5 Refinance Papers Needed

Understanding the Refinance Process

When considering refinancing a mortgage, it’s essential to understand the process and the documents required. Refinancing involves replacing an existing loan with a new one, often to take advantage of lower interest rates or to switch from an adjustable-rate to a fixed-rate loan. The process can seem daunting, but being prepared with the necessary paperwork can make it smoother.

Documents Required for Refinancing

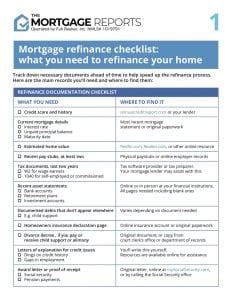

To refinance a mortgage, several key documents are needed. These documents help lenders assess the borrower’s creditworthiness and the value of the property. The primary papers required for refinancing include:

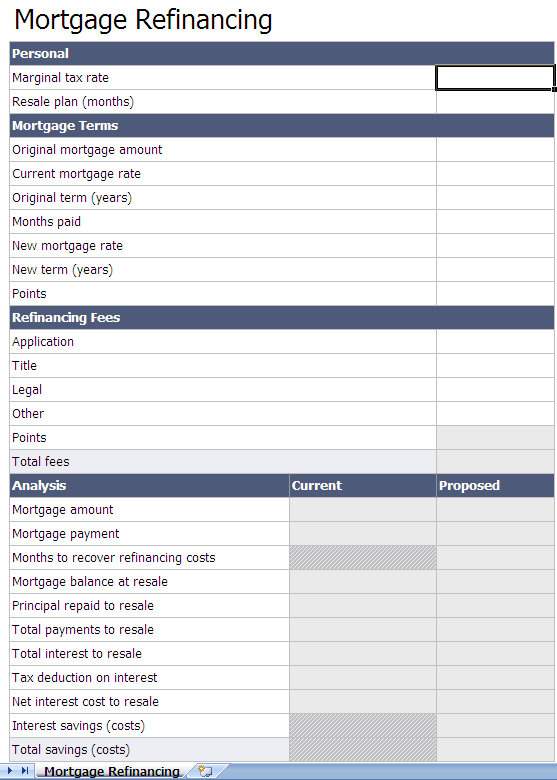

- Identification Documents: These are crucial for verifying the borrower’s identity. Common identification documents include a driver’s license, state ID, or passport.

- Income Verification: Lenders need proof of income to determine the borrower’s ability to repay the loan. This can include pay stubs, W-2 forms, or tax returns for the self-employed.

- Asset Documentation: Borrowers must provide documentation of their assets, such as bank statements, investment accounts, and retirement accounts, to show they have sufficient funds for closing costs and reserves.

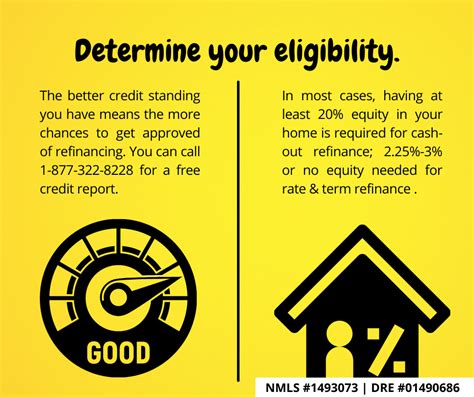

- Credit Reports: A credit report is essential for evaluating the borrower’s credit history. Lenders use this information to determine the interest rate and terms of the loan.

- Appraisal Report: An appraisal report provides an independent assessment of the property’s value. This is crucial for determining the loan-to-value ratio and ensuring the property’s value supports the loan amount.

Additional Requirements

In addition to the primary documents, other requirements may include: - Title Report: This ensures the property title is clear and free of any unexpected liens. - Insurance Information: Proof of homeowners insurance is necessary to protect the lender’s investment. - Loan Payoff Statement: If the borrower has an existing mortgage, a payoff statement from the current lender is required to finalize the refinance.

Steps in the Refinance Process

The refinance process involves several steps: 1. Application: The borrower applies for the refinance, providing initial documentation. 2. Processing: The lender processes the application, ordering an appraisal and title report as needed. 3. Underwriting: The lender’s underwriter reviews the application, verifying all information and making a final decision. 4. Closing: The borrower signs the final loan documents, and the new loan is funded.

📝 Note: It's crucial to review all loan documents carefully before signing to ensure understanding of the terms and conditions.

Benefits of Refinancing

Refinancing can offer several benefits, including: - Lower Monthly Payments: Through a lower interest rate or extended loan term. - Cash-Out Opportunities: Borrowers can tap into their home’s equity for cash. - Debt Consolidation: Refinancing can be used to consolidate other debts into a single, lower-interest loan. - Switching Loan Types: From an adjustable-rate to a fixed-rate loan for more stability.

Challenges and Considerations

While refinancing can be beneficial, there are challenges and considerations: - Closing Costs: Refinancing involves paying closing costs again, which can be significant. - Credit Score Impact: The refinance process can temporarily affect credit scores. - Market Conditions: Interest rates and market conditions can affect the feasibility of refinancing.

To summarize, refinancing a mortgage requires careful consideration and preparation. Understanding the necessary documents and the process can help borrowers navigate the system more effectively. Whether to take advantage of lower interest rates, tap into home equity, or consolidate debt, refinancing can be a powerful financial tool when approached with the right knowledge and strategy.

What are the primary reasons for refinancing a mortgage?

+

The primary reasons for refinancing a mortgage include lowering monthly payments, switching from an adjustable-rate to a fixed-rate loan, tapping into home equity, and consolidating debt into a single, lower-interest loan.

What documents are typically required for refinancing?

+

Typically, documents required for refinancing include identification, income verification, asset documentation, credit reports, and an appraisal report. Additional documents may be needed depending on the lender and the borrower’s situation.

How long does the refinance process usually take?

+

The refinance process can vary in length but typically takes several weeks to a few months. It involves applying, processing, underwriting, and closing, with each step requiring careful review and verification of documents.