New Hire Paperwork Checklist

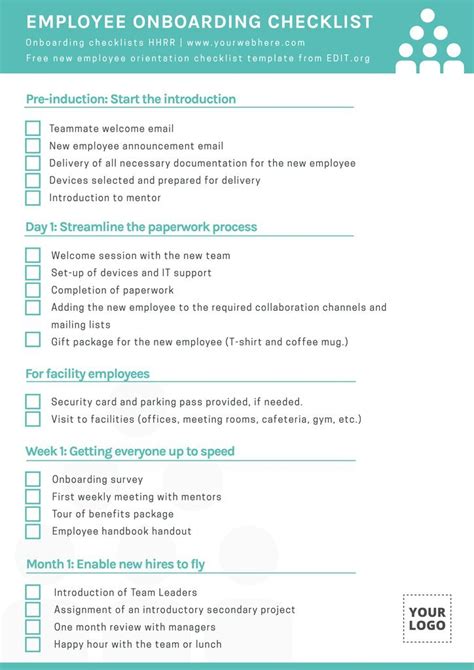

Introduction to New Hire Paperwork

When a new employee joins a company, there are numerous documents and forms that need to be completed to ensure a smooth onboarding process. This paperwork is essential for compliance with laws and regulations, as well as for the employee’s benefits and payroll. In this blog post, we will provide a comprehensive checklist of new hire paperwork to help employers and HR professionals ensure that they have everything they need to get their new employees started.

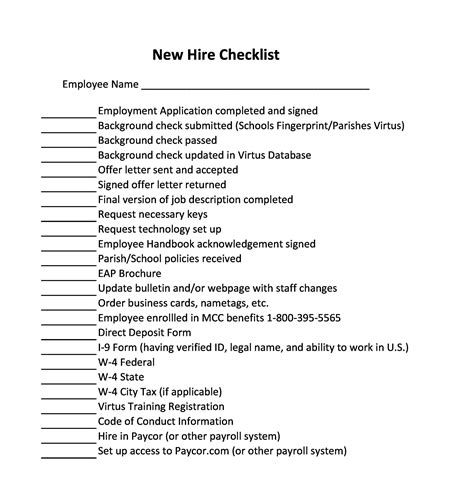

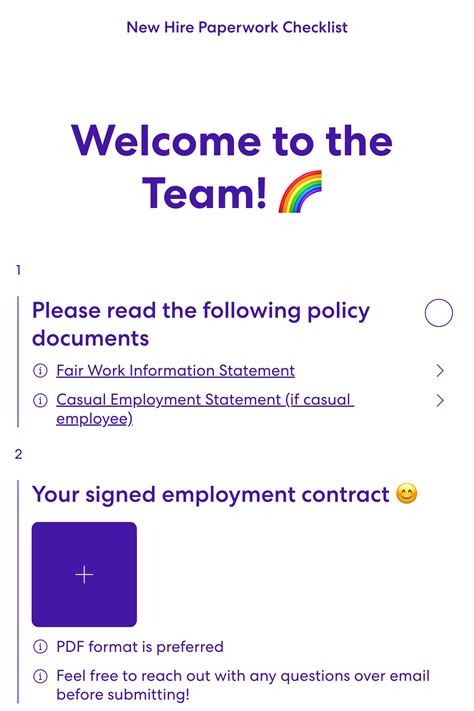

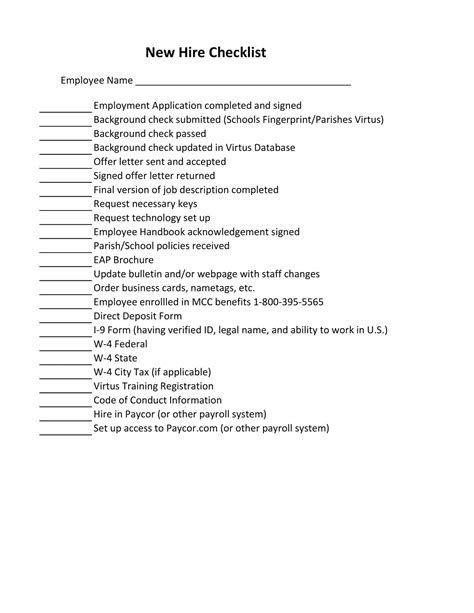

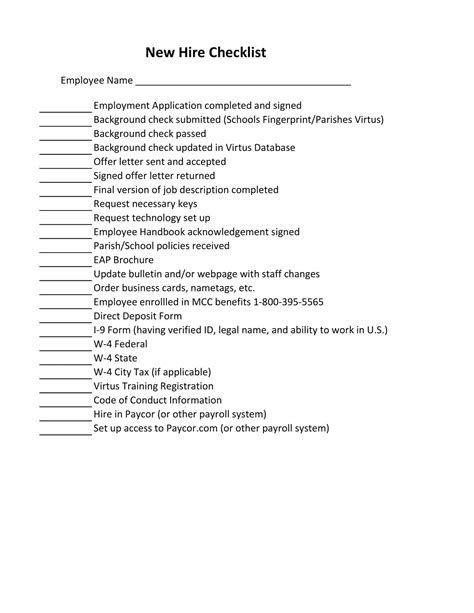

Pre-Employment Documents

Before the new employee’s first day, there are several documents that need to be completed. These include: * Job offer letter: This letter outlines the terms of the job offer, including the job title, salary, benefits, and start date. * Employment contract: This contract outlines the terms of the employment relationship, including the job duties, work schedule, and termination procedures. * Background check: Depending on the company and the job, a background check may be required to ensure that the new employee is eligible to work. * Reference checks: The company may also want to conduct reference checks to verify the new employee’s previous work experience and qualifications.

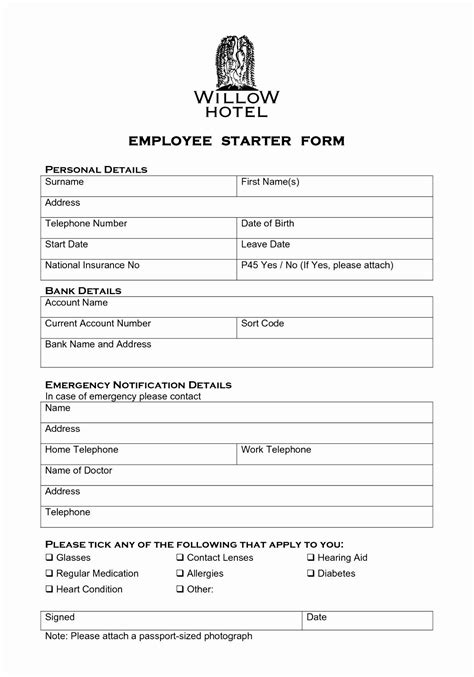

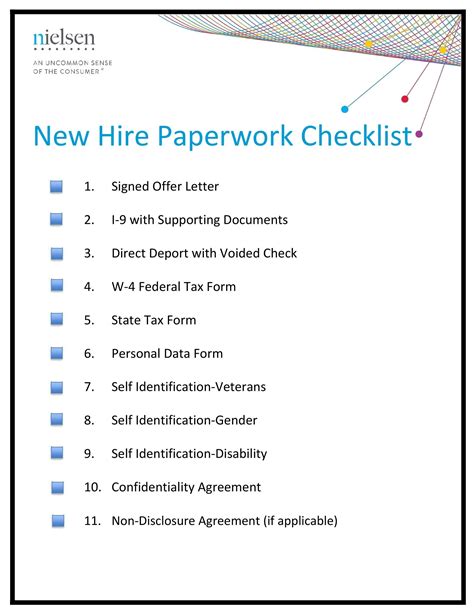

New Hire Forms

On the new employee’s first day, there are several forms that need to be completed. These include: * W-4 form: This form is used to determine the amount of taxes to be withheld from the employee’s paycheck. * I-9 form: This form is used to verify the employee’s eligibility to work in the United States. * Benefits enrollment forms: These forms are used to enroll the new employee in the company’s benefits programs, such as health insurance and retirement plans. * Direct deposit form: This form is used to set up direct deposit of the employee’s paycheck.

Payroll and Benefits Documents

In addition to the new hire forms, there are several payroll and benefits documents that need to be completed. These include: * Payroll information form: This form is used to collect information about the employee’s pay rate, pay schedule, and deductions. * Benefits information form: This form is used to collect information about the employee’s benefits, such as health insurance and retirement plans. * 401(k) or other retirement plan enrollment form: This form is used to enroll the new employee in the company’s retirement plan.

Other Documents

There are several other documents that may need to be completed, depending on the company and the job. These include: * Non-disclosure agreement: This agreement is used to protect the company’s confidential information. * Non-compete agreement: This agreement is used to prevent the employee from working for a competitor. * Employee handbook acknowledgement form: This form is used to acknowledge that the employee has received and read the employee handbook.

💡 Note: The specific documents required may vary depending on the company, the job, and the location.

Checklist Summary

To ensure that all necessary documents are completed, employers and HR professionals can use the following checklist:

| Document | Description |

|---|---|

| Job offer letter | Outlines the terms of the job offer |

| Employment contract | Outlines the terms of the employment relationship |

| Background check | Verifies the employee’s eligibility to work |

| Reference checks | Verifies the employee’s previous work experience and qualifications |

| W-4 form | Determines the amount of taxes to be withheld |

| I-9 form | Verifies the employee’s eligibility to work in the United States |

| Benefits enrollment forms | Enrolls the employee in benefits programs |

| Direct deposit form | Sets up direct deposit of the employee’s paycheck |

To wrap things up, completing the necessary new hire paperwork is crucial for a smooth onboarding process. By following this checklist, employers and HR professionals can ensure that all necessary documents are completed, and the new employee can start working as soon as possible. Remember to always check with local and federal authorities to ensure compliance with all applicable laws and regulations.

What is the purpose of the I-9 form?

+

The I-9 form is used to verify the employee’s eligibility to work in the United States.

What is the difference between a W-4 form and a W-2 form?

+

A W-4 form is used to determine the amount of taxes to be withheld from the employee’s paycheck, while a W-2 form is used to report the employee’s income and taxes withheld to the IRS.

What is the purpose of a non-disclosure agreement?

+

A non-disclosure agreement is used to protect the company’s confidential information by preventing the employee from disclosing it to others.