Paperwork

5 VRL Paperwork Tips

Introduction to VRL Paperwork

When dealing with Vehicle Registration Loans (VRL), understanding the paperwork involved is crucial. VRLs are a type of loan that uses a vehicle’s registration as collateral. These loans are popular due to their quick processing times and minimal requirements. However, navigating the paperwork can be daunting for many. In this article, we will explore five tips to help you manage VRL paperwork effectively.

Understanding VRL Paperwork

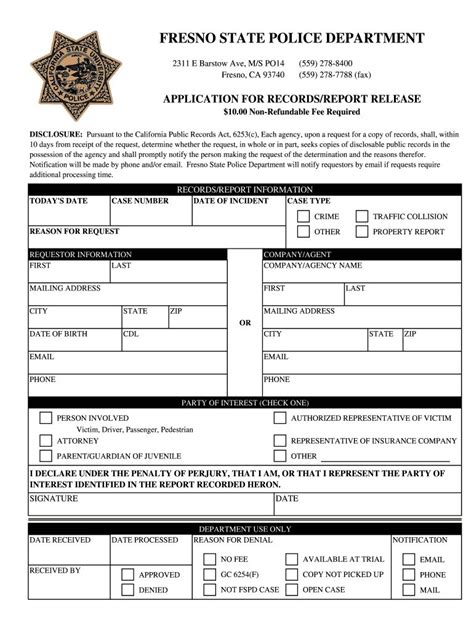

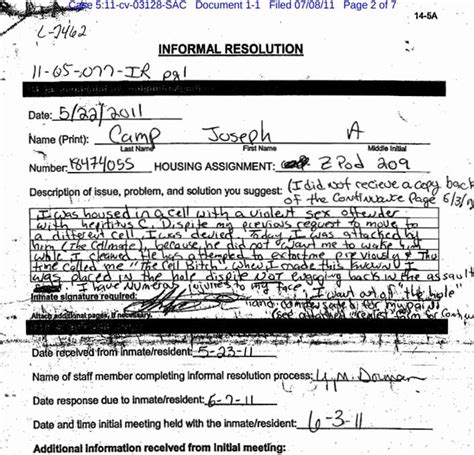

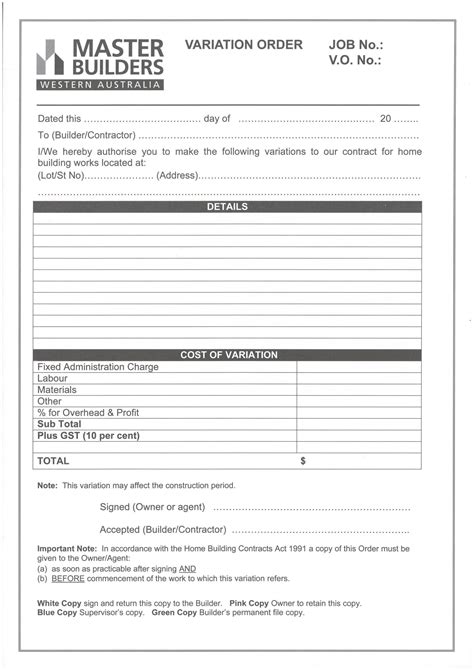

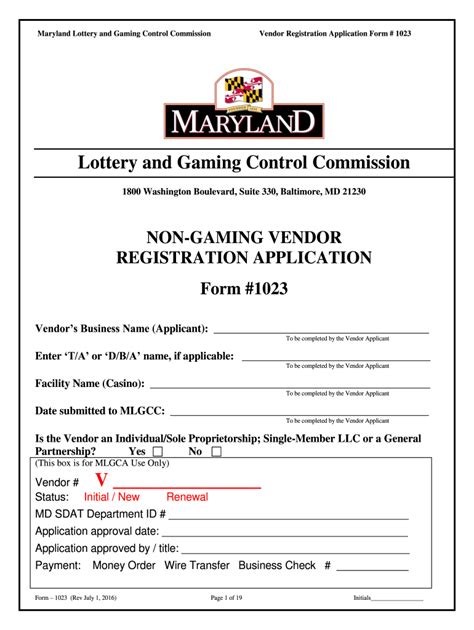

Before diving into the tips, it’s essential to understand what VRL paperwork entails. The paperwork typically includes the loan application, vehicle registration documents, proof of income, and insurance documents. Accurate and complete documentation is vital to ensure a smooth loan process. Any discrepancies or missing documents can lead to delays or even loan rejection.

Tips for Managing VRL Paperwork

Here are five tips to help you manage your VRL paperwork efficiently: * Gather all necessary documents before applying for the loan. This includes your vehicle’s registration, proof of income, and any other required documents. * Review the loan terms carefully. Understand the interest rates, repayment terms, and any fees associated with the loan. * Ensure accuracy when filling out the loan application. Incorrect information can lead to delays or loan rejection. * Keep track of deadlines. Make sure you understand when payments are due and plan accordingly to avoid late fees. * Seek professional advice if you’re unsure about any aspect of the loan process. A financial advisor can help you make informed decisions.

Benefits of Effective VRL Paperwork Management

Effective management of VRL paperwork offers several benefits, including: * Faster loan processing: Complete and accurate documentation can speed up the loan approval process. * Reduced stress: Understanding the loan terms and having all necessary documents can reduce stress and anxiety. * Improved financial management: Keeping track of deadlines and loan terms can help you manage your finances better.

Common Mistakes to Avoid

When dealing with VRL paperwork, there are several common mistakes to avoid:

| Mistake | Consequence |

|---|---|

| Incomplete documentation | Delayed loan processing |

| Inaccurate information | Loan rejection |

| Missed deadlines | Late fees and penalties |

💡 Note: It's essential to carefully review the loan terms and conditions to avoid any potential pitfalls.

Conclusion and Final Thoughts

In conclusion, managing VRL paperwork effectively is crucial for a smooth loan process. By following the five tips outlined in this article, you can ensure that your loan application is processed quickly and efficiently. Remember to gather all necessary documents, review the loan terms carefully, ensure accuracy, keep track of deadlines, and seek professional advice if needed. With the right approach, you can navigate the VRL paperwork with confidence and make informed financial decisions.

What is a Vehicle Registration Loan (VRL)?

+

A Vehicle Registration Loan (VRL) is a type of loan that uses a vehicle’s registration as collateral.

What documents are required for a VRL application?

+

The required documents typically include the vehicle’s registration, proof of income, and insurance documents.

How can I ensure a smooth loan process?

+

To ensure a smooth loan process, gather all necessary documents, review the loan terms carefully, and ensure accuracy when filling out the loan application.