Home Loan Paperwork Requirements

Introduction to Home Loan Paperwork

When considering purchasing a home, one of the most critical steps in the process is securing a home loan. This involves a significant amount of paperwork, which can often be overwhelming for first-time buyers or those unfamiliar with the process. Understanding the various documents and information required can help streamline the application process, making it less daunting and more manageable. In this article, we will delve into the necessary paperwork for a home loan, exploring the types of documents typically required and offering guidance on how to prepare them.

Pre-Approval Documents

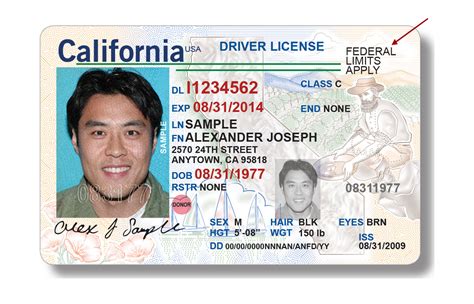

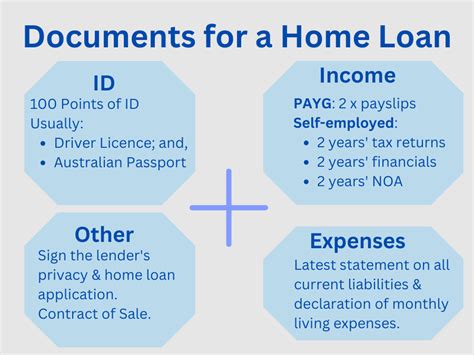

Before starting your home search, it’s beneficial to get pre-approved for a mortgage. This step provides an estimate of how much you can borrow and demonstrates to sellers that you’re a serious buyer. The pre-approval process requires several key documents: - Identification: A valid government-issued ID, such as a driver’s license or passport. - Income Proof: Pay stubs, W-2 forms, and possibly tax returns to verify your income. - Credit Reports: Your lender will pull your credit reports, but it’s a good idea to check them yourself for any errors beforehand. - Bank Statements: To show your savings and asset information.

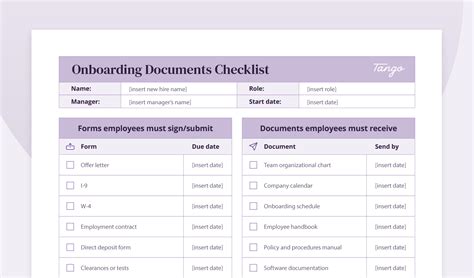

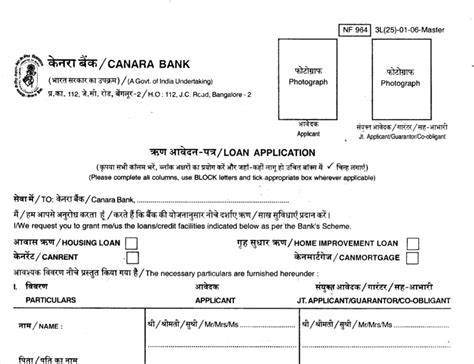

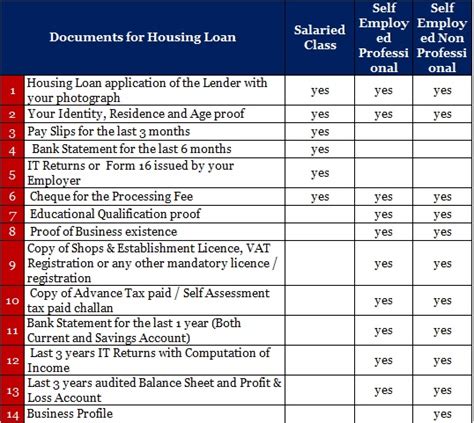

Home Loan Application Documents

Once you’ve found a home and your offer is accepted, you’ll need to finalize your mortgage application. The following documents are usually required: - Employment Verification: Letters from your employer confirming your employment status and income. - Financial Statements: Detailed lists of your assets, debts, and income. - Appraisal Reports: Though typically ordered by the lender, understanding what an appraisal entails can be helpful. - Title Reports and Insurance: To ensure the property’s title is clear and to protect against potential title issues.

Mortgage Options and Requirements

Different types of mortgages (e.g., FHA, VA, Conventional) have unique requirements. For instance: - FHA Loans require less down payment but have stricter debt-to-income ratio requirements. - VA Loans, for veterans and eligible spouses, offer favorable terms like lower interest rates and no down payment, but require a Certificate of Eligibility. - Conventional Loans often require higher down payments and better credit scores but offer more flexibility in terms.

Processing and Closing

After your loan is approved, the processing phase involves reviewing and finalizing all documents. At closing, you’ll sign the final loan documents, transfer the ownership of the property, and complete the purchase. Key documents at this stage include: - Loan Estimates and Closing Disclosures: Detailed breakdowns of your loan terms and costs. - Mortgage Note and Deed of Trust: The legal documents securing the loan with the property. - Title and Insurance Documents: Confirming ownership and protecting your investment.

📝 Note: It's essential to carefully review all documents before signing, ensuring you understand the terms and conditions of your loan.

Post-Closing Procedures

After closing, there are a few more steps to consider: - Update Your Records: Ensure your property records and insurance reflect the new ownership. - Understand Your Payments: Know how much your monthly mortgage payment is, what it covers, and when it’s due. - Tax Benefits: Familiarize yourself with the tax deductions available to homeowners, such as mortgage interest and property taxes.

What are the primary documents required for a home loan application?

+

The primary documents include identification, income proof, credit reports, and bank statements. Additional documents may be required depending on the lender and the type of loan.

How long does the home loan application process typically take?

+

The length of the process can vary significantly depending on the complexity of the application, the efficiency of the lender, and how quickly you can provide required documents. On average, it can take anywhere from a few weeks to a couple of months.

What is the difference between pre-approval and pre-qualification for a home loan?

+

Pre-qualification is an initial assessment of your ability to borrow based on basic financial information, while pre-approval involves a more detailed review of your financial documents and provides a more accurate estimate of how much you can borrow.

In summary, navigating the home loan paperwork requirements involves a thorough understanding of the necessary documents and a strategic approach to managing the application process. By being prepared and knowledgeable about the various steps and documents involved, potential homeowners can make the experience less stressful and more successful. Whether you’re a first-time buyer or an experienced homeowner, understanding the intricacies of home loan paperwork is crucial for achieving your real estate goals.