5 Documents Needed

Introduction to Essential Documents

When it comes to personal finance, legal matters, and business operations, having the right documents in place is crucial. These documents not only help in organizing one’s affairs but also provide a clear understanding of one’s rights, responsibilities, and obligations. In this article, we will discuss five essential documents that everyone should have, highlighting their importance and the role they play in our lives.

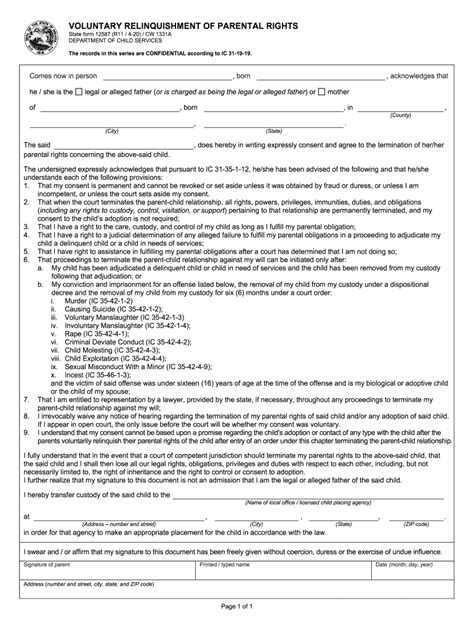

1. Will and Testament

A Will and Testament is a document that outlines how a person’s assets will be distributed after their death. It is a critical document for ensuring that one’s wishes are respected and that loved ones are protected. Without a Will, the distribution of assets will be determined by the state, which may not align with one’s intentions. A Will should include: - Executor: The person responsible for carrying out the instructions in the Will. - Beneficiaries: The individuals or organizations that will receive assets. - Guardians: If applicable, the persons appointed to care for minor children. - Assets: A list of all properties, investments, and personal items.

2. Power of Attorney

A Power of Attorney (POA) is a document that grants someone the authority to act on another person’s behalf in legal or financial matters. This document is essential for situations where an individual may become incapacitated or unable to make decisions for themselves. There are different types of POA, including: - General POA: Grants broad powers to manage finances, property, and personal matters. - Special POA: Limits the powers to specific tasks or decisions. - Durable POA: Remains in effect even if the individual becomes incapacitated.

3. Advance Directive

An Advance Directive, also known as a Living Will, is a document that specifies the medical treatments one wants or does not want if they become unable to make decisions for themselves. This document is crucial for ensuring that one’s wishes regarding end-of-life care are respected. It should include: - Do Not Resuscitate (DNR) Order: Instructions regarding CPR and life-support measures. - Healthcare Proxy: The person authorized to make medical decisions on one’s behalf. - Treatment Preferences: Specific instructions regarding pain management, hydration, and nutrition.

4. Insurance Policies

Insurance Policies provide financial protection against various risks, including health issues, accidents, and death. The most common types of insurance include: - Health Insurance: Covers medical expenses. - Life Insurance: Provides a death benefit to beneficiaries. - Disability Insurance: Offers income replacement if one becomes unable to work. - Home and Auto Insurance: Protects against property damage or loss.

5. Emergency Contact and Medical Information

Having an easily accessible document with Emergency Contact and Medical Information is vital. This document should include: - Emergency Contacts: Names and phone numbers of individuals to contact in case of an emergency. - Medical History: A brief overview of one’s medical conditions, allergies, and medications. - Blood Type: Important for medical emergencies. - Organ Donation Preferences: Instructions regarding organ and tissue donation.

📝 Note: It's essential to review and update these documents regularly to ensure they remain relevant and effective.

To maintain these documents effectively, consider the following tips: - Store them safely: Use a fireproof safe or a secure online storage service. - Inform relevant parties: Ensure that executors, beneficiaries, and healthcare proxies are aware of the documents and their locations. - Review and update: Periodically review the documents to reflect changes in one’s life, wishes, or circumstances.

In summary, having the right documents in place is crucial for protecting one’s interests, ensuring that wishes are respected, and providing for loved ones. By understanding the importance and role of these five essential documents, individuals can take proactive steps to secure their futures and the futures of those they care about. Whether it’s a Will, Power of Attorney, Advance Directive, Insurance Policies, or Emergency Contact and Medical Information, each document plays a significant role in navigating life’s challenges with confidence and peace of mind.

What is the primary purpose of a Will and Testament?

+

The primary purpose of a Will and Testament is to outline how a person’s assets will be distributed after their death, ensuring that their wishes are respected and loved ones are protected.

Why is it important to have a Power of Attorney?

+

Having a Power of Attorney is important because it grants someone the authority to act on another person’s behalf in legal or financial matters, especially in situations where the individual may become incapacitated or unable to make decisions for themselves.

What information should be included in an Advance Directive?

+

An Advance Directive should include instructions regarding end-of-life care, such as a Do Not Resuscitate (DNR) Order, Healthcare Proxy, and treatment preferences, to ensure that one’s wishes are respected if they become unable to make decisions for themselves.