5 Ways Determine IRA Beneficiary

Introduction to IRA Beneficiaries

When it comes to Individual Retirement Accounts (IRAs), one of the most critical decisions you’ll make is choosing your beneficiaries. The beneficiary of your IRA is the person or people who will inherit the account’s assets after your passing. Selecting the right beneficiary can help ensure that your retirement savings are distributed according to your wishes and minimize potential taxes and penalties. In this article, we’ll explore five ways to determine your IRA beneficiary and provide guidance on how to make this important decision.

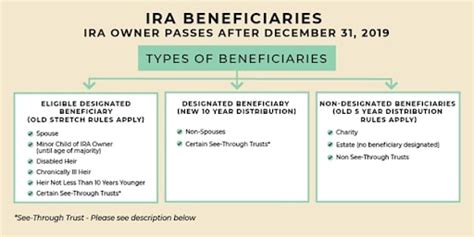

Understanding IRA Beneficiary Rules

Before we dive into the ways to determine your IRA beneficiary, it’s essential to understand the rules surrounding beneficiary designations. The IRS requires that IRA owners name a beneficiary for their account. If you don’t name a beneficiary, the account will typically pass to your estate, which can lead to unintended consequences, such as increased taxes and probate fees. Additionally, if you’re married, your spouse may have automatic beneficiary rights, depending on your state of residence.

5 Ways to Determine Your IRA Beneficiary

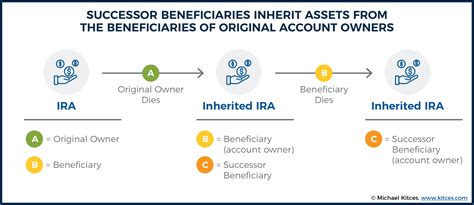

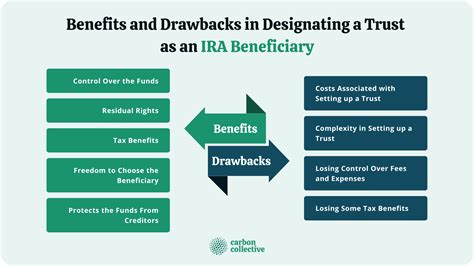

Here are five ways to determine your IRA beneficiary: * Spousal Beneficiary: If you’re married, your spouse is often the most obvious choice for beneficiary. This can provide continued financial support for your partner and allow them to roll over the IRA into their own account. * Children or Other Relatives: If you have children or other relatives who depend on you financially, you may want to consider naming them as beneficiaries. This can help ensure their financial well-being after your passing. * Charitable Organizations: If you have a favorite charity or cause, you can name them as a beneficiary of your IRA. This can provide tax benefits and support a good cause. * Trusts: In some cases, it may be beneficial to name a trust as the beneficiary of your IRA. This can help manage the distribution of the account’s assets and provide protection for beneficiaries. * Estate: While not usually the best option, you can name your estate as the beneficiary of your IRA. However, this can lead to increased taxes and probate fees, so it’s essential to weigh the pros and cons carefully.

Considerations for Choosing an IRA Beneficiary

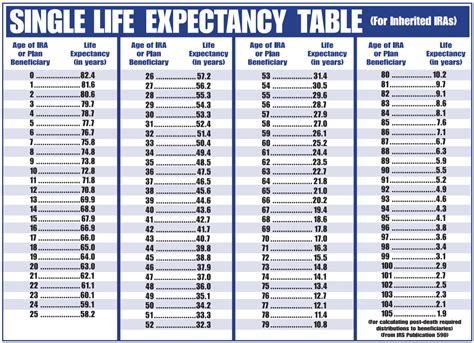

When choosing an IRA beneficiary, there are several factors to consider. These include: * Tax implications: Different beneficiaries may be subject to varying tax rates and rules. * Financial dependence: Consider the financial needs of your potential beneficiaries. * Age and health: The age and health of your beneficiaries may impact their ability to manage the account’s assets. * Relationships: Consider the relationships between your beneficiaries and how they may impact the distribution of the account’s assets.

💡 Note: It's essential to review and update your beneficiary designations regularly to ensure they reflect your current wishes and circumstances.

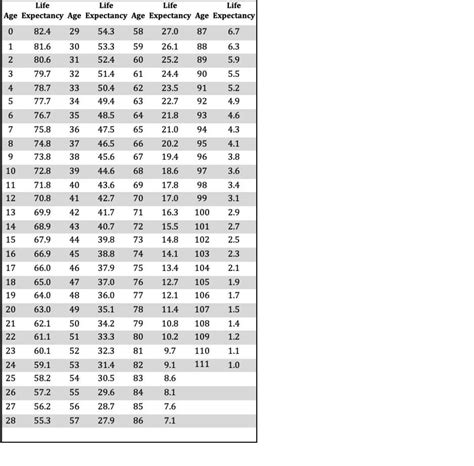

Table of IRA Beneficiary Options

Here is a summary of the IRA beneficiary options discussed:

| Beneficiary Option | Description |

|---|---|

| Spousal Beneficiary | Names your spouse as the beneficiary, providing continued financial support. |

| Children or Other Relatives | Names children or other relatives as beneficiaries, ensuring their financial well-being. |

| Charitable Organizations | Names a charity as the beneficiary, providing tax benefits and supporting a good cause. |

| Trusts | Names a trust as the beneficiary, managing the distribution of the account’s assets and providing protection for beneficiaries. |

| Estate | Names your estate as the beneficiary, which can lead to increased taxes and probate fees. |

In summary, choosing the right IRA beneficiary is a critical decision that requires careful consideration of various factors, including tax implications, financial dependence, age, and health. By understanding the rules and options surrounding IRA beneficiary designations, you can ensure that your retirement savings are distributed according to your wishes and provide for your loved ones. It’s crucial to review and update your beneficiary designations regularly to reflect your current circumstances and wishes. Ultimately, selecting the right IRA beneficiary can provide peace of mind and help you achieve your long-term financial goals.

What happens if I don’t name a beneficiary for my IRA?

+

If you don’t name a beneficiary for your IRA, the account will typically pass to your estate, which can lead to increased taxes and probate fees.

Can I name a minor as the beneficiary of my IRA?

+

Yes, you can name a minor as the beneficiary of your IRA, but you may need to establish a trust or custodial account to manage the assets until the minor reaches the age of majority.

How often should I review and update my IRA beneficiary designations?

+

You should review and update your IRA beneficiary designations regularly, such as after major life events like marriage, divorce, or the birth of a child, to ensure they reflect your current wishes and circumstances.