5 Vin Payroll Tips

Introduction to Vin Payroll Tips

Managing payroll can be a complex and time-consuming task, especially for small to medium-sized businesses. With the numerous laws and regulations surrounding payroll, it’s easy to make mistakes that can lead to costly fines and penalties. In this article, we will discuss 5 Vin payroll tips that can help you navigate the payroll process with ease and accuracy. Whether you’re a seasoned payroll professional or just starting out, these tips will provide you with the knowledge and tools you need to succeed.

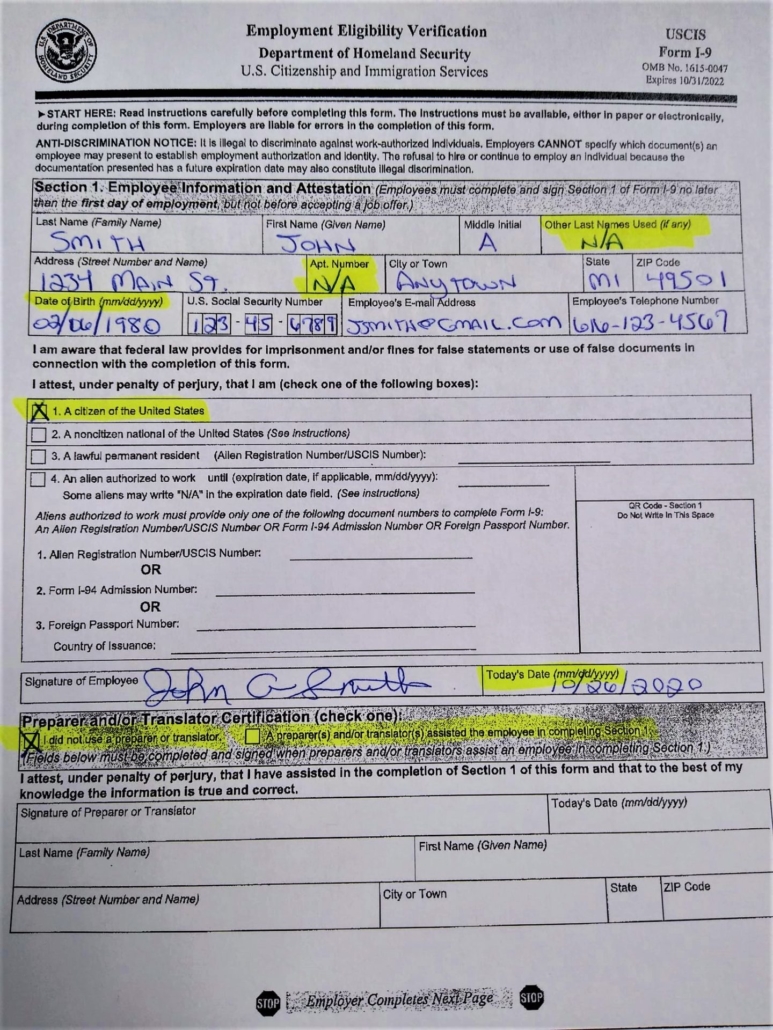

Tip 1: Understand Your Payroll Requirements

Before you can begin processing payroll, you need to understand your payroll requirements. This includes knowing how often you need to pay your employees, what taxes you need to withhold, and what benefits you need to offer. It’s essential to stay up-to-date on the latest payroll laws and regulations, as they can change frequently. You can find this information on the IRS website or by consulting with a payroll professional.

Some key payroll requirements to consider include: * Pay frequency: How often you pay your employees, such as weekly, biweekly, or monthly. * Tax withholding: What taxes you need to withhold from employee wages, such as federal income tax, state income tax, and Social Security tax. * Benefits: What benefits you need to offer, such as health insurance, retirement plans, and paid time off.

Tip 2: Choose the Right Payroll Software

Choosing the right payroll software can make a big difference in the accuracy and efficiency of your payroll process. Look for software that is user-friendly, scalable, and compliant with all relevant laws and regulations. Some popular payroll software options include QuickBooks, ADP, and Paychex.

When selecting payroll software, consider the following factors: * Ease of use: How easy is the software to use, especially for those who are new to payroll? * Scalability: Can the software grow with your business, or will you need to upgrade to a new system as you add more employees? * Compliance: Does the software ensure compliance with all relevant laws and regulations, such as tax withholding and reporting requirements?

Tip 3: Keep Accurate Records

Keeping accurate records is crucial for payroll. You need to maintain records of employee wages, taxes withheld, and benefits provided, as well as any changes to employee information, such as address changes or changes in withholding. This information can be used to generate reports, such as W-2 forms and payroll tax returns.

Some tips for keeping accurate records include: * Using a centralized system: Keep all payroll records in one place, such as a spreadsheet or payroll software. * Updating records regularly: Make sure to update records as soon as changes occur, such as when an employee moves or gets a raise. * Backing up records: Make sure to back up your records regularly, in case of a system failure or other disaster.

Tip 4: Stay Organized

Staying organized is essential for payroll. You need to keep track of deadlines, such as tax filing deadlines and payroll processing deadlines. You also need to keep track of employee information, such as wages, benefits, and taxes withheld.

Some tips for staying organized include: * Creating a calendar: Create a calendar of important payroll deadlines, such as tax filing deadlines and payroll processing deadlines. * Using a checklist: Use a checklist to ensure that all payroll tasks are completed, such as processing payroll and generating reports. * Designating a payroll person: Designate one person to be in charge of payroll, to ensure that all tasks are completed accurately and on time.

Tip 5: Seek Professional Help

Finally, don’t be afraid to seek professional help when it comes to payroll. A payroll professional can provide you with the knowledge and tools you need to succeed, and can help you avoid costly mistakes and penalties. Some options for seeking professional help include: * Hiring a payroll service: Hire a payroll service to handle all of your payroll needs, such as processing payroll and generating reports. * Consulting with a payroll professional: Consult with a payroll professional to get answers to specific payroll questions, such as how to handle a particular tax withholding situation. * Taking a payroll course: Take a payroll course to learn more about payroll and how to handle common payroll tasks.

💡 Note: It's essential to stay up-to-date on the latest payroll laws and regulations, as they can change frequently.

| Payroll Task | Frequency | Deadline |

|---|---|---|

| Process payroll | Biweekly | Every other Friday |

| File payroll tax returns | Quarterly | April 30, July 31, October 31, January 31 |

| Generate W-2 forms | Annually | January 31 |

In summary, managing payroll can be a complex and time-consuming task, but by following these 5 Vin payroll tips, you can navigate the payroll process with ease and accuracy. Remember to understand your payroll requirements, choose the right payroll software, keep accurate records, stay organized, and seek professional help when needed. By following these tips, you can ensure that your payroll is accurate, efficient, and compliant with all relevant laws and regulations.

What is the most important thing to consider when choosing payroll software?

+

The most important thing to consider when choosing payroll software is compliance with all relevant laws and regulations, such as tax withholding and reporting requirements.

How often do I need to file payroll tax returns?

+

You need to file payroll tax returns quarterly, on April 30, July 31, October 31, and January 31.

What is the best way to keep accurate payroll records?

+

The best way to keep accurate payroll records is to use a centralized system, such as a spreadsheet or payroll software, and to update records regularly.