Estimated Quarterly Tax Paperwork Needed

Introduction to Estimated Quarterly Tax

As a self-employed individual or a business owner, it is essential to understand the concept of estimated quarterly tax payments. The IRS requires these payments to be made on a quarterly basis to avoid penalties and interest. In this article, we will delve into the world of estimated quarterly tax paperwork, exploring the necessary forms, calculations, and deadlines.

Who Needs to File Estimated Quarterly Tax

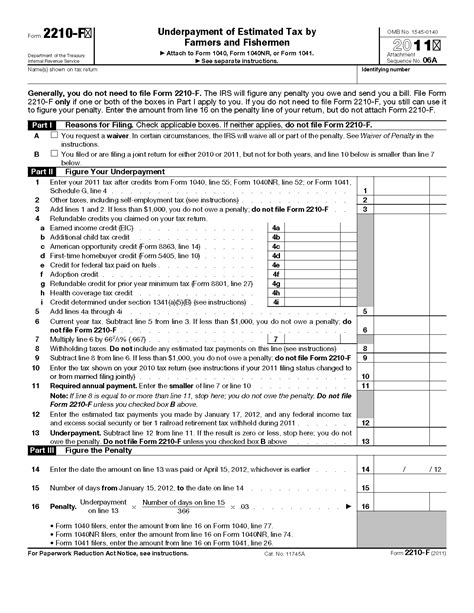

Not everyone is required to file estimated quarterly tax payments. The following individuals and businesses are typically required to make these payments: * Self-employed individuals with a net earnings from self-employment of $400 or more * Businesses, including corporations, partnerships, and S corporations * Individuals with income from rentals, investments, or other sources * Farmers and fishermen with income from their trade

📝 Note: It is crucial to determine if you are required to make estimated quarterly tax payments to avoid penalties and interest.

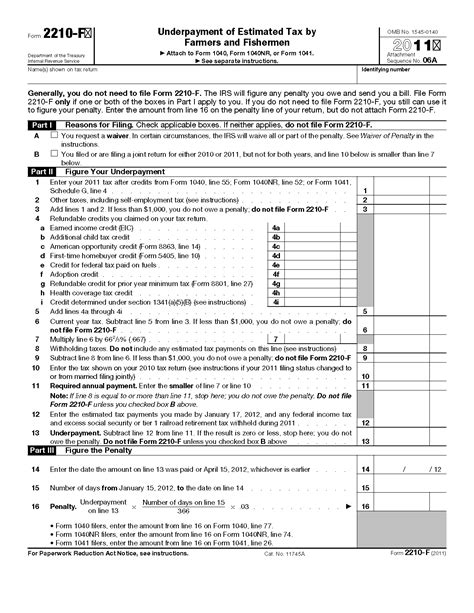

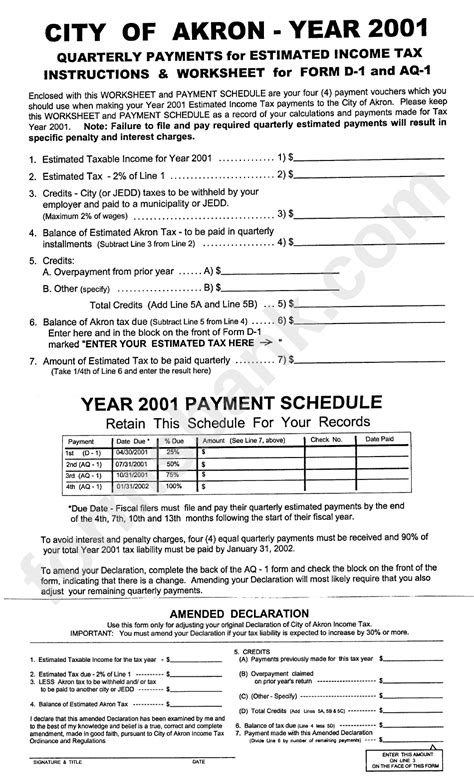

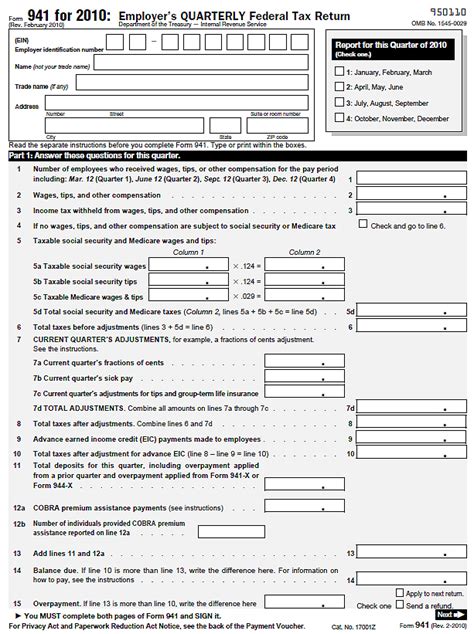

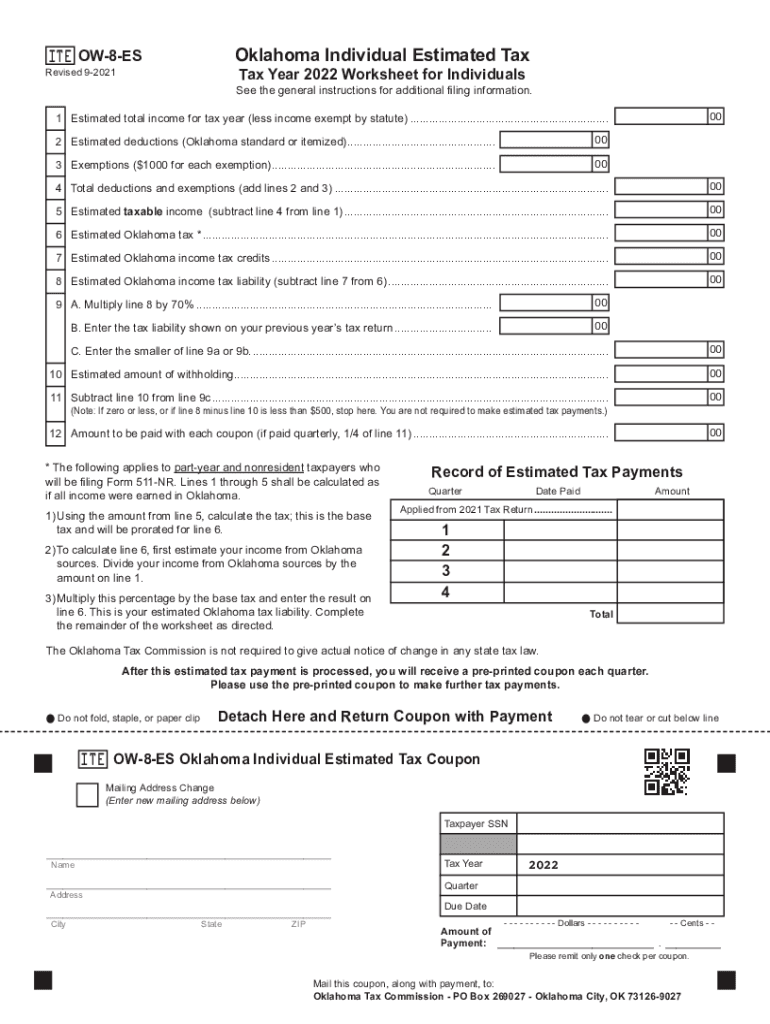

Necessary Forms and Calculations

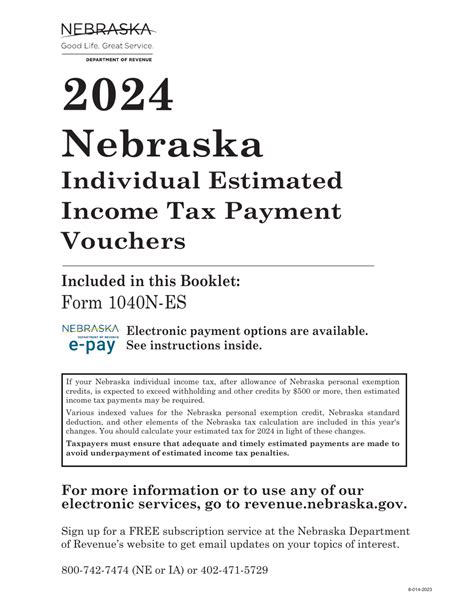

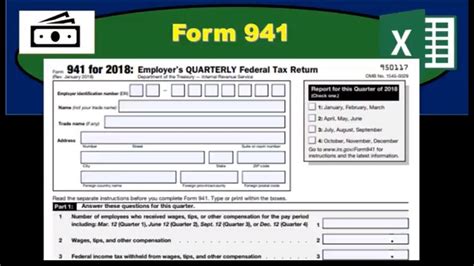

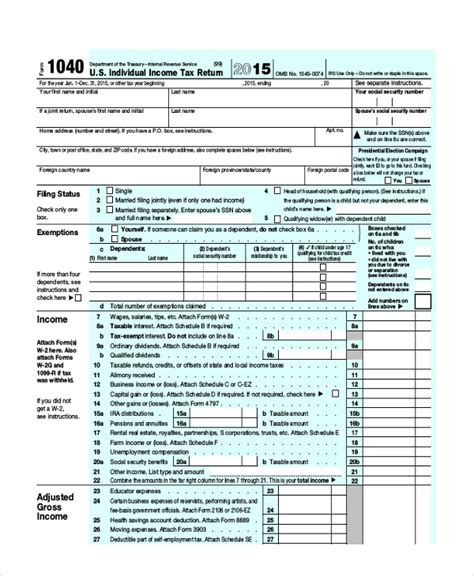

To make estimated quarterly tax payments, you will need to file Form 1040-ES. This form is used to calculate and pay your estimated tax liability. The following steps outline the process: * Calculate your estimated tax liability using the Annualized Estimated Tax Method or the Safe Harbor Rule * Complete Form 1040-ES, which includes your name, address, and Social Security number or Employer Identification Number (EIN) * Make payments online, by phone, or by mail using a check or money order

Deadlines and Payment Due Dates

Estimated quarterly tax payments are due on the following dates: * April 15th for the first quarter (January 1 - March 31) * June 15th for the second quarter (April 1 - May 31) * September 15th for the third quarter (June 1 - August 31) * January 15th of the following year for the fourth quarter (September 1 - December 31)

Penalties and Interest

Failure to make estimated quarterly tax payments or underpayment of taxes can result in penalties and interest. The IRS may charge: * A penalty for underpayment of estimated tax, which can be waived if you meet certain conditions * Interest on the unpaid amount, which accrues from the original due date

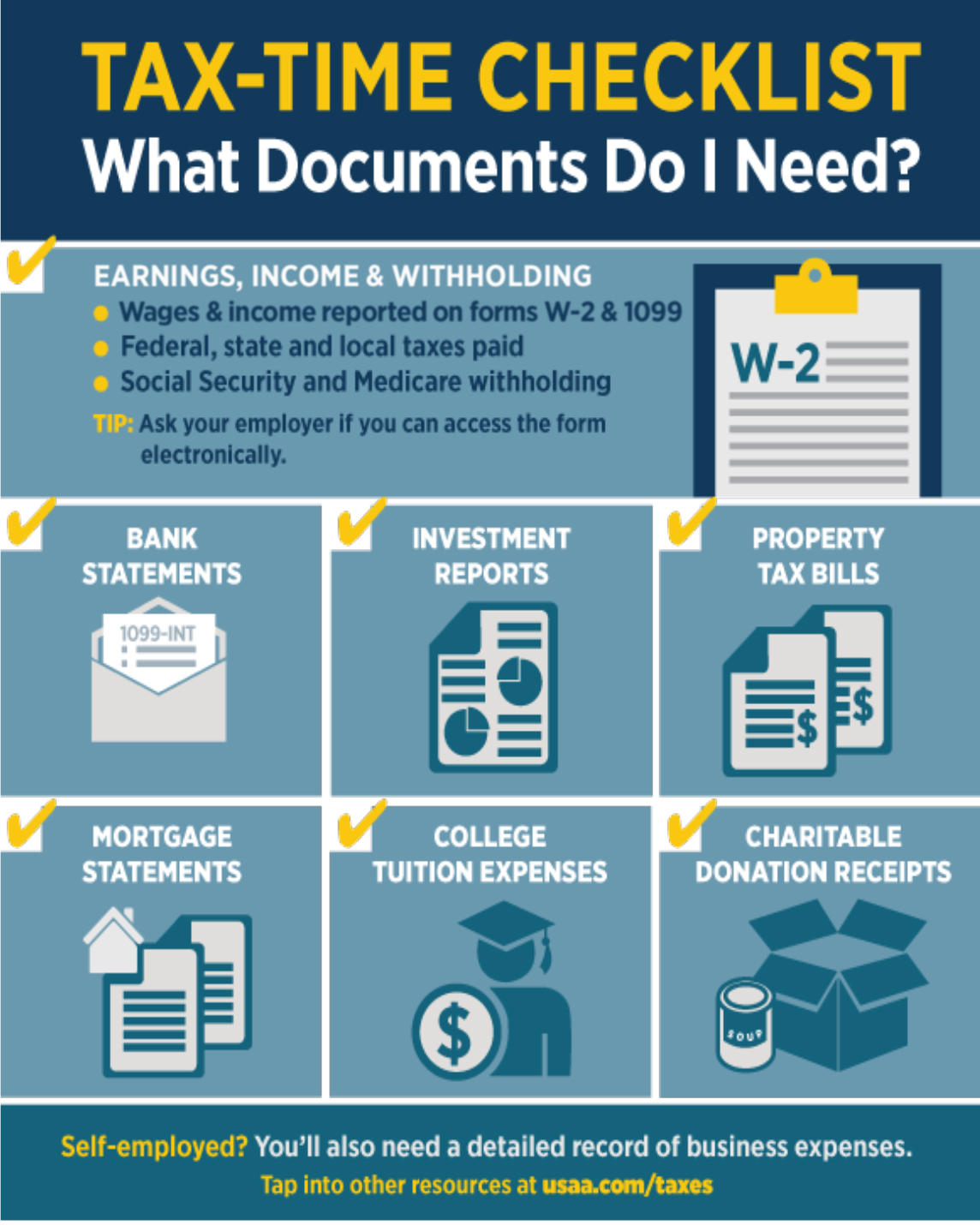

Record Keeping and Organization

To ensure accurate calculations and timely payments, it is essential to maintain proper records and organization. This includes: * Keeping track of income and expenses throughout the year * Maintaining a record of estimated tax payments made * Reviewing and adjusting your estimated tax liability as needed

Common Mistakes to Avoid

When filing estimated quarterly tax payments, be aware of the following common mistakes: * Underestimating or overestimating tax liability * Missing deadlines or making late payments * Failing to keep accurate records * Not adjusting estimated tax liability throughout the year

📝 Note: Avoid these common mistakes to minimize penalties and interest.

Conclusion and Next Steps

In conclusion, estimated quarterly tax payments are a crucial aspect of tax compliance for self-employed individuals and businesses. By understanding the necessary forms, calculations, and deadlines, you can ensure timely and accurate payments. Remember to maintain proper records and organization, and avoid common mistakes to minimize penalties and interest. As you move forward, consider consulting a tax professional or seeking guidance from the IRS to ensure you are meeting your estimated quarterly tax obligations.

What is the purpose of estimated quarterly tax payments?

+

Estimated quarterly tax payments are made to the IRS to prepay a portion of your tax liability for the year. This helps to avoid penalties and interest that may accrue if you wait until the end of the year to pay your taxes.

How do I calculate my estimated tax liability?

+

You can calculate your estimated tax liability using the Annualized Estimated Tax Method or the Safe Harbor Rule. You can also consult a tax professional or use tax software to help with the calculation.

What are the consequences of not making estimated quarterly tax payments?

+

Failure to make estimated quarterly tax payments or underpayment of taxes can result in penalties and interest. The IRS may charge a penalty for underpayment of estimated tax, and interest may accrue on the unpaid amount.