5 Annuity Paperwork Tips

Understanding Annuity Paperwork: A Comprehensive Guide

When it comes to annuity planning, navigating the complex paperwork can be overwhelming. Annuities are financial products that provide a steady income stream, typically in retirement, and are often used to ensure a stable financial future. However, the documentation involved can be daunting, making it essential to understand the key components and how to manage them effectively. In this guide, we will explore five crucial tips for handling annuity paperwork, making the process smoother and less stressful.

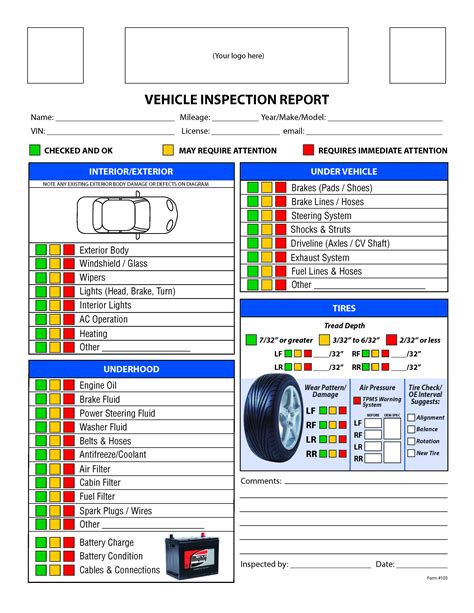

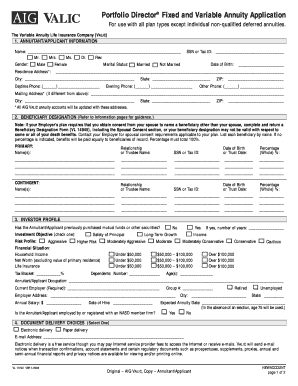

Tip 1: Read and Understand the Contract

The first and most critical step in managing annuity paperwork is to read and understand the contract thoroughly. Annuity contracts can be lengthy and filled with legal and financial jargon, but it’s vital to grasp the terms, conditions, and any penalties for early withdrawal. Understanding the contract will help you make informed decisions about your annuity, including the type of annuity, the payment schedule, and any riders or additional features. Taking the time to read through the contract carefully can prevent misunderstandings and ensure that your annuity meets your financial goals.

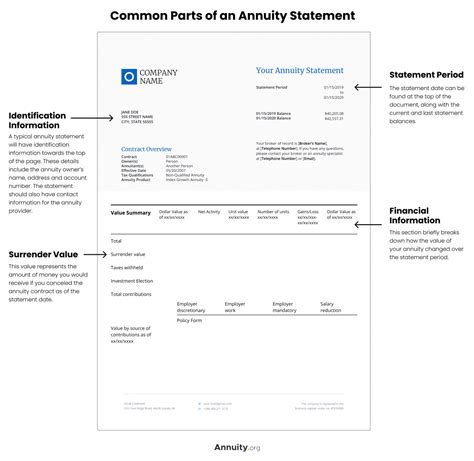

Tip 2: Keep Accurate Records

Maintaining accurate and detailed records of your annuity paperwork is crucial for several reasons. First, it helps you keep track of your payments, interest rates, and any changes to your contract. Second, it provides a clear paper trail in case of any disputes or issues with your annuity provider. Lastly, having organized records makes it easier to review and adjust your annuity strategy as needed. Consider using a spreadsheet or a dedicated folder to keep all your annuity documents in one place.

Tip 3: Review and Update Beneficiary Information

Ensuring that your beneficiary information is up-to-date is a critical aspect of annuity paperwork. Beneficiaries are the individuals who will receive the annuity payments in the event of your passing. Reviewing and updating this information regularly is essential to ensure that your annuity proceeds go to the intended recipients. This is particularly important if you experience any changes in your personal life, such as marriage, divorce, or the birth of a child. Make sure to notify your annuity provider of any updates to your beneficiary information.

Tip 4: Understand Tax Implications

Annuities have tax implications that can impact your overall financial situation. It’s essential to understand how your annuity will be taxed, including any tax-deferred growth or taxable withdrawals. Consulting with a tax professional or financial advisor can help you navigate the tax implications of your annuity and ensure that you’re making the most tax-efficient decisions. Additionally, be aware of any tax penalties for early withdrawals and plan accordingly.

Tip 5: Seek Professional Advice

Finally, seeking professional advice is a vital tip for managing annuity paperwork. A financial advisor or annuity specialist can provide valuable guidance on choosing the right annuity, understanding the contract, and optimizing your annuity strategy. They can also help you navigate any complex paperwork and ensure that you’re making informed decisions about your annuity. When selecting a professional advisor, look for someone with experience in annuity planning and a reputation for excellent customer service.

📝 Note: It's essential to work with a reputable and licensed insurance professional when purchasing an annuity to ensure that you're getting the best product for your needs.

In summary, managing annuity paperwork requires attention to detail, a thorough understanding of the contract, and a proactive approach to record-keeping and beneficiary updates. By following these five tips, you can ensure that your annuity paperwork is in order, and you’re well on your way to securing a stable financial future. Whether you’re just starting to explore annuities or have an existing annuity, taking control of your paperwork will give you peace of mind and help you achieve your long-term financial goals.

What is an annuity, and how does it work?

+

An annuity is a financial product that provides a steady income stream, typically in retirement. It works by investing a lump sum of money with an insurance company, which then provides regular payments to the annuitant.

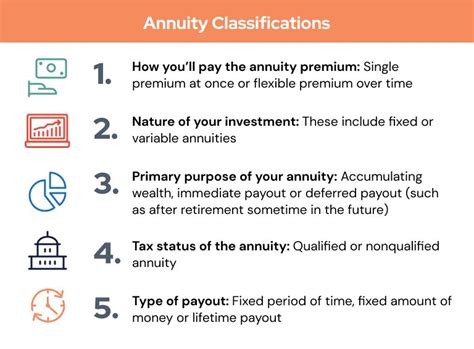

What are the different types of annuities available?

+

There are several types of annuities, including fixed annuities, variable annuities, and indexed annuities. Each type has its own unique features and benefits, and the right choice will depend on your individual financial goals and risk tolerance.

How do I choose the right annuity for my needs?

+

Choosing the right annuity requires careful consideration of your financial goals, risk tolerance, and time horizon. It’s essential to work with a licensed insurance professional who can help you navigate the different options and find the best fit for your needs.