5 Mortgage Papers

Understanding the 5 Essential Mortgage Papers

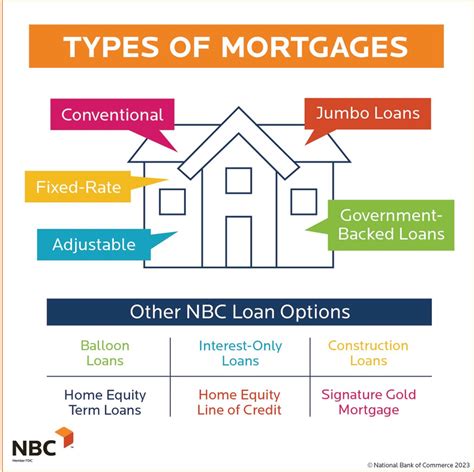

When navigating the process of purchasing a home, it’s crucial to understand the various documents involved. Among these, there are 5 key mortgage papers that play a significant role in the home buying process. These documents are vital for both the buyer and the lender, as they outline the terms of the loan and protect the interests of both parties. In this article, we will delve into the details of these 5 essential mortgage papers, exploring their significance and what they entail.

1. Loan Estimate

The Loan Estimate is a three-page document that outlines the terms of the mortgage, including the loan amount, interest rate, and monthly payments. Lenders are required to provide this document to borrowers within three business days of receiving their loan application. The Loan Estimate is designed to help borrowers understand the costs associated with their mortgage and make informed decisions. It’s essential to review this document carefully, as it will give you a clear understanding of your financial obligations.

2. Loan Application

The Loan Application is the document that initiates the mortgage process. It’s typically a lengthy form that requires borrowers to provide detailed personal and financial information, including income, employment history, and credit score. The Loan Application is used by lenders to assess the borrower’s creditworthiness and determine the risk associated with lending to them. It’s crucial to fill out this document accurately and completely, as any errors or omissions can delay the mortgage process.

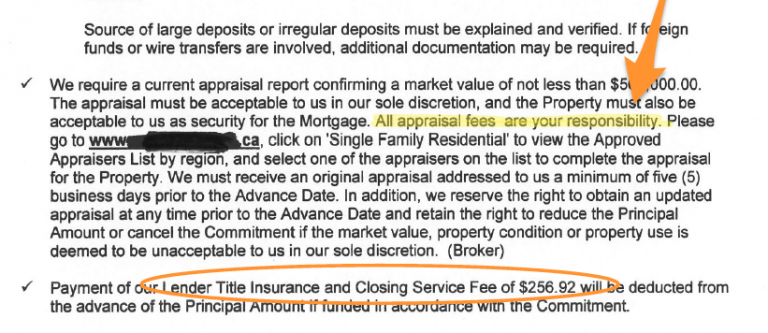

3. Appraisal Report

The Appraisal Report is a document that provides an independent assessment of the property’s value. This report is typically conducted by a licensed appraiser who evaluates the property’s condition, location, and comparable sales data to determine its value. The Appraisal Report is essential, as it ensures that the lender is not lending more than the property is worth. This protects both the lender and the borrower from potential financial losses.

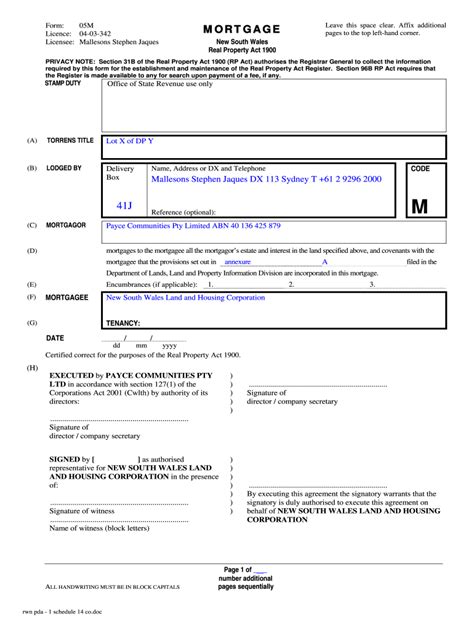

4. Title Report

The Title Report is a document that verifies the ownership of the property and identifies any potential issues with the title. This report is typically conducted by a title company or attorney who researches the property’s history to ensure that the seller has the right to sell the property. The Title Report is crucial, as it protects the borrower from potential title defects or disputes that could arise in the future.

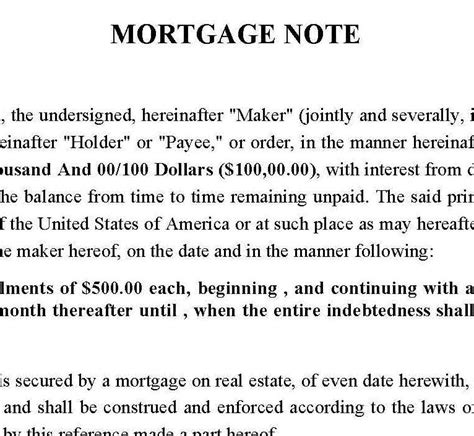

5. Closing Disclosure

The Closing Disclosure is a five-page document that outlines the final terms of the mortgage, including the loan amount, interest rate, and monthly payments. This document is provided to borrowers at least three business days before closing and is designed to ensure that they understand the terms of their mortgage. The Closing Disclosure is essential, as it provides a final review of the loan terms and gives borrowers an opportunity to ask questions or raise concerns before the loan is finalized.

📝 Note: It's essential to review all 5 mortgage papers carefully, as they contain critical information about your loan and financial obligations.

In addition to these 5 essential mortgage papers, there are other documents that may be required during the mortgage process, such as: * Identification documents: These may include a driver’s license, passport, or social security card. * Income verification: This may include pay stubs, W-2 forms, or tax returns. * Employment verification: This may include a letter from your employer or a copy of your employment contract. * Credit reports: These may be used to assess your creditworthiness and determine the interest rate on your loan.

| Mortgage Paper | Description |

|---|---|

| Loan Estimate | Outlines the terms of the mortgage, including the loan amount, interest rate, and monthly payments. |

| Loan Application | Initiates the mortgage process and requires borrowers to provide detailed personal and financial information. |

| Appraisal Report | Provides an independent assessment of the property's value. |

| Title Report | Verifies the ownership of the property and identifies any potential issues with the title. |

| Closing Disclosure | Outlines the final terms of the mortgage, including the loan amount, interest rate, and monthly payments. |

In conclusion, understanding the 5 essential mortgage papers is critical for both buyers and lenders. These documents provide a clear outline of the loan terms, protect the interests of both parties, and ensure a smooth transaction. By carefully reviewing these documents and asking questions, borrowers can make informed decisions and avoid potential pitfalls in the mortgage process. The key to a successful home buying experience is being informed and prepared, and understanding the 5 essential mortgage papers is a crucial step in achieving this goal.

What is the purpose of the Loan Estimate?

+

The Loan Estimate is designed to help borrowers understand the costs associated with their mortgage and make informed decisions.

What is the difference between the Loan Estimate and the Closing Disclosure?

+

The Loan Estimate is provided at the beginning of the mortgage process, while the Closing Disclosure is provided at the end. The Closing Disclosure outlines the final terms of the mortgage, while the Loan Estimate provides an initial estimate of the costs.

Why is the Appraisal Report important?

+

The Appraisal Report ensures that the lender is not lending more than the property is worth, protecting both the lender and the borrower from potential financial losses.