Land Payoff Paperwork

Understanding the Process of Land Payoff Paperwork

When an individual or organization purchases a piece of land, they often do so through a financing agreement, such as a loan or mortgage. Over time, as payments are made, the owner will eventually reach the point where they can pay off the remaining balance and gain full ownership of the property. This process involves specific paperwork and steps that must be carefully followed to ensure a smooth transaction. In this article, we will delve into the details of land payoff paperwork, including the necessary documents, the process of paying off the land, and important considerations to keep in mind.

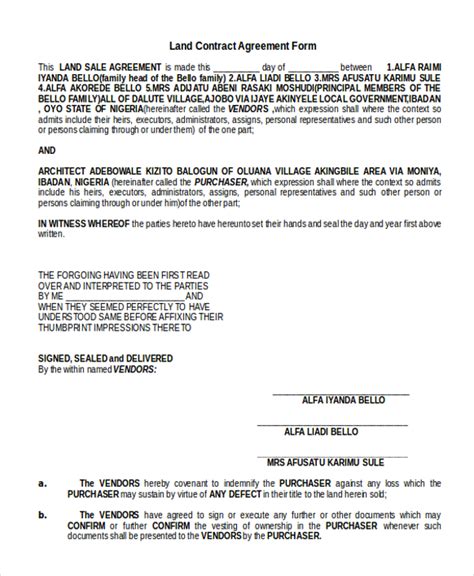

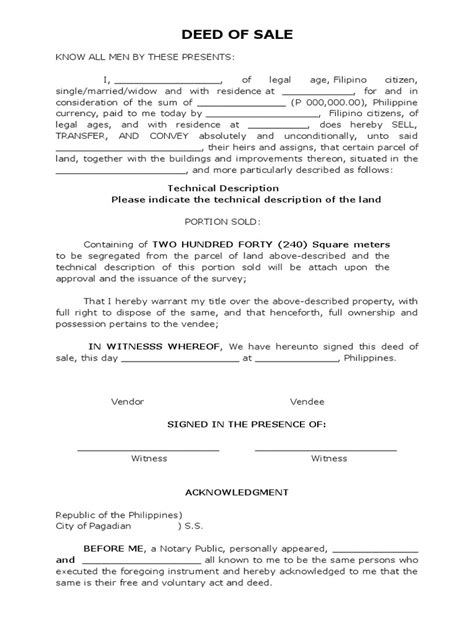

Necessary Documents for Land Payoff

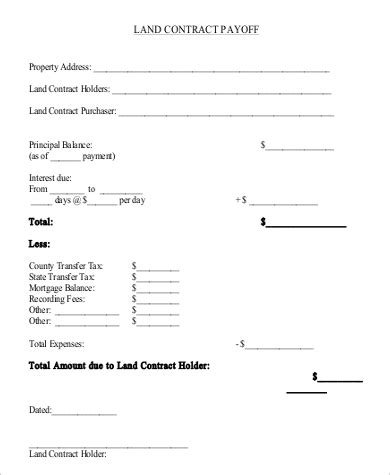

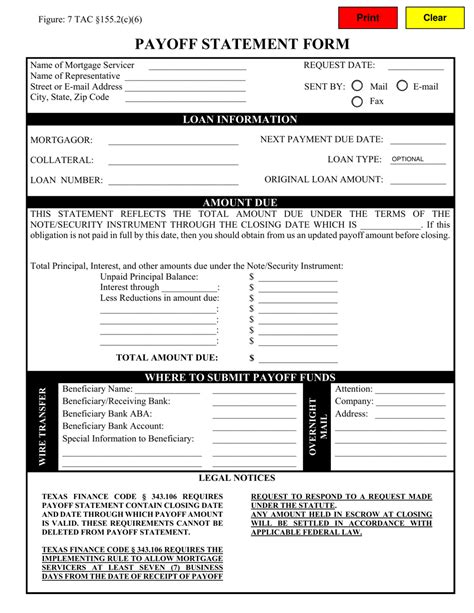

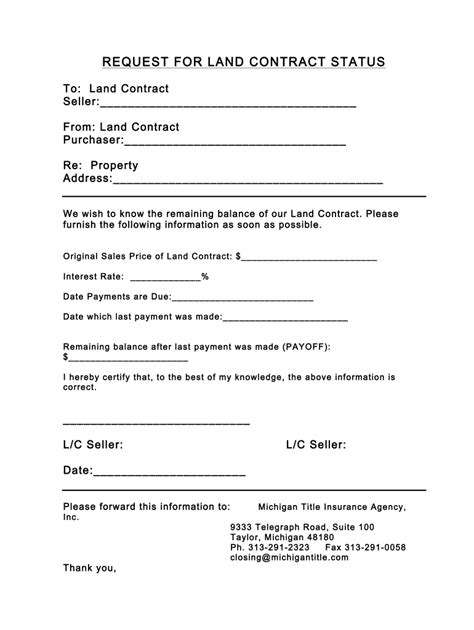

To initiate the payoff process, several key documents are required. These may include: - Loan Agreement or Mortgage Contract: The original financing agreement that outlines the terms of the loan, including the principal amount, interest rate, and repayment schedule. - Property Deed: The legal document that transfers ownership of the land from the seller to the buyer. It should be recorded in the local county records to provide public notice of the transfer. - Title Report or Abstract: A document that summarizes the ownership history of the property, ensuring there are no unexpected liens or encumbrances that could affect the payoff process. - Promissory Note: A written promise to pay a certain amount of money, including the interest, according to the terms of the loan. - Payoff Statement: Provided by the lender, this document specifies the exact amount needed to pay off the loan in full, including any outstanding interest and fees up to the date of payoff.

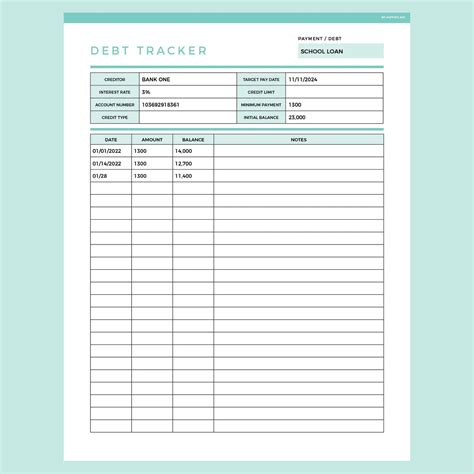

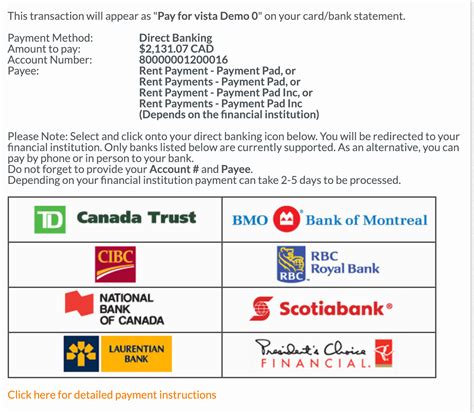

The Process of Paying Off the Land

Paying off land involves several steps: 1. Request a Payoff Statement: Contact the lender to request a payoff statement, which will detail the total amount due to pay off the loan. 2. Review the Statement: Carefully review the payoff statement to ensure it is accurate and includes all relevant fees. 3. Gather Funds: Arrange for the funds needed to pay off the loan. This could involve withdrawing from savings, securing a new loan, or other financial arrangements. 4. Submit Payment: Follow the lender’s instructions for submitting the payoff amount. This is often done via wire transfer or cashier’s check to ensure the funds are guaranteed. 5. Record the Deed: Once the payoff is confirmed, the lender will provide a satisfaction of mortgage or deed of reconveyance, which must be recorded in the county records to remove the lien from the property title.

Important Considerations

Several factors are crucial when navigating the land payoff process: - Timing: Paying off a loan early can save a significant amount in interest over the life of the loan. However, some loans may have prepayment penalties, so it’s essential to review the loan agreement carefully. - Fees: In addition to the loan balance, there may be fees associated with the payoff, such as processing fees or recording fees for the deed. - Tax Implications: Paying off a loan can have tax implications, particularly if the property is an investment. Consulting with a tax professional can help navigate these considerations.

| Document | Purpose |

|---|---|

| Loan Agreement | Outlines loan terms |

| Property Deed | Transfers ownership |

| Title Report | Summarizes ownership history |

| Promissory Note | Written promise to pay |

| Payoff Statement | Specifies payoff amount |

📝 Note: It's crucial to work closely with the lender and possibly a legal professional to ensure all documents are properly executed and recorded, preventing any potential issues with the property's title.

In the final stages of paying off land, it’s essential to verify that all documents have been correctly filed and that the property title is clear of any liens. This marks the culmination of the financing process, transferring full ownership of the land to the payer. Ensuring that each step is meticulously followed and that all necessary documents are in order will help facilitate a successful payoff process.

As the process comes to a close, reflecting on the journey from initial purchase to full ownership highlights the importance of meticulous planning, financial discipline, and attention to detail. Whether for personal or investment purposes, the payoff of land represents a significant milestone, offering a sense of accomplishment and the potential for new opportunities.

What documents are required to pay off land?

+

The necessary documents include the loan agreement, property deed, title report, promissory note, and payoff statement.

How do I request a payoff statement?

+

Contact your lender directly to request a payoff statement, which will outline the total amount needed to pay off the loan.

What happens after I pay off my land loan?

+

After paying off the loan, the lender will provide a document that releases the lien on the property, which you must record in the county records to finalize the transfer of full ownership.