5 Tax Papers

Understanding the Importance of Tax Papers

When it comes to managing finances, tax papers play a crucial role in ensuring compliance with tax laws and regulations. These documents serve as proof of income, expenses, and tax payments, making them essential for individuals and businesses alike. In this article, we will delve into the world of tax papers, exploring their significance, types, and tips for effective management.

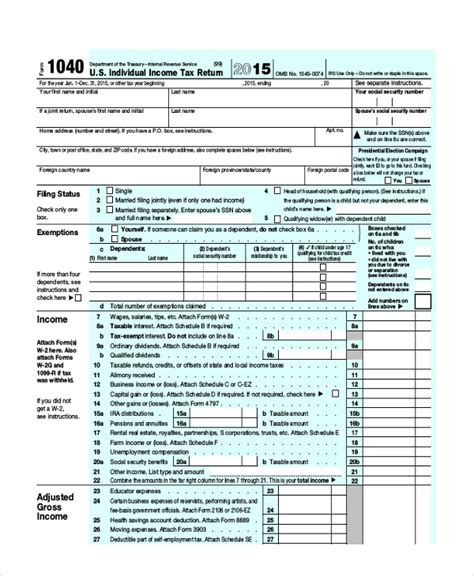

Types of Tax Papers

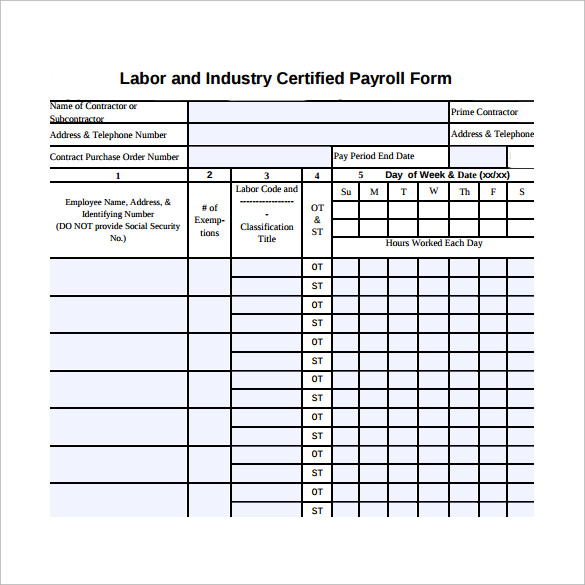

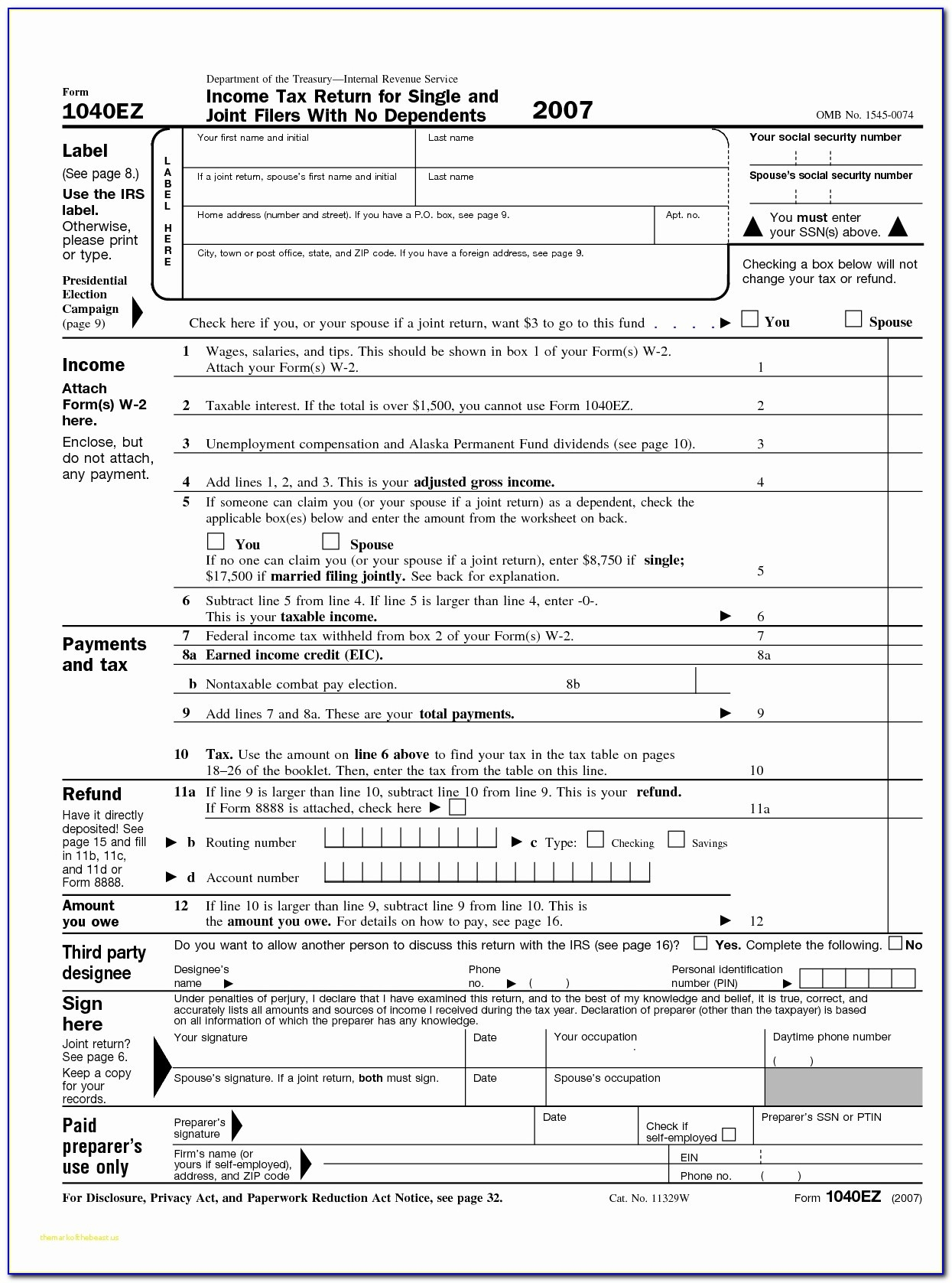

There are various types of tax papers, each serving a specific purpose. Some of the most common include: * W-2 forms: issued by employers to report employee income and taxes withheld * 1099 forms: used to report income earned from freelance work, investments, or other sources * Tax returns: documents filed with the tax authority to report income, claim deductions, and pay taxes owed * Receipts and invoices: records of business expenses and income * Audit documents: papers required during a tax audit to verify income, expenses, and tax payments

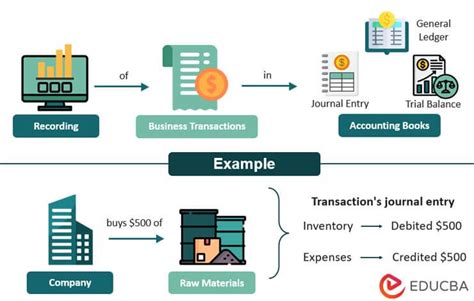

The Significance of Tax Papers

Tax papers are vital for several reasons: * Compliance: they help individuals and businesses comply with tax laws and regulations, avoiding penalties and fines * Record-keeping: tax papers serve as a record of financial transactions, making it easier to track income and expenses * Audit preparation: having organized tax papers can simplify the audit process, reducing stress and potential penalties * Financial planning: tax papers provide valuable insights into financial performance, helping individuals and businesses make informed decisions

Managing Tax Papers Effectively

To ensure seamless tax management, it’s essential to develop a system for organizing and storing tax papers. Here are some tips: * Create a dedicated folder: designate a specific folder or digital storage space for tax papers * Categorize documents: organize tax papers into categories, such as income, expenses, and tax payments * Set reminders: schedule reminders for tax-related deadlines, such as filing tax returns or making payments * Seek professional help: consider consulting a tax professional or accountant to ensure accurate and compliant tax management

| Document Type | Purpose | Frequency |

|---|---|---|

| W-2 form | Report employee income and taxes withheld | Annually |

| 1099 form | Report income earned from freelance work or investments | Annually |

| Tax return | Report income, claim deductions, and pay taxes owed | Annually |

💡 Note: It's essential to maintain accurate and up-to-date records of tax papers to avoid penalties and ensure compliance with tax laws and regulations.

As we’ve explored the world of tax papers, it’s clear that these documents play a vital role in managing finances and ensuring compliance with tax laws. By understanding the types of tax papers, their significance, and tips for effective management, individuals and businesses can navigate the complex world of taxation with confidence. In the end, having a solid grasp of tax papers can lead to better financial planning, reduced stress, and a smoother tax management process.

What is the purpose of a W-2 form?

+

A W-2 form is used to report employee income and taxes withheld, providing a record of employment and tax payments.

How often should I review my tax papers?

+

It’s recommended to review your tax papers at least annually, or whenever you experience a significant change in income or expenses.

Can I store my tax papers digitally?

+

Yes, you can store your tax papers digitally, but make sure to use a secure and reliable storage method, such as encrypted cloud storage or a password-protected digital folder.