Mortgage Loan Paperwork Explained

Introduction to Mortgage Loan Paperwork

When applying for a mortgage loan, one of the most daunting tasks can be navigating the extensive paperwork involved. The process of obtaining a mortgage can be complex, with numerous documents and forms to fill out, sign, and submit. Understanding the different types of paperwork and their purposes can help make the experience less overwhelming. In this article, we will delve into the world of mortgage loan paperwork, exploring the various documents you will encounter and providing guidance on how to manage them effectively.

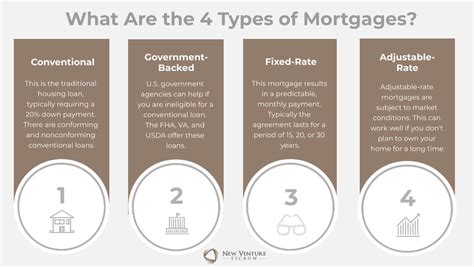

Pre-Approval and Pre-Qualification Documents

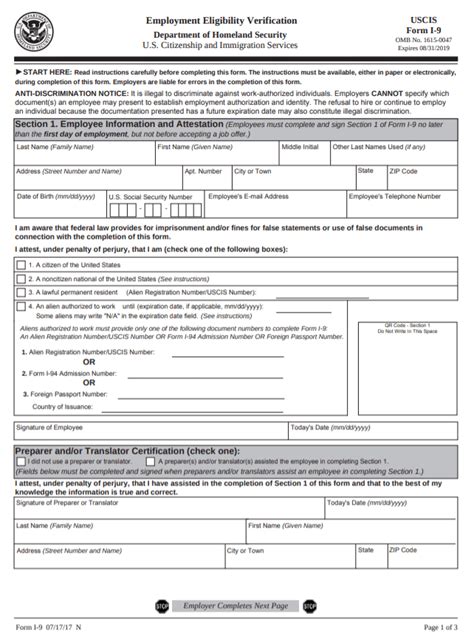

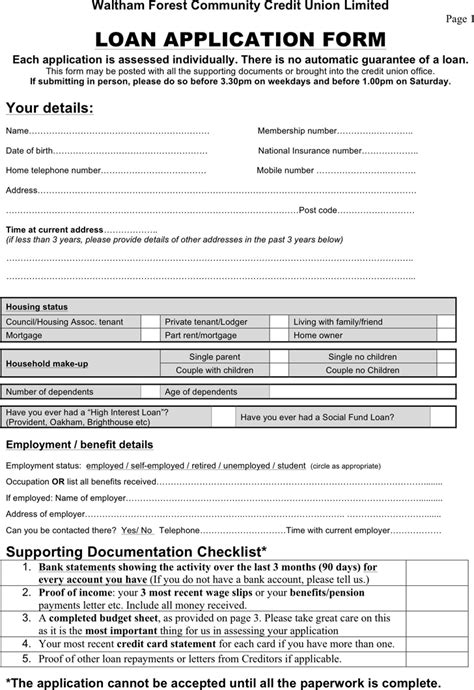

The first step in the mortgage loan process is often pre-approval or pre-qualification. These terms are sometimes used interchangeably, but they have distinct meanings. Pre-qualification is an informal estimate of how much you might be able to borrow, based on a brief overview of your financial situation. On the other hand, pre-approval is a more formal process where the lender reviews your credit report and financial documents to provide a conditional commitment to lend a specific amount. Documents required for pre-approval typically include: - Identification (driver’s license, passport) - Proof of income (pay stubs, W-2 forms) - Proof of employment (letter from employer) - Bank statements - Tax returns

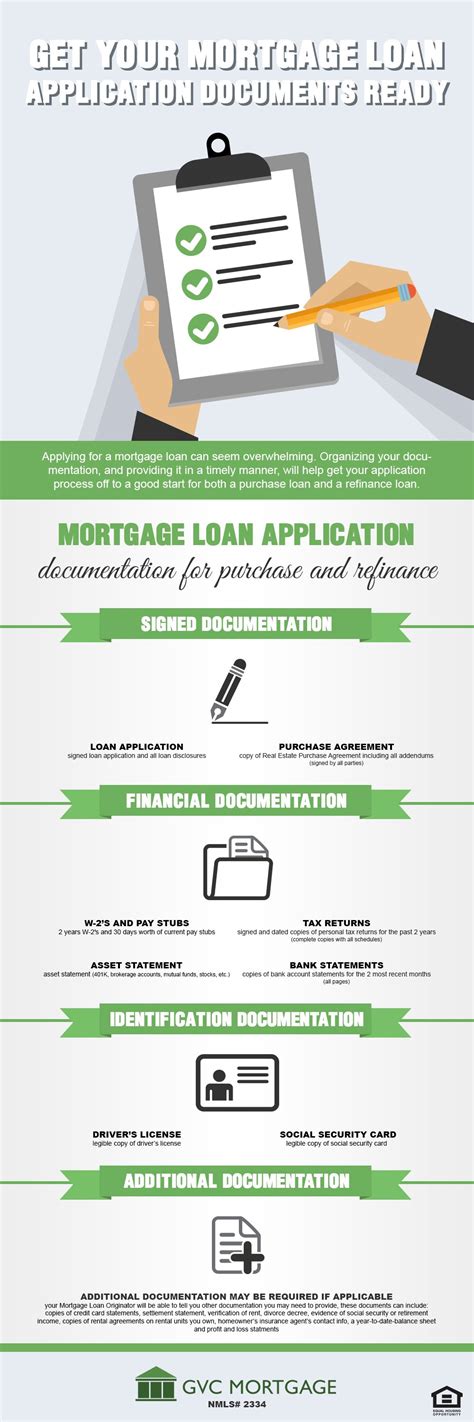

Mortgage Application Documents

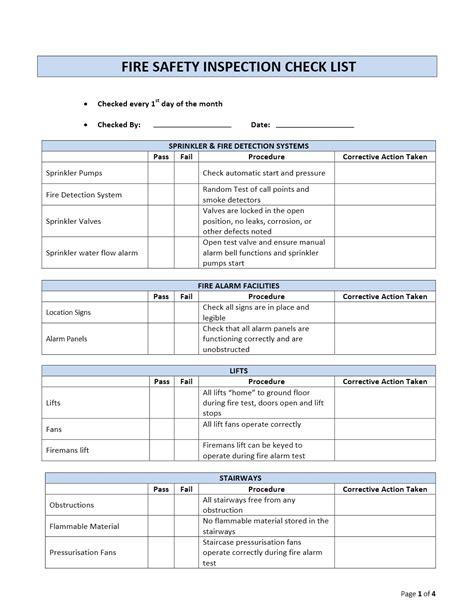

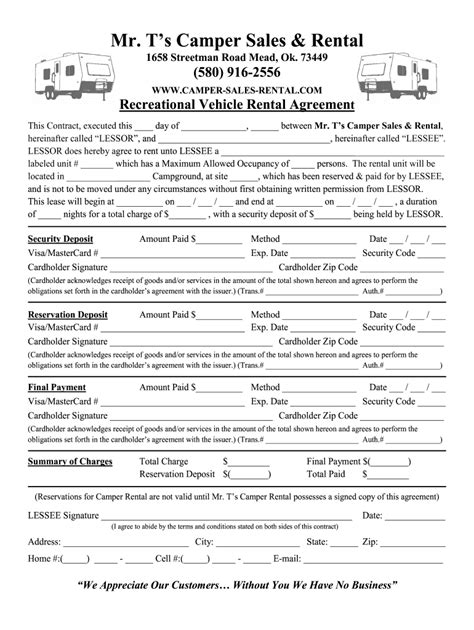

Once you have been pre-approved, the next step is to submit a formal mortgage application. This is where the bulk of the paperwork comes into play. You will need to provide detailed financial information, including: - Personal identification documents: This includes your social security number, driver’s license, and possibly a passport. - Income and employment verification: Be prepared to provide recent pay stubs, W-2 forms, and possibly a letter from your employer confirming your position and income. - Asset documentation: You will need to provide bank statements and investment account statements to prove your assets. - Credit reports: The lender will obtain your credit report, but you may also be asked to provide explanations for any negative marks on your credit history. - Property information: Details about the property you wish to purchase, including its address, purchase price, and possibly an appraisal.

Processing and Underwriting

After submitting your application, it enters the processing and underwriting phase. During this time, the lender will review all your documents, order an appraisal of the property (if necessary), and review your creditworthiness in detail. They may request additional documentation to clarify any discrepancies or to fulfill specific loan requirements. It’s essential to respond promptly to these requests to keep the process moving.

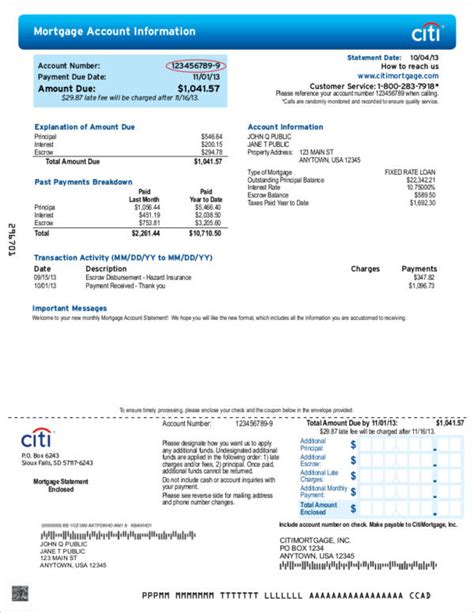

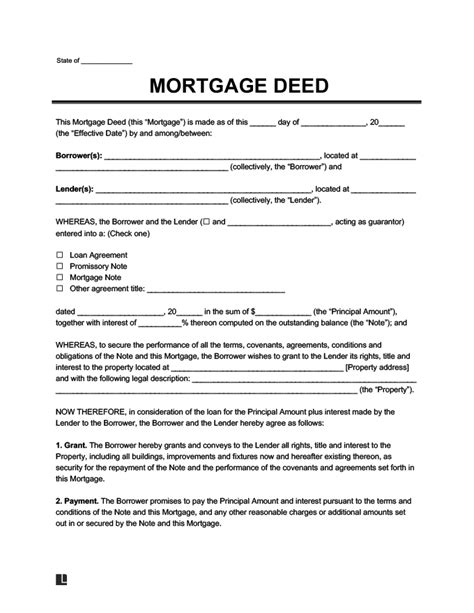

Closing Documents

The final stage of the mortgage loan process involves signing the closing documents. This is where you officially agree to the terms of the loan and transfer ownership of the property. Key documents at closing include: - Mortgage note: This document outlines the terms of the loan, including the amount borrowed, interest rate, repayment terms, and the consequences of default. - Mortgage deed: Also known as a deed of trust, this document gives the lender a lien on the property, allowing them to foreclose if you fail to repay the loan. - Deed: This document transfers the ownership of the property from the seller to you. - Closing disclosure: This form provides a detailed breakdown of all the costs associated with the loan and the transaction.

📝 Note: It's crucial to read and understand all the documents before signing. If you're unsure about any aspect, don't hesitate to ask for clarification.

Managing Mortgage Loan Paperwork

To manage the paperwork efficiently, consider the following tips: - Stay organized: Keep all your documents in a dedicated folder or digital storage space for easy access. - Understand what’s required: Familiarize yourself with the types of documents needed for each stage of the process. - Respond promptly: When the lender requests additional information, provide it as soon as possible to avoid delays. - Seek professional help: If the process becomes too overwhelming, consider hiring a mortgage broker or consultant to guide you through.

Conclusion

Navigating the complex world of mortgage loan paperwork requires patience, understanding, and a systematic approach. By knowing what to expect and being prepared to provide the necessary documents, you can make the process smoother and less stressful. Remember, each step in the mortgage loan journey, from pre-approval to closing, involves critical paperwork that must be accurately completed and submitted. With the right mindset and preparation, you can successfully navigate this process and achieve your goal of homeownership.

What is the difference between pre-qualification and pre-approval?

+

Pre-qualification is an informal estimate of how much you might be able to borrow, based on a brief overview of your financial situation. Pre-approval, on the other hand, is a more formal process where the lender reviews your credit report and financial documents to provide a conditional commitment to lend a specific amount.

What documents are typically required for a mortgage application?

+

Documents required for a mortgage application typically include identification, proof of income, proof of employment, bank statements, tax returns, and credit reports. The specific documents needed may vary depending on the lender and the type of loan.

How long does the mortgage loan process usually take?

+

The length of the mortgage loan process can vary significantly depending on several factors, including the complexity of the application, the efficiency of the lender, and the speed at which you provide required documents. On average, it can take anywhere from 30 to 60 days from application to closing.