5 Documents Needed

Introduction to Essential Documents

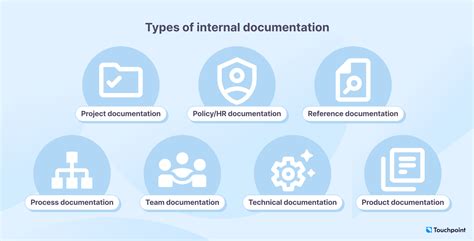

When it comes to legal, financial, and personal matters, having the right documents in place is crucial. These documents not only help in organizing one’s affairs but also ensure that wishes are respected and rights are protected. In this article, we will delve into five key documents that everyone should consider having. These documents are vital for planning one’s estate, making healthcare decisions, and managing financial affairs efficiently.

1. Last Will and Testament

A Last Will and Testament is a legal document that outlines how a person wants their assets to be distributed after they pass away. It is a way to ensure that one’s wishes are carried out regarding the distribution of property, investments, and personal belongings. Without a will, the distribution of assets is determined by the laws of the state, which may not align with the deceased person’s intentions. This document also allows for the appointment of an executor, who is responsible for carrying out the instructions outlined in the will, and a guardian for minor children.

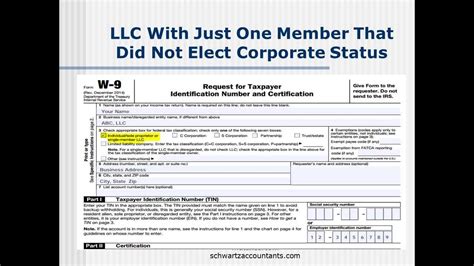

2. Power of Attorney

A Power of Attorney (POA) is a document that grants someone the legal authority to make decisions on another person’s behalf. This can include financial decisions, such as managing bank accounts, paying bills, and making investments, as well as personal care decisions. There are different types of POA, including durable (which remains in effect even if the person becomes incapacitated) and springing (which becomes effective upon the occurrence of a specific event, such as incapacitation). Having a POA in place can prevent the need for a court-appointed guardian if someone becomes unable to manage their affairs.

3. Advance Healthcare Directive

An Advance Healthcare Directive, which includes a Living Will and a Durable Power of Attorney for Healthcare, is a document that outlines a person’s wishes regarding medical treatment if they are unable to communicate for themselves. The Living Will specifies the types of medical treatment one does or does not want to receive in certain situations, such as if they are terminally ill or in a persistent vegetative state. The Durable Power of Attorney for Healthcare appoints someone to make healthcare decisions on one’s behalf. This document ensures that one’s healthcare wishes are respected and can prevent family conflicts over medical decisions.

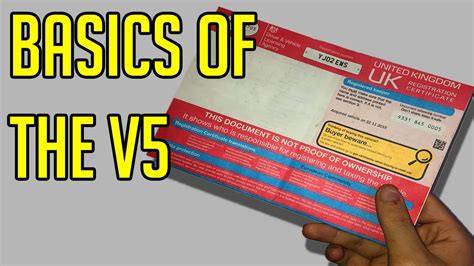

4. Beneficiary Designations

Beneficiary Designations are forms completed when opening retirement accounts, life insurance policies, and other investments. These designations specify who will receive the assets in these accounts upon the account holder’s death. Beneficiary designations supersede instructions in a will, so it is crucial to keep them up to date, especially after significant life changes like divorce or the death of a named beneficiary. Reviewing and updating beneficiary designations regularly can help ensure that assets are distributed according to one’s current wishes.

5. Letter of Intent

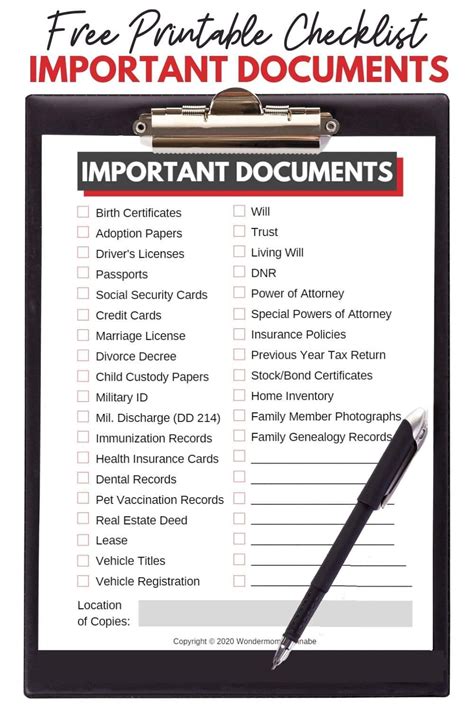

A Letter of Intent is an informal document that provides guidance on personal matters, such as how to manage a business, care for pets, or handle digital assets after one’s death. While not legally binding, it offers a way to communicate wishes and preferences that may not be covered in other estate planning documents. It can also include practical information, such as where important documents are located, which can be helpful for the executor of the estate or the person appointed as power of attorney.

💡 Note: It's essential to review and update these documents periodically or after significant life events to ensure they continue to reflect one's wishes and circumstances.

In summary, having these five documents - a Last Will and Testament, Power of Attorney, Advance Healthcare Directive, Beneficiary Designations, and a Letter of Intent - can provide peace of mind and ensure that one’s affairs are in order. They are fundamental components of estate planning, allowing individuals to control how their assets are distributed, make healthcare decisions, and manage financial and personal matters, even if they become incapacitated.

What is the primary purpose of a Last Will and Testament?

+

The primary purpose of a Last Will and Testament is to distribute one’s assets according to their wishes after they pass away, appoint an executor to manage the estate, and name a guardian for minor children if necessary.

Why is it important to keep beneficiary designations up to date?

+

Keeping beneficiary designations up to date is crucial because these designations determine who will receive assets from retirement accounts, life insurance policies, and other investments upon the account holder’s death, regardless of what is stated in a will.

What is the role of a Power of Attorney?

+

The role of a Power of Attorney is to grant someone the legal authority to make decisions on another person’s behalf, which can include financial, legal, and personal care decisions, especially when the person becomes incapacitated.