Insurance Paperwork for Taxes

Understanding Insurance Paperwork for Taxes

When it comes to taxes, insurance paperwork can be a crucial aspect to consider. Whether you are an individual or a business, having the right insurance coverage can provide financial protection and also offer tax benefits. In this article, we will delve into the world of insurance paperwork for taxes, exploring the different types of insurance, the necessary documents, and how to navigate the tax implications.

Types of Insurance and Tax Implications

There are various types of insurance that can have tax implications, including:

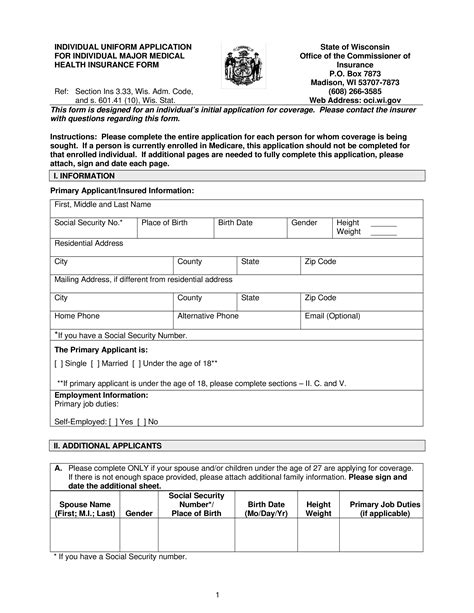

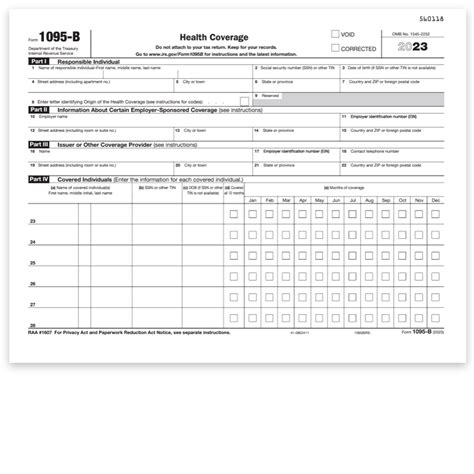

- Health Insurance: Premiums paid for health insurance can be tax-deductible, and some plans may also offer tax-free benefits.

- Life Insurance: While life insurance premiums are not typically tax-deductible, the death benefit paid out to beneficiaries is usually tax-free.

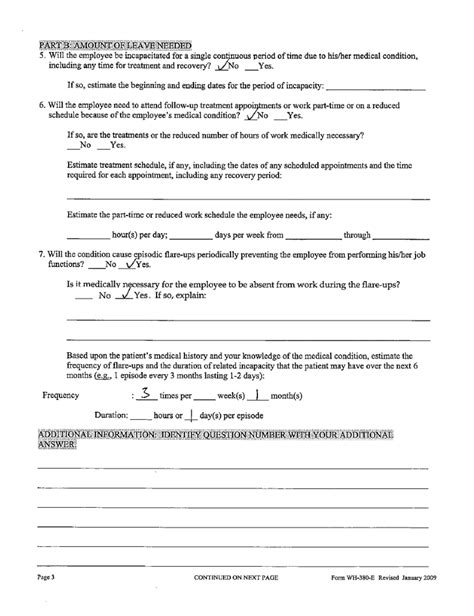

- Disability Insurance: Premiums paid for disability insurance may be tax-deductible, and benefits received may be tax-free if paid with after-tax dollars.

- Homeowners Insurance: Premiums paid for homeowners insurance may be tax-deductible as a business expense if the home is used for business purposes.

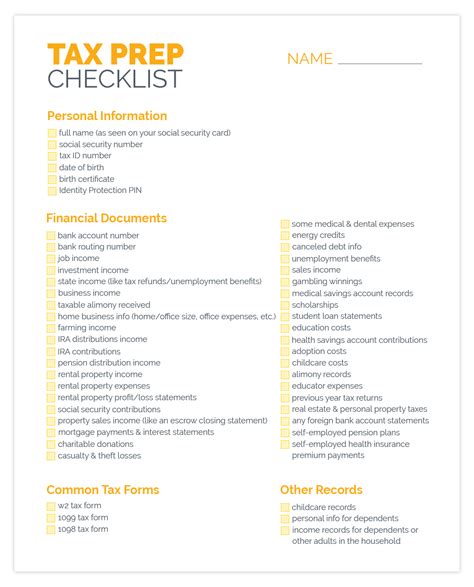

Necessary Documents for Insurance Paperwork

To navigate the tax implications of insurance paperwork, you will need to have the following documents:

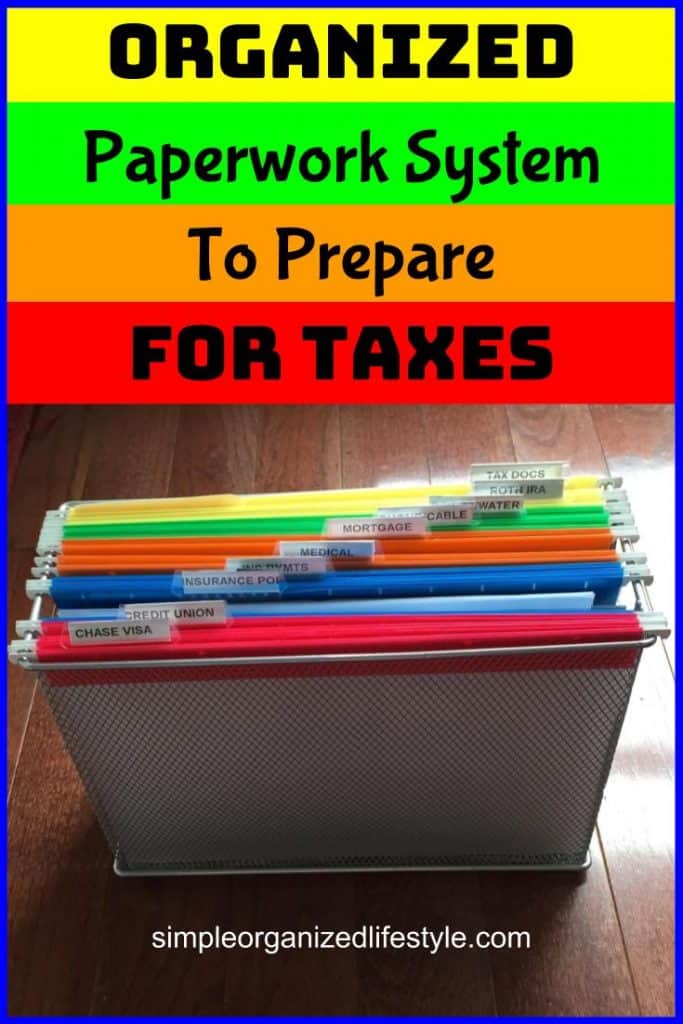

- Insurance Policies: Keep a copy of all insurance policies, including the policy number, effective dates, and premium amounts.

- Premium Payments: Keep records of all premium payments, including payment dates, amounts, and payment methods.

- Claims and Benefits: Keep records of all claims filed and benefits received, including the claim date, benefit amount, and payment method.

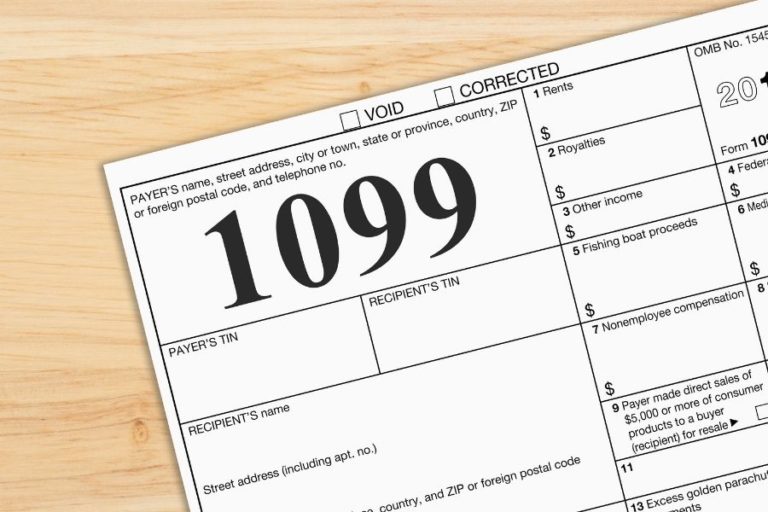

- Tax Returns: Keep copies of all tax returns, including W-2s, 1099s, and Schedule Cs.

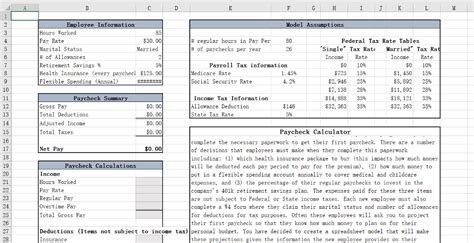

How to Report Insurance Expenses on Your Tax Return

Reporting insurance expenses on your tax return can be complex, but here are the general steps to follow:

- Determine which insurance expenses are tax-deductible, such as health insurance premiums or homeowners insurance premiums.

- Calculate the total amount of deductible insurance expenses for the tax year.

- Report the deductible insurance expenses on the appropriate tax form, such as Schedule A or Schedule C.

- Keep supporting documentation, such as receipts and invoices, in case of an audit.

Tax Benefits of Insurance Paperwork

Insurance paperwork can provide several tax benefits, including:

- Tax-Deductible Premiums: Premiums paid for certain types of insurance, such as health insurance or homeowners insurance, may be tax-deductible.

- Tax-Free Benefits: Benefits received from certain types of insurance, such as life insurance or disability insurance, may be tax-free.

- Business Expense Deductions: Insurance premiums paid for business purposes may be deductible as a business expense.

📝 Note: It is essential to consult with a tax professional or financial advisor to ensure you are taking advantage of all available tax benefits and accurately reporting your insurance expenses on your tax return.

Common Mistakes to Avoid

When dealing with insurance paperwork for taxes, there are several common mistakes to avoid:

- Incorrect Reporting: Failing to accurately report insurance expenses or benefits on your tax return can result in tax penalties or audits.

- Incomplete Documentation: Failing to keep complete and accurate records of insurance policies, premiums, and benefits can make it difficult to support tax deductions or credits.

- Missed Deadlines: Failing to meet tax filing deadlines or payment deadlines can result in penalties and interest.

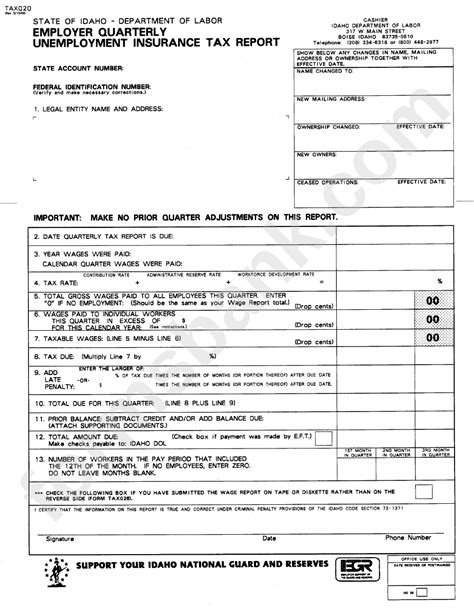

Insurance Paperwork for Businesses

For businesses, insurance paperwork can be even more complex, with additional tax implications and requirements. Businesses may need to consider:

- Workers’ Compensation Insurance: Premiums paid for workers’ compensation insurance may be tax-deductible as a business expense.

- Liability Insurance: Premiums paid for liability insurance may be tax-deductible as a business expense.

- Business Interruption Insurance: Premiums paid for business interruption insurance may be tax-deductible as a business expense.

| Type of Insurance | Tax-Deductible | Tax-Free Benefits |

|---|---|---|

| Health Insurance | Yes | No |

| Life Insurance | No | Yes |

| Disability Insurance | Yes | Yes |

| Homeowners Insurance | Yes | No |

In the end, understanding insurance paperwork for taxes is crucial for both individuals and businesses. By keeping accurate records, reporting insurance expenses correctly, and taking advantage of available tax benefits, you can minimize your tax liability and maximize your tax savings. Whether you are a seasoned tax professional or just starting to navigate the world of taxes, it is essential to stay informed and up-to-date on the latest tax laws and regulations to ensure a smooth and stress-free tax filing experience.

What types of insurance premiums are tax-deductible?

+

Health insurance premiums, homeowners insurance premiums, and disability insurance premiums may be tax-deductible, depending on the specific circumstances.

How do I report insurance expenses on my tax return?

+

You should report deductible insurance expenses on the appropriate tax form, such as Schedule A or Schedule C, and keep supporting documentation, such as receipts and invoices, in case of an audit.

Can I deduct business insurance premiums as a business expense?

+

Yes, business insurance premiums, such as workers’ compensation insurance, liability insurance, and business interruption insurance, may be deductible as a business expense.