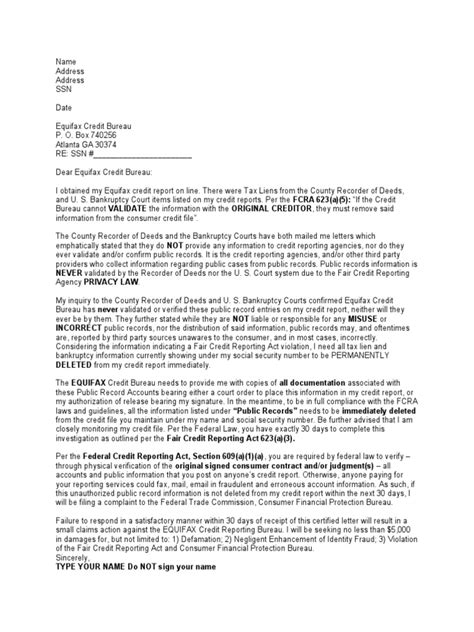

Consequences of Not Filing Bankruptcy Paperwork

If a debtor fails to file required bankruptcy paperwork, the consequences can be severe. Some potential consequences include: * Dismissal of the case: If the debtor fails to file necessary paperwork, the court may dismiss the case, leaving the debtor without the protections of the bankruptcy process. * Loss of automatic stay: The automatic stay, which halts most collection activities, may be lifted if the debtor fails to file required paperwork, allowing creditors to resume collection efforts. * Criminal charges: In extreme cases, failure to file bankruptcy paperwork can lead to criminal charges, such as bankruptcy fraud or perjury.

🚨 Note: Debtors should work closely with an experienced bankruptcy attorney to ensure all necessary paperwork is completed and filed correctly.

Common Reasons for Not Filing Bankruptcy Paperwork

There are several reasons why debtors may fail to file required bankruptcy paperwork, including: * Lack of understanding: The bankruptcy process can be complex, and debtors may not fully understand the requirements. * Procrastination: Debtors may put off completing and filing paperwork, leading to missed deadlines and consequences. * Inability to pay filing fees: Debtors may struggle to pay the required filing fees, leading to delays or failure to file.

Table of Bankruptcy Filing Fees

The following table outlines the current bankruptcy filing fees:

| Chapter | Filing Fee |

|---|---|

| Chapter 7 | 335</td> </tr> <tr> <td>Chapter 13</td> <td>310 |

| Chapter 11 | $1,717 |

Seeking Professional Help

Given the complexity of the bankruptcy process and the potential consequences of not filing required paperwork, it is essential for debtors to seek professional help. An experienced bankruptcy attorney can guide debtors through the process, ensure all necessary paperwork is completed and filed correctly, and help debtors navigate any challenges that may arise.

In the end, the key to a successful bankruptcy filing is attention to detail and timely completion of all required paperwork. By understanding the consequences of not filing bankruptcy paperwork and seeking professional help when needed, debtors can navigate the bankruptcy process with confidence and achieve a fresh start.

What happens if I fail to file required bankruptcy paperwork?

+

If you fail to file required bankruptcy paperwork, the court may dismiss your case, lift the automatic stay, or impose other penalties.

How can I ensure I complete and file all necessary bankruptcy paperwork?

+

Working with an experienced bankruptcy attorney can help ensure you complete and file all necessary paperwork correctly and on time.

What are the current bankruptcy filing fees?

+

The current bankruptcy filing fees are 335 for Chapter 7, 310 for Chapter 13, and $1,717 for Chapter 11.