5 W4 Paperwork Facts

Introduction to W4 Paperwork

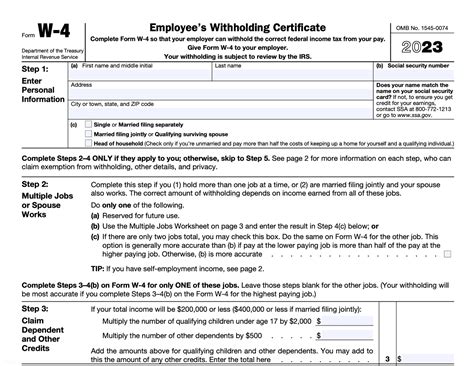

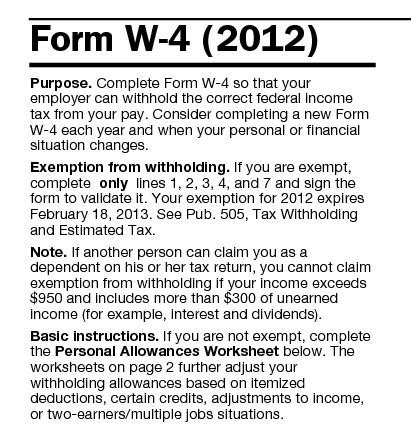

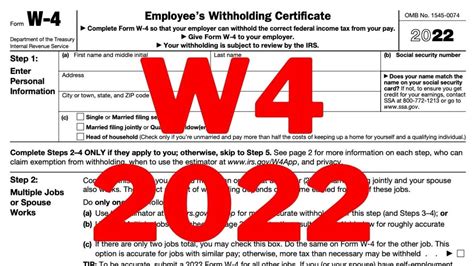

When it comes to employment, one of the most crucial documents that employees need to fill out is the W-4 form. The W-4 form, also known as the Employee’s Withholding Certificate, is used by employers to determine the amount of federal income tax to withhold from an employee’s wages. In this blog post, we will delve into the world of W4 paperwork and explore some essential facts that everyone should know.

What is a W4 Form?

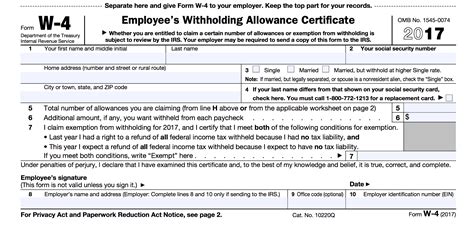

A W4 form is a document that employees fill out to provide their employer with the necessary information to calculate the correct amount of federal income tax to withhold from their wages. The form requires employees to provide their personal details, such as their name, address, and Social Security number, as well as their filing status and number of dependents. The W4 form also asks employees to claim any exemptions or deductions they are eligible for, which can affect the amount of tax withheld from their wages.

Why is W4 Paperwork Important?

W4 paperwork is important because it helps employers to accurately calculate the amount of federal income tax to withhold from an employee’s wages. If an employee’s W4 form is not filled out correctly, they may end up owing a significant amount of money in taxes at the end of the year, or they may have too much tax withheld, resulting in a large refund. Either way, it can be a frustrating and costly experience for employees. By filling out the W4 form correctly, employees can ensure that the right amount of tax is withheld from their wages, and they can avoid any potential tax-related issues.

5 Key Facts About W4 Paperwork

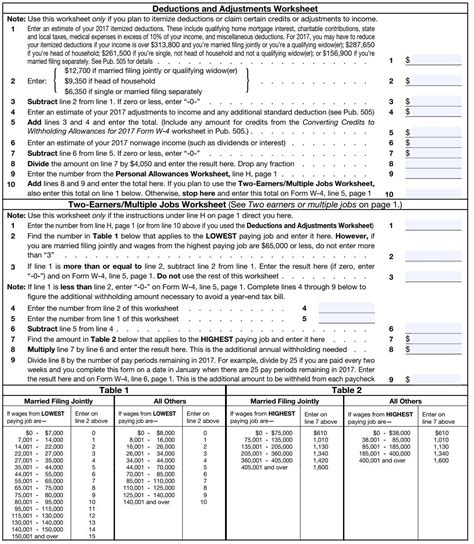

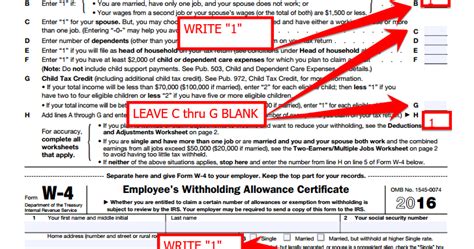

Here are five key facts about W4 paperwork that everyone should know: * Fact #1: W4 Forms Need to be Updated Regularly: Employees need to update their W4 form whenever their personal or financial situation changes. This can include getting married, having children, or starting a new job. By updating their W4 form, employees can ensure that their tax withholding is accurate and up-to-date. * Fact #2: W4 Forms Can be Completed Online: Many employers offer online W4 forms that employees can complete and submit electronically. This can make the process of filling out the W4 form faster and more convenient for employees. * Fact #3: W4 Forms Require Accurate Information: It is essential that employees provide accurate information on their W4 form. This includes their name, address, and Social Security number, as well as their filing status and number of dependents. If an employee provides incorrect information, it can lead to errors in their tax withholding. * Fact #4: W4 Forms Can be Used to Claim Exemptions: The W4 form allows employees to claim exemptions or deductions that they are eligible for. This can include exemptions for dependents, student loan interest, or mortgage interest. By claiming these exemptions, employees can reduce the amount of tax withheld from their wages. * Fact #5: W4 Forms Are Subject to Audit: The IRS can audit an employee’s W4 form to ensure that it is accurate and complete. If an employee’s W4 form is found to be incorrect, they may be subject to penalties and fines.

📝 Note: It is essential to keep a copy of your W4 form for your records, in case you need to refer to it later or make changes to your tax withholding.

How to Fill Out a W4 Form

Filling out a W4 form can seem like a daunting task, but it is relatively straightforward. Here are the steps to follow: * Step 1: Download and print the W4 form from the IRS website or obtain one from your employer. * Step 2: Fill out the personal details section, including your name, address, and Social Security number. * Step 3: Choose your filing status and number of dependents. * Step 4: Claim any exemptions or deductions you are eligible for. * Step 5: Sign and date the form. * Step 6: Submit the form to your employer.

Common Mistakes to Avoid When Filling Out a W4 Form

Here are some common mistakes to avoid when filling out a W4 form: * Mistake #1: Providing Inaccurate Information: Make sure to provide accurate information on your W4 form, including your name, address, and Social Security number. * Mistake #2: Not Updating Your W4 Form: Remember to update your W4 form whenever your personal or financial situation changes. * Mistake #3: Not Claiming Exemptions: Don’t forget to claim any exemptions or deductions you are eligible for, such as exemptions for dependents or student loan interest. * Mistake #4: Not Signing and Dating the Form: Make sure to sign and date your W4 form before submitting it to your employer.

| W4 Form Section | Description |

|---|---|

| Personal Details | Employee's name, address, and Social Security number |

| Filing Status | Employee's filing status and number of dependents |

| Exemptions | Exemptions or deductions claimed by the employee |

In summary, W4 paperwork is an essential part of the employment process, and it is crucial that employees fill out their W4 form correctly to ensure accurate tax withholding. By understanding the key facts about W4 paperwork and avoiding common mistakes, employees can ensure that their tax withholding is accurate and up-to-date.

What is a W4 form used for?

+

A W4 form is used by employers to determine the amount of federal income tax to withhold from an employee’s wages.

How often do I need to update my W4 form?

+

You should update your W4 form whenever your personal or financial situation changes, such as getting married, having children, or starting a new job.

What happens if I make a mistake on my W4 form?

+

If you make a mistake on your W4 form, it can lead to errors in your tax withholding, and you may be subject to penalties and fines. It is essential to double-check your W4 form for accuracy before submitting it to your employer.