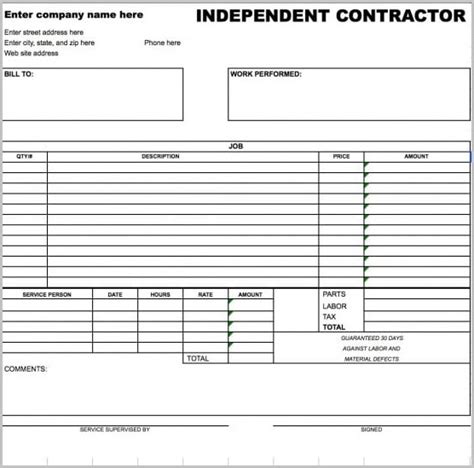

5 Forms for 1099 Employees

Understanding 1099 Employees and Their Tax Obligations

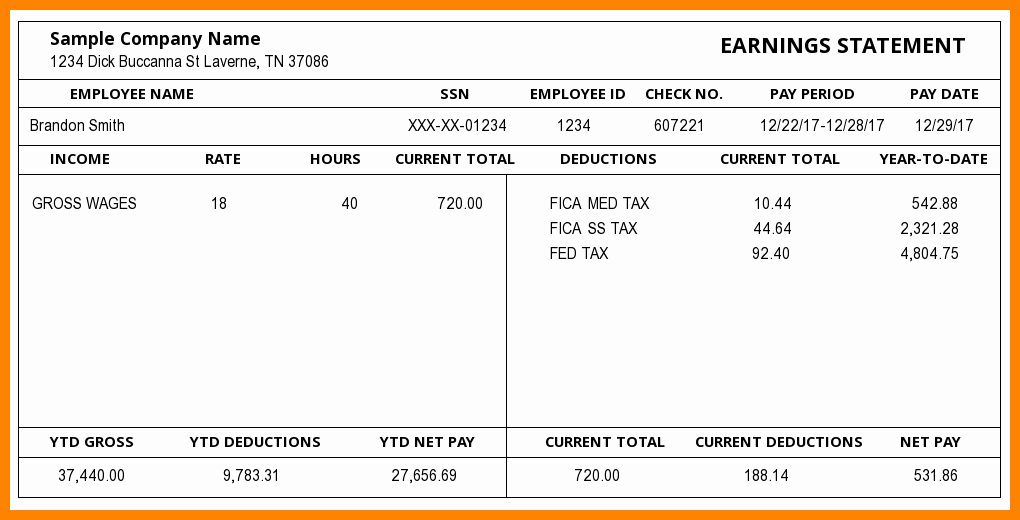

As the gig economy continues to grow, more individuals are finding themselves classified as 1099 employees. This classification signifies that the worker is an independent contractor rather than a traditional employee, which impacts their tax obligations and benefits. 1099 employees are responsible for their own taxes, including self-employment tax, which covers both the employee and employer portions of payroll taxes. This responsibility makes understanding the necessary forms and deadlines crucial for compliance and potential savings.

Forms Required for 1099 Employees

1099 employees need to be familiar with several key forms to accurately report their income and claim deductions. These forms are essential for completing their tax returns and may impact their overall tax liability.

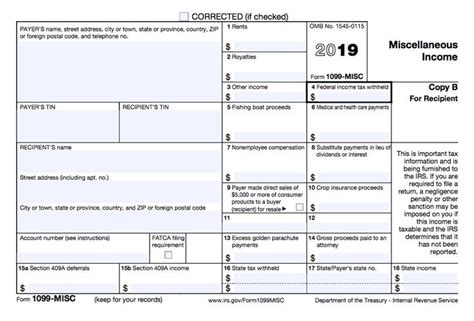

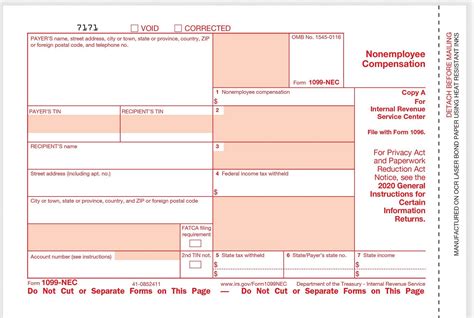

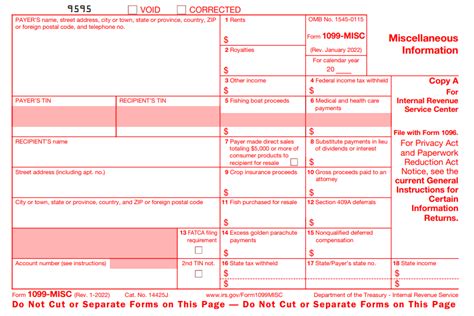

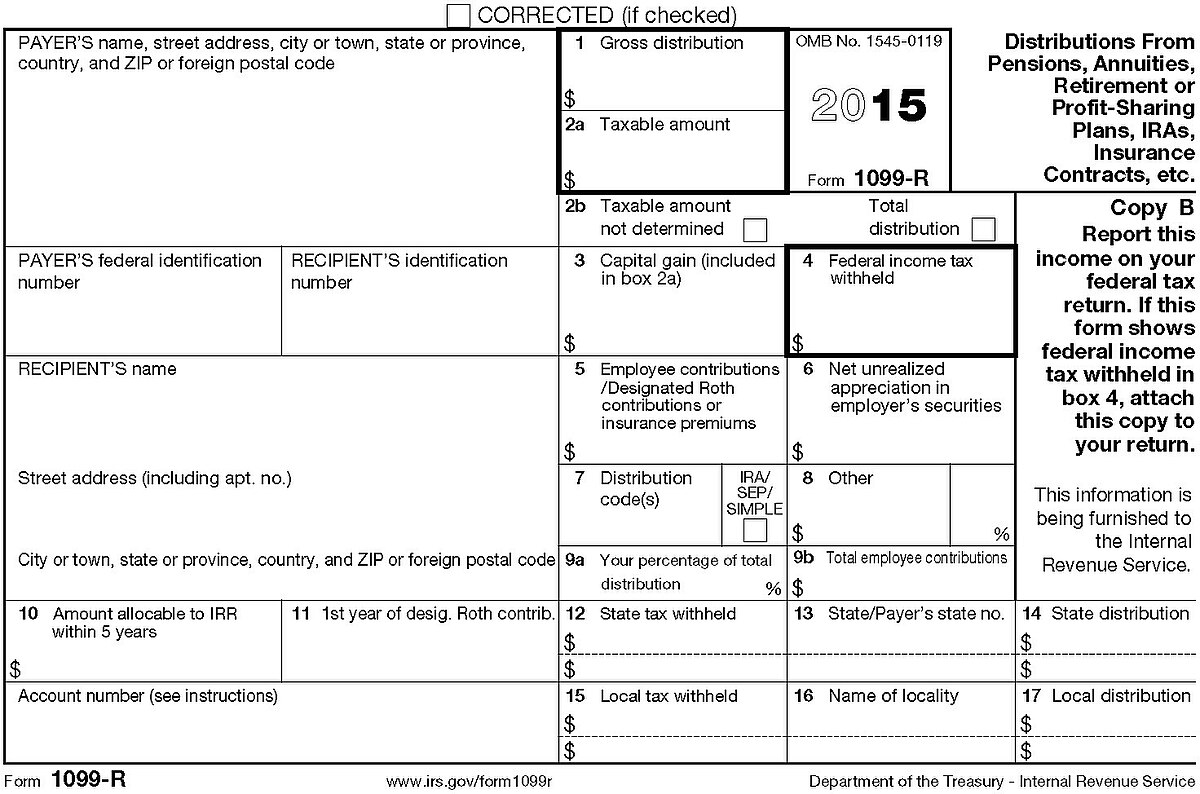

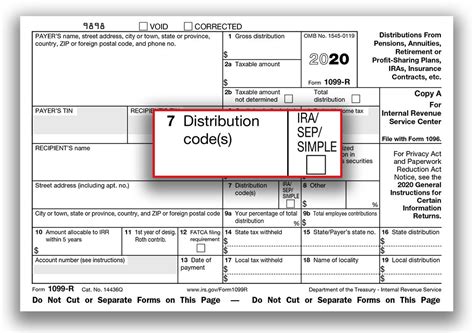

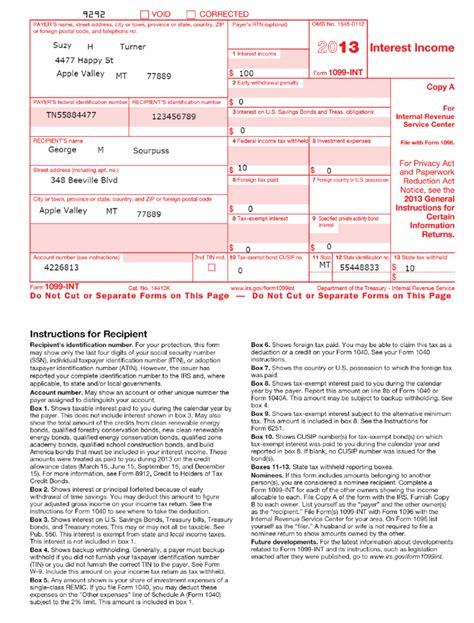

- Form 1099-MISC: This form is used to report miscellaneous income, such as freelance work, consulting fees, and other non-employee compensation. Clients are required to send a 1099-MISC to independent contractors they’ve paid more than $600 in a calendar year by January 31st of the following year.

- Schedule C (Form 1040): This form is where 1099 employees report their business income and expenses. It’s used to calculate the net profit or loss from their business, which is then reported on their personal tax return (Form 1040).

- Schedule SE (Form 1040): The Schedule SE is used to report self-employment tax. 1099 employees must pay self-employment tax on their net earnings from self-employment, which includes their business income reported on Schedule C.

- Form 8829: This form is used for expenses related to a home office. 1099 employees can deduct a portion of their rent or mortgage interest and utilities as business expenses if they use a dedicated space in their home regularly and exclusively for business.

- Form 4562: This form is for depreciation and amortization. 1099 employees can depreciate assets they’ve purchased for business use, such as equipment, vehicles, or property, to spread the cost over several years.

Managing Business Expenses

A critical aspect of being a 1099 employee is managing business expenses effectively. This involves keeping accurate records of all business-related expenditures throughout the year. Expenses can include: - Office supplies and equipment - Travel expenses related to business - Professional fees (e.g., legal, accounting) - Insurance premiums (e.g., liability, business equipment) - Education or training related to the business

📝 Note: It's essential to maintain detailed records, as these expenses can be deducted on Schedule C, potentially reducing taxable income.

Tax Deductions and Credits

Tax deductions and credits can significantly impact a 1099 employee’s tax liability. Deductions reduce taxable income, while credits directly reduce the amount of tax owed. Common deductions include: - Home office deduction - Business use of a car - Meals and entertainment (subject to certain limits and requirements) - Business insurance premiums - Retirement plan contributions

Credits might include: - Earned Income Tax Credit (EITC), depending on income level and family size - Child Tax Credit - Education credits for courses related to their business

Quarterly Estimated Tax Payments

Because 1099 employees do not have taxes withheld from their income, they are generally required to make quarterly estimated tax payments to the IRS. These payments are due on: - April 15th for the first quarter (January 1 - March 31) - June 15th for the second quarter (April 1 - May 31) - September 15th for the third quarter (June 1 - August 31) - January 15th of the following year for the fourth quarter (September 1 - December 31)

Failure to make these payments or underpayment can result in penalties and interest.

Conclusion and Future Planning

Being a 1099 employee offers flexibility and autonomy but also requires careful management of finances and taxes. Understanding the necessary forms, keeping accurate records, and planning for tax obligations can help navigate the complexities of self-employment. As the landscape of work continues to evolve, staying informed about tax laws and taking advantage of deductions and credits can make a significant difference in the success and profitability of a 1099 employee’s business ventures.

What is the deadline for receiving a 1099-MISC form from clients?

+

Clients are required to send a 1099-MISC to independent contractors by January 31st of the year following the year in which the payments were made.

How do 1099 employees report their business income and expenses to the IRS?

+

1099 employees report their business income and expenses on Schedule C (Form 1040), which is then included with their personal tax return (Form 1040).

What is the purpose of making quarterly estimated tax payments as a 1099 employee?

+

Making quarterly estimated tax payments helps 1099 employees avoid penalties and interest by prepaying their tax liability throughout the year, as they do not have taxes withheld from their income.