Paperwork

Canada New Hire Paperwork Requirements

Introduction to Canadian New Hire Paperwork Requirements

When hiring new employees in Canada, it is essential to understand the various paperwork requirements that must be completed. These requirements are in place to ensure compliance with Canadian laws and regulations, as well as to protect the rights of both the employer and the employee. In this article, we will delve into the necessary paperwork requirements for new hires in Canada, including tax forms, benefits enrollment, and employment contracts.

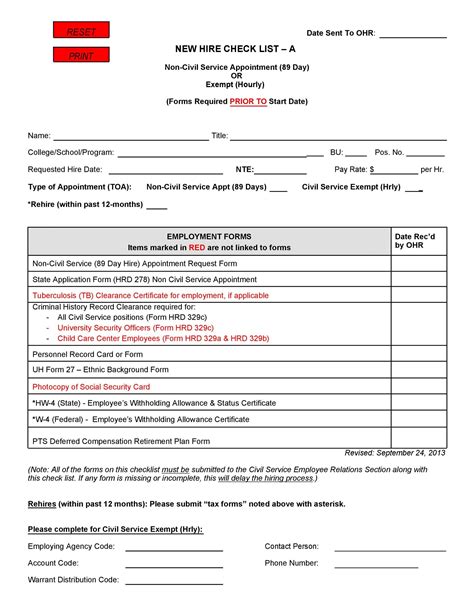

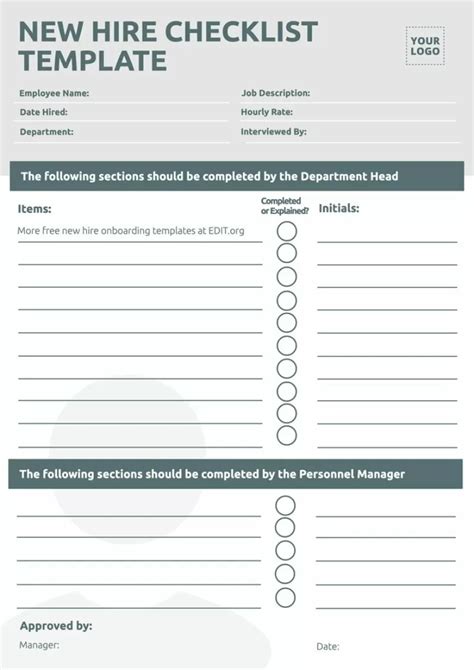

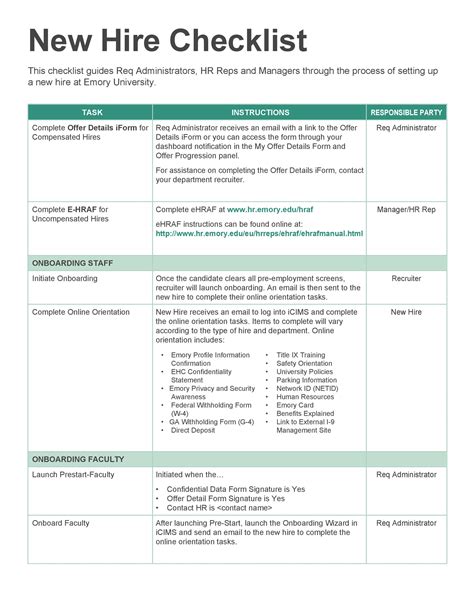

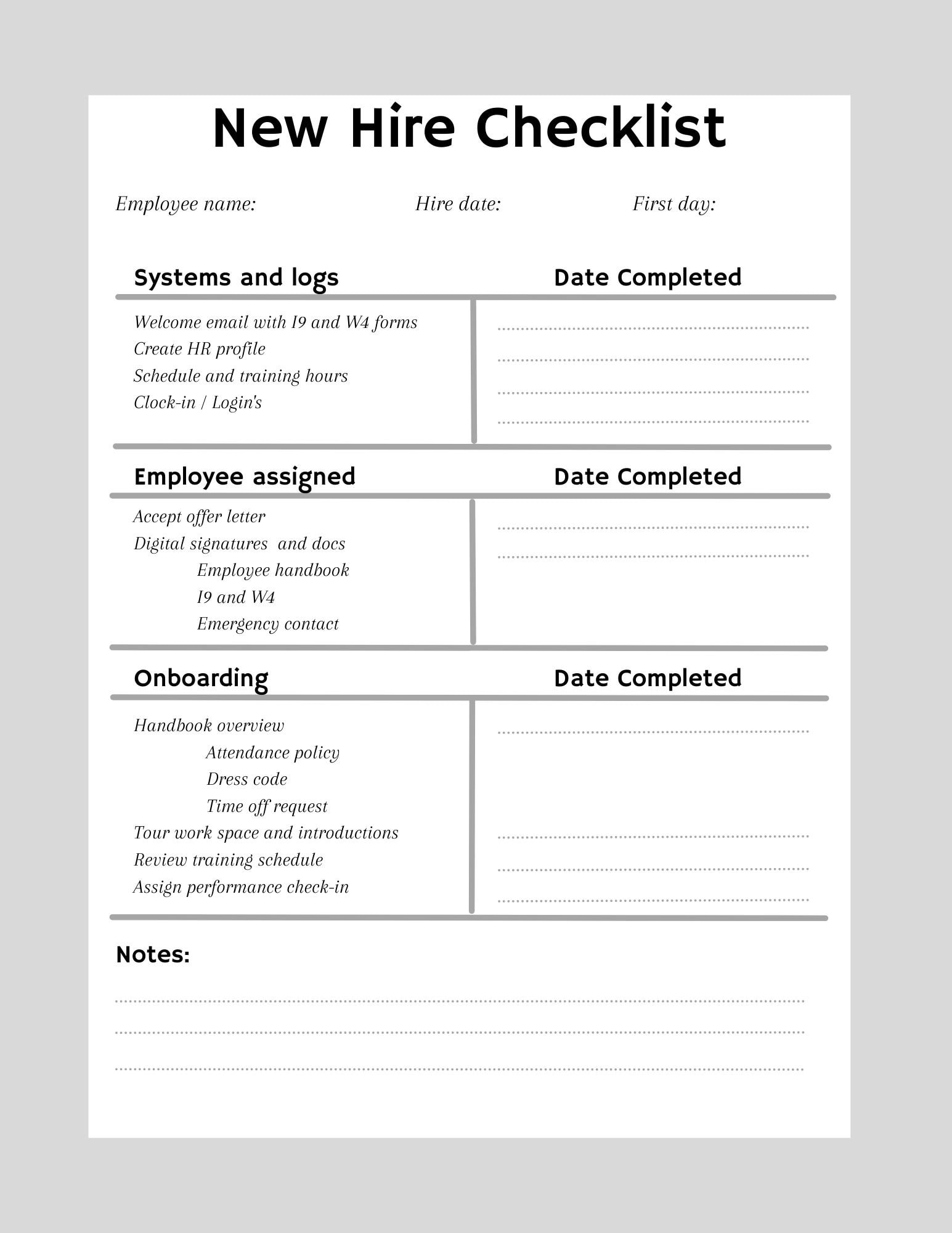

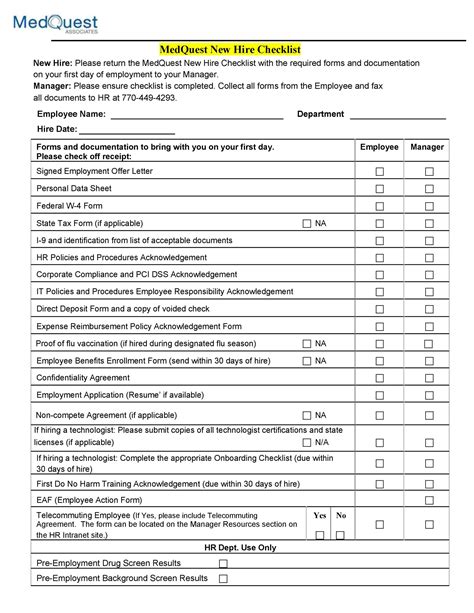

Understanding the Necessary Paperwork

The first step in the hiring process is to complete the necessary paperwork. This includes:

- T4 Slip and TD1 Form: The T4 slip is used to report an employee’s income and deductions to the Canada Revenue Agency (CRA). The TD1 form is used to determine the amount of income tax to be deducted from an employee’s wages.

- Employment Insurance (EI) and Canada Pension Plan (CPP) Forms: These forms are used to determine an employee’s eligibility for EI and CPP benefits.

- Benefits Enrollment Forms: These forms are used to enroll employees in company-sponsored benefits, such as health and dental insurance.

- Employment Contract: This is a legally binding document that outlines the terms and conditions of employment, including job duties, salary, and termination procedures.

Employee Information Requirements

In addition to the necessary paperwork, employers must also collect certain information from new hires, including:

- Personal Details: Name, address, date of birth, and social insurance number.

- Immigration Status: Proof of eligibility to work in Canada, such as a Canadian passport or permanent resident card.

- Banking Information: Direct deposit information, including bank account number and institution.

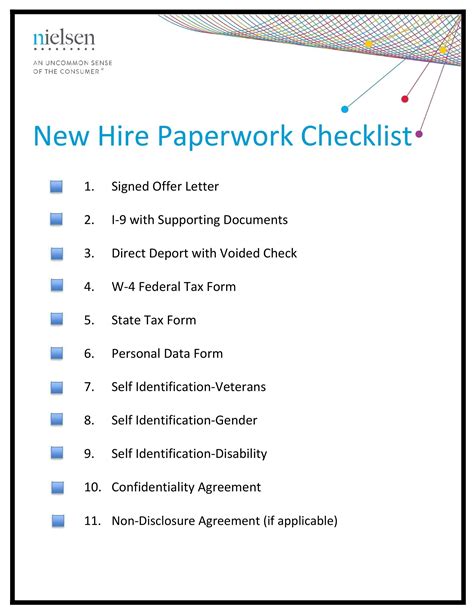

Tax Forms and Deductions

Employers must also complete tax forms and deductions for new hires, including:

- T4 Slip: This form is used to report an employee’s income and deductions to the CRA.

- TD1 Form: This form is used to determine the amount of income tax to be deducted from an employee’s wages.

- CPP and EI Deductions: These deductions are used to fund employee benefits, such as retirement savings and employment insurance.

Benefits Enrollment and Administration

Employers must also enroll new hires in company-sponsored benefits, such as:

- Health and Dental Insurance: These benefits provide employees with access to medical and dental care.

- Life Insurance: This benefit provides employees with a lump-sum payment in the event of death or disability.

- Disability Insurance: This benefit provides employees with income replacement in the event of illness or injury.

📝 Note: Employers must also comply with all applicable laws and regulations, including the Canada Labour Code and the Employment Standards Act.

Conclusion and Final Thoughts

In conclusion, the new hire paperwork requirements in Canada are complex and require careful attention to detail. Employers must complete the necessary paperwork, collect employee information, and enroll new hires in company-sponsored benefits. By understanding these requirements, employers can ensure compliance with Canadian laws and regulations, as well as protect the rights of both the employer and the employee. It is essential to stay up-to-date with the latest changes and developments in Canadian employment law to ensure a smooth and successful hiring process.

What is the purpose of the TD1 form in Canada?

+

The TD1 form is used to determine the amount of income tax to be deducted from an employee’s wages.

What benefits are typically offered to new hires in Canada?

+

Typical benefits offered to new hires in Canada include health and dental insurance, life insurance, and disability insurance.

What is the Canada Labour Code, and how does it apply to new hires?

+

The Canada Labour Code is a federal law that regulates employment standards, including minimum wage, hours of work, and termination procedures. Employers must comply with the Code when hiring new employees.