5 Loan Paperwork Tips

Understanding Loan Paperwork: A Comprehensive Guide

When applying for a loan, the paperwork involved can be overwhelming, especially for first-time borrowers. It’s essential to carefully review and understand the terms and conditions of the loan to avoid any potential pitfalls. In this article, we’ll provide you with five loan paperwork tips to help you navigate the process with confidence.

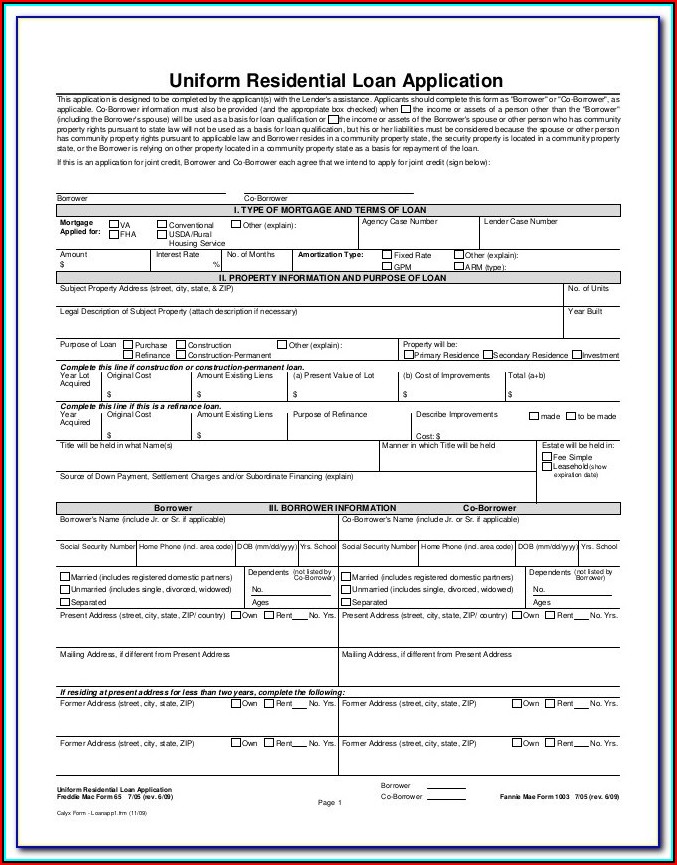

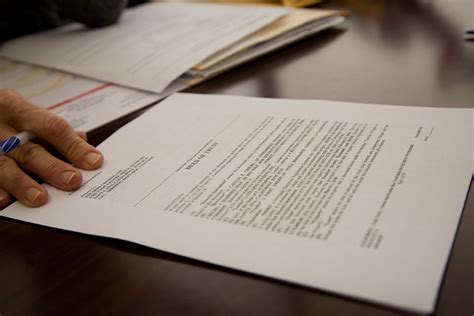

Tip 1: Read and Understand the Loan Agreement

The loan agreement is the most critical document in the loan paperwork process. It outlines the terms and conditions of the loan, including the interest rate, repayment terms, and any fees associated with the loan. It’s crucial to read the loan agreement carefully and ask questions if you’re unsure about any aspect of the loan. Don’t hesitate to seek clarification on any point that you don’t understand. A clear understanding of the loan agreement will help you avoid any potential disputes or issues down the line.

Tip 2: Check for Hidden Fees and Charges

Lenders often charge various fees and charges, such as origination fees, late payment fees, and prepayment penalties. These fees can add up quickly, so it’s essential to review the loan paperwork carefully to ensure you understand all the costs involved. Make sure to ask about any fees that you’re not sure about, and don’t be afraid to negotiate if you feel that the fees are excessive.

Tip 3: Verify the Interest Rate and Repayment Terms

The interest rate and repayment terms are critical components of the loan paperwork. Verify that the interest rate is fixed or variable, and understand how it will affect your monthly payments. Also, review the repayment terms to ensure that you can afford the monthly payments. Consider using a loan calculator to determine your monthly payments and ensure that they fit within your budget.

Tip 4: Review the Collateral Requirements

If you’re applying for a secured loan, you’ll need to provide collateral to secure the loan. Review the collateral requirements carefully to ensure that you understand what’s required and the potential risks involved. Make sure to ask about any specific requirements or restrictions on the collateral, and don’t hesitate to seek advice if you’re unsure about any aspect of the collateral requirements.

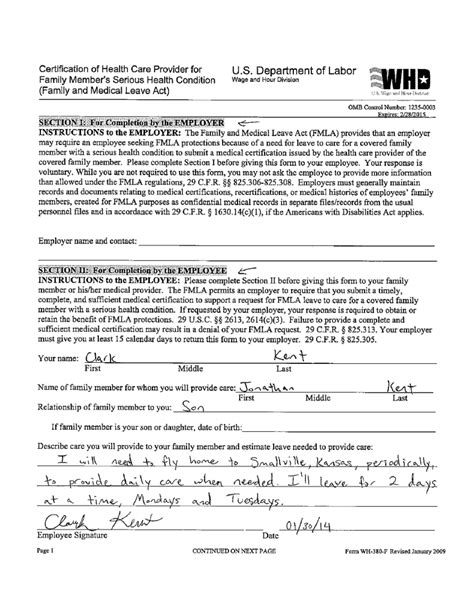

Tip 5: Keep a Record of the Loan Paperwork

Once you’ve completed the loan paperwork, it’s essential to keep a record of all the documents involved. Keep a copy of the loan agreement, promissory note, and any other relevant documents in a safe and secure place. This will help you to refer back to the terms and conditions of the loan if you need to, and will also provide a paper trail in case of any disputes or issues.

📝 Note: It's essential to keep a record of all communication with the lender, including emails, letters, and phone calls. This will help to prevent any misunderstandings or miscommunications.

Some key things to consider when reviewing loan paperwork include: * The interest rate and repayment terms * Any fees or charges associated with the loan * The collateral requirements (if applicable) * The loan agreement and promissory note * Any other relevant documents or terms and conditions

| Loan Type | Interest Rate | Repayment Terms |

|---|---|---|

| Personal Loan | 6% - 36% | 12 - 60 months |

| Car Loan | 4% - 18% | 24 - 72 months |

| Mortgage | 3% - 10% | 120 - 360 months |

In summary, understanding loan paperwork is crucial to making informed decisions about your financial situation. By following these five loan paperwork tips, you’ll be better equipped to navigate the loan process with confidence. Remember to always read the fine print, ask questions, and seek advice if you’re unsure about any aspect of the loan.

What is the importance of reading the loan agreement carefully?

+

Reading the loan agreement carefully is essential to understanding the terms and conditions of the loan, including the interest rate, repayment terms, and any fees associated with the loan. This helps to prevent any potential disputes or issues down the line.

How can I verify the interest rate and repayment terms of the loan?

+

You can verify the interest rate and repayment terms of the loan by reviewing the loan agreement and promissory note. You can also use a loan calculator to determine your monthly payments and ensure that they fit within your budget.

What are the consequences of not keeping a record of the loan paperwork?

+

Not keeping a record of the loan paperwork can lead to misunderstandings or miscommunications with the lender. It’s essential to keep a copy of the loan agreement, promissory note, and any other relevant documents in a safe and secure place to refer back to the terms and conditions of the loan if needed.