5 Refinance Papers

Understanding the Refinance Process

Refinancing a mortgage can be a complex and daunting process, involving numerous documents and financial obligations. One of the key aspects of refinancing is the paperwork involved. In this blog post, we will explore the 5 refinance papers that are typically required for a refinance transaction.

Refinance Paper 1: Application

The first step in the refinance process is to submit an application. This document provides the lender with basic information about the borrower, including their income, credit score, and employment history. The application will also require information about the property being refinanced, including its value and the amount of the outstanding mortgage balance. It is essential to ensure that all information provided is accurate and complete to avoid any delays in the process.

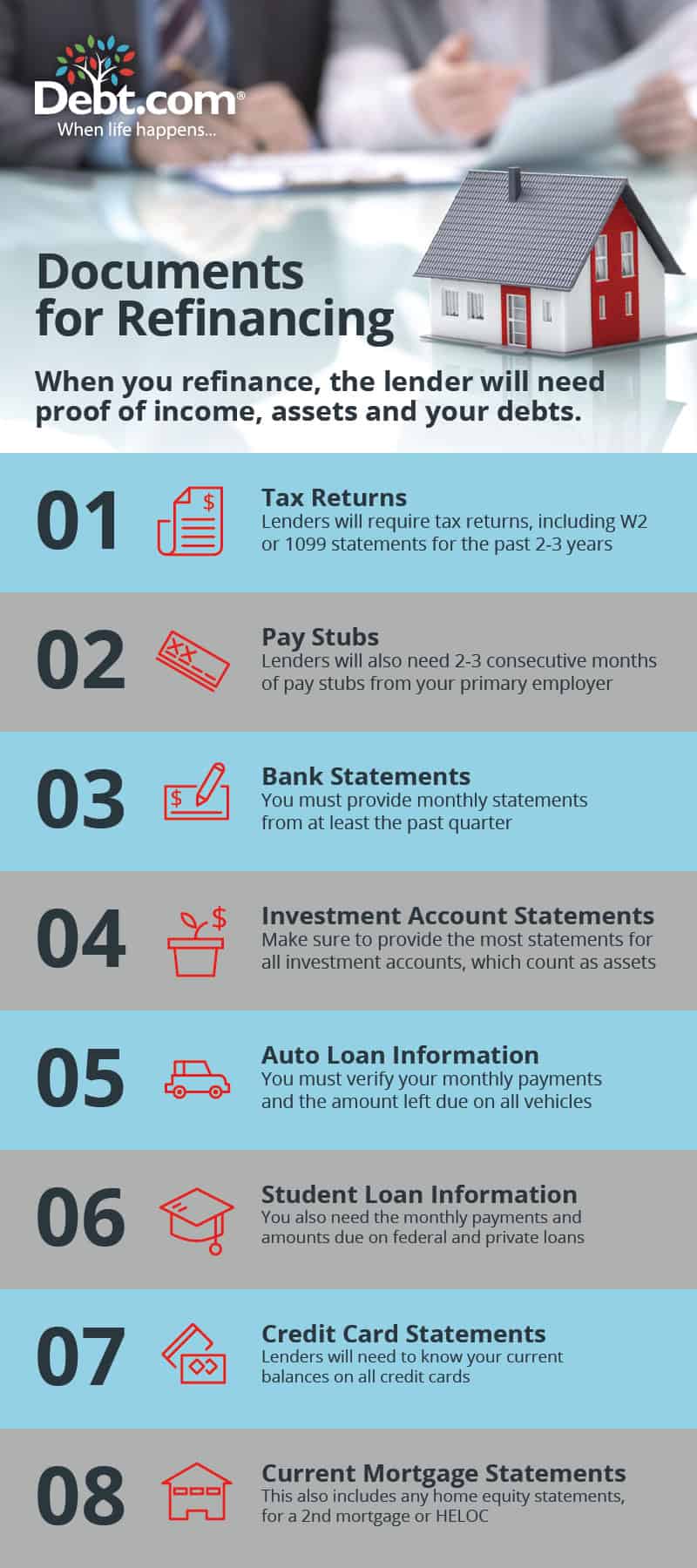

Refinance Paper 2: Pay Stub and W-2 Forms

To verify the borrower’s income, lenders require pay stubs and W-2 forms. These documents provide proof of employment and income, which is used to determine the borrower’s ability to repay the loan. Typically, lenders require pay stubs from the past 30 days and W-2 forms from the past two years. It is crucial to ensure that these documents are up-to-date and accurately reflect the borrower’s current income.

Refinance Paper 3: Bank Statements

Lenders also require bank statements to verify the borrower’s assets and cash reserves. These statements should show the borrower’s account balances, transactions, and any large deposits or withdrawals. It is essential to provide complete and consecutive statements, as any gaps in the statements may raise concerns with the lender.

Refinance Paper 4: Title Report and Insurance

A title report and insurance are critical components of the refinance process. The title report verifies the ownership of the property and ensures that there are no unexpected liens or encumbrances. Title insurance protects the lender and the borrower from any potential title defects or disputes. The lender will typically require a title report and insurance policy to be issued before the refinance can be completed.

Refinance Paper 5: Appraisal Report

An appraisal report is required to determine the value of the property being refinanced. The appraiser will inspect the property and provide a written report detailing its value, condition, and any notable features. The appraisal report is used to ensure that the loan amount does not exceed the value of the property, which helps to mitigate the risk for the lender.

📝 Note: The refinance process may vary depending on the lender and the specific loan program. It is essential to review and understand all the requirements and documents needed for the refinance transaction.

Additional Requirements

In addition to the 5 refinance papers, lenders may require other documents, such as: * Identification documents (driver’s license, passport, etc.) * Credit reports * Property tax statements * Insurance policies (hazard, flood, etc.) * Any other documents specific to the loan program or property type

Refinance Process Timeline

The refinance process can take several weeks to several months to complete. The timeline will depend on various factors, including the complexity of the loan, the speed of the lender, and the responsiveness of the borrower. Here is a general outline of the refinance process timeline: * Application and pre-approval: 1-3 days * Processing and underwriting: 1-2 weeks * Appraisal and inspection: 1-2 weeks * Closing and funding: 1-3 days

| Document | Description |

|---|---|

| Application | Provides basic information about the borrower and property |

| Pay Stub and W-2 Forms | Verifies the borrower's income and employment |

| Bank Statements | Verifies the borrower's assets and cash reserves |

| Title Report and Insurance | Verifies the ownership of the property and protects against title defects |

| Appraisal Report | Determines the value of the property |

In summary, the refinance process involves several critical documents, including the application, pay stub and W-2 forms, bank statements, title report and insurance, and appraisal report. Understanding these documents and the refinance process can help borrowers navigate the transaction more efficiently and effectively. By being prepared and providing all the necessary documents, borrowers can ensure a smooth and successful refinance experience.

What is the purpose of the refinance application?

+

The refinance application provides the lender with basic information about the borrower and property, which is used to determine the borrower’s eligibility for the loan.

How long does the refinance process typically take?

+

The refinance process can take several weeks to several months to complete, depending on the complexity of the loan, the speed of the lender, and the responsiveness of the borrower.

What is the difference between a title report and title insurance?

+

A title report verifies the ownership of the property, while title insurance protects the lender and the borrower from any potential title defects or disputes.