Paperwork

VA Loan National Guard Paperwork Required

Understanding the VA Loan Process for National Guard Members

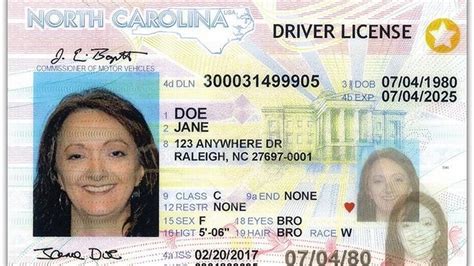

The Department of Veterans Affairs (VA) offers home loan guarantees to eligible veterans, active-duty personnel, and members of the National Guard and Reserve. For National Guard members, the process of obtaining a VA loan involves gathering specific paperwork to prove eligibility. This paperwork is crucial for lenders to verify the borrower’s military status and determine the amount of entitlement available for the loan.

Eligibility Requirements for National Guard Members

To be eligible for a VA loan, National Guard members must meet specific requirements. These include: * Having served for at least six years in the National Guard or Reserve * Being currently serving in the National Guard or Reserve * Having been discharged from the National Guard or Reserve with an honorable discharge * Being the spouse of a service member who died in service or as a result of a service-connected disability

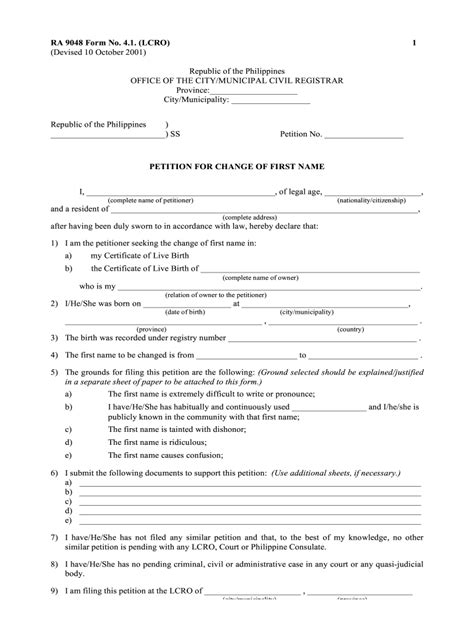

Required Paperwork for National Guard Members

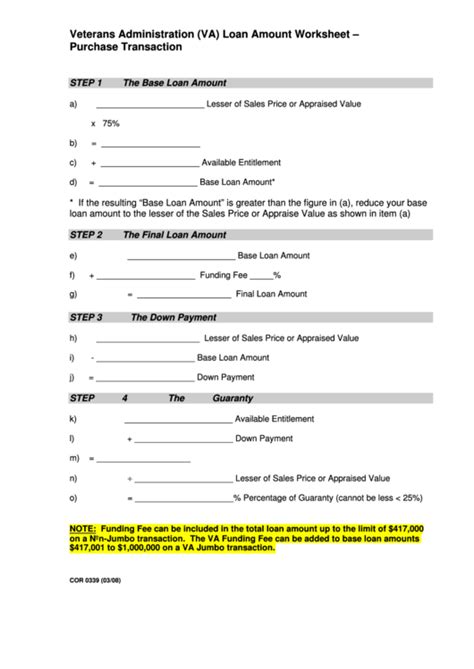

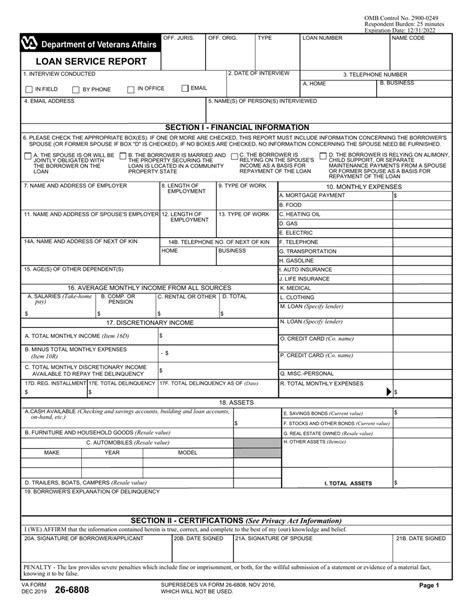

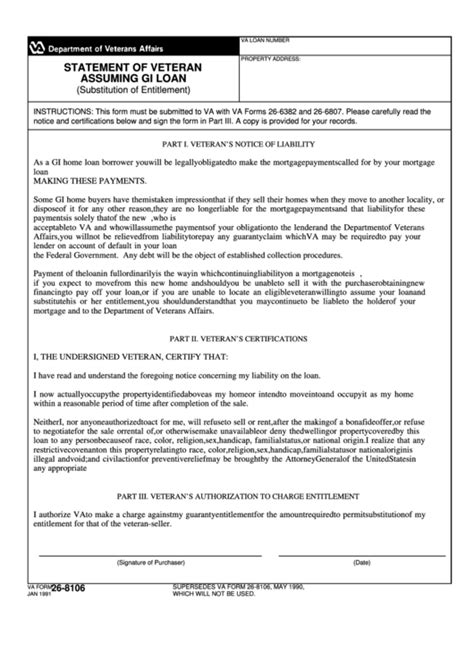

The required paperwork for National Guard members to obtain a VA loan includes: * DD Form 214: This is the Certificate of Release or Discharge from Active Duty. Although not always required for National Guard members, it may be necessary for those who have been activated for federal service. * NGB Form 22: This is the National Guard Report of Separation and Record of Service. It provides a detailed record of the service member’s time in the National Guard, including dates of service, discharge status, and any decorations or awards received. * NGB Form 23: This is the National Guard Retirement Points Statement. It shows the service member’s total retirement points, which can help determine eligibility for VA benefits. * VA Form 26-1880: This is the Request for Certificate of Eligibility. The lender will typically submit this form to the VA to obtain the Certificate of Eligibility, which is required for the loan.

📝 Note: The specific paperwork required may vary depending on the individual's circumstances. It's essential to check with the lender or the VA to determine the exact documents needed.

Additional Requirements for VA Loans

In addition to the paperwork required to prove eligibility, National Guard members must also meet the lender’s credit and income requirements. This typically includes: * A minimum credit score of 620 * A stable income and employment history * A debt-to-income ratio of 41% or less * Sufficient funds for the down payment and closing costs

Benefits of VA Loans for National Guard Members

VA loans offer several benefits to National Guard members, including: * No down payment requirement * No private mortgage insurance (PMI) requirement * Lower interest rates * Lower closing costs * More lenient credit requirements

Table of Comparison: VA Loans vs. Conventional Loans

| Loan Type | Down Payment Requirement | Private Mortgage Insurance (PMI) | Interest Rates | Closing Costs |

|---|---|---|---|---|

| VA Loan | No down payment required | No PMI required | Lower interest rates | Lower closing costs |

| Conventional Loan | Down payment required (typically 5-20%) | PMI required for down payments less than 20% | Higher interest rates | Higher closing costs |

Conclusion and Next Steps

In conclusion, National Guard members who are eligible for VA loans must gather specific paperwork to prove their eligibility. This paperwork includes the DD Form 214, NGB Form 22, NGB Form 23, and VA Form 26-1880. Additionally, they must meet the lender’s credit and income requirements. The benefits of VA loans, including no down payment requirement, no PMI requirement, and lower interest rates, make them an attractive option for National Guard members. To get started with the VA loan process, National Guard members should contact a lender and provide the required paperwork to determine their eligibility.

What is the minimum credit score required for a VA loan?

+

The minimum credit score required for a VA loan is 620. However, some lenders may have more lenient credit requirements, so it’s essential to check with the lender.

Can I use my VA loan entitlement more than once?

+

Yes, you can use your VA loan entitlement more than once. However, you must have paid off the previous VA loan in full or have sold the property and repaid the loan in full.

What is the maximum loan amount for a VA loan?

+

The maximum loan amount for a VA loan varies by location. In most areas, the maximum loan amount is 548,250. However, in some high-cost areas, the maximum loan amount can be as high as 822,375.