5 IRS Forms

Understanding IRS Forms: A Comprehensive Guide

The Internal Revenue Service (IRS) provides various forms for individuals and businesses to report their income, claim deductions, and comply with tax laws. In this article, we will delve into five essential IRS forms, exploring their purposes, requirements, and filing procedures. Whether you are a taxpayer, accountant, or business owner, this guide will help you navigate the complexities of IRS forms and ensure timely and accurate submissions.

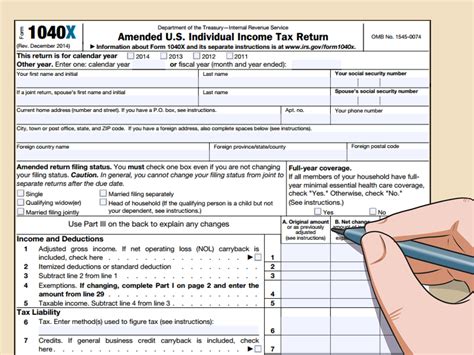

1. Form 1040: The Standard Form for Personal Income Tax

Form 1040 is the most commonly used IRS form for personal income tax returns. It is used to report an individual’s income, deductions, and credits. The form is typically filed annually by April 15th, and it is essential to submit it on time to avoid penalties and interest. Important sections of Form 1040 include: * Income from wages, salaries, and tips * Income from self-employment, investments, and retirement plans * Deductions for mortgage interest, charitable donations, and medical expenses * Credits for education, child care, and earned income

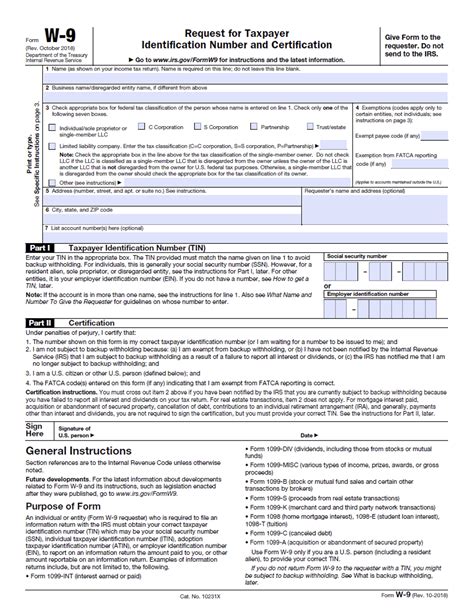

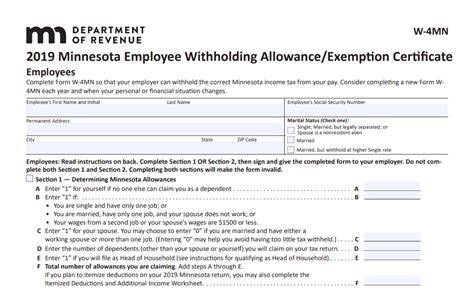

2. Form W-4: Employee’s Withholding Certificate

Form W-4 is used by employees to inform their employers about their tax withholding preferences. The form helps employers determine the correct amount of federal income tax to withhold from an employee’s wages. Key components of Form W-4 include: * Employee’s personal and employment information * Number of allowances claimed * Additional withholding requests * Certification and signature

3. Form 1099-MISC: Miscellaneous Income

Form 1099-MISC is used to report miscellaneous income, such as freelance work, consulting fees, and rental income. The form is typically filed by businesses and individuals who have paid independent contractors or freelance workers. Common types of income reported on Form 1099-MISC include: * Non-employee compensation * Rent * Royalties * Prizes and awards * Other income

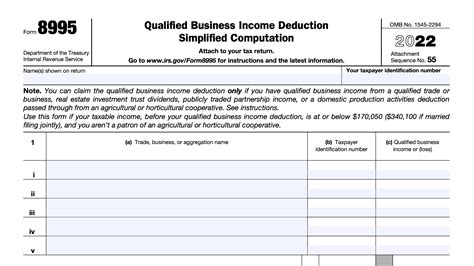

4. Form 8829: Expenses for Business Use of Your Home

Form 8829 is used to calculate and claim the home office deduction for businesses. The form helps taxpayers determine the business use percentage of their home and calculate the corresponding deduction. Key sections of Form 8829 include: * Calculation of business use percentage * Calculation of home office deduction * Depreciation and carryover of unused deductions

5. Form 4868: Application for Automatic Extension of Time To File U.S. Individual Income Tax Return

Form 4868 is used to request an automatic six-month extension of time to file a personal income tax return. The form must be filed by the original due date of the return, and it is essential to estimate and pay any owed taxes to avoid penalties and interest. Important notes about Form 4868 include: * The extension is automatic, but the form must still be filed * The extension does not extend the time to pay taxes owed * Interest and penalties may still apply if taxes are not paid on time

| Form Number | Form Name | Purpose |

|---|---|---|

| 1040 | U.S. Individual Income Tax Return | Report personal income and claim deductions |

| W-4 | Employee's Withholding Certificate | Inform employer about tax withholding preferences |

| 1099-MISC | Miscellaneous Income | Report miscellaneous income, such as freelance work |

| 8829 | Expenses for Business Use of Your Home | Calculate and claim home office deduction |

| 4868 | Application for Automatic Extension of Time To File U.S. Individual Income Tax Return | Request automatic extension of time to file personal income tax return |

📝 Note: It is essential to carefully review and complete each form to ensure accuracy and avoid errors. If you are unsure about any aspect of the forms, consider consulting a tax professional or seeking guidance from the IRS.

In summary, understanding and accurately completing IRS forms is crucial for individuals and businesses to comply with tax laws and avoid penalties. By familiarizing yourself with these five essential forms, you can ensure timely and accurate submissions, and take advantage of available deductions and credits. Remember to always follow the instructions provided with each form, and seek guidance if you are unsure about any aspect of the process. Ultimately, staying informed and up-to-date on IRS forms and regulations can help you navigate the complexities of taxation and achieve peace of mind.

What is the purpose of Form 1040?

+

Form 1040 is used to report an individual’s income, deductions, and credits, and it is the standard form for personal income tax returns.

Who needs to file Form W-4?

+

Form W-4 is used by employees to inform their employers about their tax withholding preferences, and it is typically filed when starting a new job or when personal circumstances change.

What is the deadline for filing Form 4868?

+

Form 4868 must be filed by the original due date of the personal income tax return, which is typically April 15th.