Echeck Paperwork Requirements

Introduction to Echeck Paperwork Requirements

The world of finance and banking has undergone significant transformations with the advent of digital payment systems. One such innovation is the echeck, also known as an electronic check, which allows for the electronic transfer of funds from a checking account. The use of echecks has become increasingly popular due to their convenience, speed, and security. However, like traditional checks, echecks also come with their own set of paperwork requirements that are essential for their legitimacy and for protecting both the payer and the payee. In this article, we will delve into the details of echeck paperwork requirements, their importance, and the steps involved in processing an echeck.

Understanding Echecks

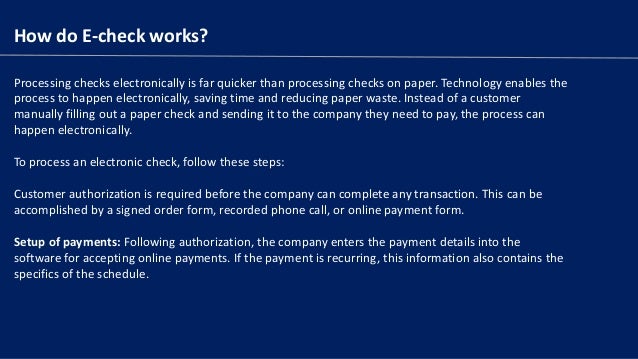

Before diving into the paperwork requirements, it’s crucial to understand what an echeck is. An echeck, or electronic check, is a type of payment that electronically draws funds from a checking account. It works similarly to a traditional paper check but is processed electronically, which makes the transaction faster and more efficient. Echecks are widely used for online transactions, bill payments, and business-to-business payments due to their convenience and the lower risk of fraud compared to credit card transactions.

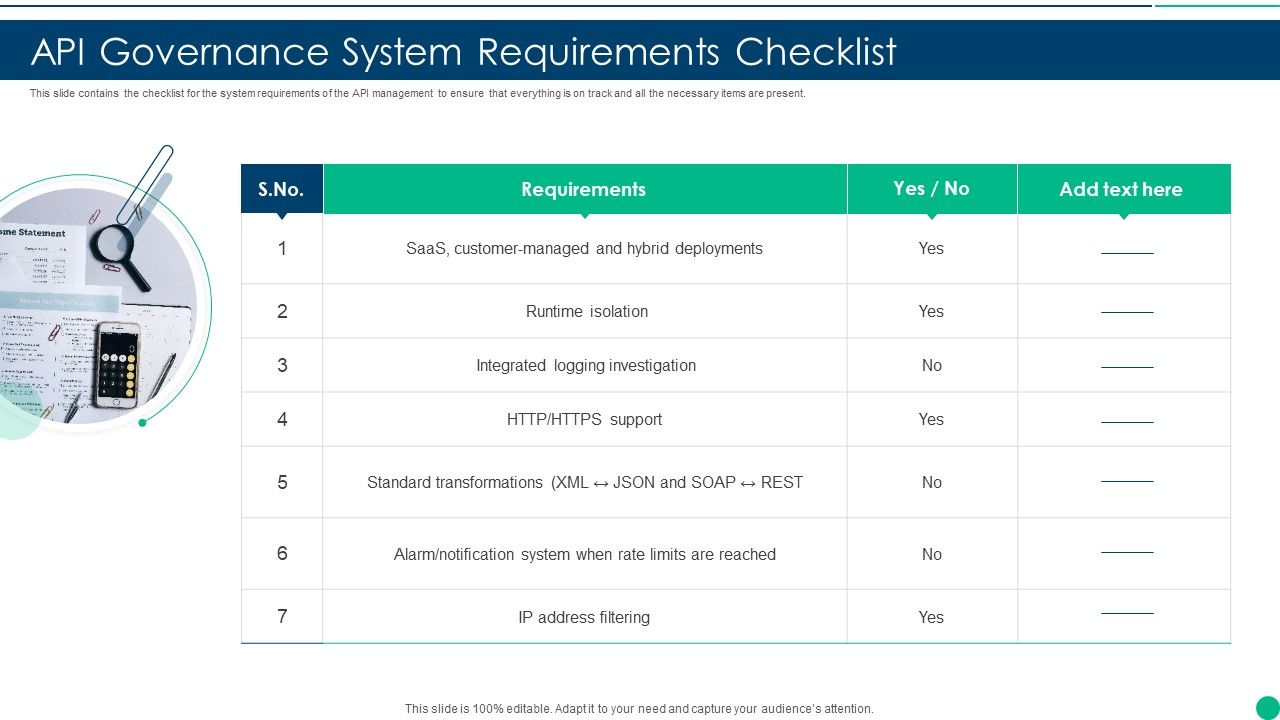

Importance of Paperwork Requirements

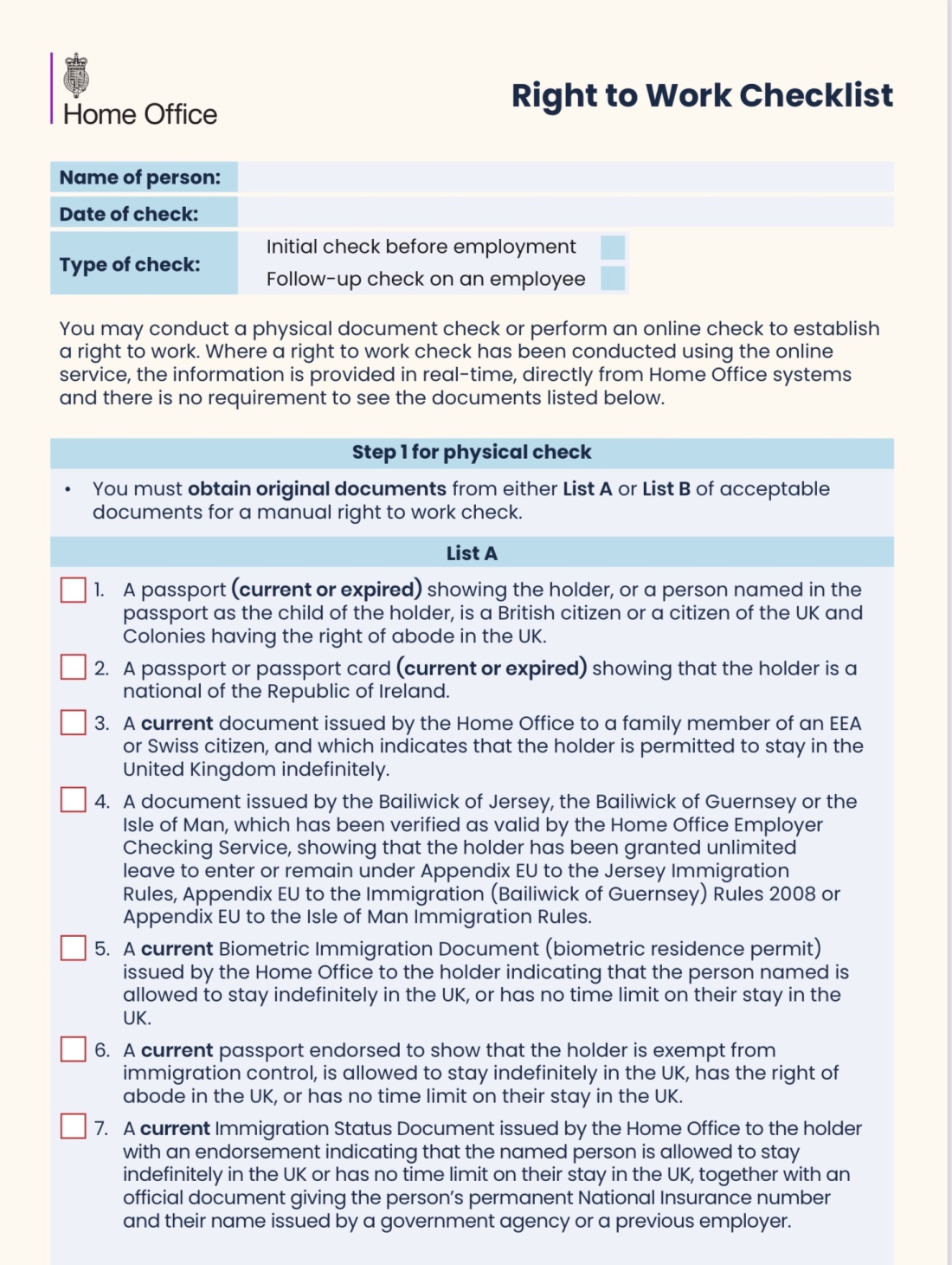

The paperwork requirements for echecks are designed to ensure the security and legitimacy of transactions. These requirements help in verifying the identity of the parties involved, confirming the authorization of the transaction, and providing a paper trail that can be useful in case of disputes or errors. The primary documents involved in echeck transactions include authorization forms, transaction receipts, and possibly identification documents.

Echeck Authorization

Authorization is a critical step in the echeck process. It involves the payer granting permission to the payee to withdraw funds from their checking account. This authorization can be obtained in various ways, including: - Written Authorization: This is a physical document signed by the payer, giving the payee the right to debit their account. - Verbal Authorization: In some cases, verbal authorization over the phone can be used, but it must be recorded and stored as per regulatory requirements. - Electronic Authorization: For online transactions, electronic authorization through checkboxes or buttons that the payer must click to confirm their consent is common.

Transaction Receipts

After an echeck transaction is processed, both parties should receive a receipt as proof of the transaction. This receipt typically includes: - Date of the transaction - Amount transferred - Payer and payee information - Transaction ID or reference number These receipts serve as a record of the transaction and can be crucial in resolving any discrepancies or disputes that may arise.

Identification Documents

In some instances, especially for large or suspicious transactions, payees may require identification documents from the payer. This could include a driver’s license, passport, or other government-issued IDs. The requirement for identification documents depends on the payee’s policies and the nature of the transaction.

Steps Involved in Processing an Echeck

The process of initiating and completing an echeck transaction involves several steps: - Authorization: The payer must authorize the transaction as discussed above. - Transaction Initiation: The payee initiates the transaction by submitting the authorized echeck details to their bank or payment processor. - Verification: The payer’s bank verifies the transaction details, including ensuring that the account has sufficient funds. - Processing: The transaction is processed, and the funds are transferred from the payer’s account to the payee’s account. - Receipt Generation: Both parties receive receipts as proof of the transaction.

📝 Note: It's essential for both payers and payees to understand and comply with the paperwork requirements to avoid any complications or potential legal issues with echeck transactions.

Benefits of Echecks

Echecks offer several benefits over traditional payment methods, including: - Convenience: Echecks can be processed online or over the phone, making them highly convenient. - Speed: Transactions are typically faster than traditional check payments. - Security: Echecks are considered more secure than credit card transactions because they are less vulnerable to fraud. - Cost-Effectiveness: Echeck transactions often have lower fees compared to credit card payments.

Challenges and Limitations

Despite their advantages, echecks also come with some challenges and limitations: - Funds Availability: Unlike credit card transactions, echecks require the payer to have sufficient funds in their account. - Bounce Risks: If an echeck bounces due to insufficient funds, it can lead to additional fees and complications. - Regulatory Compliance: Echeck transactions must comply with various regulations, including those related to consumer protection and anti-money laundering.

Future of Echecks

The future of echecks looks promising as digital payment systems continue to evolve. With advancements in technology, echecks are becoming more secure, efficient, and widely accepted. The integration of echecks with emerging payment technologies, such as blockchain, could further enhance their security and speed.

In final thoughts, echeck paperwork requirements are a crucial aspect of ensuring the legitimacy and security of electronic check transactions. Understanding these requirements and the process of echeck transactions can help both individuals and businesses to navigate the world of digital payments more effectively. Whether you’re a payer or a payee, being informed about echecks can help you leverage their benefits while minimizing their risks.

What is an echeck?

+

An echeck, or electronic check, is a type of payment that electronically draws funds from a checking account, working similarly to a traditional paper check but processed electronically.

What are the benefits of using echecks?

+

Echecks offer convenience, speed, security, and cost-effectiveness, making them a preferred method for online transactions and business-to-business payments.

How do I initiate an echeck transaction?

+

To initiate an echeck transaction, you need to authorize the transaction, either through written, verbal, or electronic means, and then the payee can process the transaction through their bank or payment processor.