7 Disclosure Musts

Introduction to Disclosure Musts

In today’s complex and highly regulated business environment, disclosure is a critical aspect of maintaining transparency and trust with stakeholders. Disclosure musts refer to the essential information that companies, organizations, or individuals are required to share publicly. This can include financial data, operational practices, potential risks, and other relevant details that might impact stakeholders’ decisions or perceptions. The importance of adequate disclosure cannot be overstated, as it directly affects the ability of stakeholders to make informed decisions and can have significant legal and reputational implications if not handled properly.

Understanding the Importance of Disclosure

The importance of disclosure lies in its role in fostering a transparent and trustworthy relationship between an entity and its stakeholders. This includes investors, customers, regulatory bodies, and the general public. Through disclosure, entities provide stakeholders with the information they need to assess risks, opportunities, and the overall health of the organization. It is a fundamental principle in corporate governance, financial reporting, and compliance with regulatory requirements. Disclosure musts are designed to ensure that all relevant information is communicated accurately, timely, and in a manner that is accessible to those who need it.

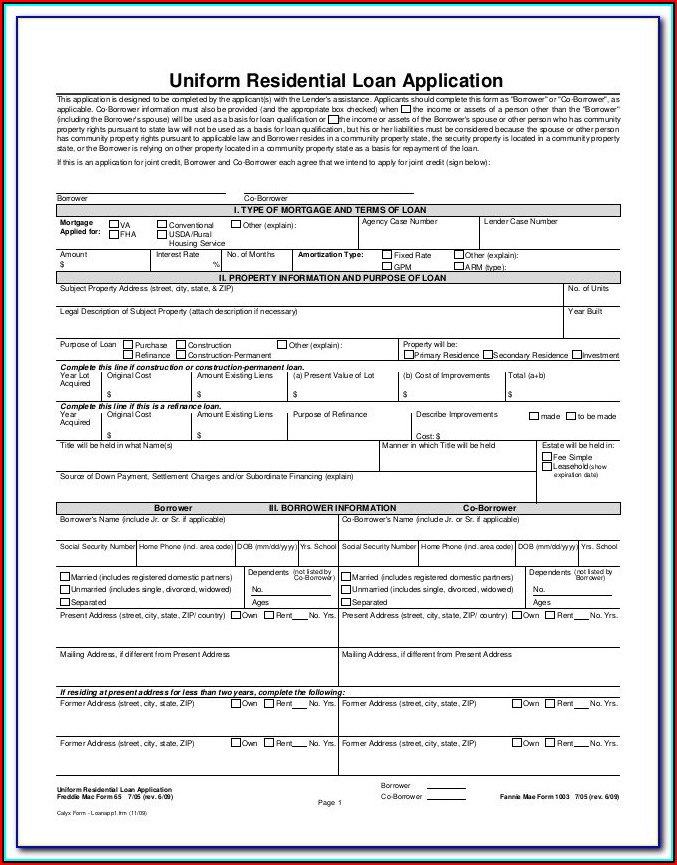

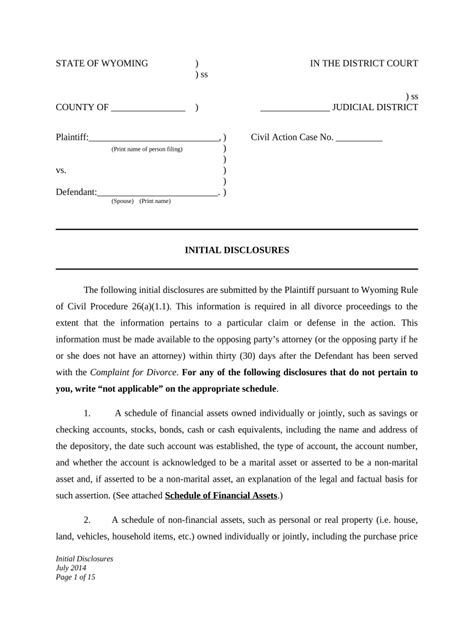

Types of Disclosure Musts

There are various types of disclosure musts, depending on the context and the stakeholders involved. These can be categorized into: - Financial Disclosure: This involves the reporting of financial information such as income statements, balance sheets, and cash flow statements. It is crucial for investors and analysts to evaluate the financial performance and position of a company. - Operational Disclosure: This pertains to the disclosure of information related to the operational aspects of a business, such as production processes, supply chain management, and human resource practices. - Risk Disclosure: Companies must disclose potential risks and uncertainties that could impact their financial condition or operating results. This helps stakeholders understand the volatility and potential downsides of their investments or associations. - Compliance Disclosure: This involves reporting on compliance with laws, regulations, and standards. It is essential for maintaining legal and regulatory integrity.

Best Practices for Disclosure

Implementing best practices for disclosure is vital for entities to ensure they are meeting their obligations effectively and efficiently. Some key strategies include: - Timeliness: Information should be disclosed in a timely manner to ensure stakeholders have access to current and relevant data. - Accuracy: Disclosed information must be accurate and free from material errors or omissions. - Clarity: The information should be presented in a clear and understandable format, avoiding technical jargon or complex language that might confuse stakeholders. - Accessibility: Ensuring that disclosed information is easily accessible to all stakeholders, possibly through a dedicated website or public repository.

Challenges in Disclosure

Despite the importance of disclosure, there are several challenges that entities may face. These include: - Information Overload: With the vast amount of data that needs to be disclosed, there is a risk of overwhelming stakeholders, making it difficult for them to identify the most critical information. - Regulatory Compliance: Keeping up with changing regulatory requirements can be challenging, especially for multinational companies operating in different jurisdictions. - Balancing Transparency with Confidentiality: Entities must balance the need for transparency with the need to protect sensitive or confidential information.

Tools and Technologies for Disclosure

To overcome the challenges associated with disclosure, entities are increasingly leveraging tools and technologies designed to facilitate the disclosure process. These include: - Disclosure Management Software: Specialized software solutions that help in the preparation, review, and submission of disclosure reports. - Data Analytics: Utilizing data analytics to identify, categorize, and present complex data in a clear and concise manner. - Digital Platforms: Hosting disclosure information on digital platforms, such as corporate websites or dedicated disclosure portals, to enhance accessibility and timeliness.

| Disclosure Type | Description | Importance |

|---|---|---|

| Financial Disclosure | Reporting of financial information | Critical for investment decisions |

| Operational Disclosure | Reporting of operational practices | Essential for understanding business operations |

| Risk Disclosure | Disclosure of potential risks | Vital for risk assessment |

| Compliance Disclosure | Reporting on compliance with regulations | Necessary for legal and regulatory integrity |

📝 Note: The effectiveness of disclosure practices can significantly impact an entity's reputation and compliance standing, underscoring the need for careful management and adherence to best practices.

In summary, disclosure musts are fundamental to the transparency and trustworthiness of any entity. By understanding the types of disclosure, implementing best practices, and leveraging appropriate tools and technologies, entities can ensure they are meeting their disclosure obligations effectively. This not only enhances stakeholder trust and decision-making but also contributes to a healthier and more transparent business environment. Ultimately, the pursuit of comprehensive and compliant disclosure practices is an ongoing process that requires diligence, adaptability, and a commitment to transparency and accountability.