House Buying Paperwork Requirements

Introduction to House Buying Paperwork

When purchasing a house, there are numerous paperwork requirements that must be fulfilled. These requirements can be overwhelming, especially for first-time homebuyers. Understanding the paperwork process is crucial to ensure a smooth and successful transaction. In this article, we will delve into the various paperwork requirements involved in buying a house, providing you with a comprehensive guide to navigate this complex process.

Pre-Purchase Paperwork

Before starting your house hunt, it’s essential to gather certain documents. These include: * Identification documents: Passport, driver’s license, or state ID * Income proof: Pay stubs, W-2 forms, or tax returns * Credit reports: Obtain a copy of your credit report to check for any errors or discrepancies * Bank statements: Recent bank statements to demonstrate your financial stability * Pre-approval letter: A pre-approval letter from a lender, indicating the amount you’re eligible to borrow

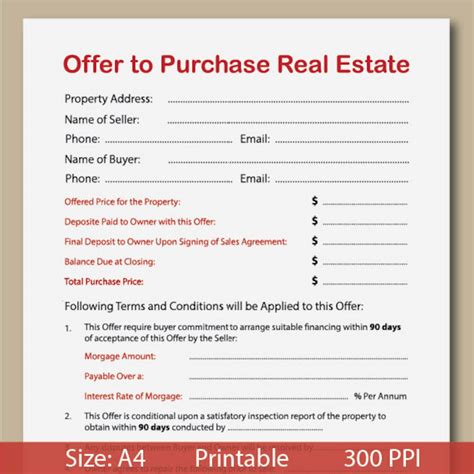

Offer and Acceptance Paperwork

Once you’ve found your dream home, it’s time to make an offer. The offer paperwork typically includes: * Purchase agreement: A document outlining the terms of the sale, including the price, closing date, and contingencies * Earnest money deposit: A deposit to demonstrate your commitment to the purchase * Inspections and tests: Arrange for inspections and tests, such as home inspections, termite inspections, and mold tests

Financing Paperwork

After your offer is accepted, you’ll need to finalize your financing. The financing paperwork includes: * Loan application: Submit a loan application to your chosen lender * Appraisal report: An appraisal report to determine the value of the property * Title search: A title search to ensure the seller has clear ownership of the property * Insurance documents: Obtain homeowners insurance and any other required insurance policies

Closing Paperwork

The final stage of the home buying process is the closing. The closing paperwork includes: * Closing disclosure: A document outlining the final terms of the loan, including the interest rate, loan amount, and closing costs * Deed: The deed to the property, which transfers ownership from the seller to the buyer * Title transfer: The title transfer, which updates the property records to reflect the new owner * Mortgage note: The mortgage note, which outlines the terms of the loan

| Document | Description |

|---|---|

| Identification documents | Proof of identity, such as passport or driver's license |

| Income proof | Documentation of income, such as pay stubs or tax returns |

| Credit reports | Copy of credit report to check for errors or discrepancies |

| Bank statements | Recent bank statements to demonstrate financial stability |

| Pre-approval letter | Letter from lender indicating amount eligible to borrow |

📝 Note: It's essential to carefully review all paperwork to ensure accuracy and completeness, as any errors or discrepancies can delay or even derail the home buying process.

As you navigate the complex world of house buying paperwork, remember to stay organized and seek professional advice when needed. By understanding the various paperwork requirements and staying on top of the process, you’ll be well on your way to becoming a proud homeowner.

In the end, the key to a successful home buying experience is to be informed, prepared, and patient. By following these guidelines and staying focused on your goal, you’ll be able to navigate the paperwork requirements with confidence and achieve your dream of owning a home.

What is the first step in the home buying process?

+

The first step in the home buying process is to gather necessary documents, such as identification, income proof, and credit reports, and to get pre-approved for a mortgage.

What is the purpose of a title search?

+

The purpose of a title search is to ensure the seller has clear ownership of the property and to identify any potential issues or liens that may affect the transfer of ownership.

What is the difference between a mortgage note and a deed?

+

A mortgage note outlines the terms of the loan, including the interest rate, loan amount, and repayment terms, while a deed transfers ownership of the property from the seller to the buyer.