5 Essential 1099 Forms

Introduction to 1099 Forms

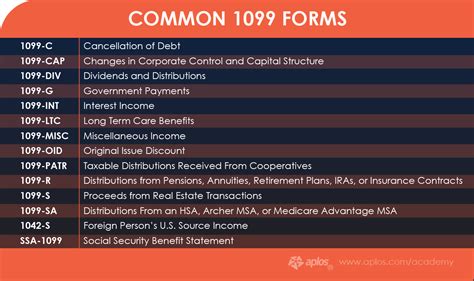

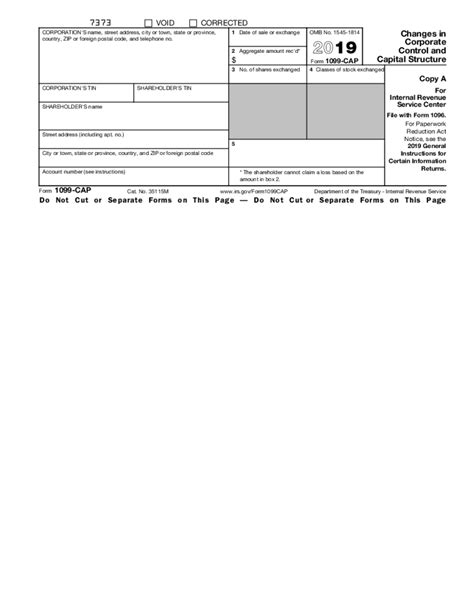

The Internal Revenue Service (IRS) requires businesses to report certain payments made to individuals and companies on information returns, known as 1099 forms. These forms are used to report various types of income, such as freelance work, rent, and dividends. There are several types of 1099 forms, each with its own specific purpose. In this article, we will explore five essential 1099 forms that businesses and individuals need to be familiar with.

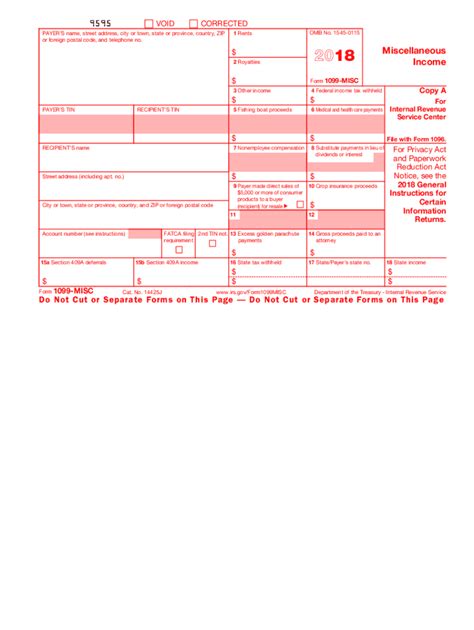

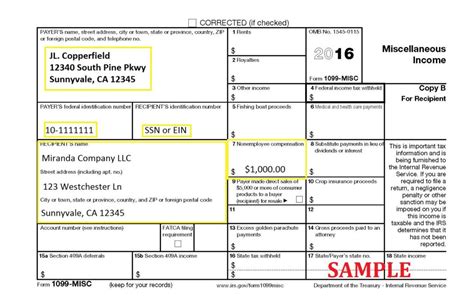

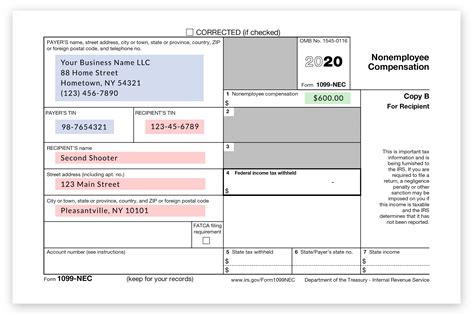

1. Form 1099-MISC: Miscellaneous Income

Form 1099-MISC is used to report miscellaneous income, such as freelance work, consulting fees, and other non-employee compensation. This form is required for payments made to individuals, sole proprietors, and single-member limited liability companies (LLCs). The form must be filed with the IRS and a copy provided to the recipient by January 31st of each year. Some common examples of income reported on Form 1099-MISC include: * Freelance writing or design services * Consulting fees * Rent payments * Prizes and awards * Other non-employee compensation

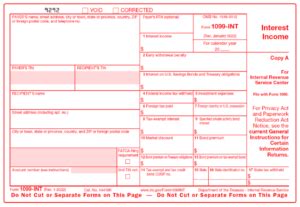

2. Form 1099-INT: Interest Income

Form 1099-INT is used to report interest income earned on investments, such as savings accounts, bonds, and stocks. This form is required for interest payments exceeding $10 in a calendar year. The form must be filed with the IRS and a copy provided to the recipient by January 31st of each year. Some common examples of interest income reported on Form 1099-INT include: * Interest earned on savings accounts * Interest earned on bonds * Interest earned on stocks * Interest earned on certificates of deposit (CDs)

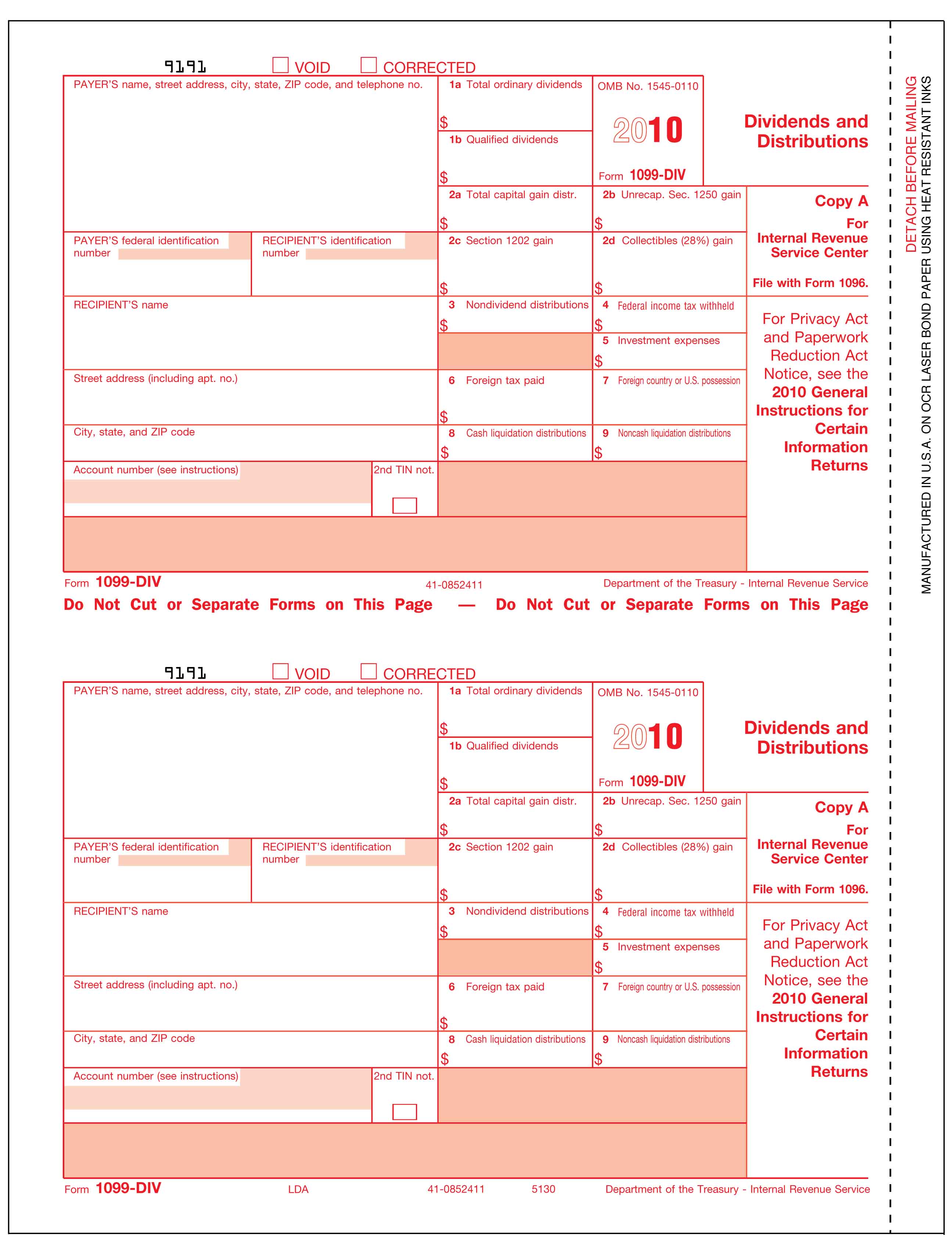

3. Form 1099-DIV: Dividend Income

Form 1099-DIV is used to report dividend income earned on investments, such as stocks and mutual funds. This form is required for dividend payments exceeding $10 in a calendar year. The form must be filed with the IRS and a copy provided to the recipient by January 31st of each year. Some common examples of dividend income reported on Form 1099-DIV include: * Dividends earned on stocks * Dividends earned on mutual funds * Dividends earned on exchange-traded funds (ETFs) * Dividends earned on real estate investment trusts (REITs)

4. Form 1099-B: Proceeds from Broker and Barter Exchange Transactions

Form 1099-B is used to report proceeds from broker and barter exchange transactions, such as sales of stocks, bonds, and other securities. This form is required for transactions exceeding $600 in a calendar year. The form must be filed with the IRS and a copy provided to the recipient by January 31st of each year. Some common examples of proceeds reported on Form 1099-B include: * Sales of stocks * Sales of bonds * Sales of mutual funds * Sales of exchange-traded funds (ETFs)

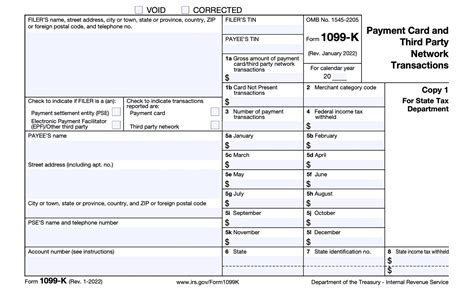

5. Form 1099-K: Payment Card and Third-Party Network Transactions

Form 1099-K is used to report payment card and third-party network transactions, such as credit card payments and online transactions. This form is required for transactions exceeding $20,000 and 200 transactions in a calendar year. The form must be filed with the IRS and a copy provided to the recipient by January 31st of each year. Some common examples of transactions reported on Form 1099-K include: * Credit card payments * Online transactions * Mobile payments * Third-party network transactions

📝 Note: It is essential to file 1099 forms accurately and on time to avoid penalties and fines. Businesses and individuals must also maintain accurate records and provide copies of the forms to recipients.

In summary, the five essential 1099 forms are used to report various types of income, including miscellaneous income, interest income, dividend income, proceeds from broker and barter exchange transactions, and payment card and third-party network transactions. Businesses and individuals must file these forms with the IRS and provide copies to recipients by the required deadline to avoid penalties and fines. By understanding the purpose and requirements of each form, individuals and businesses can ensure compliance with IRS regulations and maintain accurate records of their financial transactions.

What is the purpose of Form 1099-MISC?

+

Form 1099-MISC is used to report miscellaneous income, such as freelance work, consulting fees, and other non-employee compensation.

What is the deadline for filing Form 1099-INT?

+

The deadline for filing Form 1099-INT is January 31st of each year.

What types of income are reported on Form 1099-DIV?

+

Form 1099-DIV is used to report dividend income earned on investments, such as stocks and mutual funds.