5 Documents Needed

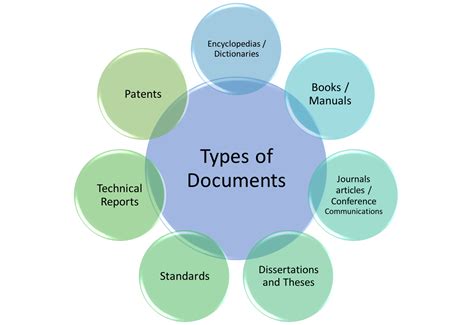

Introduction to Essential Documents

When it comes to legal, financial, and personal matters, having the right documents in place is crucial. These documents not only provide a sense of security but also help in navigating through various aspects of life with ease. In this article, we will explore five key documents that everyone should have, understanding their importance, and how they can impact our lives.

1. Will

A will is a legal document that outlines how you want your assets to be distributed after your death. It is a way to ensure that your wishes are respected and that your loved ones are taken care of. Without a will, the distribution of your assets will be decided by the laws of your state, which might not align with your desires. Creating a will is especially important if you have minor children, as it allows you to name guardians for them.

2. Power of Attorney

A power of attorney (POA) is a document that grants someone you trust the authority to make decisions on your behalf if you become incapacitated. This can include financial decisions, healthcare choices, or both, depending on the type of POA you create. Having a POA in place can prevent the need for a court-appointed guardian and ensures that your wishes are carried out even when you cannot communicate them yourself.

3. Advance Directive

An advance directive is a document that specifies the medical treatment you want to receive if you become unable to communicate your wishes. This can include a living will, which outlines your preferences for end-of-life care, and a healthcare proxy, who is authorized to make medical decisions for you. Having an advance directive ensures that your healthcare wishes are respected, even if you are not able to express them.

4. Insurance Policies

Insurance policies, such as life insurance, disability insurance, and health insurance, are crucial for protecting you and your loved ones from financial hardship in the event of unexpected circumstances. Life insurance can provide a death benefit to your beneficiaries, helping them cover funeral expenses, outstanding debts, and ongoing living costs. Disability insurance replaces a portion of your income if you become unable to work due to illness or injury. Health insurance covers medical expenses, ensuring that you can receive necessary care without facing financial ruin.

5. Beneficiary Designations

Beneficiary designations are crucial for retirement accounts, life insurance policies, and other investments. These designations determine who will receive the assets in these accounts upon your death. It is essential to review and update your beneficiary designations regularly, especially after significant life events such as marriage, divorce, or the birth of a child, to ensure that your assets are distributed according to your current wishes.

💡 Note: Regularly reviewing and updating these documents is crucial to ensure they remain relevant and effective in reflecting your current wishes and circumstances.

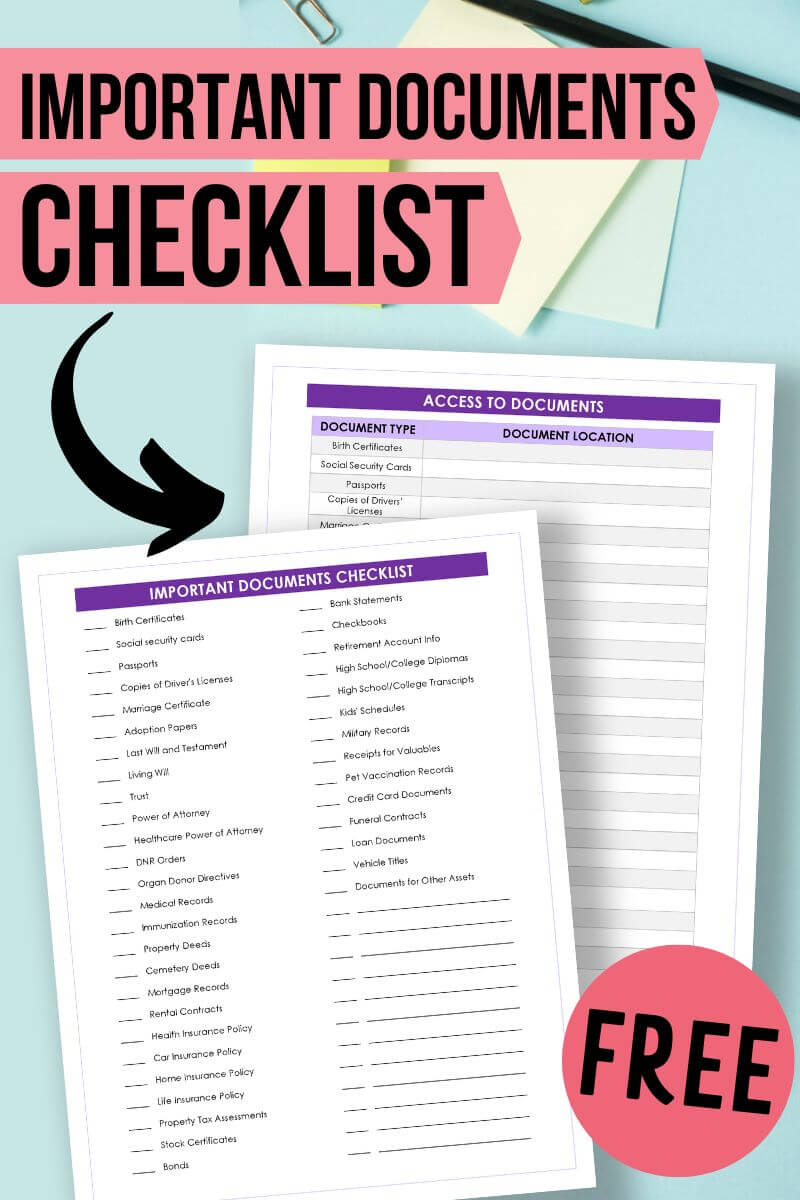

In terms of organizing these documents, consider the following steps: - Create digital copies of each document and store them in a secure, easily accessible location. - Inform a trusted individual about the location of these documents. - Review and update the documents periodically or after significant life events.

The process of creating these documents can seem daunting, but it is a necessary step in securing your future and the well-being of your loved ones. By understanding the importance of these documents and taking the time to create them, you can have peace of mind knowing that your wishes will be respected and your loved ones will be protected.

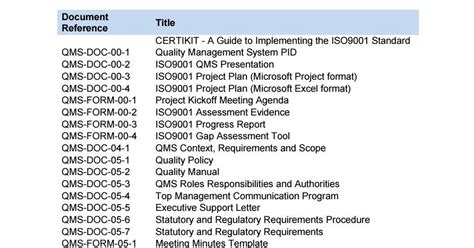

To further illustrate the importance of these documents, consider the following table:

| Document | Purpose | Importance |

|---|---|---|

| Will | Distributes assets after death | Ensures assets are distributed according to your wishes |

| Power of Attorney | Grants decision-making authority to another | Prevents the need for a court-appointed guardian |

| Advance Directive | Specifies medical treatment wishes | Ensures medical wishes are respected |

| Insurance Policies | Provides financial protection | Protects against financial hardship |

| Beneficiary Designations | Determines who receives assets upon death | Ensures assets are distributed according to your wishes |

In final thoughts, having these five documents in place is not just about planning for the future; it’s about taking control of your present. By creating a will, power of attorney, advance directive, obtaining appropriate insurance policies, and designating beneficiaries, you are ensuring that your wishes are respected, and your loved ones are protected. This proactive approach to your legal and financial affairs can provide a sense of security and peace of mind, allowing you to focus on what truly matters in life.

What is the primary purpose of a will?

+

The primary purpose of a will is to distribute your assets according to your wishes after your death, ensuring that your loved ones are taken care of and your estate is managed as you intended.

Why is it important to have a power of attorney?

+

Having a power of attorney is important because it allows you to grant someone you trust the authority to make decisions on your behalf if you become incapacitated, preventing the need for a court-appointed guardian and ensuring your wishes are carried out.

What is the difference between a living will and a healthcare proxy?

+

A living will is a document that outlines your preferences for end-of-life medical treatment, while a healthcare proxy is a person you authorize to make medical decisions for you if you are unable to communicate your wishes. Both are components of an advance directive.