5 Beneficiary Tips

Introduction to Beneficiary Tips

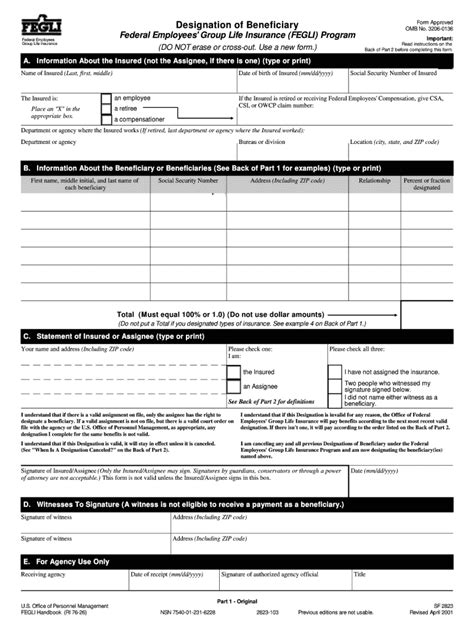

When it comes to managing finances, understanding beneficiary designations is crucial. A beneficiary is a person or entity that receives benefits from a financial product, such as a life insurance policy, retirement account, or trust. Choosing the right beneficiary can ensure that your assets are distributed according to your wishes after you pass away. In this article, we will explore five beneficiary tips to help you make informed decisions about your financial future.

Tip 1: Understand the Different Types of Beneficiaries

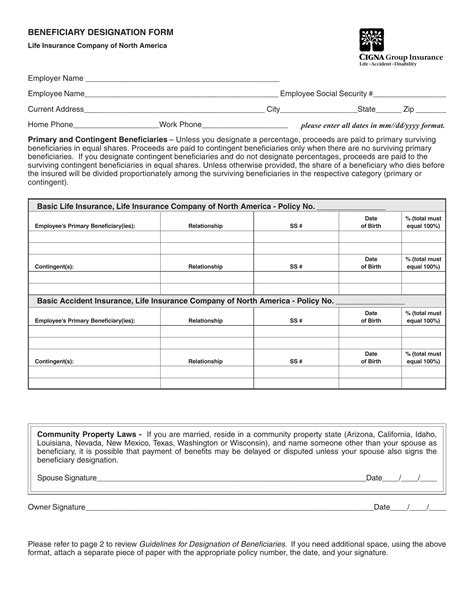

There are several types of beneficiaries, including primary, secondary, and tertiary beneficiaries. Primary beneficiaries are the first in line to receive benefits, while secondary beneficiaries receive benefits if the primary beneficiary predeceases the policyholder. Tertiary beneficiaries receive benefits if both primary and secondary beneficiaries predecease the policyholder. It’s essential to understand the differences between these types of beneficiaries to ensure that your assets are distributed correctly.

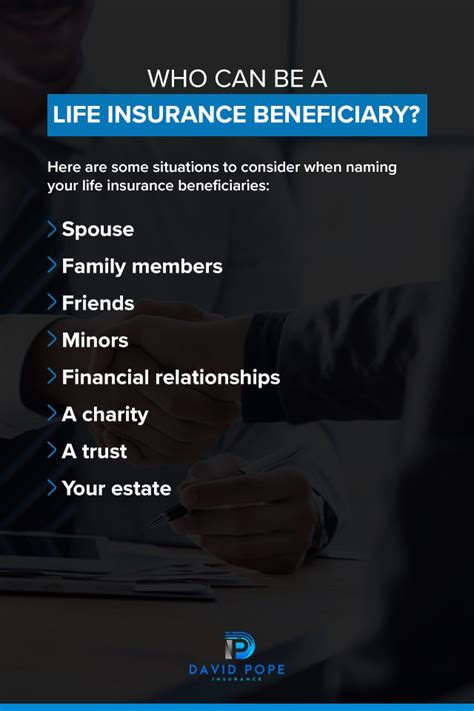

Tip 2: Choose the Right Beneficiary for Your Life Insurance Policy

When choosing a beneficiary for your life insurance policy, consider the following factors: * Age and dependents: If you have minor children, you may want to name a trust or a guardian as the beneficiary to ensure that the funds are used for their benefit. * Financial dependence: If you have a spouse or partner who relies on your income, you may want to name them as the beneficiary to provide for their financial well-being. * Tax implications: Certain beneficiaries, such as charities, may be tax-exempt, which can help minimize tax liabilities. Consider the following table to help you decide:

| Beneficiary Type | Advantages | Disadvantages |

|---|---|---|

| Spouse or partner | Provides financial support, potential tax benefits | May not be suitable for blended families or complex relationships |

| Minor children | Ensures financial support for dependents, potential tax benefits | Requires a trust or guardian to manage funds |

| Charity | Tax-exempt, supports a good cause | May not provide direct financial support to loved ones |

Tip 3: Review and Update Your Beneficiary Designations Regularly

It’s essential to review and update your beneficiary designations regularly to ensure that they remain accurate and reflect any changes in your life circumstances. Consider the following events that may require updates: * Marriage or divorce * Birth or adoption of children * Death of a beneficiary * Changes in financial circumstances * Updates to your estate plan Regular reviews can help prevent unintended consequences, such as a former spouse receiving benefits.

Tip 4: Consider the Tax Implications of Beneficiary Designations

Beneficiary designations can have significant tax implications, depending on the type of beneficiary and the assets involved. For example: * Life insurance proceeds are generally tax-free to the beneficiary. * Retirement account distributions may be subject to income tax. * Trust distributions may be subject to income tax or estate tax. It’s essential to consider the tax implications of your beneficiary designations to minimize tax liabilities and ensure that your assets are distributed efficiently.

Tip 5: Seek Professional Advice

Beneficiary designations can be complex, and it’s essential to seek professional advice to ensure that your wishes are carried out correctly. Consider consulting with: * Estate planning attorney: To create a comprehensive estate plan that includes beneficiary designations. * Financial advisor: To understand the tax implications and financial consequences of beneficiary designations. * Insurance professional: To understand the specifics of life insurance policies and beneficiary designations. Seeking professional advice can help you navigate the complexities of beneficiary designations and ensure that your assets are distributed according to your wishes.

💡 Note: It's essential to review and update your beneficiary designations regularly to ensure that they remain accurate and reflect any changes in your life circumstances.

In summary, choosing the right beneficiary is crucial to ensuring that your assets are distributed according to your wishes. By understanding the different types of beneficiaries, choosing the right beneficiary for your life insurance policy, reviewing and updating your beneficiary designations regularly, considering the tax implications, and seeking professional advice, you can make informed decisions about your financial future.

What is a beneficiary?

+

A beneficiary is a person or entity that receives benefits from a financial product, such as a life insurance policy, retirement account, or trust.

How do I choose the right beneficiary for my life insurance policy?

+

Consider factors such as age and dependents, financial dependence, and tax implications to choose the right beneficiary for your life insurance policy.

Why is it essential to review and update my beneficiary designations regularly?

+

Regular reviews can help prevent unintended consequences, such as a former spouse receiving benefits, and ensure that your beneficiary designations remain accurate and reflect any changes in your life circumstances.