Paperwork

Bankruptcy Discharge Paperwork Explained

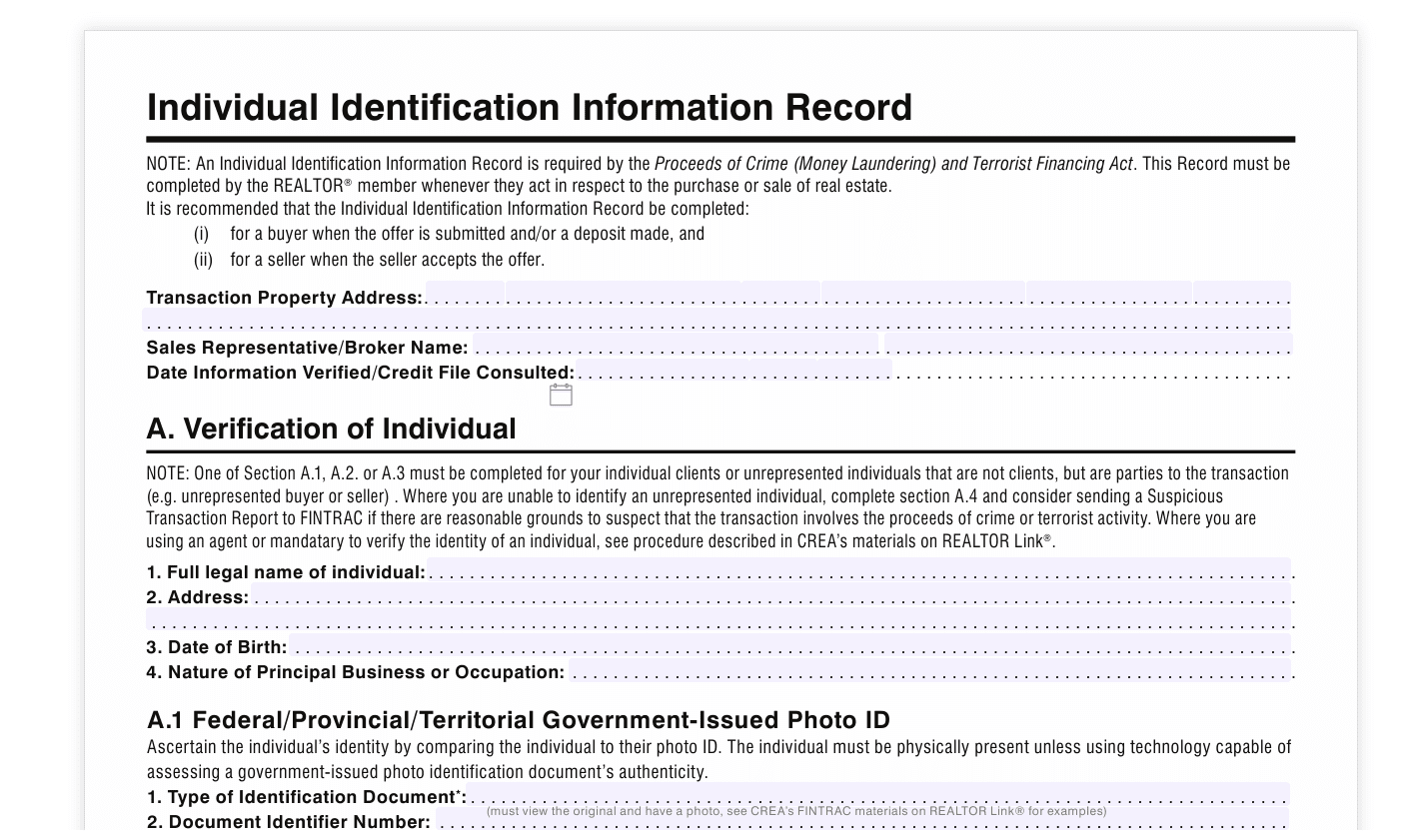

Introduction to Bankruptcy Discharge Paperwork

Bankruptcy discharge paperwork is a critical component of the bankruptcy process, marking the final stages of a debtor’s journey towards financial recovery. When an individual or business files for bankruptcy, the primary goal is often to obtain a discharge, which releases them from their obligation to pay certain debts. This process involves a series of legal documents and procedures that must be meticulously followed to ensure a successful discharge. Understanding the intricacies of bankruptcy discharge paperwork is essential for navigating the complexities of bankruptcy law.

Understanding Bankruptcy Discharge

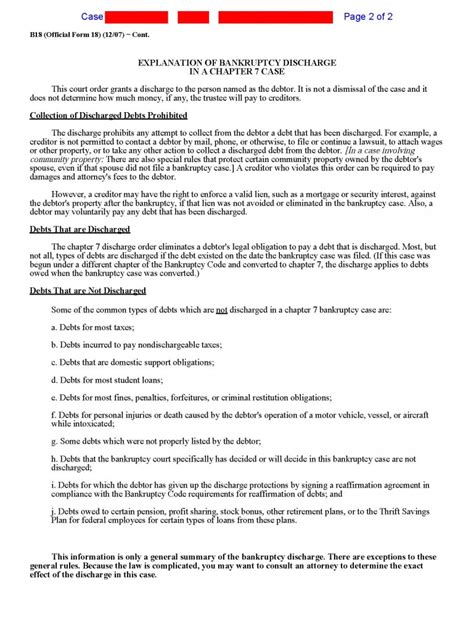

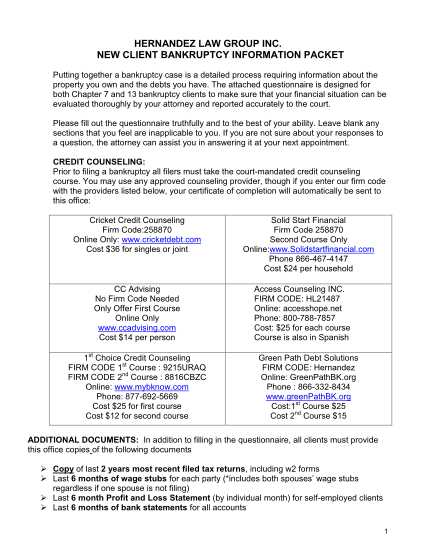

Before diving into the specifics of the paperwork, it’s crucial to grasp what a bankruptcy discharge entails. A discharge in bankruptcy refers to the court’s order that forgives debts, meaning creditors can no longer pursue the debtor for payment. Not all debts are dischargeable; non-dischargeable debts include student loans, taxes, and child support, among others. The type of bankruptcy filed, either Chapter 7 or Chapter 13, significantly affects the discharge process and the kinds of debts that can be discharged.

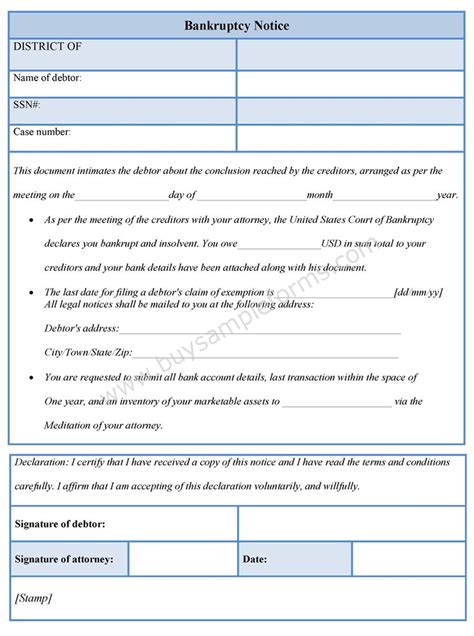

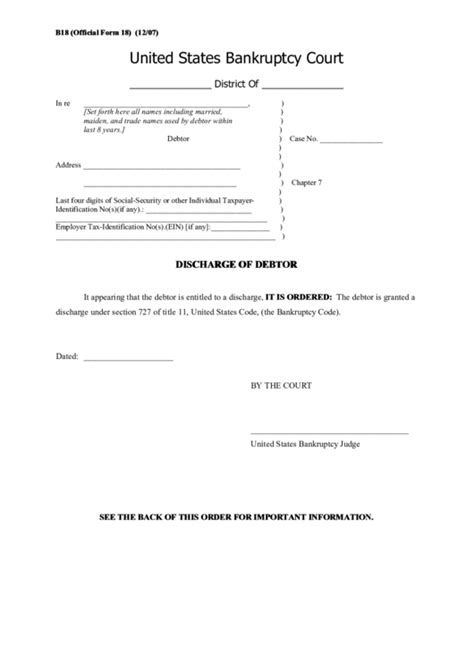

Chapter 7 Bankruptcy Discharge Paperwork

In a Chapter 7 bankruptcy, also known as liquidation bankruptcy, the trustee gathers and sells the debtor’s non-exempt assets to pay off creditors. The discharge paperwork for Chapter 7 typically includes: - Voluntary Petition: The initial document filed with the court to commence the bankruptcy process. - Schedules: Detailed lists of the debtor’s assets, liabilities, income, and expenses. - Statement of Financial Affairs: A comprehensive overview of the debtor’s financial transactions before filing for bankruptcy. - Discharge Order: The final document issued by the court, indicating which debts are discharged.

Chapter 13 Bankruptcy Discharge Paperwork

Chapter 13 bankruptcy involves creating a repayment plan to pay off a portion of the debts over time. The discharge paperwork for Chapter 13 includes: - Repayment Plan: A detailed proposal outlining how the debtor intends to pay off a portion of their debts. - Plan Confirmation Order: The court’s approval of the repayment plan. - Discharge Order: Issued after completing the repayment plan, stating which debts are discharged.

Key Documents in Bankruptcy Discharge

Several key documents play a critical role in the bankruptcy discharge process: - Notice of Chapter 7 Bankruptcy Case: Informs creditors of the bankruptcy filing. - Proof of Claim: A form creditors use to state the amount they are owed. - Trustee’s Report: The trustee’s findings on the debtor’s assets and liabilities.

Steps to Obtain a Bankruptcy Discharge

To obtain a bankruptcy discharge, debtors must: - File the Petition: Initiate the bankruptcy process by filing the voluntary petition and other required documents. - Attend the 341 Meeting: A meeting of creditors where the debtor is questioned under oath about their financial affairs. - Complete the Financial Management Course: A requirement for receiving a discharge in both Chapter 7 and Chapter 13 bankruptcies. - Receive the Discharge Order: The final step, where the court issues an order discharging eligible debts.

Challenges and Considerations

The bankruptcy discharge process is not without its challenges. Debtors may face objections to discharge from creditors, alleging that the debtor has not fulfilled the requirements for a discharge or has engaged in fraudulent activities. Additionally, understanding which debts are dischargeable and which are not is crucial for making informed decisions throughout the process.

| Type of Debt | Dischargeable in Chapter 7 | Dischargeable in Chapter 13 |

|---|---|---|

| Credit Card Debt | Yes | Yes |

| Medical Bills | Yes | Yes |

| Student Loans | No | No, except in rare cases |

| Taxes | No, except in certain circumstances | No, except in certain circumstances |

📝 Note: The dischargeability of certain debts can depend on specific circumstances and the jurisdiction in which the bankruptcy is filed.

Conclusion and Final Thoughts

Navigating the bankruptcy discharge paperwork and process requires a deep understanding of bankruptcy law and its intricacies. It’s a journey that, while challenging, offers a pathway to financial rebirth for many. By grasping the fundamental principles of bankruptcy discharge, including the critical documents involved and the steps necessary to obtain a discharge, individuals can better navigate their financial difficulties and emerge stronger on the other side.

What is the primary goal of filing for bankruptcy?

+

The primary goal of filing for bankruptcy is to obtain a discharge of debts, providing the debtor with a fresh financial start.

What are non-dischargeable debts in bankruptcy?

+

Non-dischargeable debts include student loans, taxes, child support, and certain other debts that cannot be forgiven through bankruptcy.

What is the difference between Chapter 7 and Chapter 13 bankruptcy?

+

Chapter 7 involves the liquidation of non-exempt assets to pay off debts, while Chapter 13 involves creating a repayment plan to pay off a portion of debts over time.