Paperwork

FEI on Grants Paperwork Explained

Introduction to FEI on Grants Paperwork

The process of managing grants involves a multitude of paperwork and compliance requirements. One crucial aspect of this process is the Financial and Executive Institute (FEI) guidelines, which provide a framework for handling financial aspects of grant management. Understanding FEI on grants paperwork is essential for organizations that rely on grants to fund their operations. In this article, we will delve into the details of FEI guidelines and their implications for grant management.

What is FEI?

The Financial and Executive Institute (FEI) is a professional organization that provides guidance and resources for financial executives. FEI offers various services, including training, research, and advocacy, to help financial professionals navigate the complexities of financial management. In the context of grant management, FEI guidelines play a critical role in ensuring that organizations comply with financial regulations and maintain transparency in their financial reporting.

Key Components of FEI Guidelines

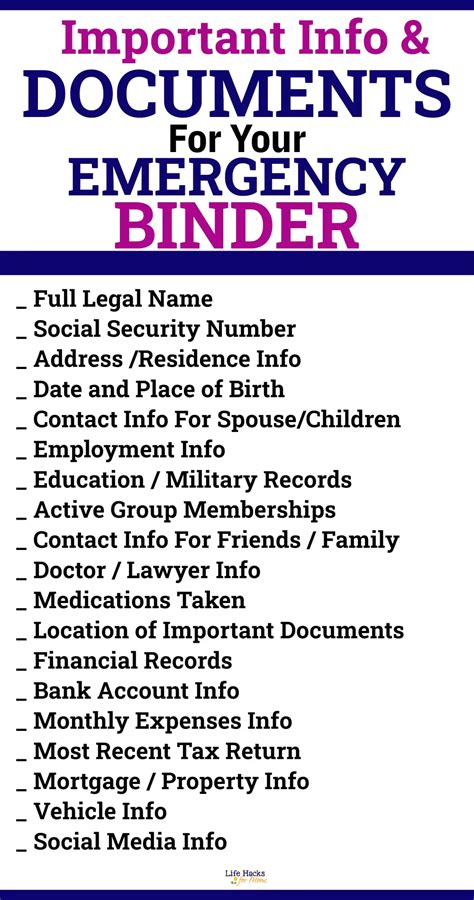

FEI guidelines for grant management cover several key areas, including: * Financial reporting: FEI guidelines emphasize the importance of accurate and timely financial reporting. This includes submitting regular financial reports to the grantor, as well as maintaining detailed records of grant expenditures. * Budgeting and forecasting: FEI guidelines recommend that organizations establish a comprehensive budgeting and forecasting process to ensure that grant funds are allocated effectively. * Internal controls: FEI guidelines stress the need for robust internal controls to prevent fraud, mismanagement, and other forms of financial irregularity. * Audit and compliance: FEI guidelines provide guidance on audit and compliance procedures to ensure that organizations meet the regulatory requirements of grant management.

Benefits of FEI Guidelines

The benefits of following FEI guidelines for grant management are numerous. Some of the key advantages include: * Improved financial transparency: By following FEI guidelines, organizations can ensure that their financial reporting is accurate, complete, and transparent. * Enhanced compliance: FEI guidelines help organizations comply with regulatory requirements, reducing the risk of non-compliance and associated penalties. * Better financial management: FEI guidelines provide a framework for effective financial management, enabling organizations to allocate grant funds efficiently and achieve their programmatic goals.

Challenges of Implementing FEI Guidelines

While FEI guidelines offer numerous benefits, implementing them can be challenging. Some of the common obstacles include: * Lack of resources: Small organizations may not have the necessary resources, including personnel and technology, to implement FEI guidelines effectively. * Complexity of regulations: Grant management regulations can be complex and difficult to navigate, making it challenging for organizations to ensure compliance. * Resistance to change: Implementing new financial management procedures can be met with resistance from staff, particularly if they are accustomed to traditional methods.

📝 Note: Organizations should carefully review FEI guidelines and assess their current financial management practices to identify areas for improvement.

Best Practices for Implementing FEI Guidelines

To overcome the challenges of implementing FEI guidelines, organizations should adopt the following best practices: * Conduct a thorough needs assessment: Organizations should assess their current financial management practices and identify areas for improvement. * Develop a comprehensive implementation plan: Organizations should develop a detailed plan for implementing FEI guidelines, including timelines, milestones, and responsible personnel. * Provide training and support: Organizations should provide training and support to staff to ensure that they understand and can implement FEI guidelines effectively.

| FEI Guideline | Description |

|---|---|

| Financial Reporting | Accurate and timely submission of financial reports to the grantor |

| Budgeting and Forecasting | Establishing a comprehensive budgeting and forecasting process |

| Internal Controls | Implementing robust internal controls to prevent fraud and mismanagement |

| Audit and Compliance | Ensuring compliance with regulatory requirements through audit and compliance procedures |

Conclusion and Future Directions

In conclusion, FEI guidelines play a critical role in ensuring that organizations manage grant funds effectively and maintain transparency in their financial reporting. By understanding and implementing FEI guidelines, organizations can improve their financial management practices, reduce the risk of non-compliance, and achieve their programmatic goals. As grant management regulations continue to evolve, it is essential for organizations to stay up-to-date with the latest guidelines and best practices to ensure their long-term sustainability.

What is the purpose of FEI guidelines for grant management?

+

The purpose of FEI guidelines is to provide a framework for financial management and compliance in grant management, ensuring that organizations manage grant funds effectively and maintain transparency in their financial reporting.

What are the key components of FEI guidelines for grant management?

+

The key components of FEI guidelines include financial reporting, budgeting and forecasting, internal controls, and audit and compliance procedures.

How can organizations implement FEI guidelines effectively?

+

Organizations can implement FEI guidelines effectively by conducting a thorough needs assessment, developing a comprehensive implementation plan, and providing training and support to staff.