Small Business Paperwork Filing Requirements

Introduction to Small Business Paperwork Filing Requirements

As a small business owner, navigating the complex world of paperwork filing requirements can be overwhelming. From tax returns to employment records, there are numerous documents that must be filed accurately and on time to avoid penalties and ensure compliance with regulatory bodies. In this article, we will delve into the essential paperwork filing requirements for small businesses, highlighting key documents, deadlines, and best practices for maintaining a seamless and efficient filing system.

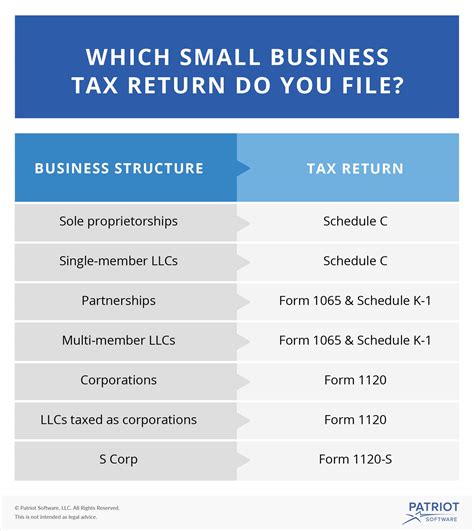

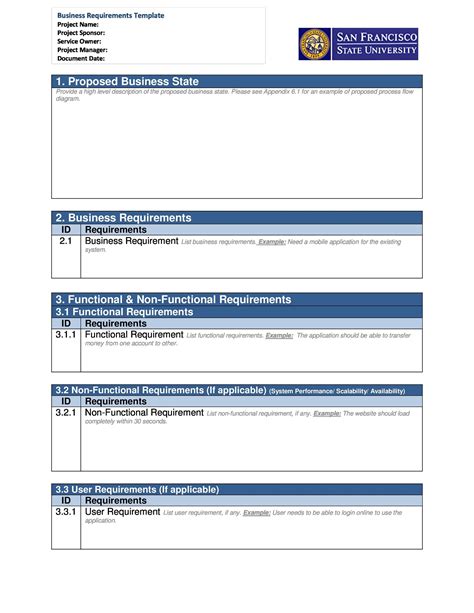

Understanding Business Structure and Paperwork Requirements

Before diving into the specifics of paperwork filing, it’s crucial to understand the type of business structure you operate under, as this will significantly impact your filing requirements. The most common business structures include: * Sole Proprietorship: A single-owner business with minimal paperwork requirements. * Partnership: A multi-owner business that requires partnership agreements and potentially more complex tax filings. * Limited Liability Company (LLC): Offers liability protection and flexible tax options, with varying paperwork requirements depending on the state. * Corporation: Provides strong liability protection but involves more formal paperwork and regulatory compliance.

Each business structure has its unique set of paperwork and filing requirements, including but not limited to business licenses, tax returns, and employment documents.

Key Paperwork Filing Requirements for Small Businesses

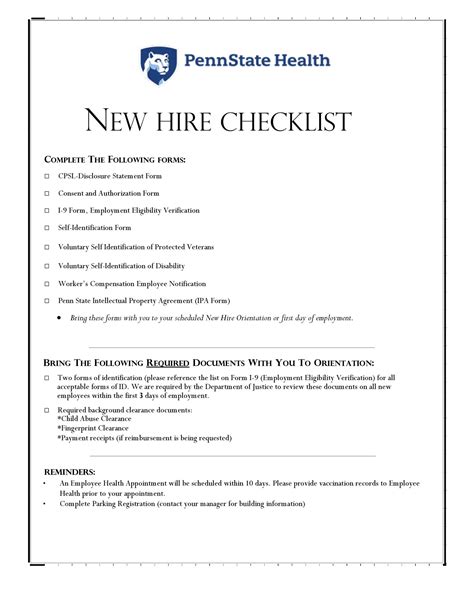

Several key documents are critical for small businesses to file correctly and on time: * Business Licenses and Permits: Necessary for operating a business legally within a state or locality. * Tax Returns: Including income tax, employment tax, and potentially sales tax, depending on the business activities. * Employment Documents: For businesses with employees, this includes payroll records, employee contracts, and benefits information. * Annual Reports: Many states require businesses to file annual reports to maintain their good standing.

Importance of Accurate and Timely Filing

Accurate and timely filing of paperwork is vital for several reasons: * Avoids Penalties: Late or incorrect filings can result in fines and penalties from regulatory bodies. * Maintains Good Standing: Filing annual reports and other required documents ensures your business remains in good standing with the state. * Supports Business Growth: A well-organized filing system can help in making informed business decisions and in securing investments or loans.

Best Practices for Managing Paperwork Filing Requirements

To manage paperwork filing requirements efficiently, small businesses should: * Implement a Filing System: Whether physical or digital, a systematic approach to storing and retrieving documents is essential. * Stay Informed: Regularly check for updates in filing requirements and deadlines. * Seek Professional Help: Consider consulting with an accountant or attorney for complex filings.

📝 Note: Regularly reviewing and updating your business's paperwork filing system can help in identifying and addressing any compliance issues before they become major problems.

Technology and Paperwork Filing

Utilizing technology can significantly streamline the paperwork filing process: * Digital Storage Solutions: Cloud storage services can securely store and organize documents. * Automated Filing Systems: Software designed for tax preparation and business management can automate many filing tasks. * Online Filing Platforms: Many government agencies offer online platforms for filing business documents, making the process more accessible and efficient.

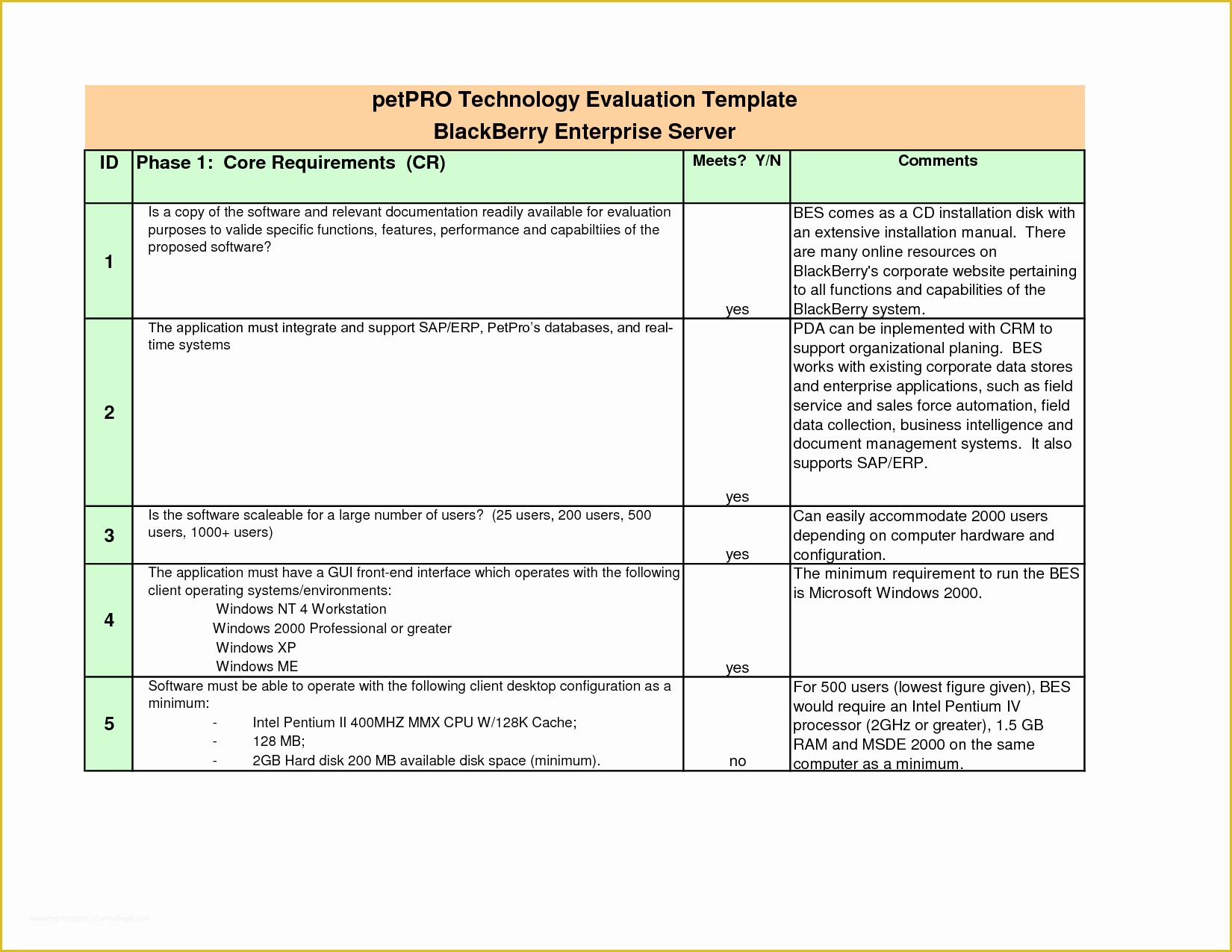

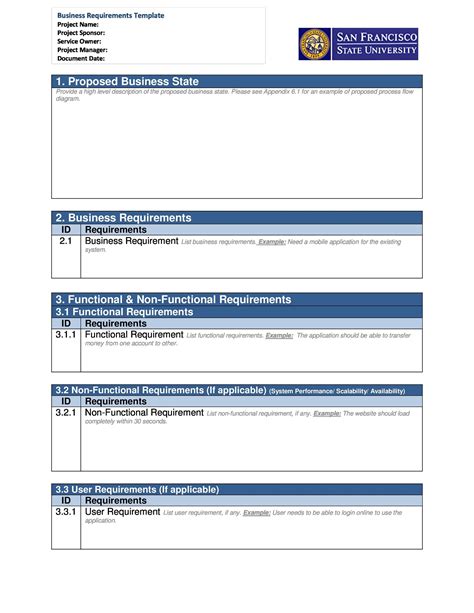

| Document Type | Filing Deadline | Description |

|---|---|---|

| Business License | Varies by State | Required for legal operation of a business |

| Income Tax Return | April 15th | Annual tax return for businesses |

| Annual Report | Varies by State | Required for maintaining business good standing |

In wrapping up the discussion on small business paperwork filing requirements, it’s clear that understanding and complying with these regulations is crucial for the success and legality of any business operation. By implementing efficient filing systems, staying informed about regulatory updates, and leveraging technology, small businesses can navigate the complex landscape of paperwork requirements with ease and confidence.

What are the primary paperwork filing requirements for small businesses?

+

The primary requirements include business licenses, tax returns, employment documents, and annual reports, though specific requirements can vary based on the business structure and location.

Why is accurate and timely filing of paperwork important for small businesses?

+

Accurate and timely filing avoids penalties, maintains the business’s good standing, and supports business growth by ensuring compliance with regulatory requirements and facilitating informed decision-making.

How can technology aid in managing paperwork filing requirements?

+

Technology can aid through digital storage solutions, automated filing systems, and online filing platforms, making the process more efficient, accessible, and reducing the risk of errors or late filings.